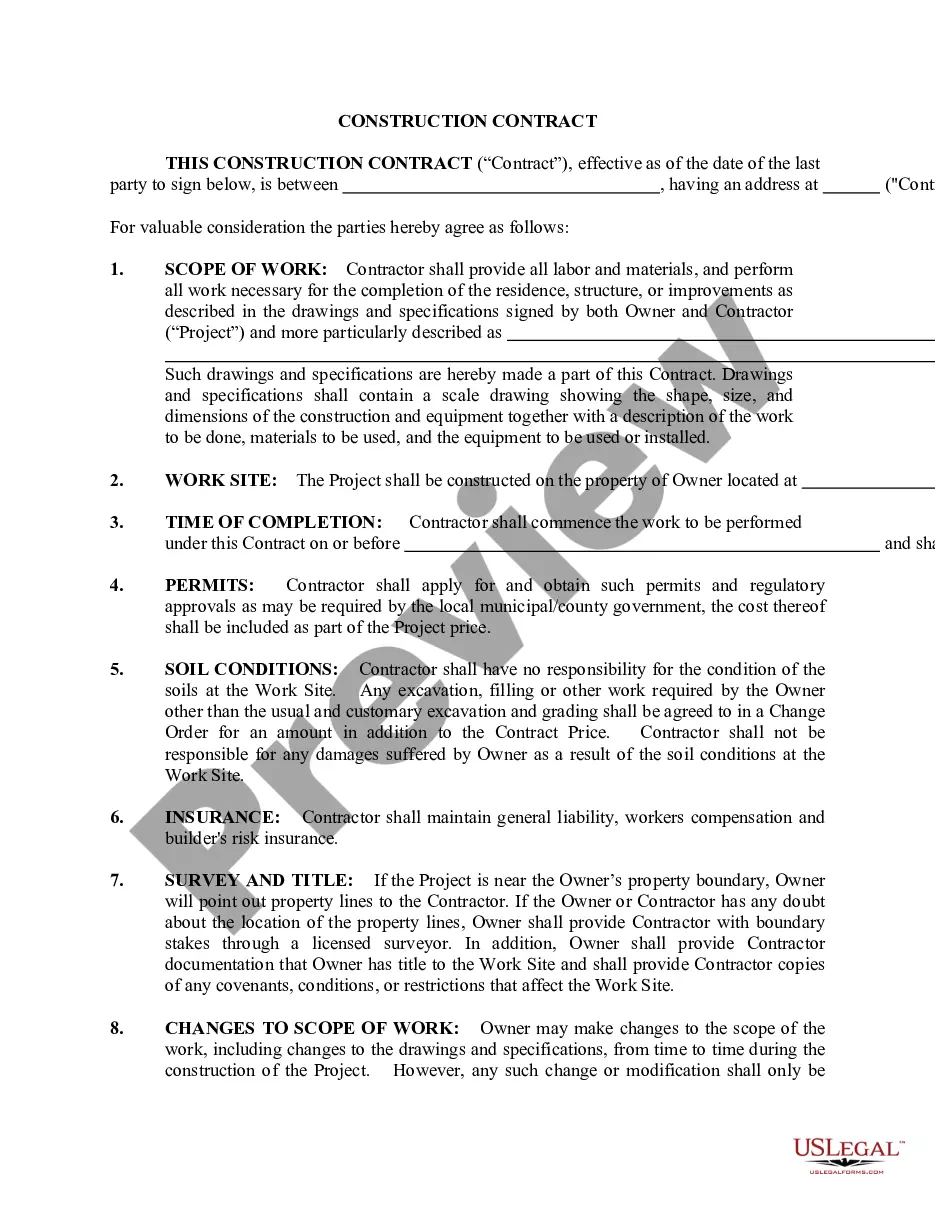

Minnesota Commercial Contract for Contractor

Description

How to fill out Minnesota Commercial Contract For Contractor?

Have any template from 85,000 legal documents including Minnesota Commercial Contract for Contractor online with US Legal Forms. Every template is prepared and updated by state-certified legal professionals.

If you have a subscription, log in. Once you’re on the form’s page, click the Download button and go to My Forms to get access to it.

In case you haven’t subscribed yet, follow the tips listed below:

- Check the state-specific requirements for the Minnesota Commercial Contract for Contractor you would like to use.

- Read description and preview the sample.

- As soon as you’re sure the template is what you need, click on Buy Now.

- Choose a subscription plan that really works for your budget.

- Create a personal account.

