- US Legal Forms

-

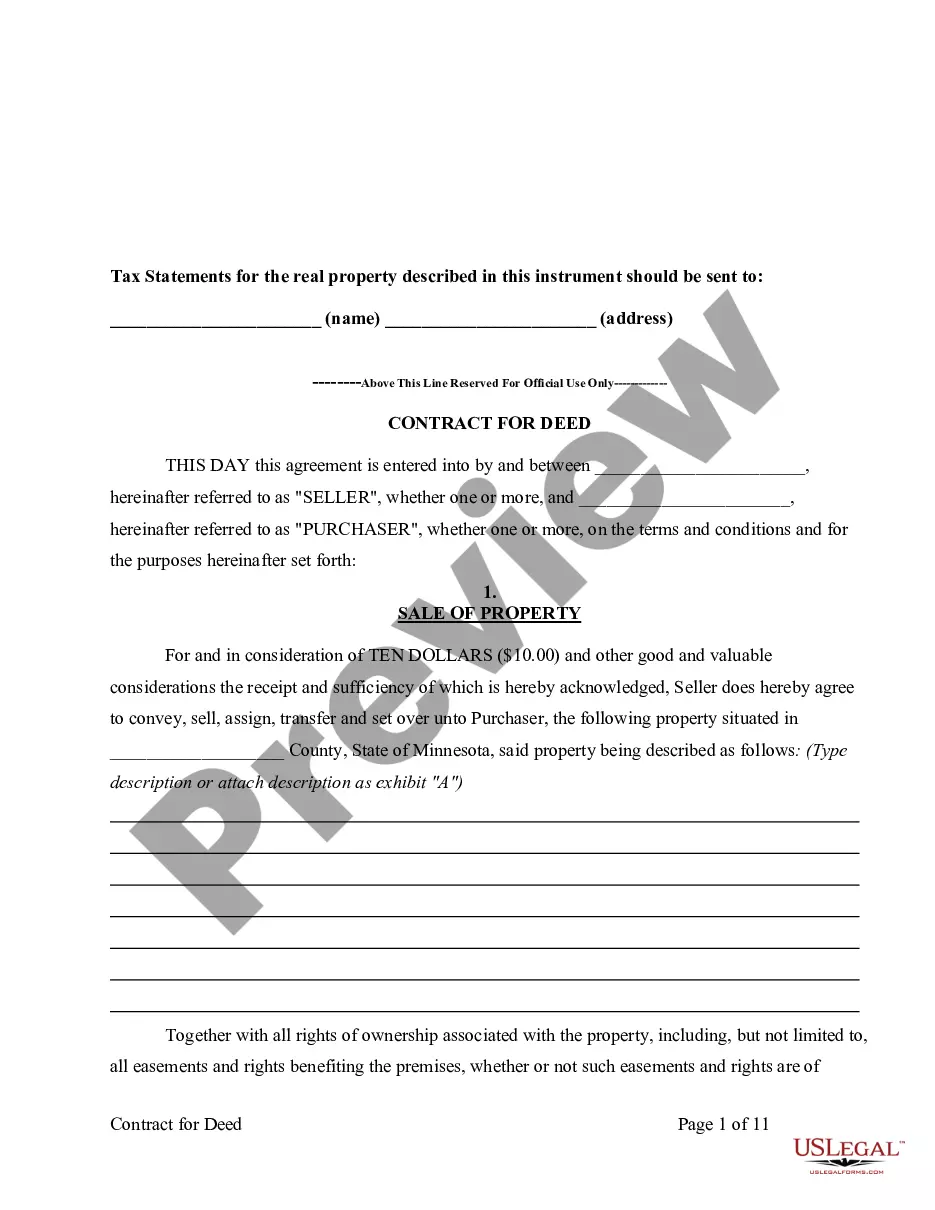

Minnesota Agreement or Contract for Deed for Sale and Purchase of Real...

