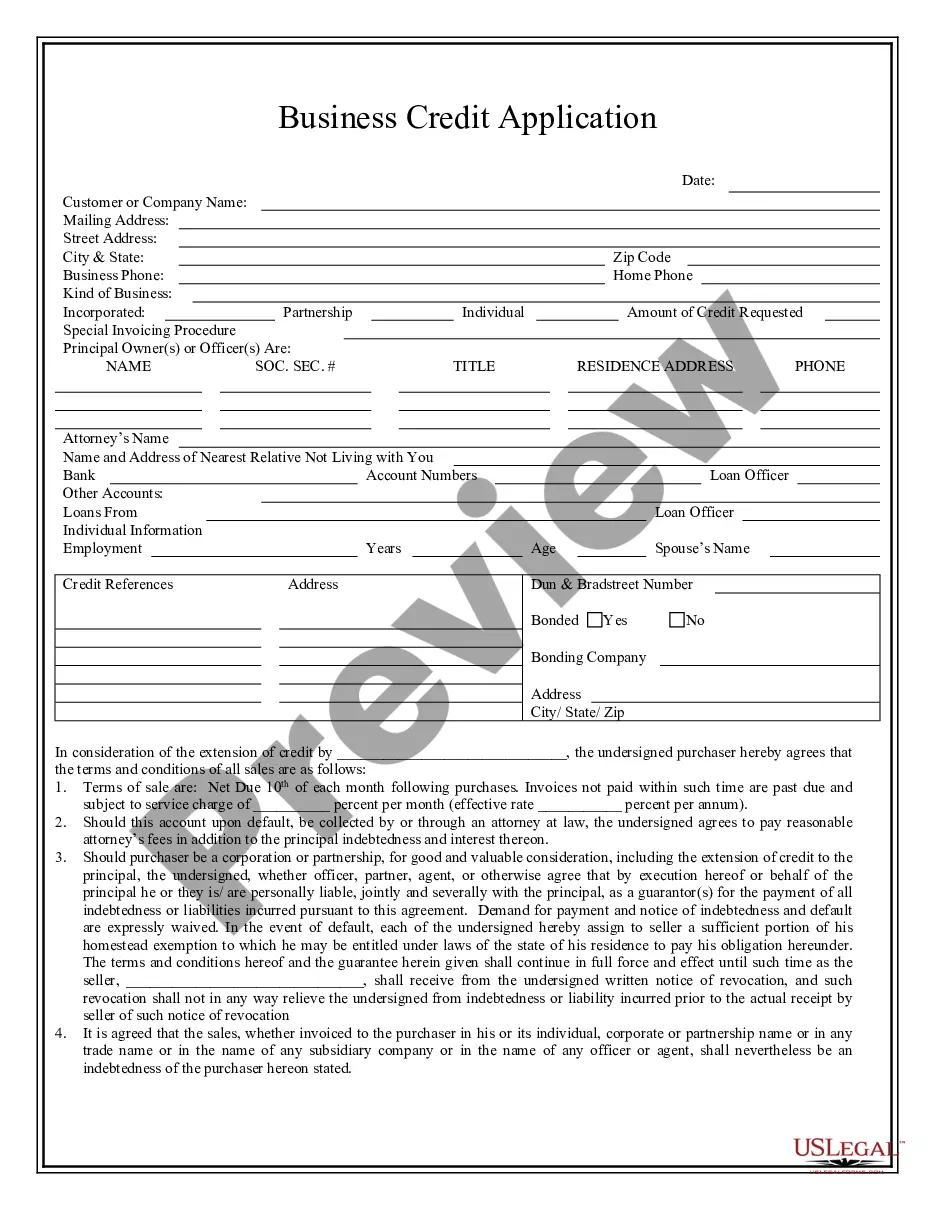

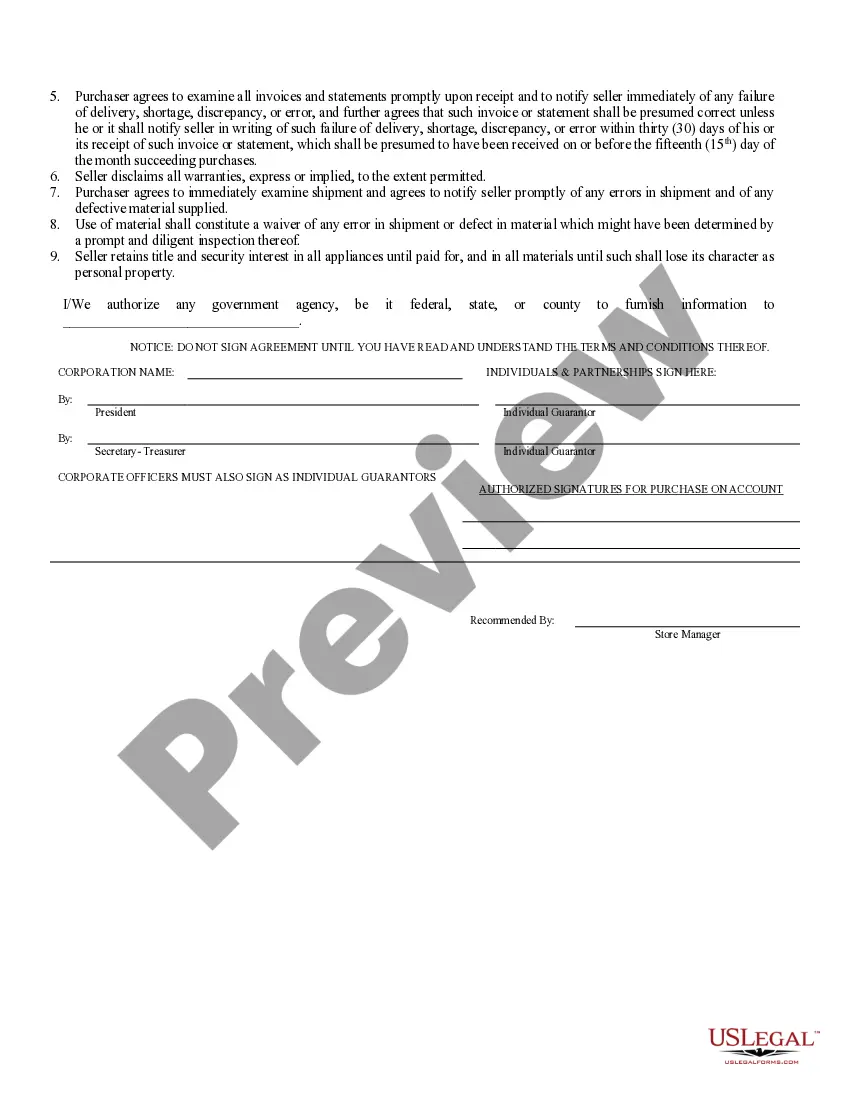

Minnesota Business Credit Application

Description

How to fill out Minnesota Business Credit Application?

Have any template from 85,000 legal documents such as Minnesota Business Credit Application online with US Legal Forms. Every template is prepared and updated by state-accredited lawyers.

If you already have a subscription, log in. Once you’re on the form’s page, click the Download button and go to My Forms to access it.

If you have not subscribed yet, follow the steps listed below:

- Check the state-specific requirements for the Minnesota Business Credit Application you would like to use.

- Read description and preview the sample.

- When you’re sure the template is what you need, simply click Buy Now.

- Choose a subscription plan that actually works for your budget.

- Create a personal account.

- Pay out in one of two appropriate ways: by credit card or via PayPal.

- Select a format to download the document in; two options are available (PDF or Word).

- Download the file to the My Forms tab.

- As soon as your reusable form is ready, print it out or save it to your device.

With US Legal Forms, you’ll always have immediate access to the proper downloadable template. The service provides you with access to forms and divides them into categories to streamline your search. Use US Legal Forms to get your Minnesota Business Credit Application fast and easy.

Form popularity

FAQ

Obtain Professional Licensing. Register an Assumed or Fictitious Business Name. Register a Trademark or Trade Name.

The business credit application is your opportunity to prove that your business is an appropriate credit risk.If your business is not listed with any of the business credit reporting agencies then a lender will only have personal credit reports to assess credit risk.

Incorporate your business. Obtain a federal tax identification number (EIN). Open a business bank account. Establish a business phone number. Open a business credit file. Obtain business credit card(s). Establish a line of credit with vendors or suppliers.

Expected filing schedule (monthly, quarterly, or annual). Accounting method (cash or accrual) Any local or special local taxes that may apply to your business.

A credit application is an application filed by a prospective borrower and submitted to a credit lender. A credit application can be submitted in writing either through online and offline modes or orally in person at the lender's premises.

The business credit application is your opportunity to prove that your business is an appropriate credit risk.These reports and business credit scores are used to decide not only if your business should be approved, but also what the terms of the loan or credit line will be if approved.

Legal business name. Business address. Type of business. Business phone number. Tax identification number. Annual business revenue. Years in business. Monthly business expenses.

Expected filing schedule (monthly, quarterly, or annual). Accounting method (cash or accrual) Any local or special local taxes that may apply to your business.