- Pay out in one of two suitable ways: by credit card or via PayPal.

- Select a format to download the file in; two ways are available (PDF or Word).

- Download the file to the My Forms tab.

- As soon as your reusable template is ready, print it out or save it to your gadget.

With US Legal Forms, you’ll always have quick access to the right downloadable sample. The platform provides you with access to documents and divides them into groups to simplify your search. Use US Legal Forms to get your Minnesota Commercial Contract for Contractor fast and easy.

Form popularity

FAQ

Yes, absolutely. Starting work without a signed contract means that your position isn't clear, or even worse it's weak.It also means that the contract is legally enforceable and will be able to support you if you decide to take legal action.

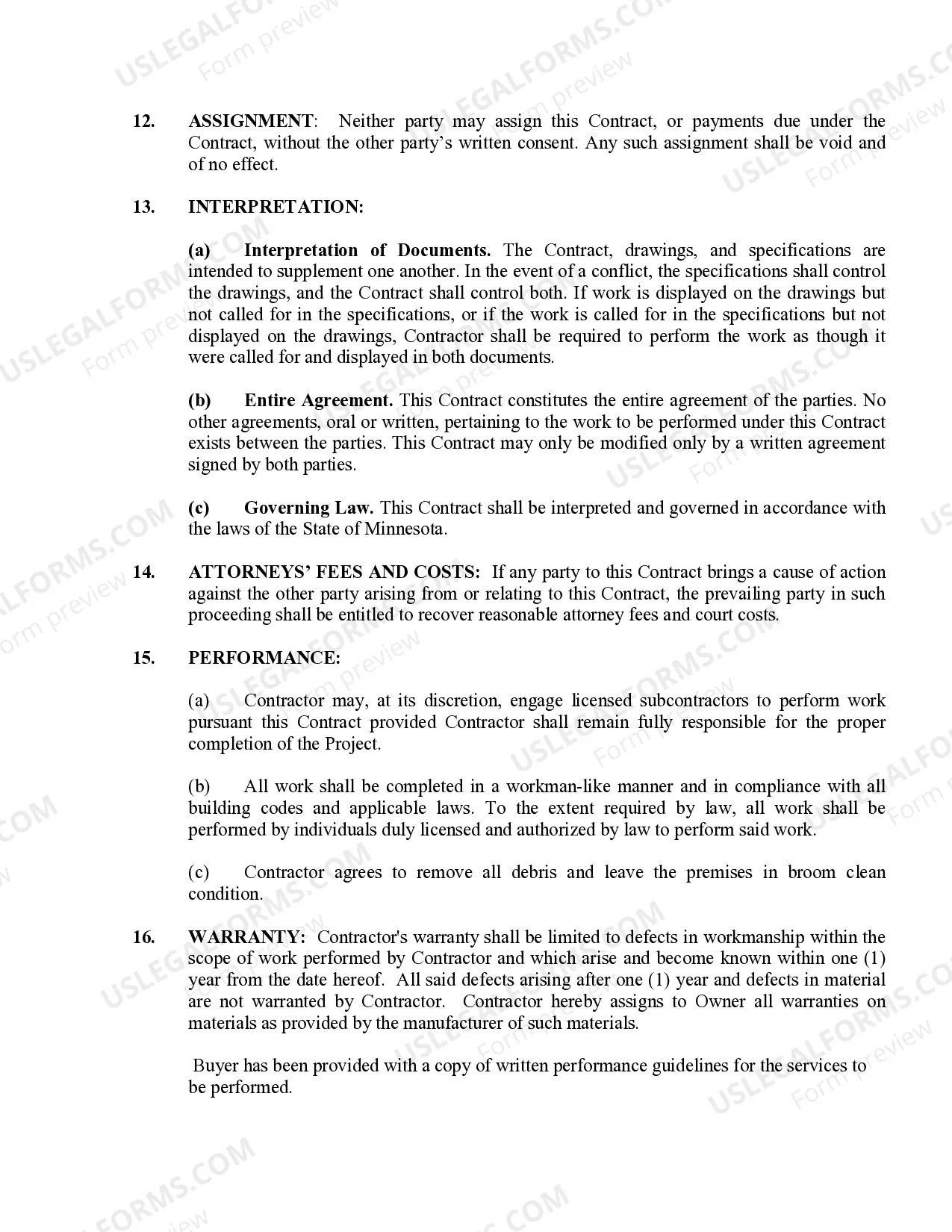

The state of Minnesota requires state licenses if you will be doing contract work. To register your business, refer to The Department of Employment and Economic Development website. Register as necessary with Minnesota's Secretary of State before applying for a contractors license.

