Minnesota Warranty Deed from Individual to a Trust

Description Special Warranty Deed Form Minnesota

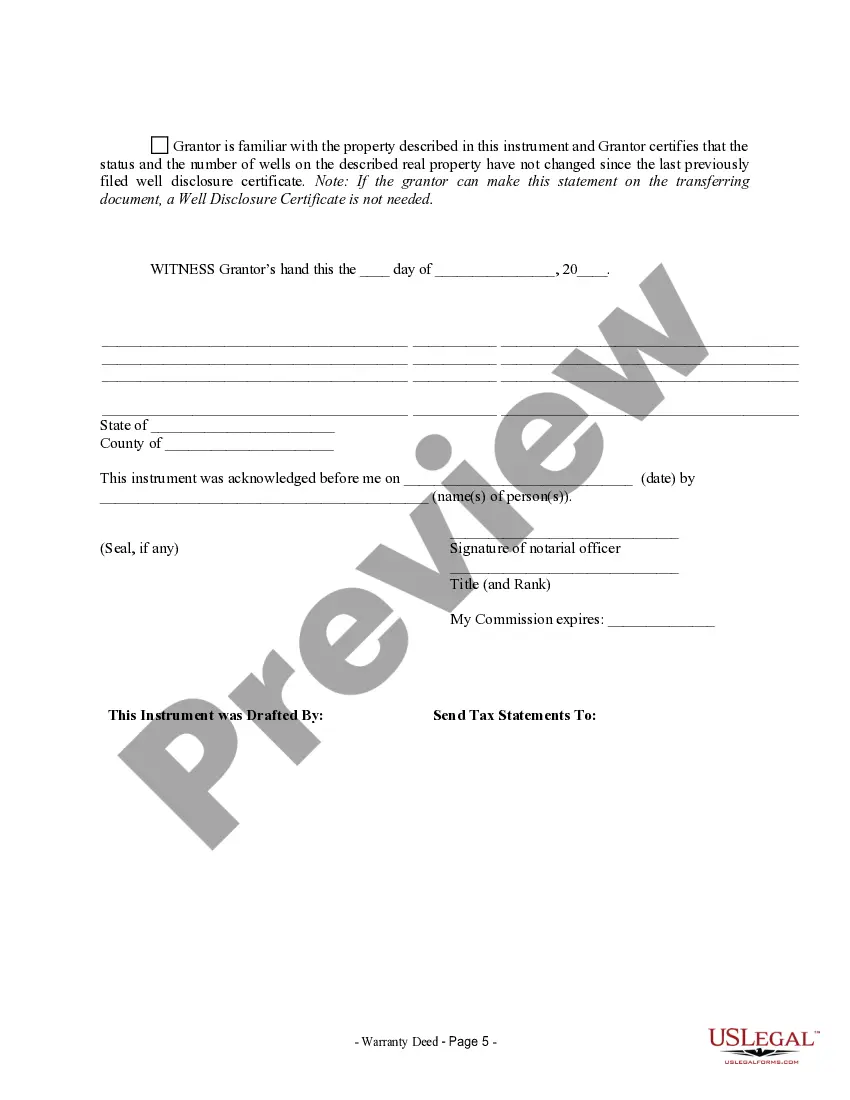

How to fill out Minnesota Warranty Deed Requirements?

Get any template from 85,000 legal documents including Minnesota Warranty Deed from Individual to a Trust online with US Legal Forms. Every template is prepared and updated by state-licensed lawyers.

If you have a subscription, log in. When you’re on the form’s page, click on the Download button and go to My Forms to get access to it.

