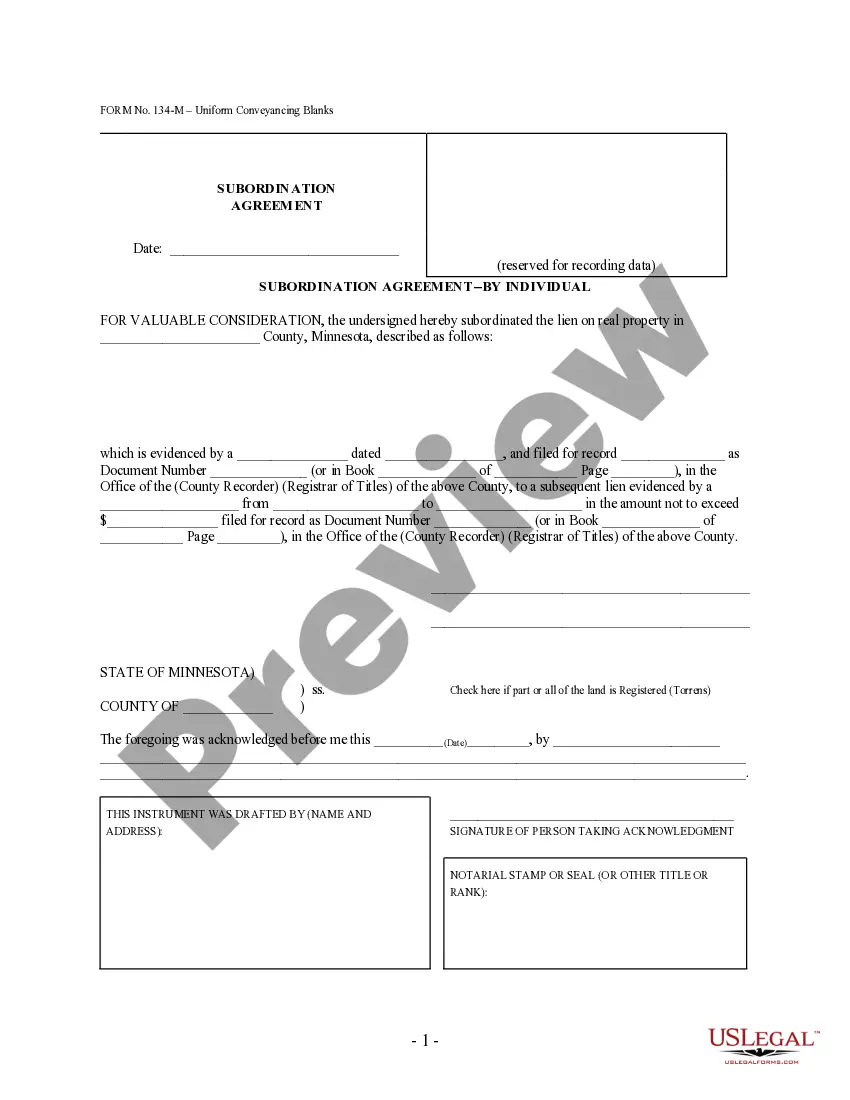

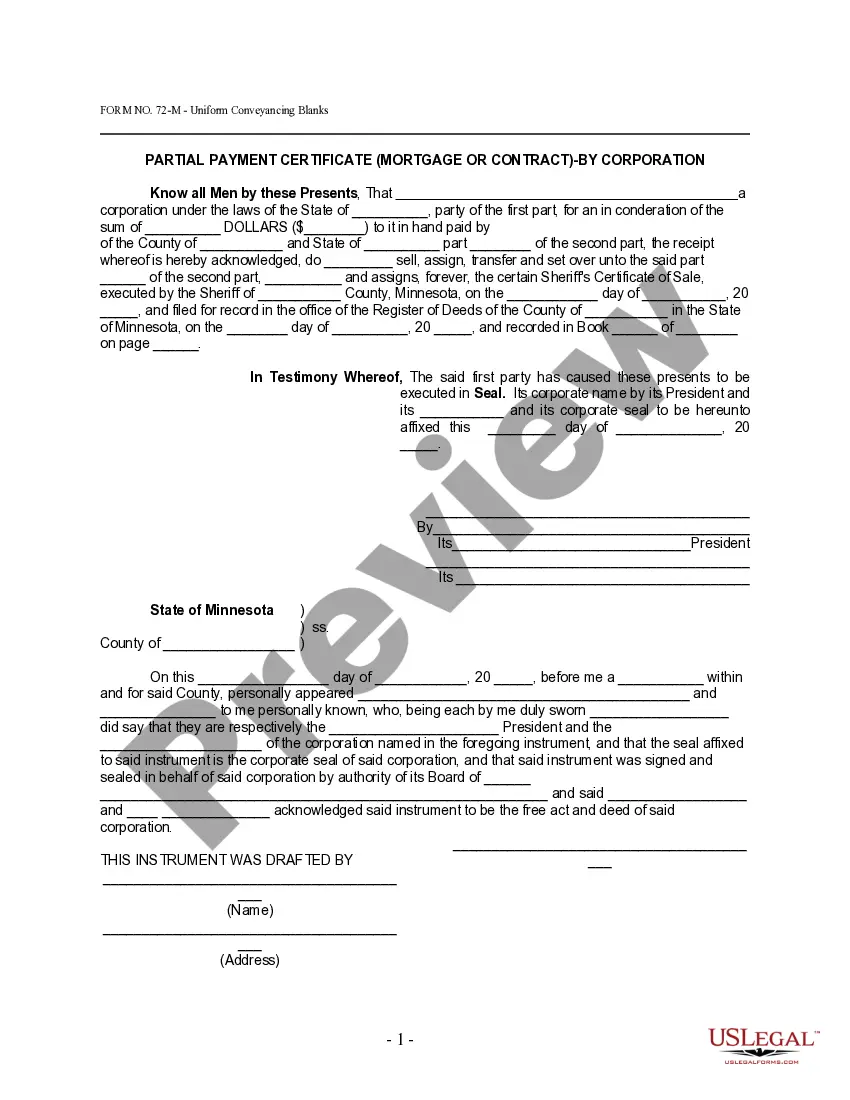

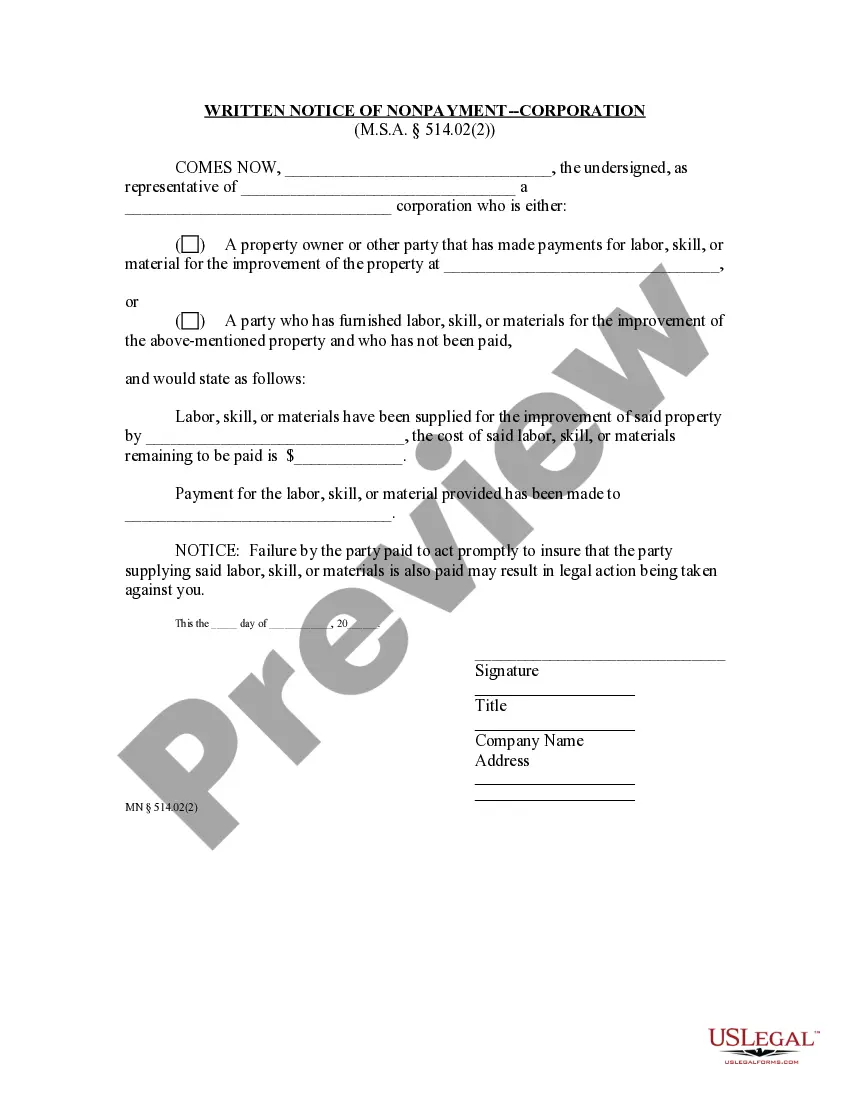

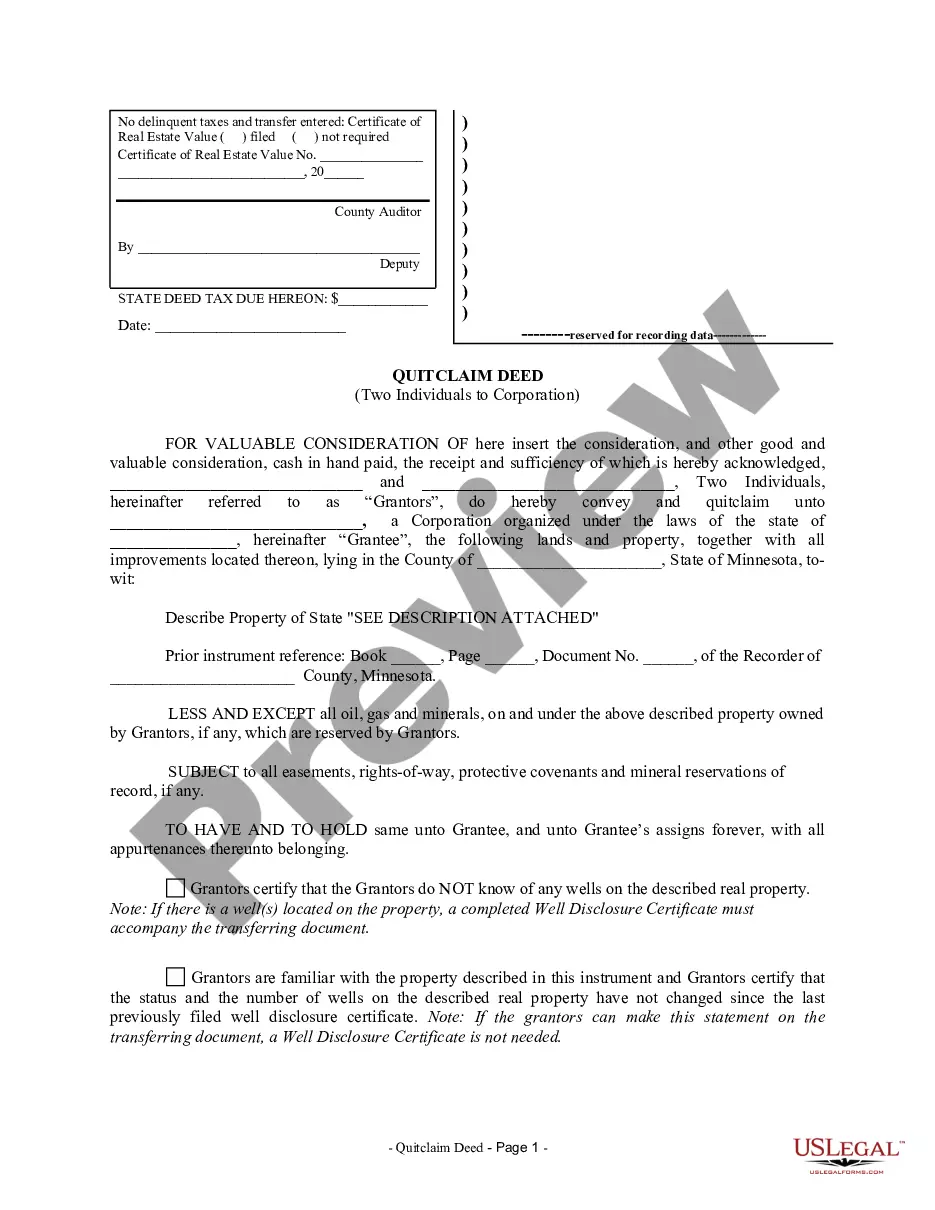

This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms, which pertain to the transfer of legal title of property from one person to another, or the granting of an encumbrance such as a mortgage or a lien, have been approved by the Commissioner of Commerce.The form is available here in PDF format.