Sale A

Description Purchase Land Executory

Real Aka Land Executory Related forms

View Buyer's Request for Accounting from Seller under Contract for Deed

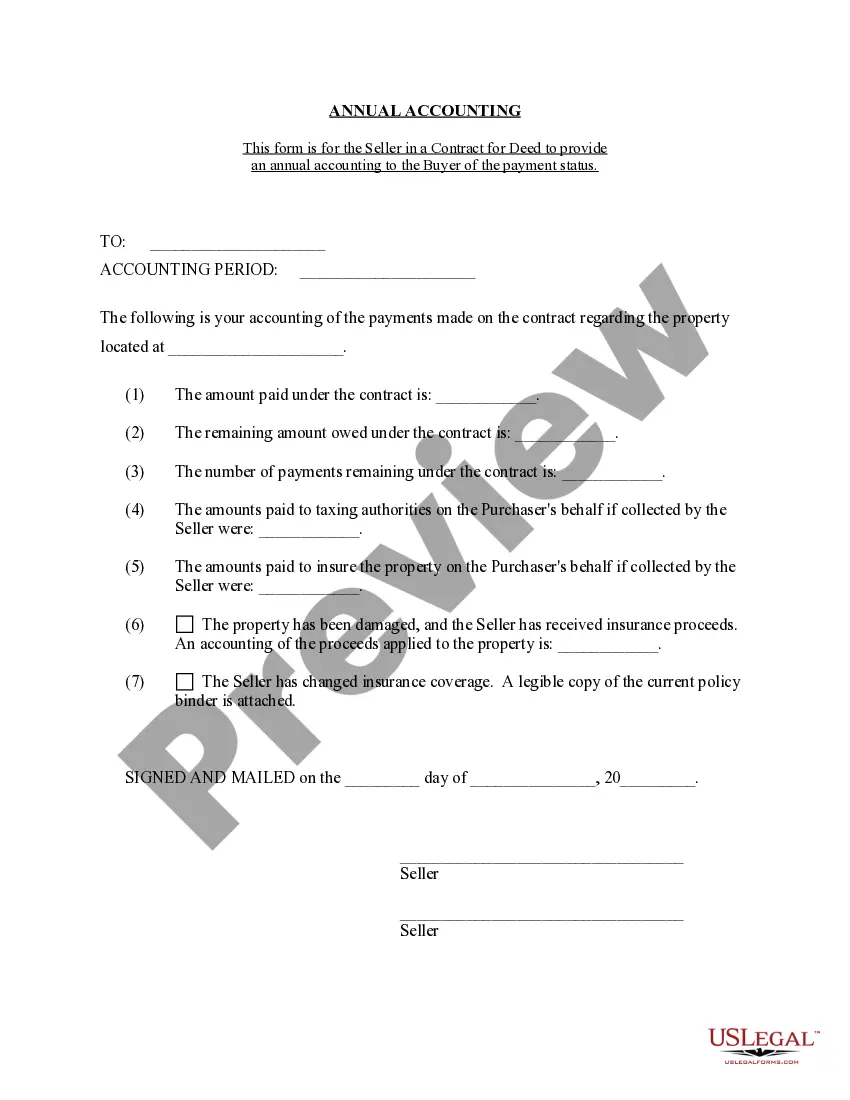

View Contract for Deed Seller's Annual Accounting Statement

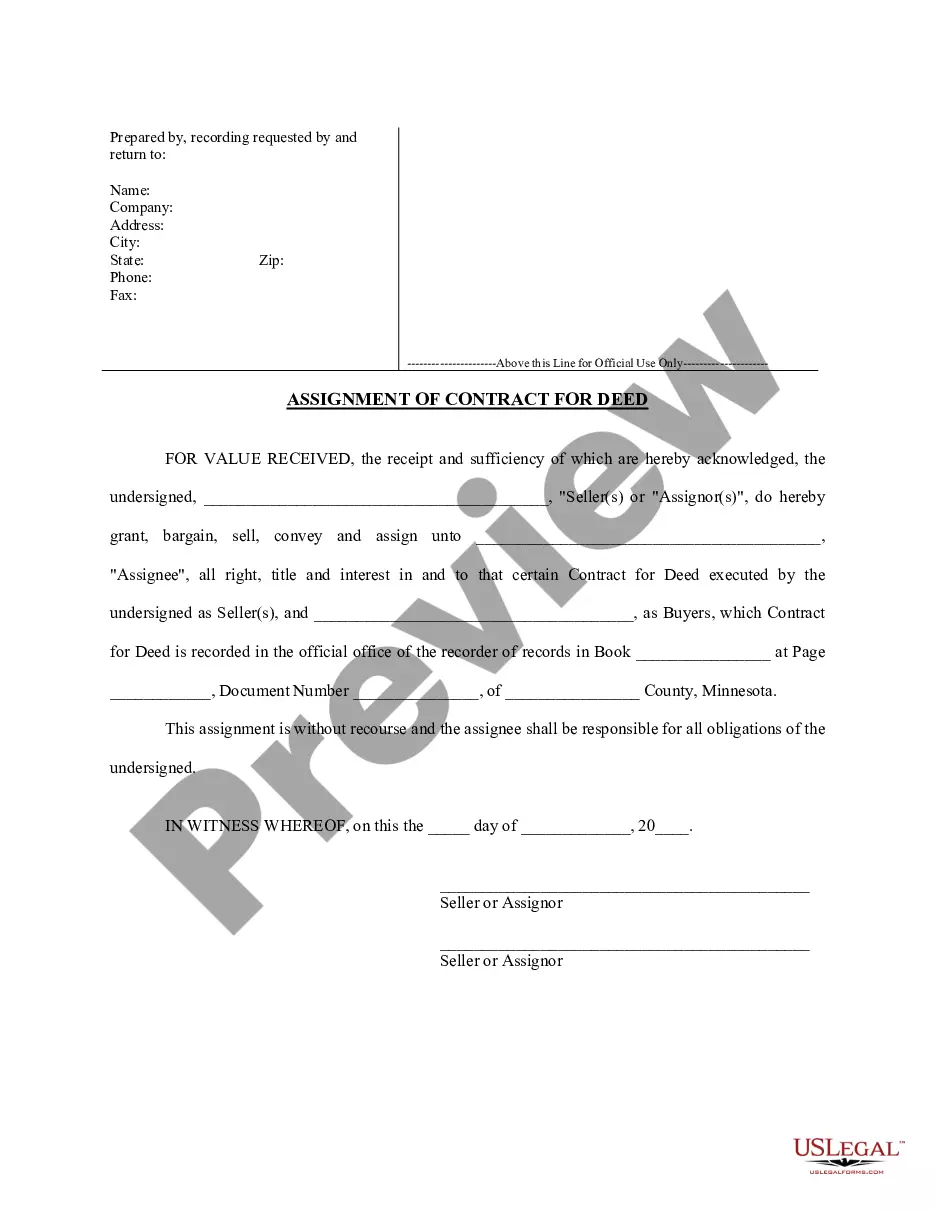

View Assignment of Contract for Deed by Seller

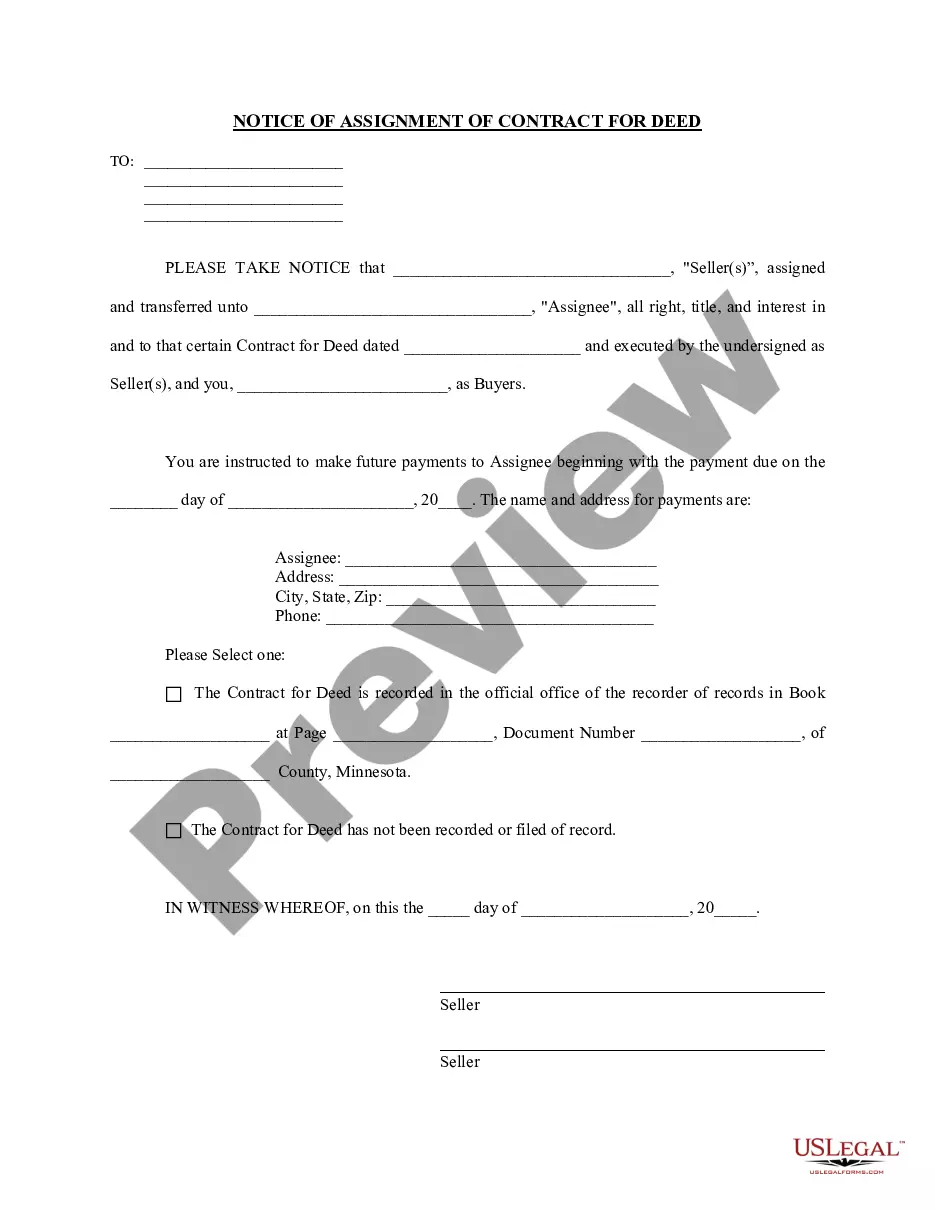

View Notice of Assignment of Contract for Deed

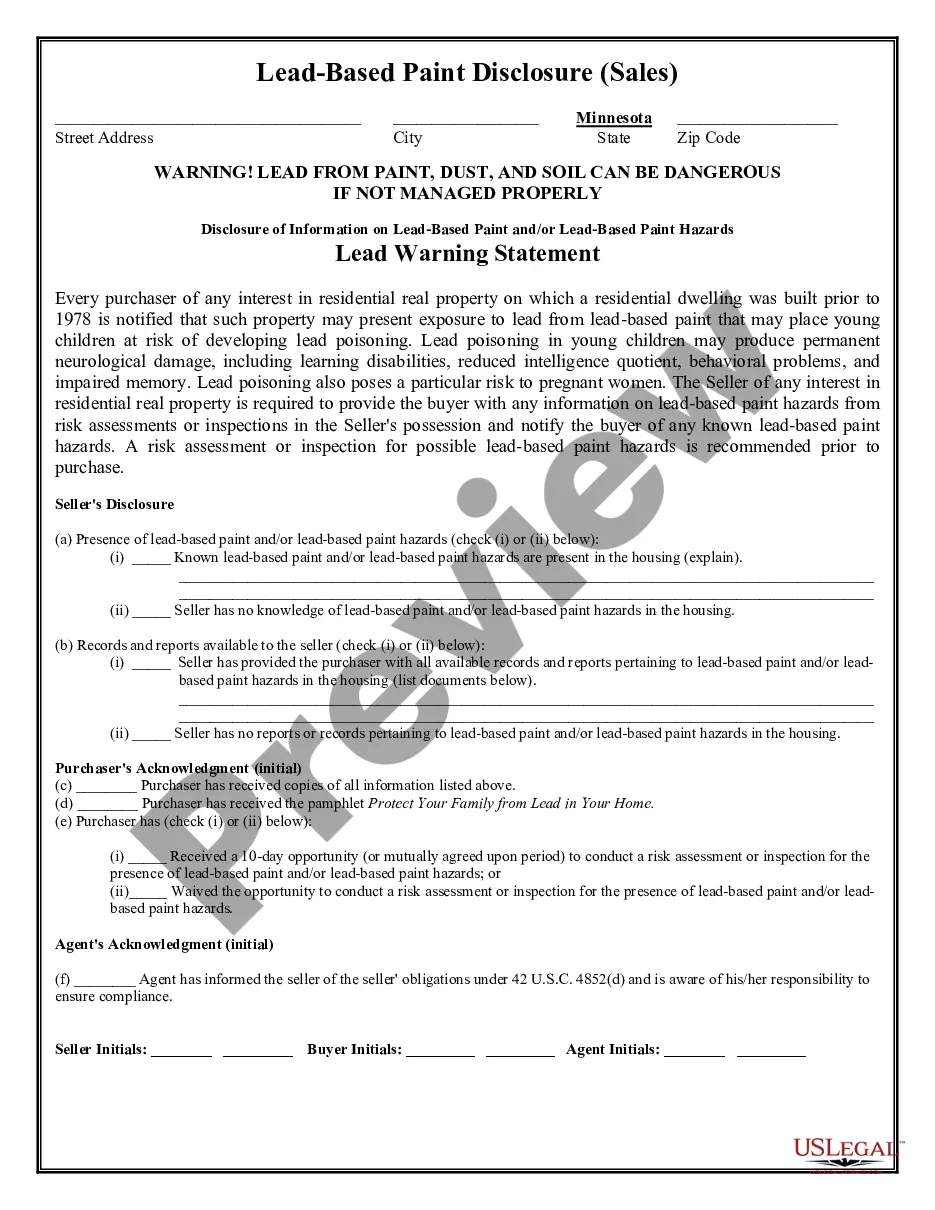

View Lead Based Paint Disclosure for Sales Transaction

Related legal definitions

How to fill out Minnesota Estate A?

Have any form from 85,000 legal documents such as Minnesota Agreement or Contract for Deed for Sale and Purchase of Real Estate a/k/a Land or Executory Contract on-line with US Legal Forms. Every template is drafted and updated by state-accredited legal professionals.

If you already have a subscription, log in. Once you are on the form’s page, click the Download button and go to My Forms to get access to it.

In case you haven’t subscribed yet, follow the steps listed below:

- Check the state-specific requirements for the Minnesota Agreement or Contract for Deed for Sale and Purchase of Real Estate a/k/a Land or Executory Contract you would like to use.

- Look through description and preview the template.

- When you’re sure the template is what you need, just click Buy Now.

- Select a subscription plan that works for your budget.

- Create a personal account.

- Pay in one of two suitable ways: by bank card or via PayPal.

- Pick a format to download the file in; two options are available (PDF or Word).

- Download the file to the My Forms tab.

- As soon as your reusable form is downloaded, print it out or save it to your device.

With US Legal Forms, you’ll always have instant access to the right downloadable sample. The platform provides you with access to documents and divides them into groups to streamline your search. Use US Legal Forms to get your Minnesota Agreement or Contract for Deed for Sale and Purchase of Real Estate a/k/a Land or Executory Contract easy and fast.

Mn Deed Form Rating

Contract Real Executory Form popularity

Purchase Real Estate Other Form Names

A Executory Document FAQ

Contract for Deed Seller Financing. A contract for deed is used by some sellers who finance the sale of their homes. Seller's Ownership Liability. Buyer Default Risk. Seller Performance. Property Liens Could Hinder Purchase.

Under a contract for deed, the grantor retains the legal title to the real property until the purchase price is paid in full and the other terms of the contract are completed. Before a contract is paid off, the grantor (vendor) may choose to assign its contract rights to a third party.

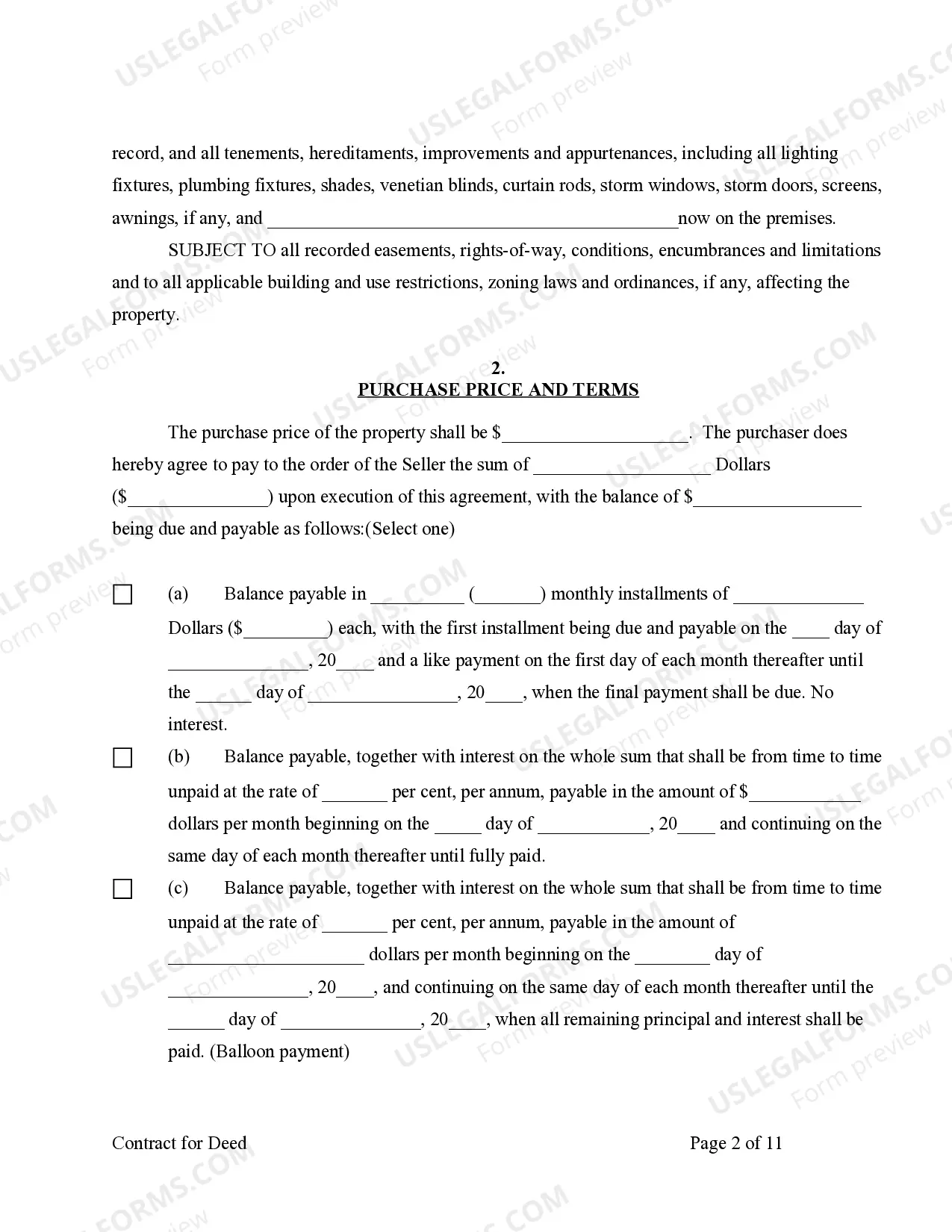

In a contract for deed sale, the buyer agrees to pay the purchase price of the property in monthly installments.The buyer has the right of occupancy and, in states like Minnesota, the right to claim a homestead property tax exemption.

