Minnesota Articles of Incorporation for Professional Corporation

Description Articles Of Incorporation Minnesota

How to fill out Minnesota Articles Of Incorporation For Professional Corporation?

Have any form from 85,000 legal documents including Minnesota Articles of Incorporation for Professional Corporation on-line with US Legal Forms. Every template is prepared and updated by state-certified legal professionals.

If you already have a subscription, log in. When you’re on the form’s page, click the Download button and go to My Forms to access it.

In case you haven’t subscribed yet, follow the tips listed below:

- Check the state-specific requirements for the Minnesota Articles of Incorporation for Professional Corporation you need to use.

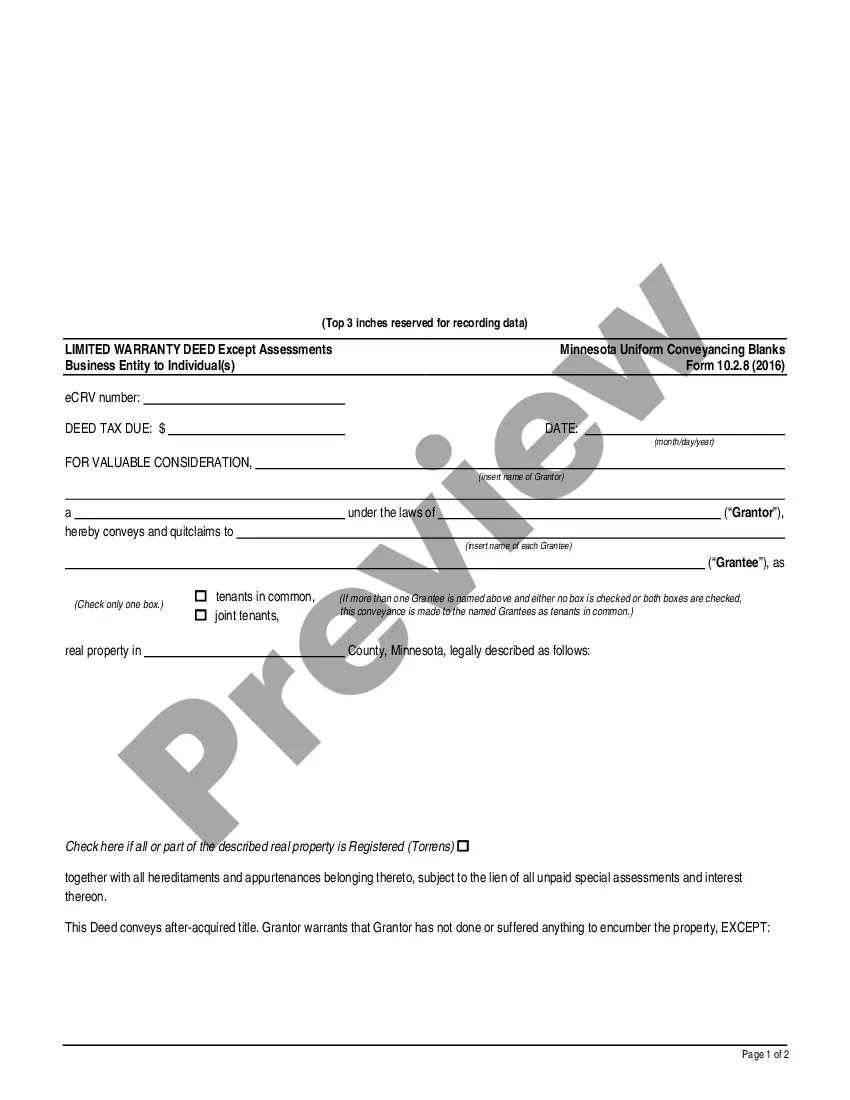

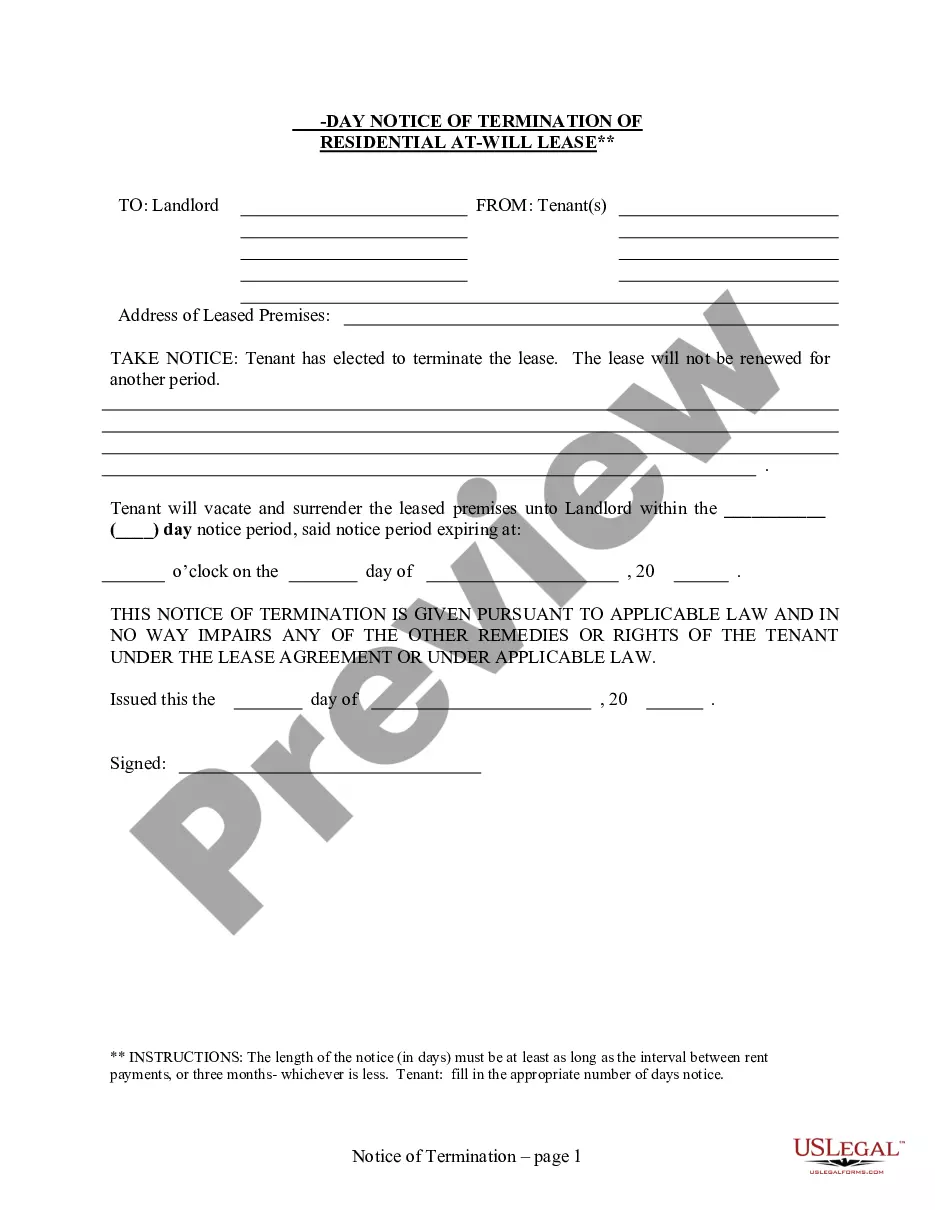

- Look through description and preview the template.

- As soon as you are confident the sample is what you need, click on Buy Now.

- Choose a subscription plan that works well for your budget.

- Create a personal account.

- Pay out in one of two suitable ways: by card or via PayPal.

- Pick a format to download the document in; two ways are available (PDF or Word).

- Download the document to the My Forms tab.

- When your reusable form is ready, print it out or save it to your device.

With US Legal Forms, you will always have immediate access to the right downloadable sample. The platform provides you with access to forms and divides them into categories to streamline your search. Use US Legal Forms to get your Minnesota Articles of Incorporation for Professional Corporation easy and fast.

Form popularity

FAQ

A professional corporation is one that only performs services in one, single profession. It is a specific type of corporation for professionals like doctors, lawyers, accountants, etc. The professional is able to form a corporation, but the professional remains liable for his or her own actions.

