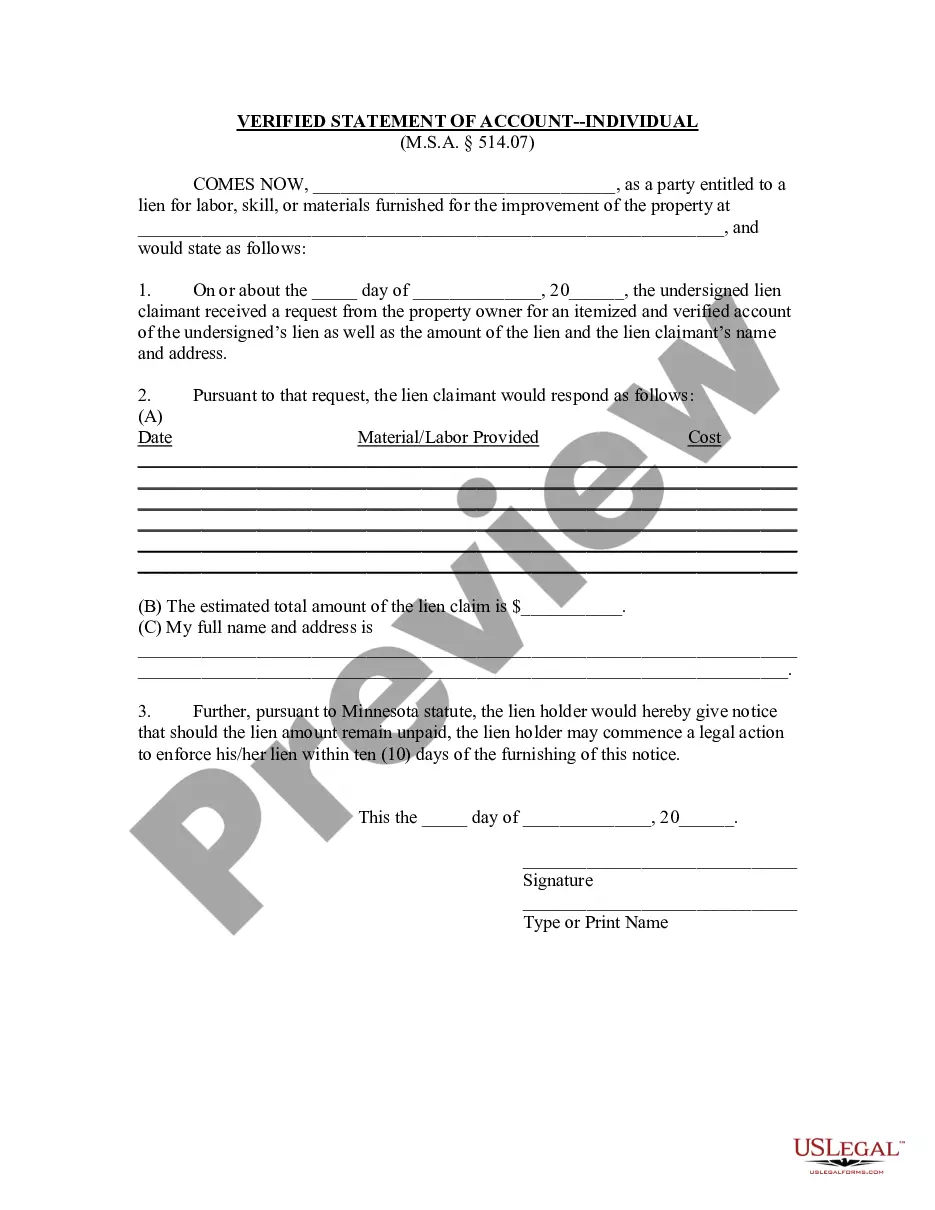

This form is used by a lien claimant to respond to a property owner's request for information about the lien. The request must be made within fifteen (15) days of the completion of work and the lien claimant may not pursue a court action to enforce the lien until ten days after the information is provided.

Minnesota Verified Statement of Account - Individual

Description

How to fill out Minnesota Verified Statement Of Account - Individual?

Get any form from 85,000 legal documents such as Minnesota Verified Statement of Account - Individual online with US Legal Forms. Every template is drafted and updated by state-accredited attorneys.

If you have a subscription, log in. When you’re on the form’s page, click on the Download button and go to My Forms to access it.

If you haven’t subscribed yet, follow the steps listed below:

- Check the state-specific requirements for the Minnesota Verified Statement of Account - Individual you want to use.

- Look through description and preview the template.

- When you’re sure the sample is what you need, just click Buy Now.

- Select a subscription plan that really works for your budget.

- Create a personal account.

- Pay out in a single of two suitable ways: by card or via PayPal.

- Choose a format to download the document in; two ways are available (PDF or Word).

- Download the file to the My Forms tab.

- Once your reusable template is downloaded, print it out or save it to your gadget.

With US Legal Forms, you will always have instant access to the proper downloadable template. The platform gives you access to documents and divides them into groups to simplify your search. Use US Legal Forms to obtain your Minnesota Verified Statement of Account - Individual fast and easy.

Form popularity

FAQ

The complete name of the person providing the statement. The date that the request was made. The name of the person requesting the statement. The written statement as well as detailed facts and reasons that support the statement. The signature of the affiant. The date signed.

A statement of account is a detailed report of the contents of an account.A sample statement of account usually includes the following information: The beginning total of unpaid invoices. The invoice number, invoice date, and total amount of each invoice issued to the customer during the time period.

Name and Address. Top Half On the top half of the statement the customer's full business name and address needs to be included, as well as yours, the seller, with contact numbers. Reference. Date. Opening Balance. Headings. Totals/Interest. Extra Details. Remittance.

A sample statement of account usually includes the following information: The beginning total of unpaid invoices. The invoice number, invoice date, and total amount of each invoice issued to the customer during the time period.

Name and Address. Top Half On the top half of the statement the customer's full business name and address needs to be included, as well as yours, the seller, with contact numbers. Reference. Date. Opening Balance. Headings. Totals/Interest. Extra Details. Remittance.

An overall balance. A date range. Every transaction made within the specific date range, including sales (paid upfront or on credit), payments, and refunds. Document numbers to support each transaction.

Vendor's name, address, phone number, email. Client's name, address, phone number, email. Statement date (or date of issue). Statement number. Customer ID # (or Account #).

Parts of a bank statement include information about the banksuch as bank name and addressas well as your information. The bank statement will also contain account information and the statement date, as well as the beginning and ending balance of the account.