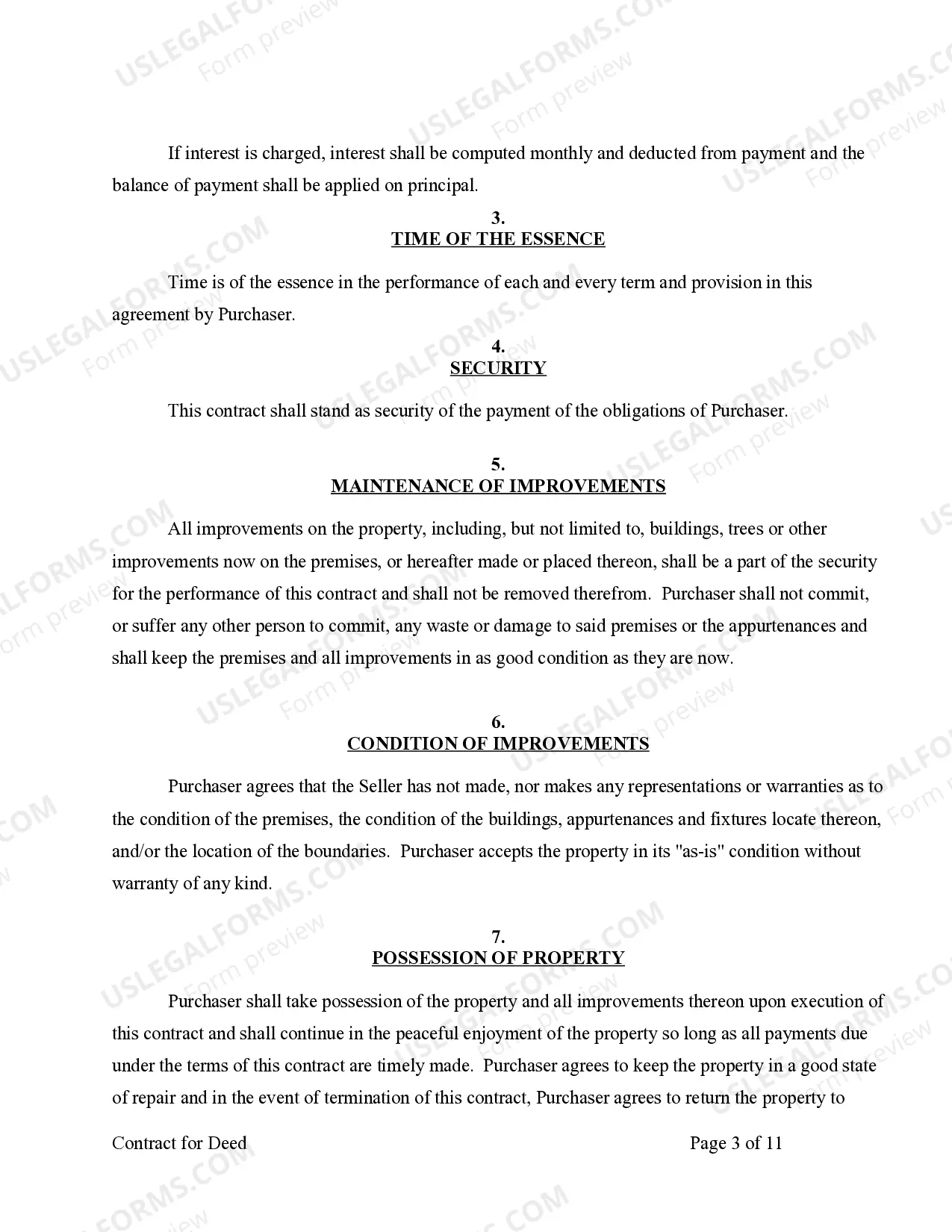

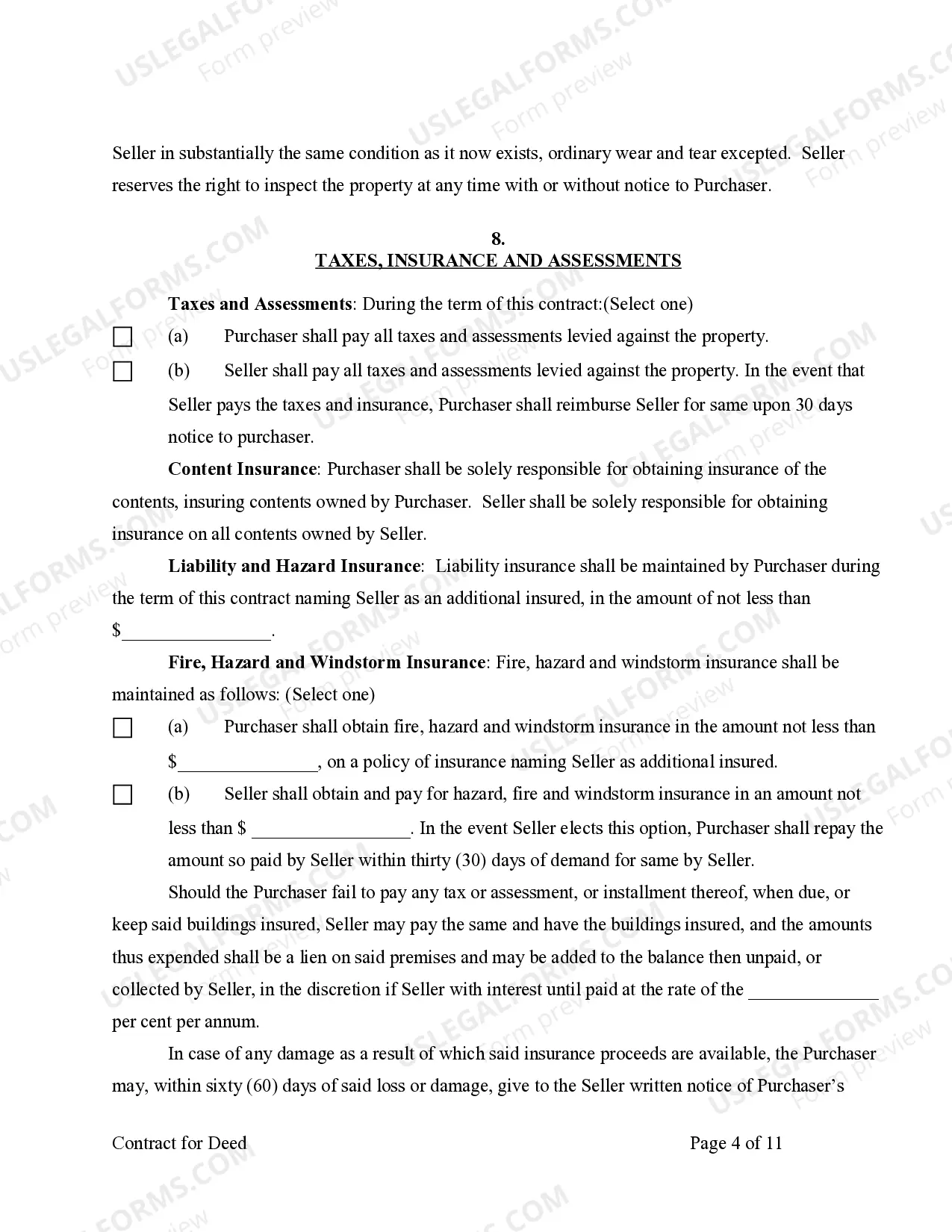

A contract for deed is a legal agreement for the sale of property in which a buyer takes possession and makes payments directly to the seller, but the seller holds the title until the full payment is made.

The Difference Between Renting to Own and a Contract for Deed. Renting to own usually means renting now, with an option to buy later. When you make this kind of deal, you are still a tenant, and the seller is still a landlord, until the final purchase. A contract for deed is very different.

A contract for deed is an agreement for buying property without going to a mortgage lender. The buyer agrees to pay the seller monthly payments, and the deed is turned over to the buyer when all payments have been made.

A contract for deed, also known as a "bond for deed," "land contract," or "installment land contract," is a transaction in which the seller finances the sale of his or her own property. In a contract for deed sale, the buyer agrees to pay the purchase price of the property in monthly installments.

A contract for deed, also called a land contract or contract for sale, is a financing option for buyers who do not qualify for a mortgage loan to purchase property. In a contract for deed, the seller finances the purchase of the property, much like a mortgage company in a more traditional mortgage situation.

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum. If a seller needs funds from the sale to buy another property, this would not be a beneficial method of selling real estate.

Contract Deed Real Aka Blank Trusted and secure by over 3 million people of the world’s leading companies

-

No results found.

-

Minnesota

-

Alabama

-

Alaska

-

Arizona

-

Arkansas

-

California

-

Colorado

-

Connecticut

-

Delaware

-

District of Columbia

-

Florida

-

Georgia

-

Hawaii

-

Idaho

-

Illinois

-

Indiana

-

Iowa

-

Kansas

-

Kentucky

-

Louisiana

-

Maine

-

Maryland

-

Massachusetts

-

Michigan

-

Mississippi

-

Missouri

-

Montana

-

Nebraska

-

Nevada

-

New Hampshire

-

New Jersey

-

New Mexico

-

New York

-

North Carolina

-

North Dakota

-

Ohio

-

Oklahoma

-

Oregon

-

Pennsylvania

-

Rhode Island

-

South Carolina

-

South Dakota

-

Tennessee

-

Texas

-

Utah

-

Vermont

-

Virginia

-

Washington

-

West Virginia

-

Wisconsin

-

Wyoming

PROPERTY INTERESTS AND LIENS (Chap. 500-515B)

CHAPTER 507 RECORDING AND FILING CONVEYANCES

507.235 Filing contracts for deed.

§ Subdivision 1. Filing required.

All contracts for deed executed on or after January 1, 1984, shall be recorded by the vendee within four months in the office of the county recorder or registrar of titles in the county in which the land is located. Any other person may record the contract. This filing period may be extended if failure to pay the property tax due in the current year on a parcel as required in section 272.121 has prevented filing and recording of the contract. In the case of a parcel that was divided and classified under section 273.13 as class 1a or 1b, the period may be extended to October 31 of the year in which the sale occurred, and in the case of a parcel that was divided and classified under section 273.13 as class 2a, the period may be extended to November 30 of the year in which the sale occurred.

A person receiving an assignment of a vendee's interest in a contract for deed that is transferred on or after January 1, 1989, shall record the assignment within four months of the date of transfer in the office of the county recorder or registrar of titles in the county in which the land is located. For the purpose of this section, "assignment" means an assignment or other transfer of all or part of a vendee's interest in a contract for deed. Any other person may record an assignment.

§ Subd. 1a.Requirements of vendor.

(a) A vendor entering into a contract for deed involving residential real property must, contemporaneously with the execution of the contract for deed:

(1) deliver to the vendee a copy of the contract for deed containing original signatures in recordable form; and

(2) pay, or reimburse the vendee for payment of, any delinquent taxes necessary for recordation of the contract for deed, unless the contract for deed provides for the vendee to pay the delinquent taxes.

(b) For purposes of this subdivision:

(1) "contract for deed" means an executory contract for the conveyance of residential real property under which the seller provides financing for the purchase of the residential real property and under which the purchaser does or has a right to go into possession. Contract for deed does not include:

(i) a purchase agreement;

(ii) an earnest money contract;

(iii) an exercised option or a lease, including a lease with an option to purchase; or

(iv) a mortgage, as defined in section 287.01; and

(2) "residential real property" means real property occupied, or intended to be occupied, by one to four families, if the purchaser intends to occupy the real property. Residential real property does not include property subject to a family farm security loan or a transaction subject to sections 583.20 to 583.32.

§ Subd. 2. Penalty for failure to file.

