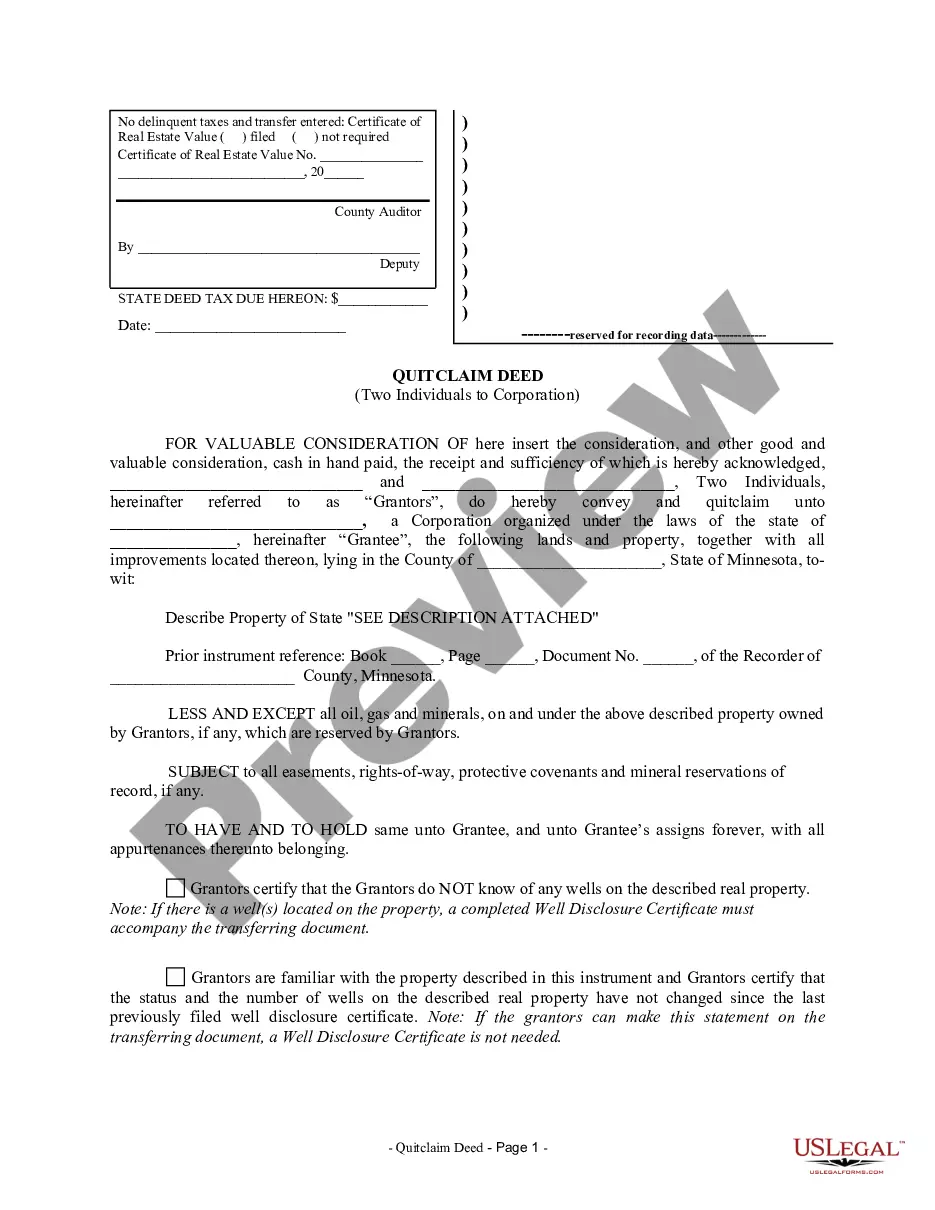

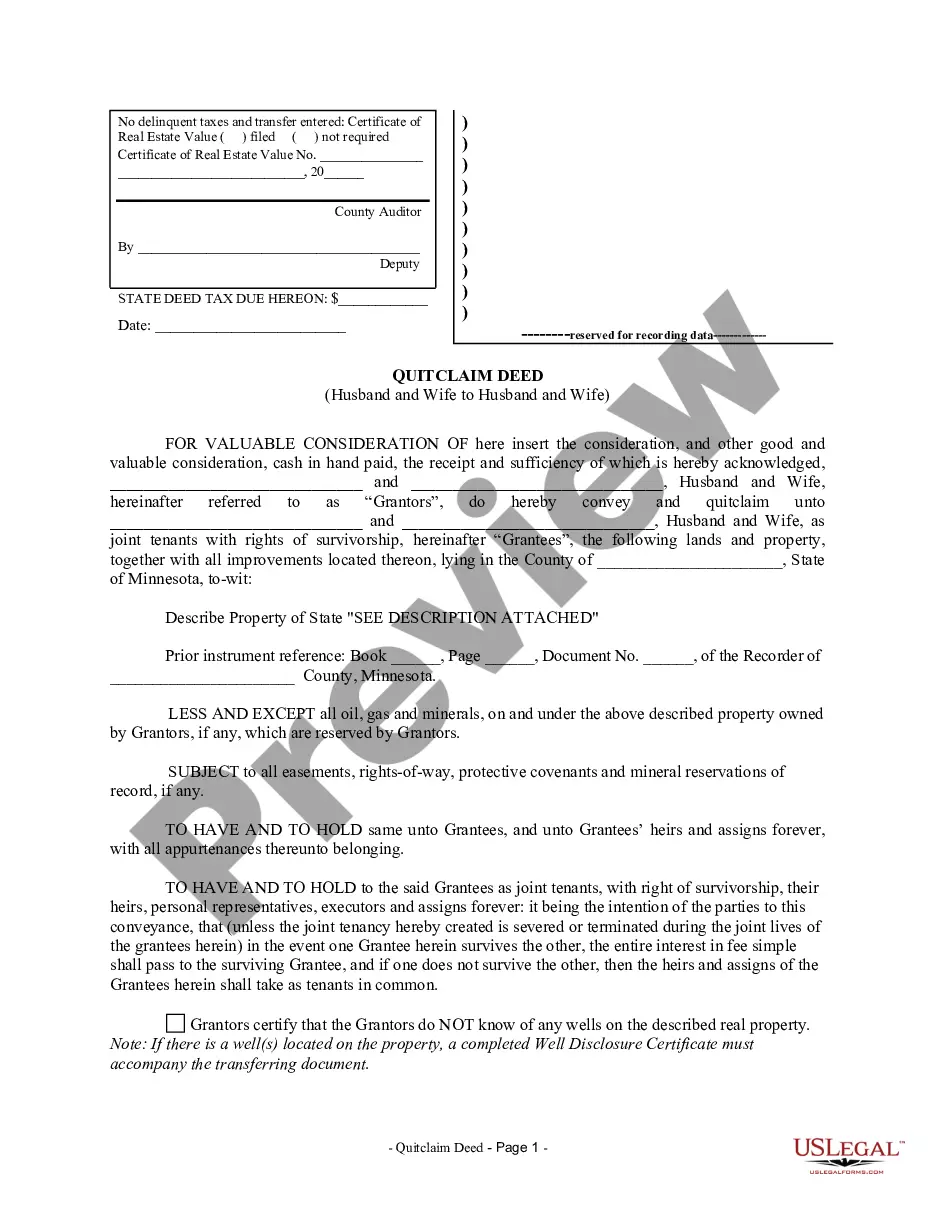

Minnesota Partial Payment Certificate - Mortgage or Contract - By Corporation - UCBC Form 60.4.5

Description Mn Ucbc Form

How to fill out Partial Payment Contract?

Have any form from 85,000 legal documents such as Minnesota Partial Payment Certificate - Mortgage or Contract - By Corporation - UCBC Form 60.4.5 on-line with US Legal Forms. Every template is prepared and updated by state-licensed lawyers.

If you already have a subscription, log in. When you are on the form’s page, click on the Download button and go to My Forms to access it.

If you have not subscribed yet, follow the tips below:

- Check the state-specific requirements for the Minnesota Partial Payment Certificate - Mortgage or Contract - By Corporation - UCBC Form 60.4.5 you want to use.

- Read through description and preview the sample.

- As soon as you’re sure the template is what you need, click Buy Now.

- Select a subscription plan that really works for your budget.

- Create a personal account.

- Pay out in just one of two suitable ways: by card or via PayPal.

- Choose a format to download the file in; two ways are available (PDF or Word).

- Download the document to the My Forms tab.

- After your reusable template is ready, print it out or save it to your device.

With US Legal Forms, you will always have instant access to the right downloadable template. The platform provides you with access to documents and divides them into groups to simplify your search. Use US Legal Forms to obtain your Minnesota Partial Payment Certificate - Mortgage or Contract - By Corporation - UCBC Form 60.4.5 easy and fast.

Minnesota Partial Payment Form popularity

Minnesota Certificate Form Other Form Names

Mn Payment Paper FAQ

You can pay Minnesota estimated tax through any of the following ways: Pay through our e-Services Payment System - It's secure, easy, and convenient. You can make a single payment or schedule all four payments at once. On the Welcome page, select No, I am not using a Letter ID.

