This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms are to be used as a guide. The form is available here in PDF format.

Minnesota Notice of Mortgage Foreclosure Sale And Affidavit of Publication - Form 60.3.2

Description Minnesota Foreclosure

How to fill out Mortgage Foreclosure Form?

Get any template from 85,000 legal documents such as Minnesota Notice of Mortgage Foreclosure Sale And Affidavit of Publication - Form 60.3.2 on-line with US Legal Forms. Every template is prepared and updated by state-licensed lawyers.

If you have a subscription, log in. Once you’re on the form’s page, click on the Download button and go to My Forms to get access to it.

In case you have not subscribed yet, follow the steps below:

- Check the state-specific requirements for the Minnesota Notice of Mortgage Foreclosure Sale And Affidavit of Publication - Form 60.3.2 you want to use.

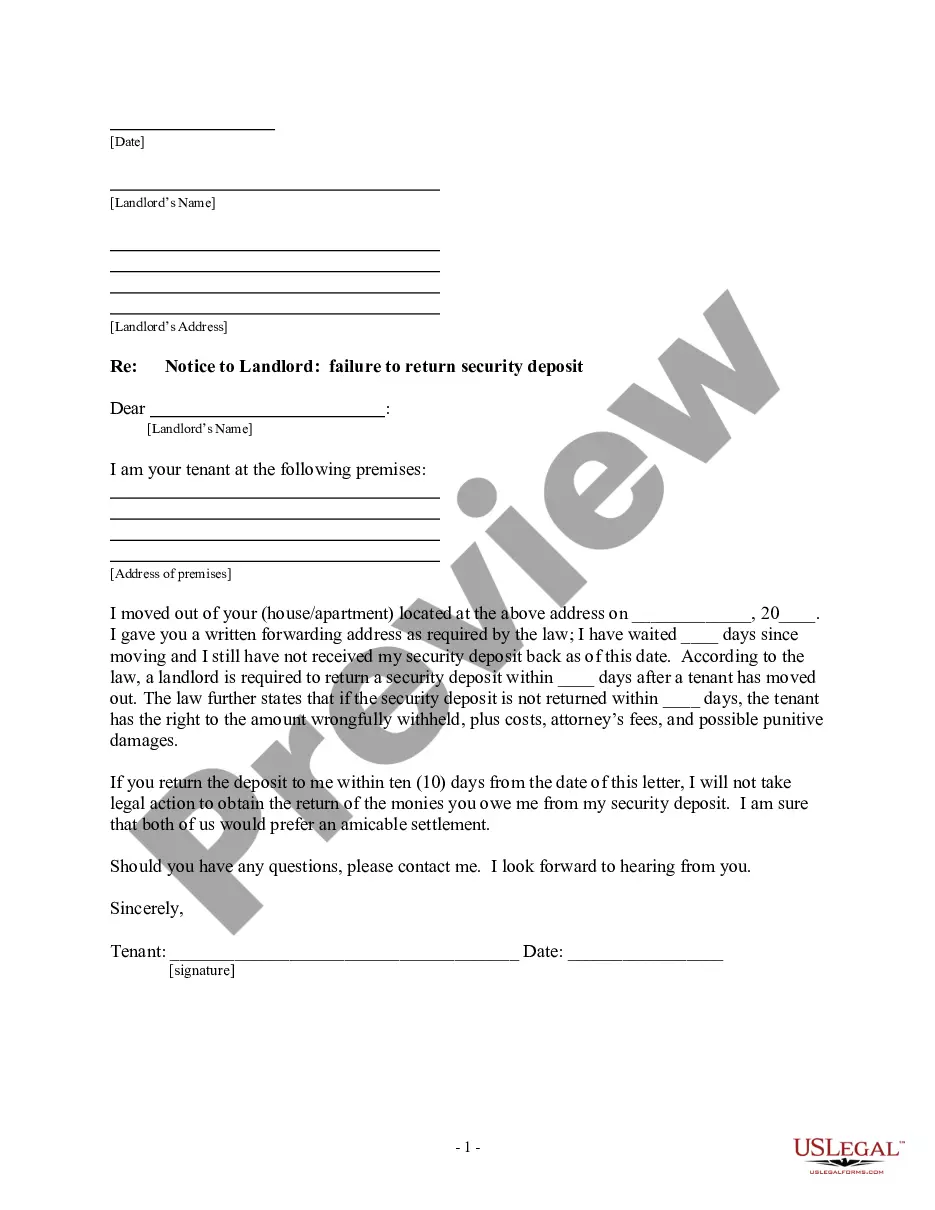

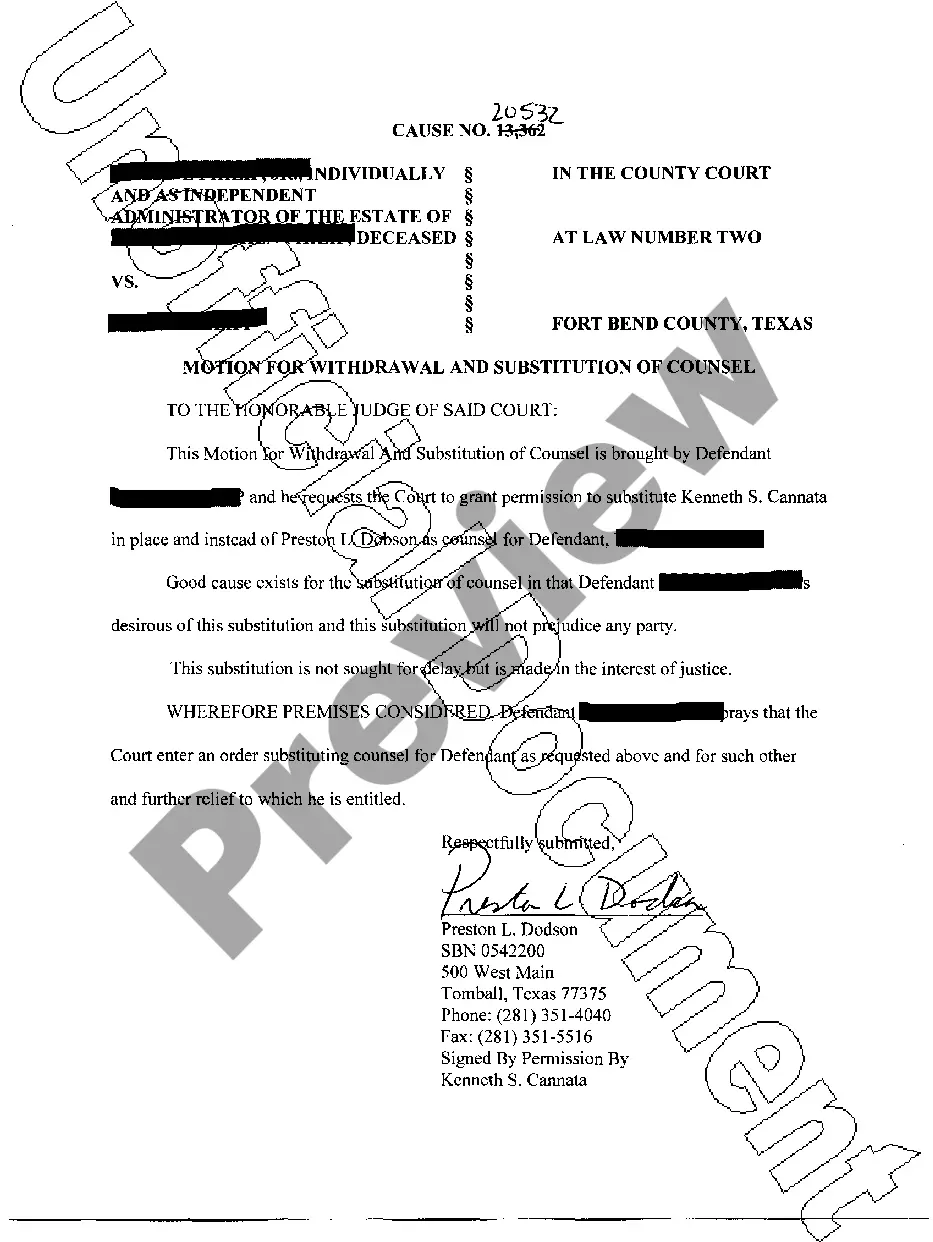

- Read description and preview the template.

- When you are confident the template is what you need, click on Buy Now.

- Select a subscription plan that works well for your budget.

- Create a personal account.

- Pay out in just one of two suitable ways: by credit card or via PayPal.

- Pick a format to download the file in; two options are available (PDF or Word).

- Download the document to the My Forms tab.

- Once your reusable form is downloaded, print it out or save it to your device.

With US Legal Forms, you’ll always have instant access to the right downloadable template. The service gives you access to forms and divides them into categories to streamline your search. Use US Legal Forms to obtain your Minnesota Notice of Mortgage Foreclosure Sale And Affidavit of Publication - Form 60.3.2 fast and easy.

Minnesota Foreclosure Sale Form popularity

Minnesota Notice Mortgage Other Form Names

Minnesota Affidavit Form FAQ