(a) A vendee who fails to record a contract for deed, as required by subdivision 1, is subject to a civil penalty, payable under subdivision 5, equal to two percent of the principal amount of the contract debt, unless the vendee has not received a copy of the contract for deed in recordable form, as required under subdivision 1a. Payments of the penalty shall be deposited in the general fund of the county. The penalty may be enforced as a lien against the vendee's interest in the property.

(b) A person receiving an assignment of a vendee's interest in a contract for deed who fails to record the assignment as required by subdivision 1 is subject to a civil penalty, payable under subdivision 5, equal to two percent of the original principal amount of the contract debt. Payments of the penalty must be deposited in the general fund of the county. The penalty may be enforced as a lien against the vendee's interest in the property.

§ Subd. 3. Disclosure.

(a) Whenever a contract for deed or assignment of a vendee's interest in a contract for deed is not recorded and a city or county attorney requires information concerning the contract for deed or assignment of contract for deed for the performance of the attorney's duties on behalf of the city or county, the city or county attorney may request disclosure under paragraph (b).

(b) A vendor, vendee, or current or former holder of a vendor's or vendee's interest in a contract for deed, a person who collects payments made under a contract for deed, or a person in possession of the property subject to a contract for deed shall, on written request that includes a copy of this section made by the city or county attorney of the city or county in which the property is located, disclose all information known to the person relating to:

(1) the identity and residence or office mailing address of the parties to the contract for deed; and

(2) any assignments of the contract for deed.

The disclosure also must include any legible, true and correct copies of each contract for deed and assignment documents in the possession of or reasonably available to the person required to disclose.

The information must be disclosed in writing to the city or county attorney within 14 days of receipt of the written request.

§ Subd. 4.

[Repealed, 2013 c 85 art 6 s 13]

§ Subd. 5. Civil enforcement.

(a) A city in which the land is located or, if the land is not located within a city, the county in which the land is located, may enforce the provisions of this section. The city or county may bring an action to compel the recording of a contract for deed or any assignments of a contract for deed, an action to impose the civil penalty, or an action to compel disclosure of information.

(b) Prior to bringing an action under this subdivision to compel recording or to impose the penalty, or an action under subdivision 4, the city or county must provide written notice to the person, subject to subdivision 1, of the person's duty to record the contract for deed or the assignment. If the person so notified fails to record the contract for deed or assignment documents within 14 days of receipt of the notice, an action may be brought.

(c) It is an affirmative defense in an enforcement action under this section that the contract for deed or assignment document is not recordable, or that section 272.121 prohibits the recording of the contract for deed or assignment, and that the defendant has provided to the city or county attorney true and correct copies of the documents within 14 days after receipt of the notice.

(d) In an action brought under this subdivision, the city or county attorney may recover costs and disbursements, including reasonable attorney fees.

History:

1983 c 342 art 2 s 25; 1984 c 593 s 45; 1984 c 655 art 1 s 69; 1988 c 566 s 1; 1988 c 719 art 19 s 25; 2009 c 130 s 2; 2010 c 233 s 1; 2013 c 85 art 6 s 6

PROPERTY INTERESTS AND LIENS (Chap. 500-515B)

CHAPTER 507 RECORDING AND FILING CONVEYANCES

507.236 Transfer statement for contract for deed.

§ Subdivision 1.Definition.

In this section, "transfer statement for a contract for deed" means a document that:

(1) is a transfer statement made in compliance with section 336.9-619(a); and

(2) transfers a seller's interest in an executory contract for the sale of real estate or of an interest in real estate that entitles the purchaser to possession of the real estate.

§ Subd. 2.Recording of statement.

A transferee under a transfer statement for a contract for deed is entitled to have the statement recorded as provided in section 336.9-619(b). Recording must be with the county recorder or registrar of titles in the county where the affected real estate is located.<br />

<br />

§ Subd. 3.Effects of recording.<br />

<br />

Subject to compliance with any applicable provisions of section 508.491 or 508A.491, recording a transfer statement for a contract for deed has the following effects:<br />

<br />

(1) it transfers from the contract seller named as debtor in the statement to the transferee all title and interest of the contract seller in the real estate described in the statement;<br />

<br />

(2) it has the same effect as an assignment and a deed from the contract seller to the transferee; and<br />

<br />

(3) it is a conveyance within the meaning of section 507.34.<br />

<br />

History:<br />

2001 c 195 art 1 s 19<br />

<br />

<br />

JUDICIAL PROCEDURE, DISTRICT COURT (Chap. 540-552)<br />

CHAPTER 541 LIMITATION OF TIME, COMMENCING ACTIONS<br />

<br />

541.05 Various cases, six years.<br />

<br />

§ Subdivision 1.Six-year limitation.<br />

<br />

Except where the Uniform Commercial Code otherwise prescribes, the following actions shall be commenced within six years:<br />

<br />

(1) upon a contract or other obligation, express or implied, as to which no other limitation is expressly prescribed;<br />

<br />

(2) upon a liability created by statute, other than those arising upon a penalty or forfeiture or where a shorter period is provided by section 541.07;<br />

<br />

(3) for a trespass upon real estate;<br />

<br />

(4) for taking, detaining, or injuring personal property, including actions for the specific recovery thereof;<br />

<br />

(5) for criminal conversation, or for any other injury to the person or rights of another, not arising on contract, and not hereinafter enumerated;<br />

<br />

(6) for relief on the ground of fraud, in which case the cause of action shall not be deemed to have accrued until the discovery by the aggrieved party of the facts constituting the fraud;<br />

<br />

(7) against sureties upon the official bond of any public officer, whether of the state or of any county, town, school district, or a municipality therein; in which case the limitation shall not begin to run until the term of such officer for which the bond was given shall have expired;<br />

<br />

(8) for damages caused by a dam, used for commercial purposes; or<br />

<br />

(9) for assault, battery, false imprisonment, or other tort resulting in personal injury, if the conduct that gives rise to the cause of action also constitutes domestic abuse as defined in section 518B.01.<br />

<br />

§ Subd. 2.Strict liability.<br />

<br />

Unless otherwise provided by law, any action based on the strict liability of the defendant and arising from the manufacture, sale, use or consumption of a product shall be commenced within four years.<br />

<br />

History:<br />

(9191) RL s 4076; 1953 c 378 s 1; 1965 c 812 s 20; 1978 c 738 s 1; 1986 c 444; 2000 c 471 s 1; 2015 c 5 art 15 s 18<br />

<br />

DECLARATORY, CORRECTIVE AND ADMINISTRATIVE REMEDIES (Chap. 553-563)<br />

CHAPTER 559 ADVERSE CLAIMS TO REAL ESTATE<br />

<br />

559.21 Contract termination; notice; service; costs; conditions.<br />

<br />

§ Subdivision 1.<br />

<br />

[Repealed, 1Sp1985 c 18 s 16]<br />

<br />

§ Subd. 1a.<br />

<br />

[Repealed, 1Sp1985 c 18 s 16]<br />

<br />

§ Subd. 1b.For contract executed before 8/2/1976.<br />

<br />

If a default occurs in the conditions of a contract for the conveyance of real estate or an interest in real estate executed on or prior to August 1, 1976, that gives the seller a right to terminate it, the seller may terminate the contract by serving upon the purchaser or the purchaser’s personal representatives or assigns, within or outside the state, a notice specifying the conditions in which default has been made. The notice must state that the contract will terminate 30 days after the service of the notice, unless prior to the termination date the purchaser:<br />

<br />

(1) complies with the conditions in default;<br />

<br />

(2) pays the costs of service of the notice, including the reasonable costs of service by sheriff, public officer, or private process server; except payment of costs of service is not required unless the seller notifies the purchaser of the actual costs of service by certified mail to the purchaser’s last known address at least ten days prior to the date of termination; and<br />

<br />

(3) pays an amount to apply on attorneys’ fees actually expended or incurred, of $50 if the amount in default is less than $500, and of $100 if the amount in default is $500 or more; except no amount is required to be paid for attorneys’ fees unless some part of the conditions of default has existed for at least 45 days prior to the date of service of the notice.<br />

<br />

§ Subd. 1c.For contract executed before 5/1/1980.<br />

<br />

If a default occurs in the conditions of a contract for the conveyance of real estate or an interest in real estate executed after August 1, 1976, and prior to May 1, 1980, that gives the seller a right to terminate it, the seller may terminate the contract by serving upon the purchaser or the purchaser’s personal representatives or assigns, within or outside the state, a notice specifying the conditions in which default has been made. The notice must state that the contract will terminate 30 days after the service of the notice if the purchaser has paid less than 30 percent of the purchase price, 45 days after service of the notice if the purchaser has paid 30 percent or more of the purchase price but less than 50 percent, or 60 days after service of the notice if the purchaser has paid 50 percent or more of the purchase price; unless prior to the termination date the purchaser:<br />

<br />

(1) complies with the conditions in default;<br />

<br />

(2) pays the costs of service of the notice, including the reasonable costs of service by sheriff, public officer, or private process server; except payment of costs of service is not required unless the seller notifies the purchaser of the actual costs of service by certified mail to the purchaser’s last known address at least ten days prior to the date of termination; and<br />

<br />

(3) pays an amount to apply on attorneys’ fees actually expended or incurred, of $75 if the amount in default is less than $750, and of $200 if the amount in default is $750 or more; except no amount is required to be paid for attorneys’ fees unless some part of the conditions of default has existed for at least 45 days prior to the date of service of the notice.<br />

<br />

§ Subd. 1d.For contract executed before 8/1/1985.<br />

<br />

If a default occurs in the conditions of a contract for the conveyance of real estate or an interest in real estate executed on or after May 1, 1980 and prior to August 1, 1985, that gives the seller a right to terminate it, the seller may terminate the contract by serving upon the purchaser or the purchaser’s personal representatives or assigns, within or outside the state, a notice specifying the conditions in which default has been made. The notice must state that the contract will terminate 30 days after the service of the notice if the purchaser has paid less than ten percent of the purchase price, 60 days after service of the notice if the purchaser has paid ten percent or more of the purchase price but less than 25 percent, or 90 days after service of the notice if the purchaser has paid 25 percent or more of the purchase price; unless prior to the termination date the purchaser:<br />

<br />

(1) complies with the conditions in default;<br />

<br />

(2) makes all payments due and owing to the seller under the contract through the date that payment is made;<br />

<br />

(3) pays the costs of service of the notice, including the reasonable costs of service by sheriff, public officer, or private process server; except payment of costs of service is not required unless the seller notifies the purchaser of the actual costs of service by certified mail to the purchaser’s last known address at least ten days prior to the date of termination; and<br />

<br />

(4) pays an amount to apply on attorneys’ fees actually expended or incurred, of $125 if the amount in default is less than $750, and of $250 if the amount in default is $750 or more; except no amount is required to be paid for attorneys’ fees unless some part of the conditions of default has existed for at least 45 days prior to the date of service of the notice.<br />

<br />

§ Subd. 1e.Determination of purchase price.<br />

<br />

For purposes of determining the purchase price and the amount of the purchase price paid on contracts executed prior to August 1, 1985:<br />

<br />

(a) The purchase price is the sale price under the contract alleged to be in default, including the initial down payment. Mortgages, prior contracts for deed, special assessments, delinquent real estate taxes, or other obligations or encumbrances assumed by the purchaser are excluded in determining the purchase price.<br />

<br />

(b) The amount paid by the purchaser is the total of payments of principal made under the contract alleged to be in default, including the initial down payment. Interest payments and payments made under mortgages, prior contracts for deed, special assessments, delinquent real estate taxes, or other obligations or encumbrances assumed by the purchaser are excluded in determining the amount paid by the purchaser.<br />

<br />

§ Subd. 2.<br />

<br />

[Repealed, 1Sp1985 c 18 s 16]<br />

<br />

§ Subd. 2a.For post 7/31/1985 contract.<br />

<br />

If a default occurs in the conditions of a contract for the conveyance of real estate or an interest in real estate executed on or after August 1, 1985, that gives the seller a right to terminate it, the seller may terminate the contract by serving upon the purchaser or the purchaser’s personal representatives or assigns, within or outside of the state, a notice specifying the conditions in which default has been made. The notice must state that the contract will terminate 60 days, or a shorter period allowed in subdivision 4, after the service of the notice, unless prior to the termination date the purchaser:<br />