If you do not feel comfortable writing the articles of incorporation on your own, you can hire an attorney or an incorporation service to write the articles of incorporation and even file for the incorporation of your business for you.

Professional corporations or professional service corporation (abbreviated as PC or PSC) are those corporate entities for which many corporation statutes make special provision, regulating the use of the corporate form by licensed professionals such as attorneys, architects, engineers, public accountants and physicians

The name of the LLC. The names of the members and managers of the LLC. The address of the LLC's principal place of business.

Broadly, articles of incorporation should include the company's name, type of corporate structure, and number and type of authorized shares. Bylaws work in conjunction with the articles of incorporation to form the legal backbone of the business.

The definition of incorporated is combined or put together into one unit. An example of something incorporated is a classroom that has students from all learning levels. An example of something incorporated is several parts of a business combined together to form a legal corporation.

Choose a Corporate Name. Prepare and File Articles of Incorporation. Appoint a Registered Agent. Set Up a Corporate Records Book. Prepare Corporate Bylaws. Appoint Initial Corporate Directors. Hold Your First Board of Directors Meeting. Issue Stock.

The name of your corporation. your corporation's principal place of business. the name and address of your corporation's registered agent. a statement of the corporation's purpose. the corporation's duration. information about the number of shares and classes of stock the corporation is authorized to issue.

The IRS categorizes professional corporations as C corporations. They are considered taxpayers and must pay income taxes at the corporate rate. In some states, physicians are not allowed to form professional corporations and must instead establish professional associations.