Minnesota Registration of Foreign Corporation

Description

How to fill out Minnesota Registration Of Foreign Corporation?

Get any form from 85,000 legal documents such as Minnesota Registration of Foreign Corporation on-line with US Legal Forms. Every template is prepared and updated by state-licensed attorneys.

If you have already a subscription, log in. Once you’re on the form’s page, click the Download button and go to My Forms to get access to it.

In case you have not subscribed yet, follow the tips below:

- Check the state-specific requirements for the Minnesota Registration of Foreign Corporation you would like to use.

- Look through description and preview the sample.

- When you are sure the sample is what you need, just click Buy Now.

- Choose a subscription plan that really works for your budget.

- Create a personal account.

- Pay in just one of two appropriate ways: by credit card or via PayPal.

- Choose a format to download the file in; two ways are available (PDF or Word).

- Download the file to the My Forms tab.

- After your reusable form is downloaded, print it out or save it to your gadget.

With US Legal Forms, you’ll always have instant access to the proper downloadable sample. The platform will give you access to documents and divides them into groups to simplify your search. Use US Legal Forms to get your Minnesota Registration of Foreign Corporation easy and fast.

Form popularity

FAQ

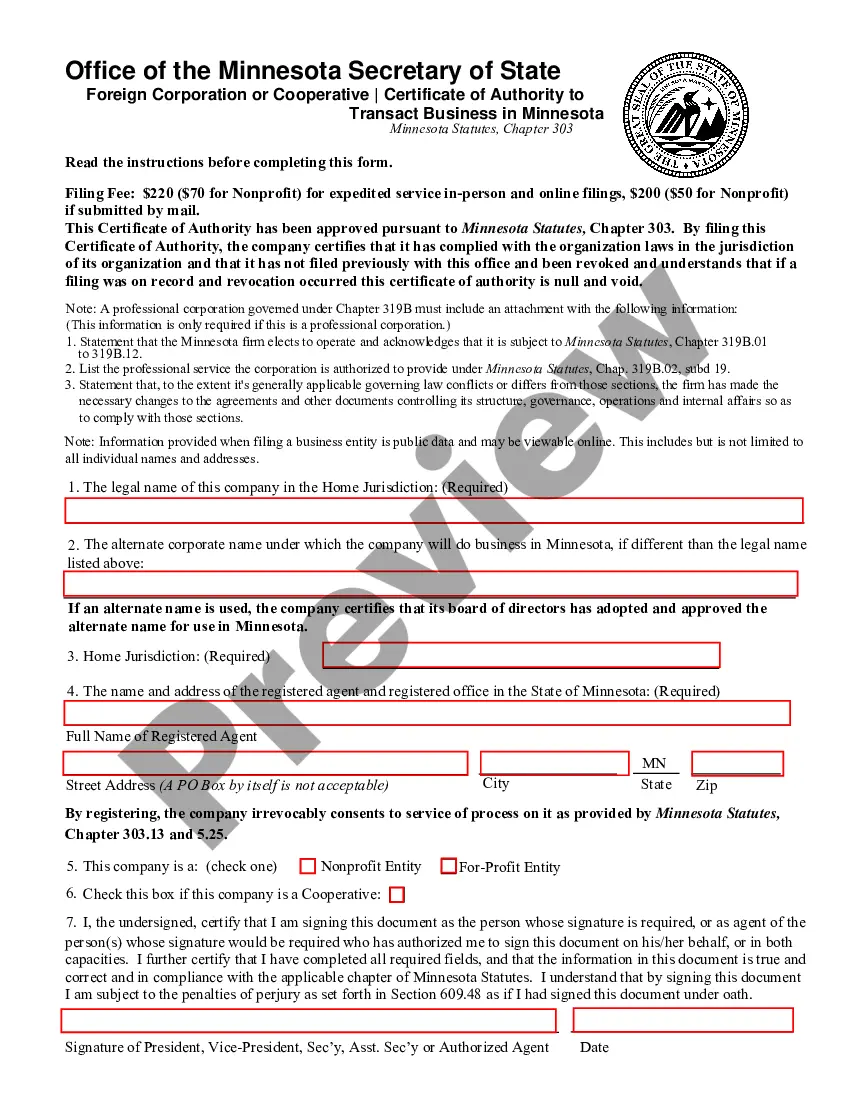

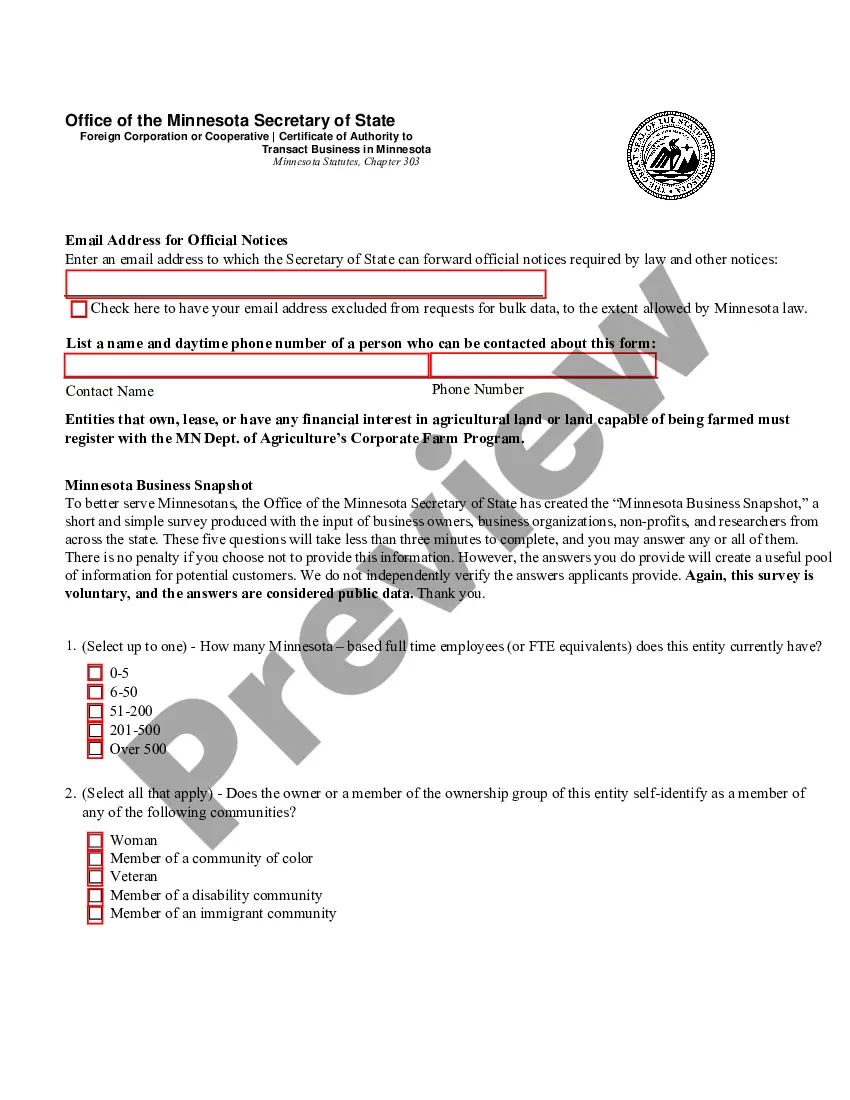

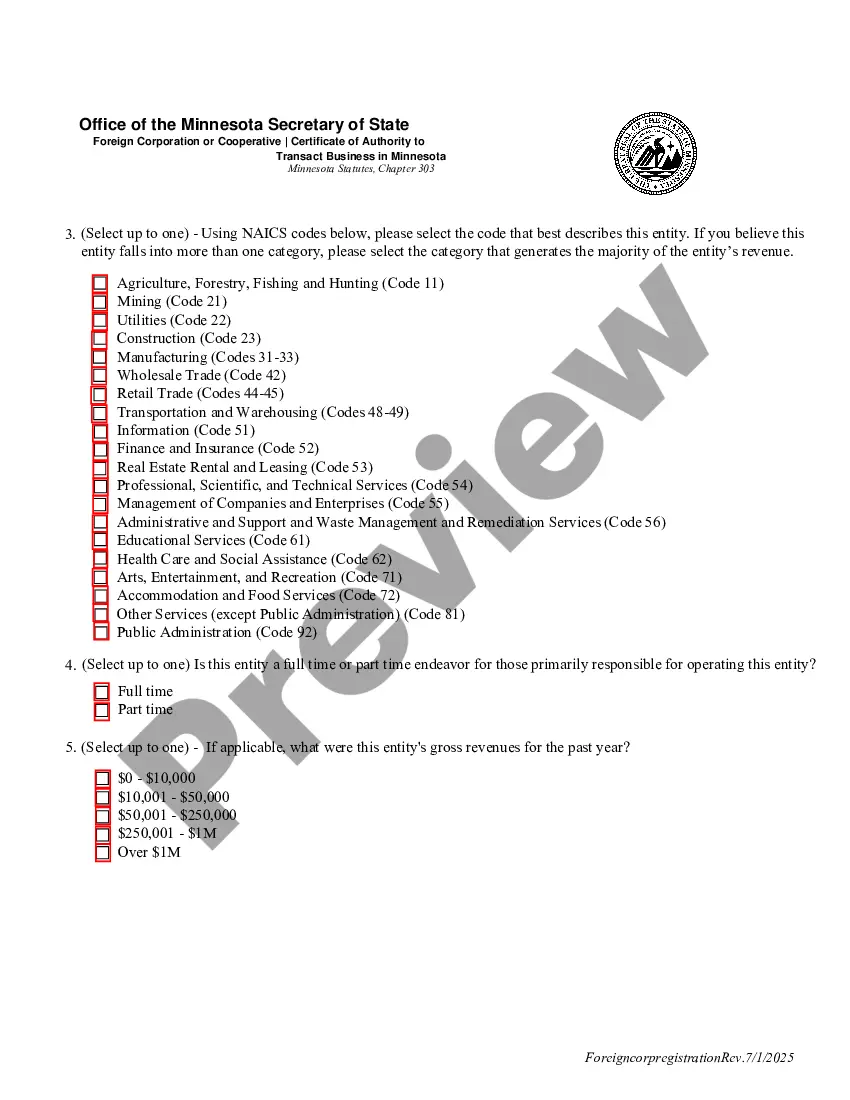

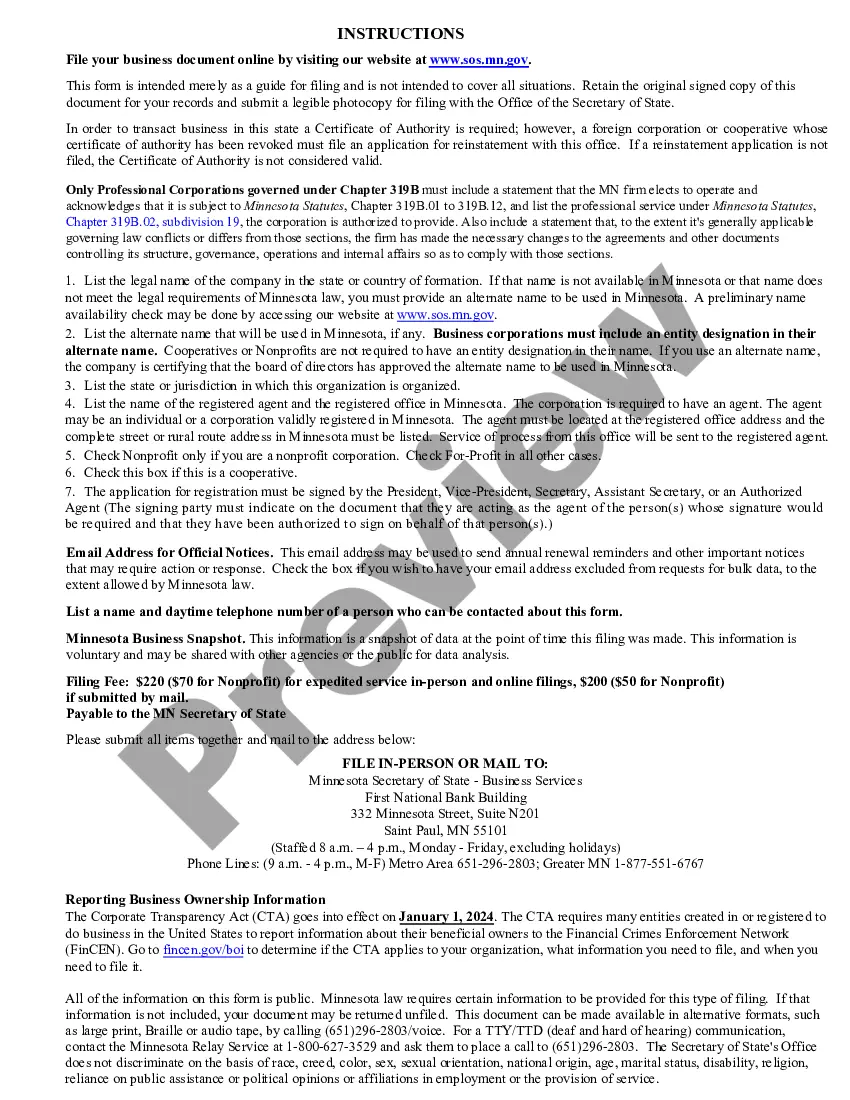

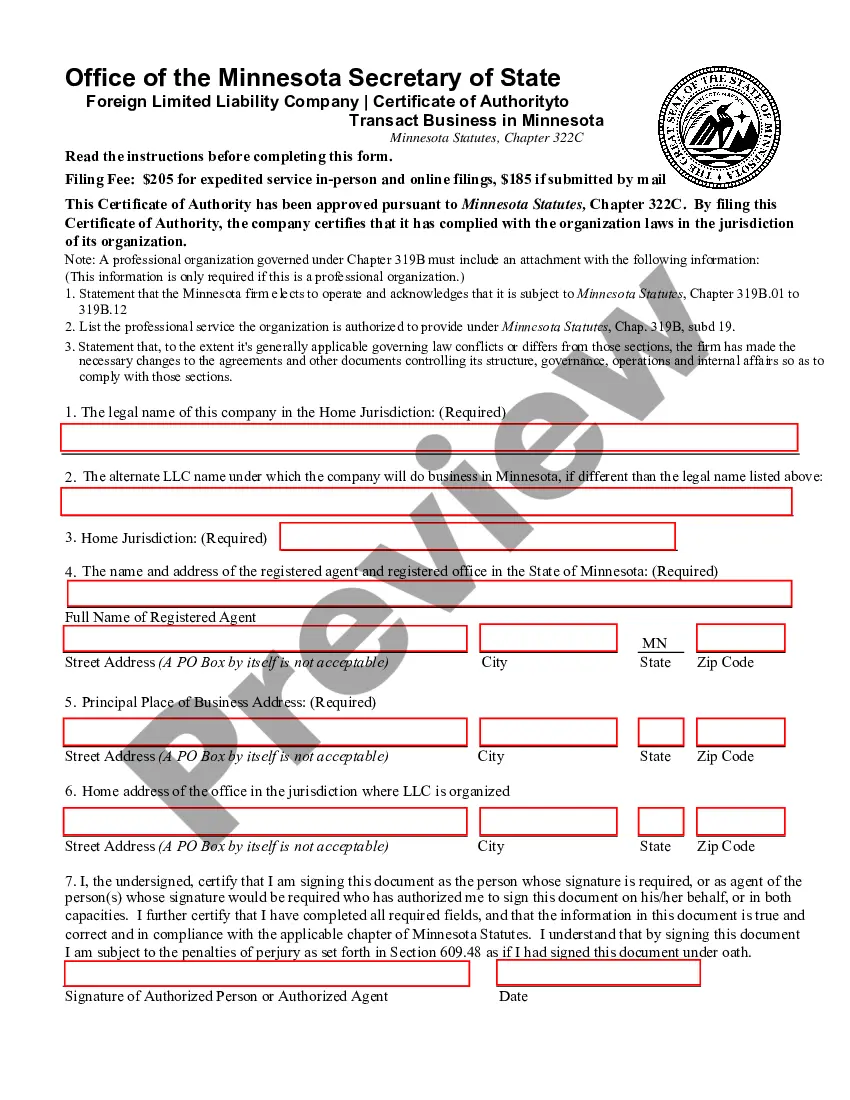

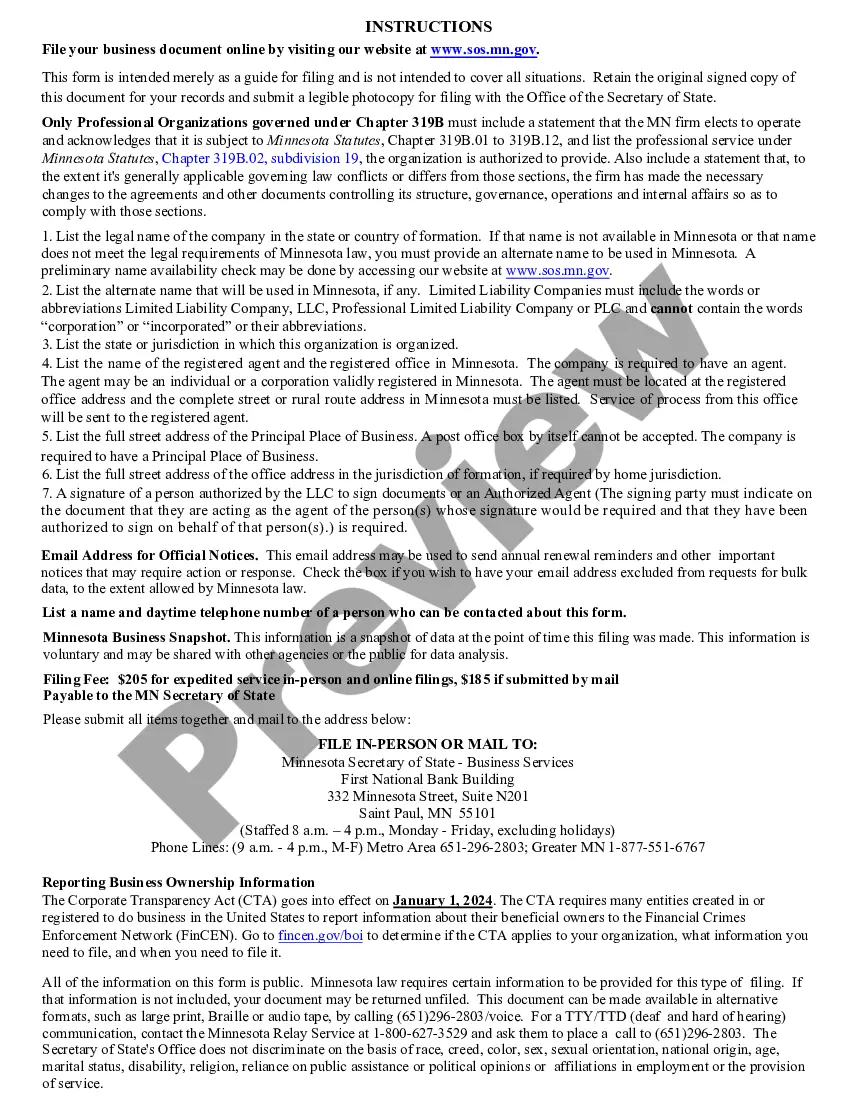

If you need to file a foreign qualification, you will have to register in the state(s) by submitting a Certificate of Authority application (sometimes called Statement & Designation by a Foreign Corporation) with the particular state's Secretary of State office.

Foreign entity registration is the process of registering your business in one state to do business in another state. The only state that your business is not foreign to is the original state you registered your business in.