<br />

(1) complies with the conditions in default;<br />

<br />

(2) makes all payments due and owing to the seller under the contract through the date that payment is made;<br />

<br />

(3) pays the costs of service of the notice, including the reasonable costs of service by sheriff, public officer, or private process server; except payment of costs of service is not required unless the seller notifies the purchaser of the actual costs of service by certified mail to the purchaser’s last known address at least ten days prior to the date of termination;<br />

<br />

(4) except for earnest money contracts, purchase agreements, and exercised options, pays two percent of any amount in default at the time of service, not including the final balloon payment, any taxes, assessments, mortgages, or prior contracts that are assumed by the purchaser; and<br />

<br />

(5) if the contract is executed on or after August 1, 1999, pays an amount to apply on attorneys’ fees actually expended or incurred, of $250 if the amount in default is less than $1,000, and of $500 if the amount in default is $1,000 or more; or if the contract is executed before August 1, 1999, pays an amount to apply on attorneys’ fees actually expended or incurred, of $125 if the amount in default is less than $750, and of $250 if the amount in default is $750 or more; except that no amount for attorneys’ fees is required to be paid unless some part of the conditions of default has existed for at least 30 days prior to the date of service of the notice.<br />

<br />

§ Subd. 3.Notice defined.<br />

<br />

For purposes of this section, the term “notice” means a writing stating the information required in this section, stating the name, address and telephone number of the seller or of an attorney authorized by the seller to accept payments pursuant to the notice and the fact that the person named is authorized to receive the payments, stating a mailing address and a street address or location where the seller or the attorney will accept payment pursuant to the notice, and including the following information in 12-point or larger underlined uppercase type, or 8-point type if published, or in large legible handwritten letters:<br />

<br />

THIS NOTICE IS TO INFORM YOU THAT BY THIS NOTICE THE SELLER HAS BEGUN PROCEEDINGS UNDER MINNESOTA STATUTES, SECTION 559.21, TO TERMINATE YOUR CONTRACT FOR THE PURCHASE OF YOUR PROPERTY FOR THE REASONS SPECIFIED IN THIS NOTICE. THE CONTRACT WILL TERMINATE ….. DAYS AFTER (SERVICE OF THIS NOTICE UPON YOU) (THE FIRST DATE OF PUBLICATION OF THIS NOTICE) (STRIKE ONE) UNLESS BEFORE THEN:<br />

<br />

(a) THE PERSON AUTHORIZED IN THIS NOTICE TO RECEIVE PAYMENTS RECEIVES FROM YOU:<br />

<br />

(1) THE AMOUNT THIS NOTICE SAYS YOU OWE; PLUS<br />

<br />

(2) THE COSTS OF SERVICE (TO BE SENT TO YOU); PLUS<br />

<br />

(3) $……….. TO APPLY TO ATTORNEYS’ FEES ACTUALLY EXPENDED OR INCURRED; PLUS<br />

<br />

(4) FOR CONTRACTS EXECUTED ON OR AFTER MAY 1, 1980, ANY ADDITIONAL PAYMENTS BECOMING DUE UNDER THE CONTRACT TO THE SELLER AFTER THIS NOTICE WAS SERVED ON YOU; PLUS<br />

<br />

(5) FOR CONTRACTS, OTHER THAN EARNEST MONEY CONTRACTS, PURCHASE AGREEMENTS, AND EXERCISED OPTIONS, EXECUTED ON OR AFTER AUGUST 1, 1985, $…. (WHICH IS TWO PERCENT OF THE AMOUNT IN DEFAULT AT THE TIME OF SERVICE OTHER THAN THE FINAL BALLOON PAYMENT, ANY TAXES, ASSESSMENTS, MORTGAGES, OR PRIOR CONTRACTS THAT ARE ASSUMED BY YOU); OR<br />

<br />

(b) YOU SECURE FROM A COUNTY OR DISTRICT COURT AN ORDER THAT THE TERMINATION OF THE CONTRACT BE SUSPENDED UNTIL YOUR CLAIMS OR DEFENSES ARE FINALLY DISPOSED OF BY TRIAL, HEARING OR SETTLEMENT. YOUR ACTION MUST SPECIFICALLY STATE THOSE FACTS AND GROUNDS THAT DEMONSTRATE YOUR CLAIMS OR DEFENSES.<br />

<br />

IF YOU DO NOT DO ONE OR THE OTHER OF THE ABOVE THINGS WITHIN THE TIME PERIOD SPECIFIED IN THIS NOTICE, YOUR CONTRACT WILL TERMINATE AT THE END OF THE PERIOD AND YOU WILL LOSE ALL THE MONEY YOU HAVE PAID ON THE CONTRACT; YOU WILL LOSE YOUR RIGHT TO POSSESSION OF THE PROPERTY; YOU MAY LOSE YOUR RIGHT TO ASSERT ANY CLAIMS OR DEFENSES THAT YOU MIGHT HAVE; AND YOU WILL BE EVICTED. IF YOU HAVE ANY QUESTIONS ABOUT THIS NOTICE, CONTACT AN ATTORNEY IMMEDIATELY.<br />

<br />

§ Subd. 4.Law prevails over contract; procedure; conditions.<br />

<br />

(a) The notice required by this section must be given notwithstanding any provisions in the contract to the contrary, except that earnest money contracts, purchase agreements, and exercised options that are subject to this section may, unless by their terms they provide for a longer termination period, be terminated on 30 days’ notice, or may be canceled under section 559.217. The notice must be served within the state in the same manner as a summons in the district court, and outside of the state, in the same manner, and without securing any sheriff’s return of not found, making any preliminary affidavit, mailing a copy of the notice or doing any other preliminary act or thing whatsoever. Service of the notice outside of the state may be proved by the affidavit of the person making the same, made before an authorized officer having a seal, and within the state by such an affidavit or by the return of the sheriff of any county therein.<br />

<br />

(b) If a person to be served is a resident individual who has departed from the state, or cannot be found in the state; or is a nonresident individual or a foreign corporation, partnership, or association, service may be made by publication as provided in this paragraph. Three weeks’ published notice has the same effect as personal service of the notice. The published notice must comply with subdivision 3 and state (1) that the person to be served is allowed 90 days after the first date of publication of the notice to comply with the conditions of the contract, and (2) that the contract will terminate 90 days after the first date of publication of the notice, unless before the termination date the purchaser complies with the notice. If the real estate described in the contract is actually occupied, then, in addition to publication, a person in possession must be personally served, in like manner as the service of a summons in a civil action in state district court, within 30 days after the first date of publication of the notice. If an address of a person to be served is known, then within 30 days after the first date of publication of the notice a copy of the notice must be mailed to the person’s last known address by first class mail, postage prepaid.<br />

<br />

(c) The contract is reinstated if, within the time mentioned, the person served:<br />

<br />

(1) complies with the conditions in default;<br />

<br />

(2) if subdivision 1d or 2a applies, makes all payments due and owing to the seller under the contract through the date that payment is made;<br />

<br />

(3) pays the costs of service as provided in subdivision 1b, 1c, 1d, or 2a;<br />

<br />

(4) if subdivision 2a applies, pays two percent of the amount in default, not including the final balloon payment, any taxes, assessments, mortgages, or prior contracts that are assumed by the purchaser; and<br />

<br />

(5) pays attorneys’ fees as provided in subdivision 1b, 1c, 1d, or 2a.<br />

<br />

(d) The contract is terminated if the provisions of paragraph (c) are not met.<br />

<br />

(e) In the event that the notice was not signed by an attorney for the seller and the seller is not present in the state, or cannot be found in the state, then compliance with the conditions specified in the notice may be made by paying to the court administrator of the district court in the county wherein the real estate or any part thereof is situated any money due and filing proof of compliance with other defaults specified, and the court administrator of the district court shall be deemed the agent of the seller for such purposes. A copy of the notice with proof of service thereof, and the affidavit of the seller, the seller’s agent or attorney, showing that the purchaser has not complied with the terms of the notice, may be recorded with the county recorder or registrar of titles, and is prima facie evidence of the facts stated in it; but this section in no case applies to contracts for the sale or conveyance of lands situated in another state or in a foreign country. If the notice is served by publication, the affidavit must state that the affiant believes that the party to be served is not a resident of the state, or cannot be found in the state, and either that the affiant has mailed a copy of the notice by first class mail, postage prepaid, to the party’s last known address, or that such address is not known to the affiant.<br />

<br />

§ Subd. 5.If required, notify commissioner. When required by and in the manner provided in section 270C.63, subdivision 11, the notice required by this section shall also be given to the commissioner of revenue.<br />

<br />

§ Subd. 6. [Repealed, 1983 c 215 s 16; 1984 c 474 s 7; 1985 c 306 s 26; 1987 c 292 s 36; 1989 c 350 art 16 s 7]<br />

<br />

§ Subd. 7. Cancellation of land sale. The state of Minnesota shall cancel any sale of land made by the state under an installment contract upon default therein only in accord with the provisions of this section.<br />

<br />

§ Subd. 8. Attorney as agent for service. Any attorney expressly authorized by the seller to receive payments in the notice of termination under this section is designated as the attorney who may receive service as agent for the seller of all summons, complaints, orders, and motions made in conjunction with an action by the purchaser to restrain the termination. Service in the action may be made upon the seller by mailing a copy of the process to the seller or to the seller’s attorney, by first class mail, postage prepaid, to the address stated in the notice where payments will be accepted.<br />

<br />

History:<br />

<br />

(9576) RL s 4442; 1913 c 136 s 1; 1915 c 200 s 1; 1925 c 163 s 1; 1959 c 618 s 1; 1961 c 270 s 1; 1976 c 181 s 2; 1976 c 240 s 1; 1980 c 373 s 6; 1982 c 500 s 3,4; 1982 c 523 art 2 s 47; 1983 c 215 s 2; 1983 c 342 art 15 s 38; 1984 c 474 s 2; 1985 c 300 s 29; 1985 c 306 s 7; 1Sp1985 c 16 art 2 s 44; 1Sp1985 c 18 s 6-10,16; 1986 c 438 s 1-8; 1Sp1986 c 3 art 1 s 82; 1992 c 463 s 30,31; 1994 c 388 art 2 s 1-3; 1999 c 11 art 4 s 4; 2004 c 203 art 1 s 9; 2005 c 4 s 136; 2005 c 151 art 2 s 17<br />

<br />

DECLARATORY, CORRECTIVE AND ADMINISTRATIVE REMEDIES (Chap. 553-563)<br />

CHAPTER 559 ADVERSE CLAIMS TO REAL ESTATE<br />

<br />

559.205 Contracts for deed; modification.<br />

<br />

Notwithstanding any law to the contrary, a renegotiated contract for deed or an agreement modifying the terms of a contract for deed which was valid at its inception shall not be construed as creating a mortgage or an equitable mortgage. This section does not modify any other requirements relating to contracts for deed.<br />

<br />

History:<br />

<br />

1982 c 500 s 2<br />

<br />

DECLARATORY, CORRECTIVE AND ADMINISTRATIVE REMEDIES (Chap. 553-563)<br />

CHAPTER 559 ADVERSE CLAIMS TO REAL ESTATE<br />

<br />

559.215 Validating terminations of contract of sale.<br />

<br />

Every termination of a contract for the conveyance of real property or an interest in real property is legal and valid after the expiration of the period specified in section 559.216 as against the following objections:<br />

<br />

(1) that prior to the service of notice of termination, no mortgage registration tax was paid on the contract, or an insufficient registration tax was paid on the contract;<br />