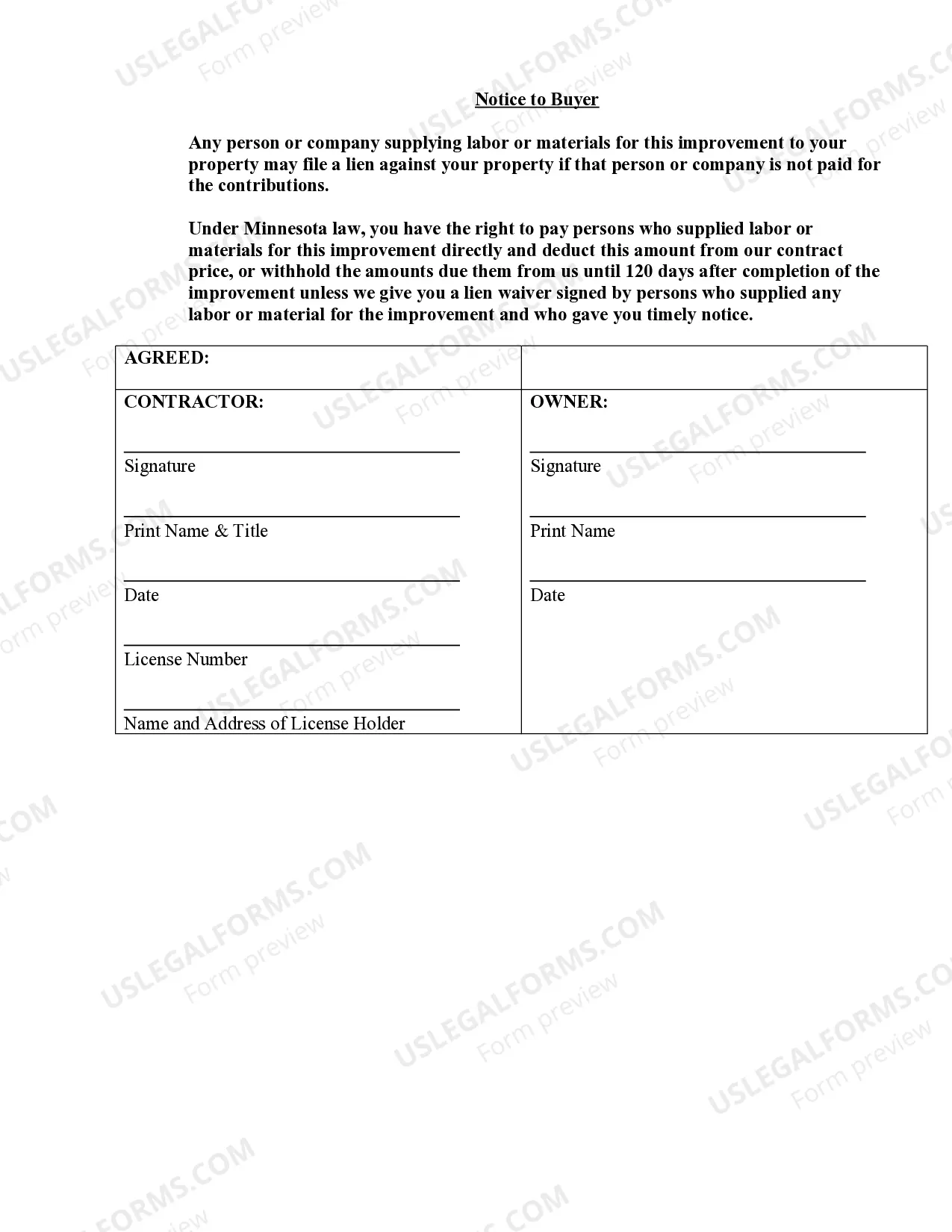

Both parties should sign the contract, and both should be bound by the terms and conditions spelled out in the agreement. In general that means the contractor will be obliged to provide specified materials and to perform certain services for you. In turn, you will be required to pay for those goods and that labor.

If you run a small business that hires 1099 contractors, also known as independent contractors, it is vital that you have them sign an independent contractor contract. This is because there is a significant gray area between who is classified as an independent contractor and who is classified as an employee.

Have a current license, certificate or registration issued by the agency; are an employee of a business performing construction services; have a current residential building contractor or remodeler certificate of exemption; or. are excluded from registration requirements under Minnesota Statutes 326B.