Minnesota Satisfaction of Mortgage by Business Entity - UCBC Form 20.5.2

Description Mn Satisfaction Of Mortgage Form

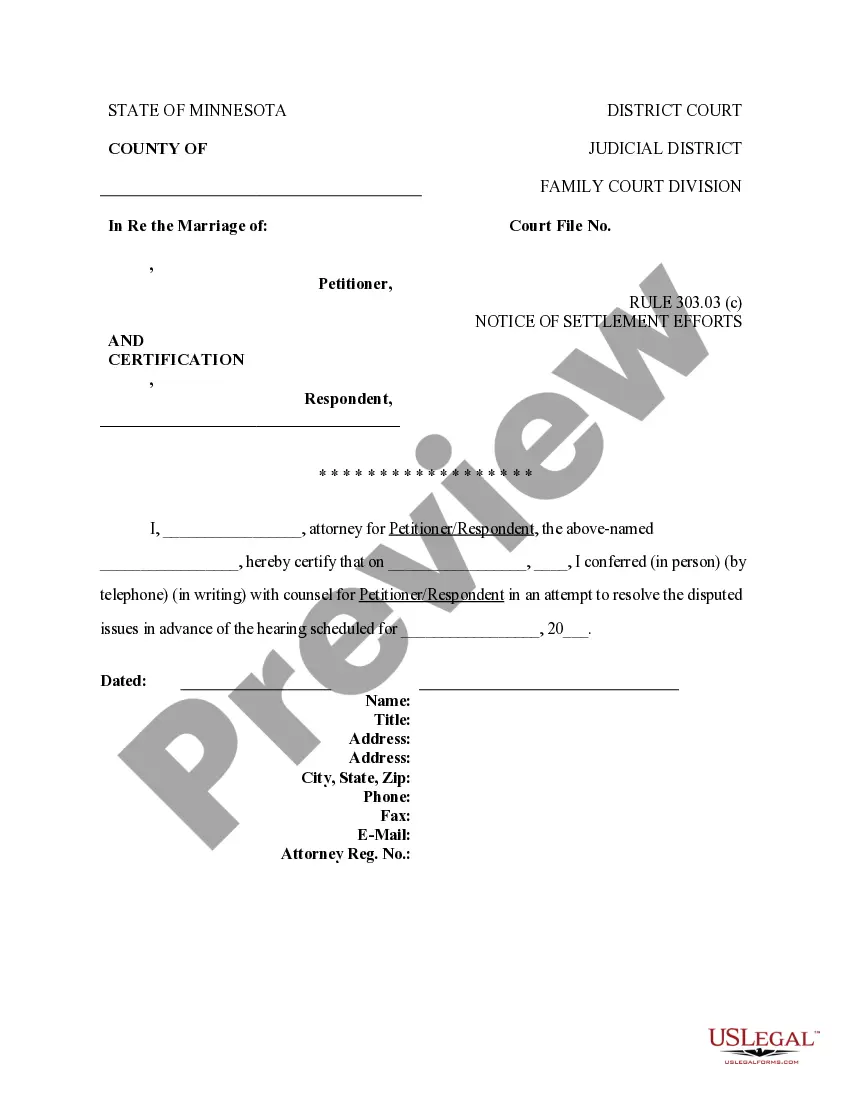

How to fill out Minnesota Satisfaction Of Mortgage By Business Entity - UCBC Form 20.5.2?

Get any template from 85,000 legal documents such as Minnesota Satisfaction of Mortgage by Business Entity - UCBC Form 20.5.2 online with US Legal Forms. Every template is drafted and updated by state-accredited attorneys.

If you have a subscription, log in. When you’re on the form’s page, click on the Download button and go to My Forms to get access to it.

If you have not subscribed yet, follow the steps listed below:

- Check the state-specific requirements for the Minnesota Satisfaction of Mortgage by Business Entity - UCBC Form 20.5.2 you need to use.