<br />

(2) that the notice:<br />

<br />

(i) did not correctly state the amount of attorney fees;<br />

<br />

(ii) failed to state or incorrectly stated the names of one or more of the sellers, or the sellers’ successors or assigns, or incorrectly described the interest or representative capacity of the person giving the notice;<br />

<br />

(iii) was printed or typed in an incorrect type size;<br />

<br />

(iv) incorrectly stated the number of days after service that the contract will terminate, provided that the number of days stated is not less than 30 days; or<br />

<br />

(v) did not correctly state the two percent amount required to be paid by section 559.21, subdivision 2a, clause (4);<br />

<br />

(3) that the cancellation was commenced by less than all sellers; or<br />

<br />

(4) that in the case of a termination by publication the notice was not served on all persons in possession of the real estate, provided it was served on at least one of those persons.<br />

<br />

History:<br />

1990 c 575 s 8; 1996 c 338 art 1 s 11<br />

<br />

DECLARATORY, CORRECTIVE AND ADMINISTRATIVE REMEDIES (Chap. 553-563)<br />

CHAPTER 559 ADVERSE CLAIMS TO REAL ESTATE<br />

<br />

559.216 Application of curative provisions.<br />

<br />

§ Subdivision 1.Expiration periods.<br />

<br />

Upon expiration of the periods specified in this section, the provisions of section 559.215 apply to a termination of a contract for the conveyance of real property or an interest in real property subject to this section:<br />

<br />

(1) as to section 559.215, clause (2), item (iv), and clause (3), five years after the last day of the correct reinstatement period of the purchaser or the purchaser’s personal representatives or assigns; and<br />

<br />

(2) as to all other provisions of section 559.215, one year after the last day of the reinstatement period of the purchaser or the purchaser’s personal representatives or assigns.<br />

<br />

§ Subd. 2.Pending and newly commenced actions.<br />

<br />

This section and section 559.215, as enacted by Laws 1990, chapter 575, sections 8 and 9, do not affect any action or proceeding pending on August 1, 1990, or commenced before February 1, 1991, involving the validity of the termination or conveyance.<br />

<br />

The amendments to this section and section 559.215 by Laws 1996, chapter 338, article 1, shall not affect any action pending on August 1, 1996, or that is commenced before February 1, 1997, involving the validity of the termination or conveyance.<br />

<br />

History:<br />

1990 c 575 s 9; 1996 c 338 art 1 s 12<br />

<br />

Minnesota Case Law<br />

<br />

General Principle<br />

<br />

Contracts for deed provide a useful alternative financing mechanism which promotes the availability of credit and the transferability of property, and the legislature has approved contracts for deed as being in Minnesota’s best interest by enacting legislation which supports their continued use. Minn. Stat. §§ 559.205-.216 (1994). In Minnesota, one remedy available to a vendor upon the vendee’s defaulting under the terms of the contract for deed is the vendor’s ability to cancel the contract pursuant to Minn. Stat. § 559.21. A statutory cancellation of a contract for deed results in the vendee’s forfeiture of all payments made and restoration of full legal and equitable title in the property to the vendor. This result is different from that in a mortgage foreclosure sale, where the defaulting party may receive proceeds of a mortgage foreclosure sale above the amount owed on the property. Shields v. Goldetsky, 552 N.W.2d 226, (1996).<br />

<br />

Notice of Cancellation<br />

<br />

Minn. Stat. § 559.21 (1976) provides that a contract for deed terminates 30 days after personal service of notice of cancellation unless the vendee, within that time period, complies with the specified conditions in default. The statute has a double purpose: to ameliorate the harsh common-law rule which permitted a peremptory forfeiture upon default by providing a grace period; and also to remove grounds for uncertainty or controversy with respect to property ownership by prescribing a definite procedure for termination. Aune v. Bona, 305 N.W.2d 602, (1981).<br />

<br />

Remedies<br />

<br />

When a vendee defaults under a contract for deed the vendor has a choice of remedies. The vendor may sue on the contract for the balance of the purchase price or cancel the contract, recover the land and forego recovery of the balance. Neuman v. Demmer, 414 N.W.2d 240, (1987).<br />

<br />

Usury<br />

<br />

Minn. Stat. § 47.20 (1998) forbids a contract for deed vendor from charging interest on contracts for deed at an interest rate in excess of the Federal National Mortgage Association posted yields on 30-year mortgage commitments for delivery within 60 days on standard conventional fixed-rate mortgages, plus four percentage points. Minn. Stat. § 47.20, subds. 3, 4a. These limitations on interest are only applicable to a contract for deed for an amount less than $ 100,000. Minn. Stat. § 47.20, subd. 2(2).<br />

<br />

Statute of Limitations<br />

<br />

The action of a vendee for unjust enrichment in connection with a contract for deed was barred under Minn. Stat. § 541.05, subd. 1(6), because not brought within six years of the closing of the contract. Nordstrom v. Kim, 1994 Minn. App. LEXIS 914 (Minn. Ct. App. June 21 1994).

PROPERTY INTERESTS AND LIENS (Chap. 500-515B)

CHAPTER 507 RECORDING AND FILING CONVEYANCES

507.235 Filing contracts for deed.

§ Subdivision 1. Filing required.

All contracts for deed executed on or after January 1, 1984, shall be recorded by the vendee within four months in the office of the county recorder or registrar of titles in the county in which the land is located. Any other person may record the contract. This filing period may be extended if failure to pay the property tax due in the current year on a parcel as required in section 272.121 has prevented filing and recording of the contract. In the case of a parcel that was divided and classified under section 273.13 as class 1a or 1b, the period may be extended to October 31 of the year in which the sale occurred, and in the case of a parcel that was divided and classified under section 273.13 as class 2a, the period may be extended to November 30 of the year in which the sale occurred.

A person receiving an assignment of a vendee's interest in a contract for deed that is transferred on or after January 1, 1989, shall record the assignment within four months of the date of transfer in the office of the county recorder or registrar of titles in the county in which the land is located. For the purpose of this section, "assignment" means an assignment or other transfer of all or part of a vendee's interest in a contract for deed. Any other person may record an assignment.

§ Subd. 1a.Requirements of vendor.

(a) A vendor entering into a contract for deed involving residential real property must, contemporaneously with the execution of the contract for deed:

(1) deliver to the vendee a copy of the contract for deed containing original signatures in recordable form; and

(2) pay, or reimburse the vendee for payment of, any delinquent taxes necessary for recordation of the contract for deed, unless the contract for deed provides for the vendee to pay the delinquent taxes.

(b) For purposes of this subdivision:

(1) "contract for deed" means an executory contract for the conveyance of residential real property under which the seller provides financing for the purchase of the residential real property and under which the purchaser does or has a right to go into possession. Contract for deed does not include:

(i) a purchase agreement;

(ii) an earnest money contract;

(iii) an exercised option or a lease, including a lease with an option to purchase; or

(iv) a mortgage, as defined in section 287.01; and

(2) "residential real property" means real property occupied, or intended to be occupied, by one to four families, if the purchaser intends to occupy the real property. Residential real property does not include property subject to a family farm security loan or a transaction subject to sections 583.20 to 583.32.

§ Subd. 2. Penalty for failure to file.

(a) A vendee who fails to record a contract for deed, as required by subdivision 1, is subject to a civil penalty, payable under subdivision 5, equal to two percent of the principal amount of the contract debt, unless the vendee has not received a copy of the contract for deed in recordable form, as required under subdivision 1a. Payments of the penalty shall be deposited in the general fund of the county. The penalty may be enforced as a lien against the vendee's interest in the property.

(b) A person receiving an assignment of a vendee's interest in a contract for deed who fails to record the assignment as required by subdivision 1 is subject to a civil penalty, payable under subdivision 5, equal to two percent of the original principal amount of the contract debt. Payments of the penalty must be deposited in the general fund of the county. The penalty may be enforced as a lien against the vendee's interest in the property.

§ Subd. 3. Disclosure.

(a) Whenever a contract for deed or assignment of a vendee's interest in a contract for deed is not recorded and a city or county attorney requires information concerning the contract for deed or assignment of contract for deed for the performance of the attorney's duties on behalf of the city or county, the city or county attorney may request disclosure under paragraph (b).

(b) A vendor, vendee, or current or former holder of a vendor's or vendee's interest in a contract for deed, a person who collects payments made under a contract for deed, or a person in possession of the property subject to a contract for deed shall, on written request that includes a copy of this section made by the city or county attorney of the city or county in which the property is located, disclose all information known to the person relating to:

(1) the identity and residence or office mailing address of the parties to the contract for deed; and

(2) any assignments of the contract for deed.

The disclosure also must include any legible, true and correct copies of each contract for deed and assignment documents in the possession of or reasonably available to the person required to disclose.

The information must be disclosed in writing to the city or county attorney within 14 days of receipt of the written request.

§ Subd. 4.

[Repealed, 2013 c 85 art 6 s 13]

§ Subd. 5. Civil enforcement.

(a) A city in which the land is located or, if the land is not located within a city, the county in which the land is located, may enforce the provisions of this section. The city or county may bring an action to compel the recording of a contract for deed or any assignments of a contract for deed, an action to impose the civil penalty, or an action to compel disclosure of information.

(b) Prior to bringing an action under this subdivision to compel recording or to impose the penalty, or an action under subdivision 4, the city or county must provide written notice to the person, subject to subdivision 1, of the person's duty to record the contract for deed or the assignment. If the person so notified fails to record the contract for deed or assignment documents within 14 days of receipt of the notice, an action may be brought.

(c) It is an affirmative defense in an enforcement action under this section that the contract for deed or assignment document is not recordable, or that section 272.121 prohibits the recording of the contract for deed or assignment, and that the defendant has provided to the city or county attorney true and correct copies of the documents within 14 days after receipt of the notice.

(d) In an action brought under this subdivision, the city or county attorney may recover costs and disbursements, including reasonable attorney fees.

History:

1983 c 342 art 2 s 25; 1984 c 593 s 45; 1984 c 655 art 1 s 69; 1988 c 566 s 1; 1988 c 719 art 19 s 25; 2009 c 130 s 2; 2010 c 233 s 1; 2013 c 85 art 6 s 6

PROPERTY INTERESTS AND LIENS (Chap. 500-515B)

CHAPTER 507 RECORDING AND FILING CONVEYANCES

507.236 Transfer statement for contract for deed.

§ Subdivision 1.Definition.

In this section, "transfer statement for a contract for deed" means a document that:

(1) is a transfer statement made in compliance with section 336.9-619(a); and

(2) transfers a seller's interest in an executory contract for the sale of real estate or of an interest in real estate that entitles the purchaser to possession of the real estate.

§ Subd. 2.Recording of statement.