There are two main ways to buy a foreclosed home: at auction or through a real estate listing. Once a bank takes possession of a property, it goes to a public foreclosure auction, during which the bank attempts to sell the property to the highest bidder.

You can stop the foreclosure process by informing your lender that you will pay off the default amount and extra fees. Your lender would prefer to have the money much more than they would have your home, so unless there are extenuating circumstances, this should work.

In most cases, the lender has to send you a written notice of the default before officially starting a foreclosure. The notice must provide 30 days to cure the default.

How Can I Stop a Foreclosure in Minnesota? A few potential ways to stop a foreclosure include reinstating the loan, redeeming the property before or after the sale, or filing for bankruptcy. Of course, if you're able to work out a loss mitigation option, like a loan modification, that will also stop a foreclosure.

Pay what you owe. Some states like California allow you to satisfy your mortgage default within up to five days of the scheduled public auction.Stop the foreclosure sale on the same day by contacting your lender to arrange payment of all monies due.

The term redemption period refers to the period of time after a foreclosure sale (sheriff's sale) has been held. For residential property in Minnesota, the redemption period is typically six months, but in some cases twelve months.

Gather your loan documents and set up a case file. Learn about your legal rights. Organize your financial information. Review your budget. Know your options. Call your servicer. Contact a HUD-approved housing counselor.

Phase 1: Payment Default. Phase 2: Notice of Default. Phase 3: Notice of Trustee's Sale. Phase 4: Trustee's Sale. Phase 5: Real Estate Owned (REO) Phase 6: Eviction. The Bottom Line.