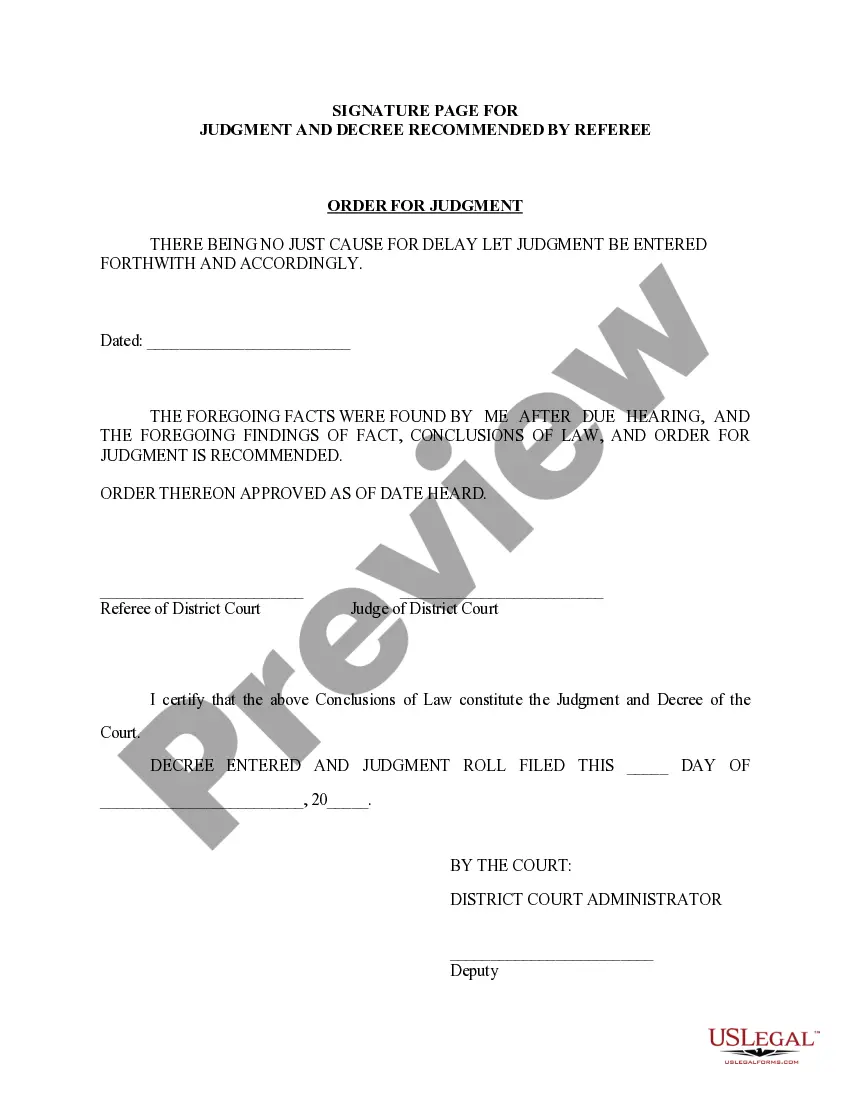

- Look through description and preview the sample.

- As soon as you’re sure the sample is what you need, click Buy Now.

- Choose a subscription plan that works well for your budget.

- Create a personal account.

- Pay out in just one of two suitable ways: by credit card or via PayPal.

- Select a format to download the document in; two ways are available (PDF or Word).

- Download the file to the My Forms tab.

- When your reusable form is downloaded, print it out or save it to your device.

With US Legal Forms, you’ll always have immediate access to the proper downloadable sample. The platform gives you access to forms and divides them into categories to simplify your search. Use US Legal Forms to obtain your Minnesota Satisfaction of Mortgage by Business Entity - UCBC Form 20.5.2 easy and fast.

Form popularity

FAQ

If you use part of your home for business, you may be able to deduct expenses for the business use of your home. These expenses may include mortgage interest, insurance, utilities, repairs, and depreciation.

If your home office is 300 square feet or less and you opt to take the simplified deduction, the IRS gives you a deduction of $5 per square foot of your home that is used for business, up to a maximum of $1,500 for a 300-square-foot space.

If you own a business that is an LLC, you can get an FHA loan. However, the FHA loan cannot be in the name of the LLC.

You can however, take out money from your business account for personal expenses.Sole Proprietor/LLC You can make multiple draws from your account as needed for cash flow, but do not pay your mortgage, or anything else, directly from the business checking account.

An LLC is a business entity with its own assets and income. As such, it can purchase real estate, including a house or business premises, for any reason outlined in its articles of organization.Separation of personal and business finances. Liability protection.

Late to the party, but you can definitely get a 30 yr fixed mortgage with a private lender with the borrowing entity as an LLC . Most rates are mid 5's so you're paying a premium. Most banks are still at a 5 or 10 fix over 20/25 years.

Yes, you can get a conventional mortgage loan under an LLC name, and often for affordable interest rates.As mentioned above, conventional mortgage lenders usually require income documentation. They'll also pull your credit report, so if your credit isn't tip-top, start working on building your credit fast.

You could set up an LLC to rent to yourself, but if that LLC is a disregarded entity (meaning that it doesn't file its own tax return) the IRS will ignore the entity and say that you are the taxpayer for 1031 purposes.So you're paying tax for the privilege of paying yourself rent.

Contractors sometimes forget that their limited company is a separate entity to them. Therefore, any money that is held within its bank account belongs to the business and not you.Once this transfer is completed, the money is yours and you can use it to pay their personal mortgage.

In most cases, the answer is yes. When you borrow a mortgage for an LLC-owned rental property, the lender typically requires you to sign a personal guarantee. The document says that even though the LLC is the borrower on the loan, you personally guarantee the payments, and therefore become personally liable for them.