A transferee under a transfer statement for a contract for deed is entitled to have the statement recorded as provided in section 336.9-619(b). Recording must be with the county recorder or registrar of titles in the county where the affected real estate is located.<br />

<br />

§ Subd. 3.Effects of recording.<br />

<br />

Subject to compliance with any applicable provisions of section 508.491 or 508A.491, recording a transfer statement for a contract for deed has the following effects:<br />

<br />

(1) it transfers from the contract seller named as debtor in the statement to the transferee all title and interest of the contract seller in the real estate described in the statement;<br />

<br />

(2) it has the same effect as an assignment and a deed from the contract seller to the transferee; and<br />

<br />

(3) it is a conveyance within the meaning of section 507.34.<br />

<br />

History:<br />

2001 c 195 art 1 s 19<br />

<br />

<br />

JUDICIAL PROCEDURE, DISTRICT COURT (Chap. 540-552)<br />

CHAPTER 541 LIMITATION OF TIME, COMMENCING ACTIONS<br />

<br />

541.05 Various cases, six years.<br />

<br />

§ Subdivision 1.Six-year limitation.<br />

<br />

Except where the Uniform Commercial Code otherwise prescribes, the following actions shall be commenced within six years:<br />

<br />

(1) upon a contract or other obligation, express or implied, as to which no other limitation is expressly prescribed;<br />

<br />

(2) upon a liability created by statute, other than those arising upon a penalty or forfeiture or where a shorter period is provided by section 541.07;<br />

<br />

(3) for a trespass upon real estate;<br />

<br />

(4) for taking, detaining, or injuring personal property, including actions for the specific recovery thereof;<br />

<br />

(5) for criminal conversation, or for any other injury to the person or rights of another, not arising on contract, and not hereinafter enumerated;<br />

<br />

(6) for relief on the ground of fraud, in which case the cause of action shall not be deemed to have accrued until the discovery by the aggrieved party of the facts constituting the fraud;<br />

<br />

(7) against sureties upon the official bond of any public officer, whether of the state or of any county, town, school district, or a municipality therein; in which case the limitation shall not begin to run until the term of such officer for which the bond was given shall have expired;<br />

<br />

(8) for damages caused by a dam, used for commercial purposes; or<br />

<br />

(9) for assault, battery, false imprisonment, or other tort resulting in personal injury, if the conduct that gives rise to the cause of action also constitutes domestic abuse as defined in section 518B.01.<br />

<br />

§ Subd. 2.Strict liability.<br />

<br />

Unless otherwise provided by law, any action based on the strict liability of the defendant and arising from the manufacture, sale, use or consumption of a product shall be commenced within four years.<br />

<br />

History:<br />

(9191) RL s 4076; 1953 c 378 s 1; 1965 c 812 s 20; 1978 c 738 s 1; 1986 c 444; 2000 c 471 s 1; 2015 c 5 art 15 s 18<br />

<br />

DECLARATORY, CORRECTIVE AND ADMINISTRATIVE REMEDIES (Chap. 553-563)<br />

CHAPTER 559 ADVERSE CLAIMS TO REAL ESTATE<br />

<br />

559.21 Contract termination; notice; service; costs; conditions.<br />

<br />

§ Subdivision 1.<br />

<br />

[Repealed, 1Sp1985 c 18 s 16]<br />

<br />

§ Subd. 1a.<br />

<br />

[Repealed, 1Sp1985 c 18 s 16]<br />

<br />

§ Subd. 1b.For contract executed before 8/2/1976.<br />

<br />

If a default occurs in the conditions of a contract for the conveyance of real estate or an interest in real estate executed on or prior to August 1, 1976, that gives the seller a right to terminate it, the seller may terminate the contract by serving upon the purchaser or the purchaser’s personal representatives or assigns, within or outside the state, a notice specifying the conditions in which default has been made. The notice must state that the contract will terminate 30 days after the service of the notice, unless prior to the termination date the purchaser:<br />

<br />

(1) complies with the conditions in default;<br />

<br />

(2) pays the costs of service of the notice, including the reasonable costs of service by sheriff, public officer, or private process server; except payment of costs of service is not required unless the seller notifies the purchaser of the actual costs of service by certified mail to the purchaser’s last known address at least ten days prior to the date of termination; and<br />

<br />

(3) pays an amount to apply on attorneys’ fees actually expended or incurred, of $50 if the amount in default is less than $500, and of $100 if the amount in default is $500 or more; except no amount is required to be paid for attorneys’ fees unless some part of the conditions of default has existed for at least 45 days prior to the date of service of the notice.<br />

<br />

§ Subd. 1c.For contract executed before 5/1/1980.<br />

<br />

If a default occurs in the conditions of a contract for the conveyance of real estate or an interest in real estate executed after August 1, 1976, and prior to May 1, 1980, that gives the seller a right to terminate it, the seller may terminate the contract by serving upon the purchaser or the purchaser’s personal representatives or assigns, within or outside the state, a notice specifying the conditions in which default has been made. The notice must state that the contract will terminate 30 days after the service of the notice if the purchaser has paid less than 30 percent of the purchase price, 45 days after service of the notice if the purchaser has paid 30 percent or more of the purchase price but less than 50 percent, or 60 days after service of the notice if the purchaser has paid 50 percent or more of the purchase price; unless prior to the termination date the purchaser:<br />

<br />

(1) complies with the conditions in default;<br />

<br />

(2) pays the costs of service of the notice, including the reasonable costs of service by sheriff, public officer, or private process server; except payment of costs of service is not required unless the seller notifies the purchaser of the actual costs of service by certified mail to the purchaser’s last known address at least ten days prior to the date of termination; and<br />

<br />

(3) pays an amount to apply on attorneys’ fees actually expended or incurred, of $75 if the amount in default is less than $750, and of $200 if the amount in default is $750 or more; except no amount is required to be paid for attorneys’ fees unless some part of the conditions of default has existed for at least 45 days prior to the date of service of the notice.<br />

<br />

§ Subd. 1d.For contract executed before 8/1/1985.<br />

<br />

If a default occurs in the conditions of a contract for the conveyance of real estate or an interest in real estate executed on or after May 1, 1980 and prior to August 1, 1985, that gives the seller a right to terminate it, the seller may terminate the contract by serving upon the purchaser or the purchaser’s personal representatives or assigns, within or outside the state, a notice specifying the conditions in which default has been made. The notice must state that the contract will terminate 30 days after the service of the notice if the purchaser has paid less than ten percent of the purchase price, 60 days after service of the notice if the purchaser has paid ten percent or more of the purchase price but less than 25 percent, or 90 days after service of the notice if the purchaser has paid 25 percent or more of the purchase price; unless prior to the termination date the purchaser:<br />

<br />

(1) complies with the conditions in default;<br />

<br />

(2) makes all payments due and owing to the seller under the contract through the date that payment is made;<br />

<br />

(3) pays the costs of service of the notice, including the reasonable costs of service by sheriff, public officer, or private process server; except payment of costs of service is not required unless the seller notifies the purchaser of the actual costs of service by certified mail to the purchaser’s last known address at least ten days prior to the date of termination; and<br />

<br />

(4) pays an amount to apply on attorneys’ fees actually expended or incurred, of $125 if the amount in default is less than $750, and of $250 if the amount in default is $750 or more; except no amount is required to be paid for attorneys’ fees unless some part of the conditions of default has existed for at least 45 days prior to the date of service of the notice.<br />

<br />

§ Subd. 1e.Determination of purchase price.<br />

<br />

For purposes of determining the purchase price and the amount of the purchase price paid on contracts executed prior to August 1, 1985:<br />

<br />

(a) The purchase price is the sale price under the contract alleged to be in default, including the initial down payment. Mortgages, prior contracts for deed, special assessments, delinquent real estate taxes, or other obligations or encumbrances assumed by the purchaser are excluded in determining the purchase price.<br />

<br />

(b) The amount paid by the purchaser is the total of payments of principal made under the contract alleged to be in default, including the initial down payment. Interest payments and payments made under mortgages, prior contracts for deed, special assessments, delinquent real estate taxes, or other obligations or encumbrances assumed by the purchaser are excluded in determining the amount paid by the purchaser.<br />

<br />

§ Subd. 2.<br />

<br />

[Repealed, 1Sp1985 c 18 s 16]<br />

<br />

§ Subd. 2a.For post 7/31/1985 contract.<br />

<br />

If a default occurs in the conditions of a contract for the conveyance of real estate or an interest in real estate executed on or after August 1, 1985, that gives the seller a right to terminate it, the seller may terminate the contract by serving upon the purchaser or the purchaser’s personal representatives or assigns, within or outside of the state, a notice specifying the conditions in which default has been made. The notice must state that the contract will terminate 60 days, or a shorter period allowed in subdivision 4, after the service of the notice, unless prior to the termination date the purchaser:<br />

<br />

(1) complies with the conditions in default;<br />

<br />

(2) makes all payments due and owing to the seller under the contract through the date that payment is made;<br />

<br />

(3) pays the costs of service of the notice, including the reasonable costs of service by sheriff, public officer, or private process server; except payment of costs of service is not required unless the seller notifies the purchaser of the actual costs of service by certified mail to the purchaser’s last known address at least ten days prior to the date of termination;<br />

<br />

(4) except for earnest money contracts, purchase agreements, and exercised options, pays two percent of any amount in default at the time of service, not including the final balloon payment, any taxes, assessments, mortgages, or prior contracts that are assumed by the purchaser; and<br />

<br />

(5) if the contract is executed on or after August 1, 1999, pays an amount to apply on attorneys’ fees actually expended or incurred, of $250 if the amount in default is less than $1,000, and of $500 if the amount in default is $1,000 or more; or if the contract is executed before August 1, 1999, pays an amount to apply on attorneys’ fees actually expended or incurred, of $125 if the amount in default is less than $750, and of $250 if the amount in default is $750 or more; except that no amount for attorneys’ fees is required to be paid unless some part of the conditions of default has existed for at least 30 days prior to the date of service of the notice.<br />

<br />

§ Subd. 3.Notice defined.<br />

<br />

For purposes of this section, the term “notice” means a writing stating the information required in this section, stating the name, address and telephone number of the seller or of an attorney authorized by the seller to accept payments pursuant to the notice and the fact that the person named is authorized to receive the payments, stating a mailing address and a street address or location where the seller or the attorney will accept payment pursuant to the notice, and including the following information in 12-point or larger underlined uppercase type, or 8-point type if published, or in large legible handwritten letters:<br />

<br />

THIS NOTICE IS TO INFORM YOU THAT BY THIS NOTICE THE SELLER HAS BEGUN PROCEEDINGS UNDER MINNESOTA STATUTES, SECTION 559.21, TO TERMINATE YOUR CONTRACT FOR THE PURCHASE OF YOUR PROPERTY FOR THE REASONS SPECIFIED IN THIS NOTICE. THE CONTRACT WILL TERMINATE ….. DAYS AFTER (SERVICE OF THIS NOTICE UPON YOU) (THE FIRST DATE OF PUBLICATION OF THIS NOTICE) (STRIKE ONE) UNLESS BEFORE THEN:<br />

<br />

(a) THE PERSON AUTHORIZED IN THIS NOTICE TO RECEIVE PAYMENTS RECEIVES FROM YOU:<br />

<br />

(1) THE AMOUNT THIS NOTICE SAYS YOU OWE; PLUS<br />

<br />

(2) THE COSTS OF SERVICE (TO BE SENT TO YOU); PLUS<br />

<br />

(3) $……….. TO APPLY TO ATTORNEYS’ FEES ACTUALLY EXPENDED OR INCURRED; PLUS<br />

<br />

(4) FOR CONTRACTS EXECUTED ON OR AFTER MAY 1, 1980, ANY ADDITIONAL PAYMENTS BECOMING DUE UNDER THE CONTRACT TO THE SELLER AFTER THIS NOTICE WAS SERVED ON YOU; PLUS<br />

<br />

(5) FOR CONTRACTS, OTHER THAN EARNEST MONEY CONTRACTS, PURCHASE AGREEMENTS, AND EXERCISED OPTIONS, EXECUTED ON OR AFTER AUGUST 1, 1985, $…. (WHICH IS TWO PERCENT OF THE AMOUNT IN DEFAULT AT THE TIME OF SERVICE OTHER THAN THE FINAL BALLOON PAYMENT, ANY TAXES, ASSESSMENTS, MORTGAGES, OR PRIOR CONTRACTS THAT ARE ASSUMED BY YOU); OR<br />

<br />

(b) YOU SECURE FROM A COUNTY OR DISTRICT COURT AN ORDER THAT THE TERMINATION OF THE CONTRACT BE SUSPENDED UNTIL YOUR CLAIMS OR DEFENSES ARE FINALLY DISPOSED OF BY TRIAL, HEARING OR SETTLEMENT. YOUR ACTION MUST SPECIFICALLY STATE THOSE FACTS AND GROUNDS THAT DEMONSTRATE YOUR CLAIMS OR DEFENSES.<br />