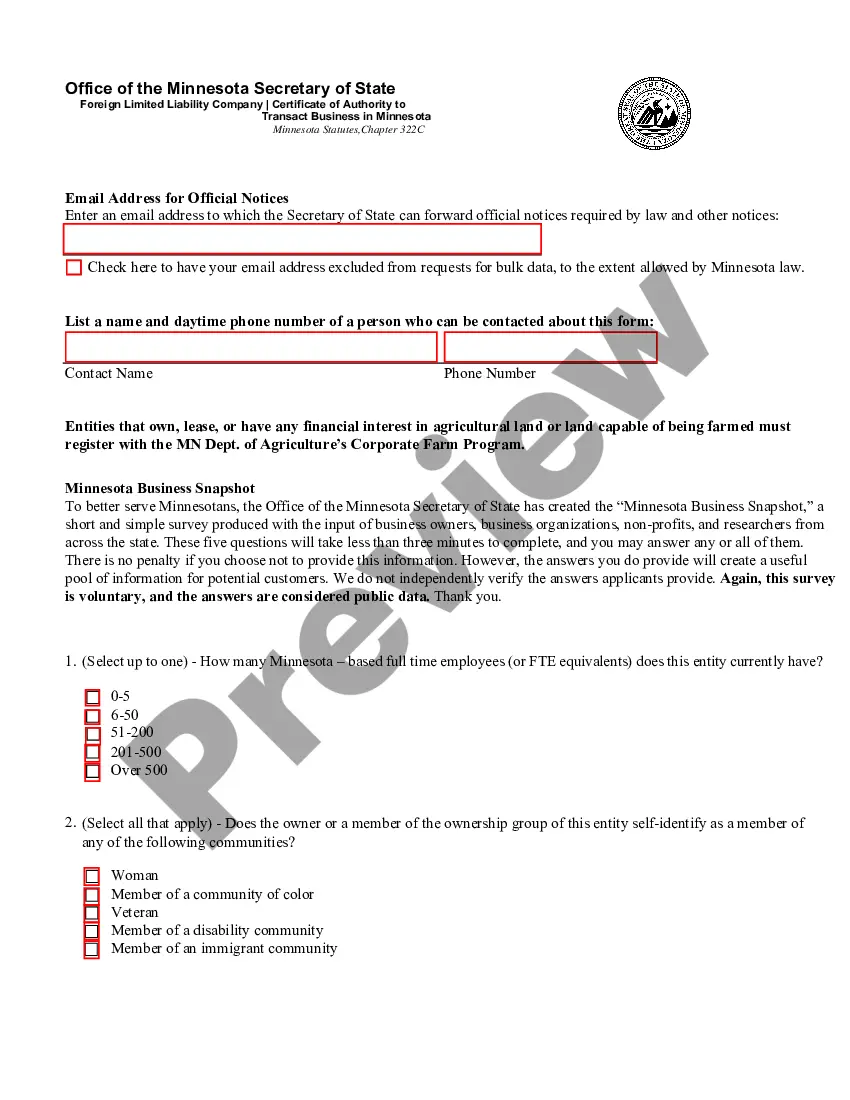

Before you make any taxable sales in Minnesota, you must register for a Minnesota Tax ID Number and a Sales and Use Tax account. If you need a Minnesota Tax ID Number, you can apply: Online Go to Business Tax Registration.

Foreigner registration is a mandatory requirement by the Government of India under which all foreign nationals (excluding overseas citizens of India) visiting India on a long term visa (more than 180 days) are required to register themselves with a Registration Officer within 14 days of arriving in India.

Minnesota requires that different articles be filed, based on whether the LLC accepted or did not accept contributions. If your LLC accepted contributions, you must first file a notice of dissolution with the Secretary of State by mail or in person. This is followed by filing an articles of termination form.

Foreign Qualification / Registration (also Certificate of Authority or Application for Authority to do Business) is a filing made with a Secretary of State's office.Registering your corporation or LLC as a foreign corporation allows you to legally conduct business in states not incorporated in.

Under 322C, the ability of a member, or anyone else, to act as an agent of the LLC is to be addressed, if at all, in an operating agreement. An LLC may file statements of authority with the Office of Minnesota Secretary of State (similar to those filed by partnerships) with respect to non-members.

When you formed your business, you had to do so in a specific state.Foreign entity registration is the process of registering your business in one state to do business in another state. The only state that your business is not foreign to is the original state you registered your business in.

Every Minnesota LLC owner should have an operating agreement in place to protect the operations of their business. While not legally required by the state, having an operating agreement will set clear rules and expectations for your LLC while establishing your credibility as a legal entity.