You can find your Withholding Account ID online or on any notice you have received from the Department of Revenue. If you're unable to locate this, contact the agency at (651) 282-9999.

You can make payments for taxes and fees online, from your bank account, by phone, or in person. If you received a bill from the Minnesota Department of Revenue and cannot pay in full, you may request an installment plan.You may make a payment directly from your bank account.

200bA Minnesota Tax ID Number is a seven-digit number used to report and pay Minnesota business taxes. If you need one, you can apply through Business Tax Registration. You need a Minnesota Tax ID if you: + Make taxable sales or leases in Minnesota.

You may pay online using the Minnesota Department of Revenue's e-Services system or pay by phone, credit or debit card, or check. When paying electronically, you must use an account that is not associated with any foreign banks.

You can pay Minnesota estimated tax through any of the following ways: Pay through our e-Services Payment System - It's secure, easy, and convenient. You can make a single payment or schedule all four payments at once. On the Welcome page, select No, I am not using a Letter ID.

During the eFile.com process, you can pay your taxes owed via electronic fund withdrawal from a bank account (direct debit) or check/money order. You can only submit tax payments for the current tax year, not previous or future tax years.

You may pay online using the Minnesota Department of Revenue's e-Services system or pay by phone, credit or debit card, or check. When paying electronically, you must use an account that is not associated with any foreign banks.

If you are waiting for a refund and want to know its status: Use our Where's My Refund? system. Call our automated phone system (available 24/7) at 651-296-4444 or 1-800-657-3676 (toll-free).