<br />

IF YOU DO NOT DO ONE OR THE OTHER OF THE ABOVE THINGS WITHIN THE TIME PERIOD SPECIFIED IN THIS NOTICE, YOUR CONTRACT WILL TERMINATE AT THE END OF THE PERIOD AND YOU WILL LOSE ALL THE MONEY YOU HAVE PAID ON THE CONTRACT; YOU WILL LOSE YOUR RIGHT TO POSSESSION OF THE PROPERTY; YOU MAY LOSE YOUR RIGHT TO ASSERT ANY CLAIMS OR DEFENSES THAT YOU MIGHT HAVE; AND YOU WILL BE EVICTED. IF YOU HAVE ANY QUESTIONS ABOUT THIS NOTICE, CONTACT AN ATTORNEY IMMEDIATELY.<br />

<br />

§ Subd. 4.Law prevails over contract; procedure; conditions.<br />

<br />

(a) The notice required by this section must be given notwithstanding any provisions in the contract to the contrary, except that earnest money contracts, purchase agreements, and exercised options that are subject to this section may, unless by their terms they provide for a longer termination period, be terminated on 30 days’ notice, or may be canceled under section 559.217. The notice must be served within the state in the same manner as a summons in the district court, and outside of the state, in the same manner, and without securing any sheriff’s return of not found, making any preliminary affidavit, mailing a copy of the notice or doing any other preliminary act or thing whatsoever. Service of the notice outside of the state may be proved by the affidavit of the person making the same, made before an authorized officer having a seal, and within the state by such an affidavit or by the return of the sheriff of any county therein.<br />

<br />

(b) If a person to be served is a resident individual who has departed from the state, or cannot be found in the state; or is a nonresident individual or a foreign corporation, partnership, or association, service may be made by publication as provided in this paragraph. Three weeks’ published notice has the same effect as personal service of the notice. The published notice must comply with subdivision 3 and state (1) that the person to be served is allowed 90 days after the first date of publication of the notice to comply with the conditions of the contract, and (2) that the contract will terminate 90 days after the first date of publication of the notice, unless before the termination date the purchaser complies with the notice. If the real estate described in the contract is actually occupied, then, in addition to publication, a person in possession must be personally served, in like manner as the service of a summons in a civil action in state district court, within 30 days after the first date of publication of the notice. If an address of a person to be served is known, then within 30 days after the first date of publication of the notice a copy of the notice must be mailed to the person’s last known address by first class mail, postage prepaid.<br />

<br />

(c) The contract is reinstated if, within the time mentioned, the person served:<br />

<br />

(1) complies with the conditions in default;<br />

<br />

(2) if subdivision 1d or 2a applies, makes all payments due and owing to the seller under the contract through the date that payment is made;<br />

<br />

(3) pays the costs of service as provided in subdivision 1b, 1c, 1d, or 2a;<br />

<br />

(4) if subdivision 2a applies, pays two percent of the amount in default, not including the final balloon payment, any taxes, assessments, mortgages, or prior contracts that are assumed by the purchaser; and<br />

<br />

(5) pays attorneys’ fees as provided in subdivision 1b, 1c, 1d, or 2a.<br />

<br />

(d) The contract is terminated if the provisions of paragraph (c) are not met.<br />

<br />

(e) In the event that the notice was not signed by an attorney for the seller and the seller is not present in the state, or cannot be found in the state, then compliance with the conditions specified in the notice may be made by paying to the court administrator of the district court in the county wherein the real estate or any part thereof is situated any money due and filing proof of compliance with other defaults specified, and the court administrator of the district court shall be deemed the agent of the seller for such purposes. A copy of the notice with proof of service thereof, and the affidavit of the seller, the seller’s agent or attorney, showing that the purchaser has not complied with the terms of the notice, may be recorded with the county recorder or registrar of titles, and is prima facie evidence of the facts stated in it; but this section in no case applies to contracts for the sale or conveyance of lands situated in another state or in a foreign country. If the notice is served by publication, the affidavit must state that the affiant believes that the party to be served is not a resident of the state, or cannot be found in the state, and either that the affiant has mailed a copy of the notice by first class mail, postage prepaid, to the party’s last known address, or that such address is not known to the affiant.<br />

<br />

§ Subd. 5.If required, notify commissioner. When required by and in the manner provided in section 270C.63, subdivision 11, the notice required by this section shall also be given to the commissioner of revenue.<br />

<br />

§ Subd. 6. [Repealed, 1983 c 215 s 16; 1984 c 474 s 7; 1985 c 306 s 26; 1987 c 292 s 36; 1989 c 350 art 16 s 7]<br />

<br />

§ Subd. 7. Cancellation of land sale. The state of Minnesota shall cancel any sale of land made by the state under an installment contract upon default therein only in accord with the provisions of this section.<br />

<br />

§ Subd. 8. Attorney as agent for service. Any attorney expressly authorized by the seller to receive payments in the notice of termination under this section is designated as the attorney who may receive service as agent for the seller of all summons, complaints, orders, and motions made in conjunction with an action by the purchaser to restrain the termination. Service in the action may be made upon the seller by mailing a copy of the process to the seller or to the seller’s attorney, by first class mail, postage prepaid, to the address stated in the notice where payments will be accepted.<br />

<br />

History:<br />

<br />

(9576) RL s 4442; 1913 c 136 s 1; 1915 c 200 s 1; 1925 c 163 s 1; 1959 c 618 s 1; 1961 c 270 s 1; 1976 c 181 s 2; 1976 c 240 s 1; 1980 c 373 s 6; 1982 c 500 s 3,4; 1982 c 523 art 2 s 47; 1983 c 215 s 2; 1983 c 342 art 15 s 38; 1984 c 474 s 2; 1985 c 300 s 29; 1985 c 306 s 7; 1Sp1985 c 16 art 2 s 44; 1Sp1985 c 18 s 6-10,16; 1986 c 438 s 1-8; 1Sp1986 c 3 art 1 s 82; 1992 c 463 s 30,31; 1994 c 388 art 2 s 1-3; 1999 c 11 art 4 s 4; 2004 c 203 art 1 s 9; 2005 c 4 s 136; 2005 c 151 art 2 s 17<br />

<br />

DECLARATORY, CORRECTIVE AND ADMINISTRATIVE REMEDIES (Chap. 553-563)<br />

CHAPTER 559 ADVERSE CLAIMS TO REAL ESTATE<br />

<br />

559.205 Contracts for deed; modification.<br />

<br />

Notwithstanding any law to the contrary, a renegotiated contract for deed or an agreement modifying the terms of a contract for deed which was valid at its inception shall not be construed as creating a mortgage or an equitable mortgage. This section does not modify any other requirements relating to contracts for deed.<br />

<br />

History:<br />

<br />

1982 c 500 s 2<br />

<br />

DECLARATORY, CORRECTIVE AND ADMINISTRATIVE REMEDIES (Chap. 553-563)<br />

CHAPTER 559 ADVERSE CLAIMS TO REAL ESTATE<br />

<br />

559.215 Validating terminations of contract of sale.<br />

<br />

Every termination of a contract for the conveyance of real property or an interest in real property is legal and valid after the expiration of the period specified in section 559.216 as against the following objections:<br />

<br />

(1) that prior to the service of notice of termination, no mortgage registration tax was paid on the contract, or an insufficient registration tax was paid on the contract;<br />

<br />

(2) that the notice:<br />

<br />

(i) did not correctly state the amount of attorney fees;<br />

<br />

(ii) failed to state or incorrectly stated the names of one or more of the sellers, or the sellers’ successors or assigns, or incorrectly described the interest or representative capacity of the person giving the notice;<br />

<br />

(iii) was printed or typed in an incorrect type size;<br />

<br />

(iv) incorrectly stated the number of days after service that the contract will terminate, provided that the number of days stated is not less than 30 days; or<br />

<br />

(v) did not correctly state the two percent amount required to be paid by section 559.21, subdivision 2a, clause (4);<br />

<br />

(3) that the cancellation was commenced by less than all sellers; or<br />

<br />

(4) that in the case of a termination by publication the notice was not served on all persons in possession of the real estate, provided it was served on at least one of those persons.<br />

<br />

History:<br />

1990 c 575 s 8; 1996 c 338 art 1 s 11<br />

<br />

DECLARATORY, CORRECTIVE AND ADMINISTRATIVE REMEDIES (Chap. 553-563)<br />

CHAPTER 559 ADVERSE CLAIMS TO REAL ESTATE<br />

<br />

559.216 Application of curative provisions.<br />

<br />

§ Subdivision 1.Expiration periods.<br />

<br />

Upon expiration of the periods specified in this section, the provisions of section 559.215 apply to a termination of a contract for the conveyance of real property or an interest in real property subject to this section:<br />

<br />

(1) as to section 559.215, clause (2), item (iv), and clause (3), five years after the last day of the correct reinstatement period of the purchaser or the purchaser’s personal representatives or assigns; and<br />

<br />

(2) as to all other provisions of section 559.215, one year after the last day of the reinstatement period of the purchaser or the purchaser’s personal representatives or assigns.<br />

<br />

§ Subd. 2.Pending and newly commenced actions.<br />

<br />

This section and section 559.215, as enacted by Laws 1990, chapter 575, sections 8 and 9, do not affect any action or proceeding pending on August 1, 1990, or commenced before February 1, 1991, involving the validity of the termination or conveyance.<br />

<br />

The amendments to this section and section 559.215 by Laws 1996, chapter 338, article 1, shall not affect any action pending on August 1, 1996, or that is commenced before February 1, 1997, involving the validity of the termination or conveyance.<br />

<br />

History:<br />

1990 c 575 s 9; 1996 c 338 art 1 s 12<br />

<br />

Minnesota Case Law<br />

<br />

General Principle<br />

<br />

Contracts for deed provide a useful alternative financing mechanism which promotes the availability of credit and the transferability of property, and the legislature has approved contracts for deed as being in Minnesota’s best interest by enacting legislation which supports their continued use. Minn. Stat. §§ 559.205-.216 (1994). In Minnesota, one remedy available to a vendor upon the vendee’s defaulting under the terms of the contract for deed is the vendor’s ability to cancel the contract pursuant to Minn. Stat. § 559.21. A statutory cancellation of a contract for deed results in the vendee’s forfeiture of all payments made and restoration of full legal and equitable title in the property to the vendor. This result is different from that in a mortgage foreclosure sale, where the defaulting party may receive proceeds of a mortgage foreclosure sale above the amount owed on the property. Shields v. Goldetsky, 552 N.W.2d 226, (1996).<br />

<br />

Notice of Cancellation<br />

<br />

Minn. Stat. § 559.21 (1976) provides that a contract for deed terminates 30 days after personal service of notice of cancellation unless the vendee, within that time period, complies with the specified conditions in default. The statute has a double purpose: to ameliorate the harsh common-law rule which permitted a peremptory forfeiture upon default by providing a grace period; and also to remove grounds for uncertainty or controversy with respect to property ownership by prescribing a definite procedure for termination. Aune v. Bona, 305 N.W.2d 602, (1981).<br />

<br />

Remedies<br />

<br />

When a vendee defaults under a contract for deed the vendor has a choice of remedies. The vendor may sue on the contract for the balance of the purchase price or cancel the contract, recover the land and forego recovery of the balance. Neuman v. Demmer, 414 N.W.2d 240, (1987).<br />

<br />

Usury<br />

<br />

Minn. Stat. § 47.20 (1998) forbids a contract for deed vendor from charging interest on contracts for deed at an interest rate in excess of the Federal National Mortgage Association posted yields on 30-year mortgage commitments for delivery within 60 days on standard conventional fixed-rate mortgages, plus four percentage points. Minn. Stat. § 47.20, subds. 3, 4a. These limitations on interest are only applicable to a contract for deed for an amount less than $ 100,000. Minn. Stat. § 47.20, subd. 2(2).<br />

<br />

Statute of Limitations<br />

<br />

The action of a vendee for unjust enrichment in connection with a contract for deed was barred under Minn. Stat. § 541.05, subd. 1(6), because not brought within six years of the closing of the contract. Nordstrom v. Kim, 1994 Minn. App. LEXIS 914 (Minn. Ct. App. June 21 1994).