In case you have not subscribed yet, follow the steps below:

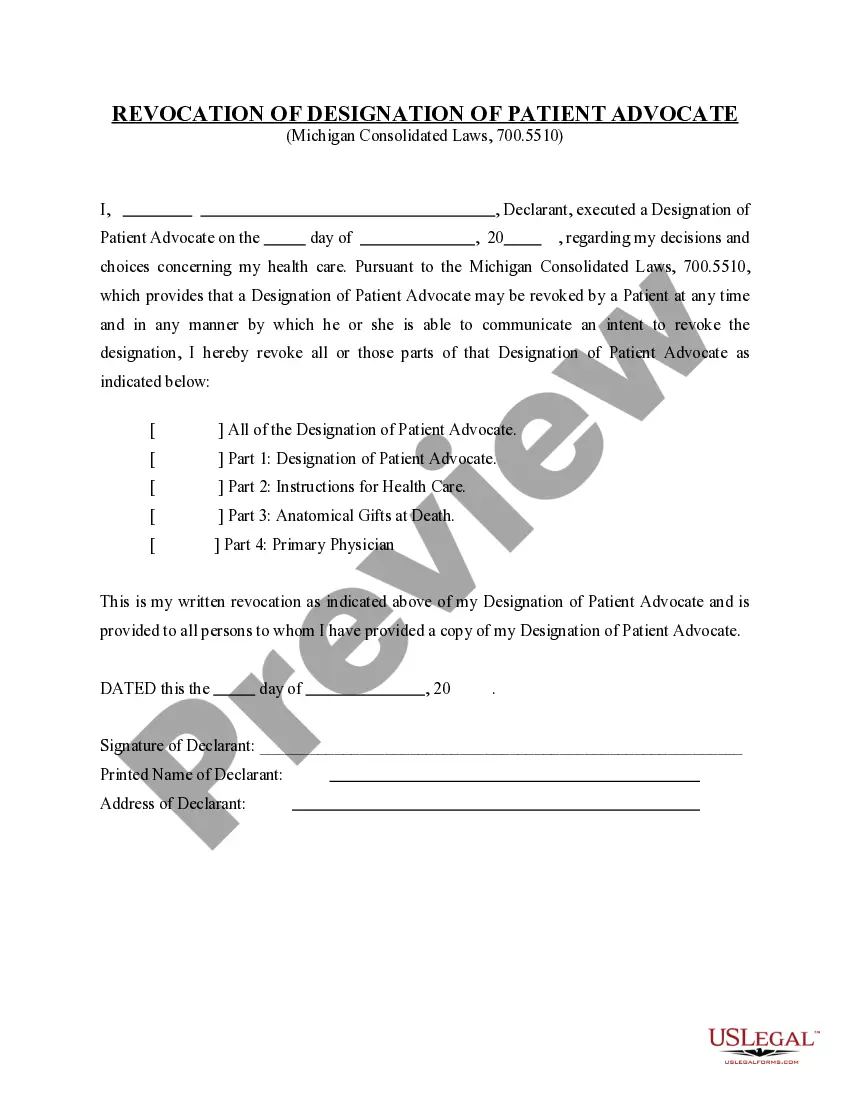

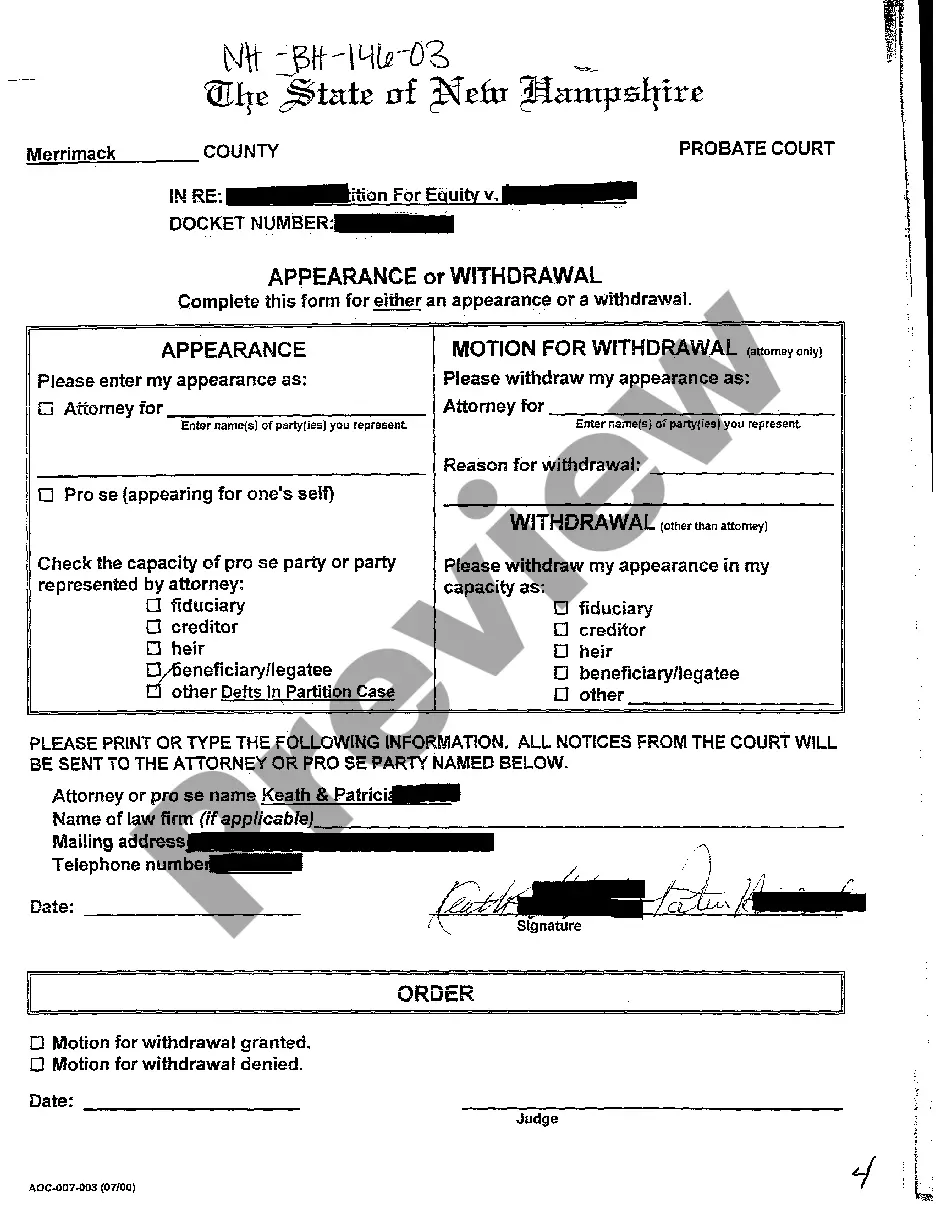

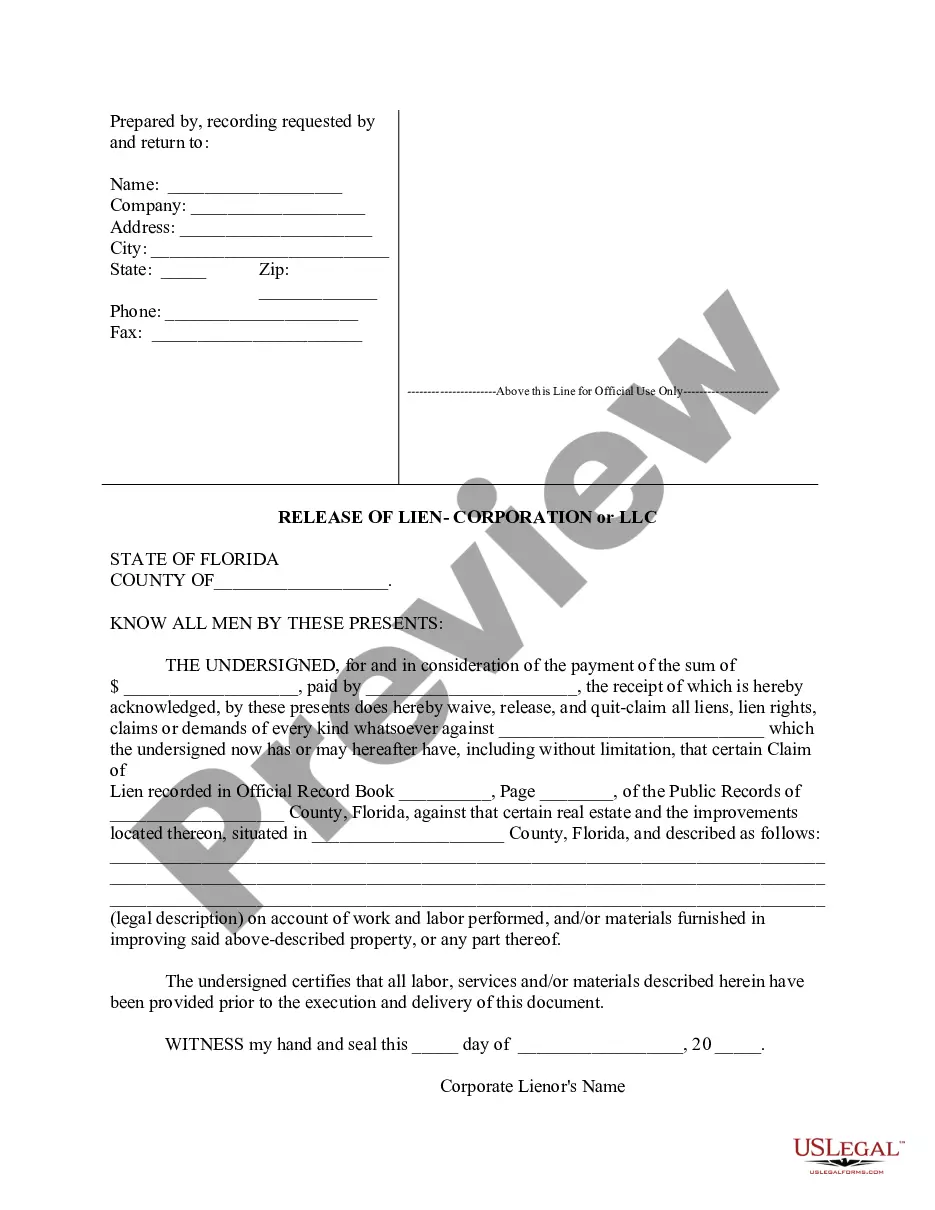

- Check the state-specific requirements for the Minnesota Warranty Deed from Individual to a Trust you would like to use.

- Look through description and preview the template.

- Once you’re confident the sample is what you need, click Buy Now.

- Select a subscription plan that works for your budget.

- Create a personal account.

- Pay in a single of two appropriate ways: by card or via PayPal.

- Choose a format to download the file in; two ways are available (PDF or Word).

- Download the document to the My Forms tab.

- Once your reusable template is downloaded, print it out or save it to your gadget.

With US Legal Forms, you will always have quick access to the proper downloadable sample. The service provides you with access to forms and divides them into groups to simplify your search. Use US Legal Forms to get your Minnesota Warranty Deed from Individual to a Trust fast and easy.

Special Warranty Deed Minnesota Form popularity

Minnesota Special Warranty Deed Other Form Names

Trusta Warranty Here Com FAQ

The mortgage company usually prepares this deed as part of the loan package and delivers it to the title company for you to sign at closing. The title company is commonly the trustee to the deed and holds legal title to the property until the loan gets fully repaid.

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.

Trustee's deeds convey real estate out of a trust.This type of conveyance is named for the person using the form the trustee who stands in for the beneficiary of the trust and holds title to the property.