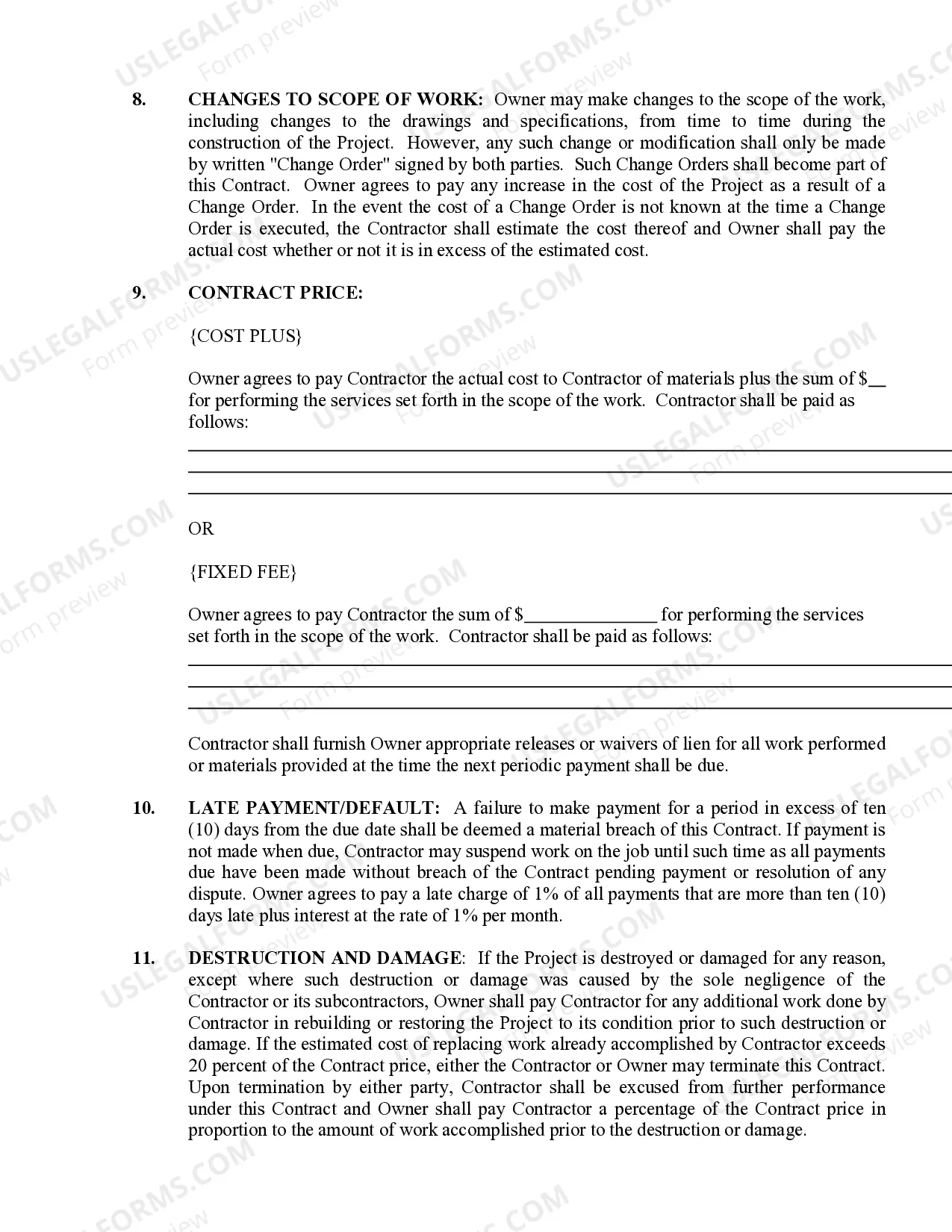

Name of contractor and contact information. Name of homeowner and contact information. Describe property in legal terms. List attachments to the contract. The cost. Failure of homeowner to obtain financing. Description of the work and the completion date. Right to stop the project.

Licenses are required for all residential building contractors and remodelers in Minnesota who contract with a homeowner to construct or improve dwellings by offering more than one special skill.View frequently asked questions about contractor, remodeler and roofer requirements.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

Identifying/Contact Information. Title and Description of the Project. Projected Timeline and Completion Date. Cost Estimate and Payment Schedule. Stop Work Clause and Stop Payment Clause. Act of God Clause. Change Order Agreement. Warranty.