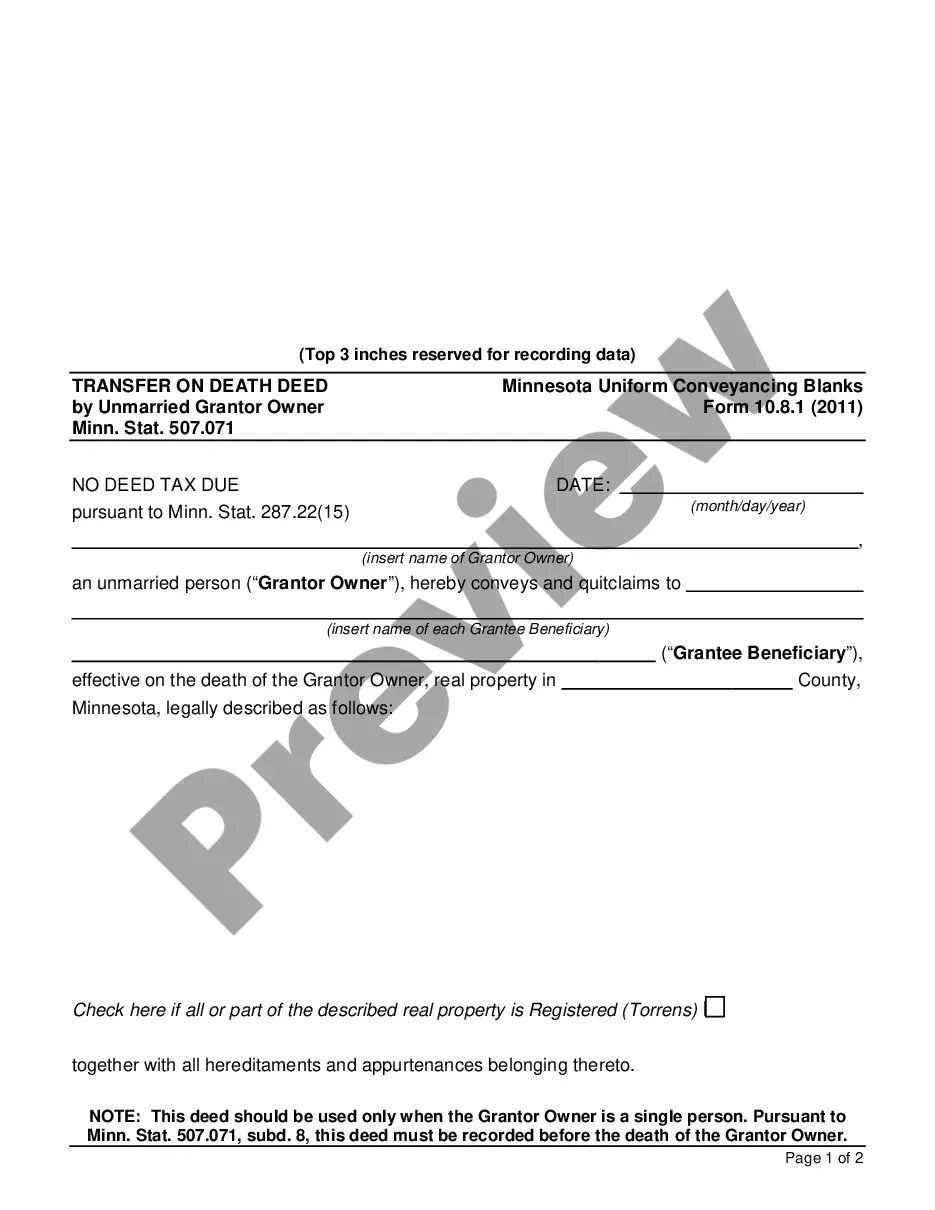

This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms, which pertain to the transfer of legal title of property from one person to another, or the granting of an encumbrance such as a mortgage or a lien, have been approved by the Commissioner of Commerce. The form is available here in PDF format.

Minnesota Transfer on Death Deed by Unmarried Grantor Owner Minn. Stat. 507.071

Description Minnesota Tod Deed Form

How to fill out Minnesota Transfer On Death Deed By Unmarried Grantor Owner Minn. Stat. 507.071?

Get any form from 85,000 legal documents including Minnesota Transfer on Death Deed by Unmarried Grantor Owner Minn. Stat. 507.071 on-line with US Legal Forms. Every template is prepared and updated by state-certified attorneys.

If you have a subscription, log in. Once you’re on the form’s page, click on the Download button and go to My Forms to access it.

In case you have not subscribed yet, follow the steps listed below:

- Check the state-specific requirements for the Minnesota Transfer on Death Deed by Unmarried Grantor Owner Minn. Stat. 507.071 you would like to use.

- Look through description and preview the template.

- When you’re confident the sample is what you need, simply click Buy Now.

- Choose a subscription plan that works well for your budget.

- Create a personal account.

- Pay out in a single of two appropriate ways: by bank card or via PayPal.

- Pick a format to download the document in; two ways are available (PDF or Word).

- Download the file to the My Forms tab.

- Once your reusable template is ready, print it out or save it to your device.

With US Legal Forms, you will always have instant access to the right downloadable sample. The platform gives you access to documents and divides them into categories to streamline your search. Use US Legal Forms to obtain your Minnesota Transfer on Death Deed by Unmarried Grantor Owner Minn. Stat. 507.071 fast and easy.

Form popularity

FAQ

File a petition in probate court. The first step to transferring the property to the rightful new owners is to open up a case in probate court. Petition the court for sale and convey the property to the purchaser. Next, you must petition the court to sell the property.

Typically, you need the property ownership document and the Will, or the Will with probate or succession certificate. In the absence of a Will, you may also need to prepare an affidavit along with a no-objection certificate from other legal heirs or their successors.

Fill in information about you and the TOD beneficiary. write a description of the property. check over the completed deed. sign the deed and have it notarized. record the deed at the recorder's office in the county where the property is located.

Once you obtain a transfer-on-death deed, complete the form to name a beneficiary. The transfer deed will ask you to name the person(s) you wish to inherit your property. You can name multiple people as the beneficiary, as well as an organization. List the beneficiary's complete name and avoid titles.

Fill in information about you and the TOD beneficiary. write a description of the property. check over the completed deed. sign the deed and have it notarized. record the deed at the recorder's office in the county where the property is located.

If you'd like to avoid having your property going through the probate process, it's a good idea to look into a transfer on death deed. A transfer on death deed allows you to select a beneficiary who will receive your property, but only when you've passed away.

Yes, Minnesota has a law that lets you transfer the title to real estate when you die to avoid probate. It is an estate planning tool called a Transfer on Death Deed (TODD). It is like the "payable on death" (POD) designation on a bank account.They have no rights or control of the property until the owner dies.

A revocable TOD deed does not avoid the owner's creditors. Creditors may seek collection against the designated beneficiaries as to secured and unsecured obligations of the original owner.