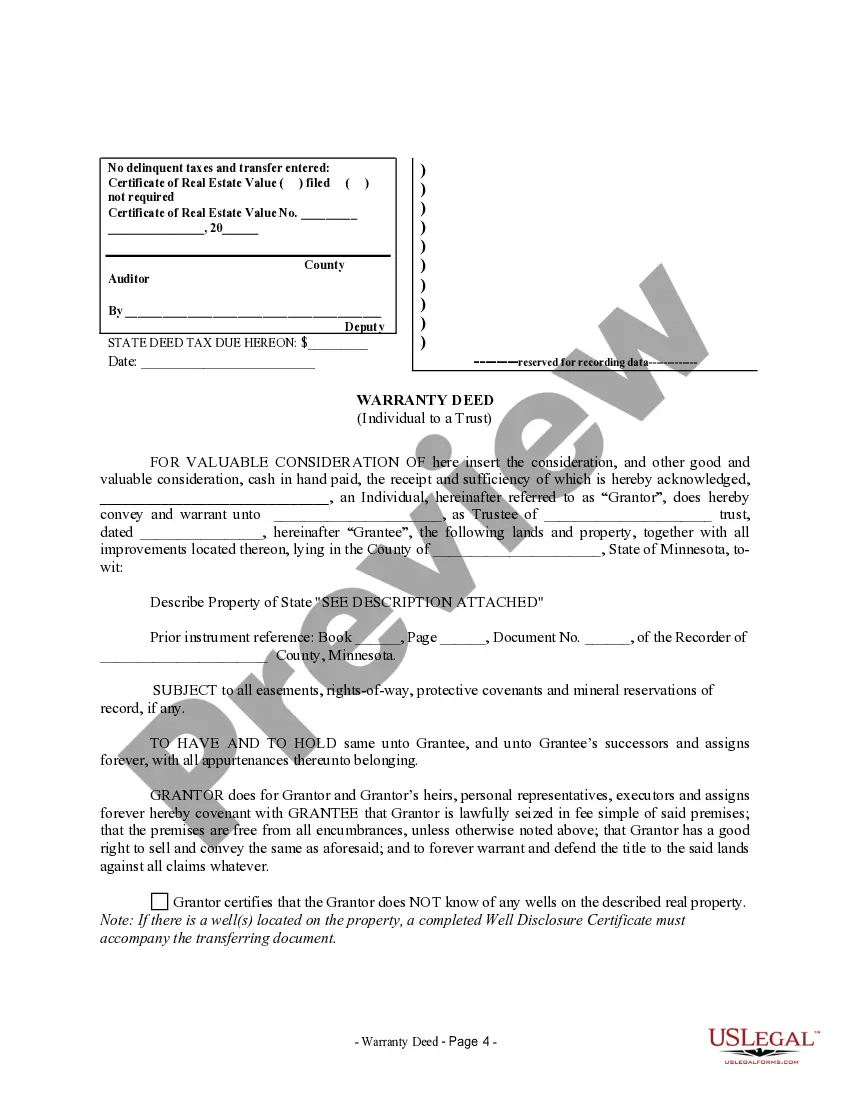

A general warranty deed is used to transfer an interest in real estate in Minnesota in most real estate transactions. A Minnesota warranty deed conveys real property with warranty covenants to the buyer. It requires an acknowledgement of the grantor's signature.

A warranty deed protects property owners from future claims that someone else actually owns a portion (or all) of their property, while trustee deeds protect lenders when borrowers default on their mortgage loans.

A general warranty deed is used to transfer an interest in real estate in Minnesota in most real estate transactions. A Minnesota warranty deed conveys real property with warranty covenants to the buyer. It requires an acknowledgement of the grantor's signature.

A trustee deed offers no such warranties about the title.

A warranty deed protects property owners from future claims that someone else actually owns a portion (or all) of their property, while trustee deeds protect lenders when borrowers default on their mortgage loans.

Yes, Minnesota has a law that lets you transfer the title to real estate when you die to avoid probate. It is an estate planning tool called a Transfer on Death Deed (TODD). It is like the "payable on death" (POD) designation on a bank account.They have no rights or control of the property until the owner dies.