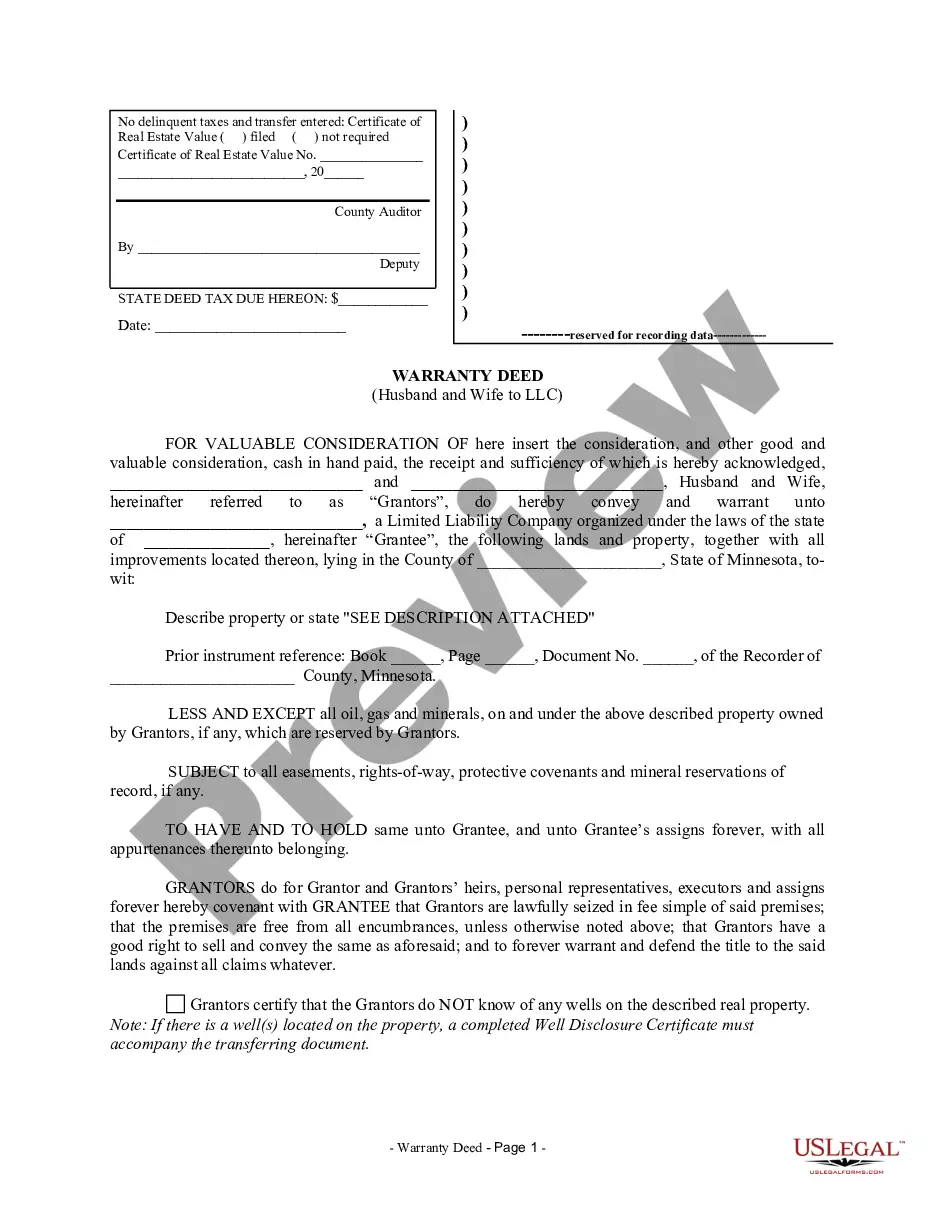

Minnesota Warranty Deed from Husband and Wife to LLC

Description

How to fill out Minnesota Warranty Deed From Husband And Wife To LLC?

Get any form from 85,000 legal documents such as Minnesota Warranty Deed from Husband and Wife to LLC online with US Legal Forms. Every template is prepared and updated by state-certified lawyers.

If you have already a subscription, log in. When you’re on the form’s page, click on the Download button and go to My Forms to get access to it.

In case you haven’t subscribed yet, follow the tips below:

- Check the state-specific requirements for the Minnesota Warranty Deed from Husband and Wife to LLC you need to use.

- Look through description and preview the template.

- As soon as you’re confident the sample is what you need, click on Buy Now.

- Select a subscription plan that really works for your budget.

- Create a personal account.

- Pay out in just one of two appropriate ways: by credit card or via PayPal.

- Pick a format to download the document in; two options are available (PDF or Word).

- Download the file to the My Forms tab.

- As soon as your reusable form is ready, print it out or save it to your gadget.

With US Legal Forms, you will always have quick access to the right downloadable template. The platform gives you access to documents and divides them into groups to simplify your search. Use US Legal Forms to get your Minnesota Warranty Deed from Husband and Wife to LLC easy and fast.

Form popularity

FAQ

First, so long as you own the property you purchased, you are obligated to pay its property taxes. One way to get a warranty deed to the property you acquired via a foreclosure where you got a quit claim deed for it is to simply deed the property to yourself or a trust that you created as a grant (warranty) deed.

A general warranty deed is used to transfer an interest in real estate in Minnesota in most real estate transactions. A Minnesota warranty deed conveys real property with warranty covenants to the buyer. It requires an acknowledgement of the grantor's signature.

The right of survivorship is an attribute of several types of joint ownership of property, most notably joint tenancy and tenancy in common. When jointly owned property includes a right of survivorship, the surviving owner automatically absorbs a dying owner's share of the property.

Go to your local county reporting office and obtain two types of deeds to set up a right of survivorship agreement for real property (land and houses). The first deed needs to be a Joint Ownership deed. This deed will be signed by both parties, then filed with the county recording office.

The General Rule. In the great majority of states, if you and the other owners call yourselves "joint tenants with the right of survivorship," or put the abbreviation "JT WROS" after your names on the title document, you create a joint tenancy. A car salesman or bank staffer may assure you that other words are enough.

What Is the Difference Between a Warranty Deed & a Survivorship Deed?A warranty deed is the most comprehensive and provides the most guarantees. Survivorship isn't so much a deed as a title. It's a way to co-own property where, upon the death of one owner, ownership automatically passes to the survivor.

Survivorship rights take precedence over any contrary terms in a person's will because property subject to rights of survivorship is not legally part of their estate at death and so cannot be distributed through a will.

It is also crucial that a spouse know about the loan, even if he or she is not on the mortgage. In general, the spouse must sign a deed of trust, the Truth in Lending and Right to Cancel documents. By signing these documents, they are simply acknowledging the existence of the mortgage.

In order to transfer ownership of the marital home pursuant to a divorce, one spouse is going to need to sign a quitclaim deed, interspousal transfer deed, or a grant deed, in order to convey the title to the property.