Minnesota law does not have a specific provision for the release of a lien. However, this form is a general use form that would allow a lien holder to provide notice that the lien is released after being paid in full.

Minnesota Satisfaction of Mechanic's Lien By Business Entity - UCBC Form 40.3.2

Description

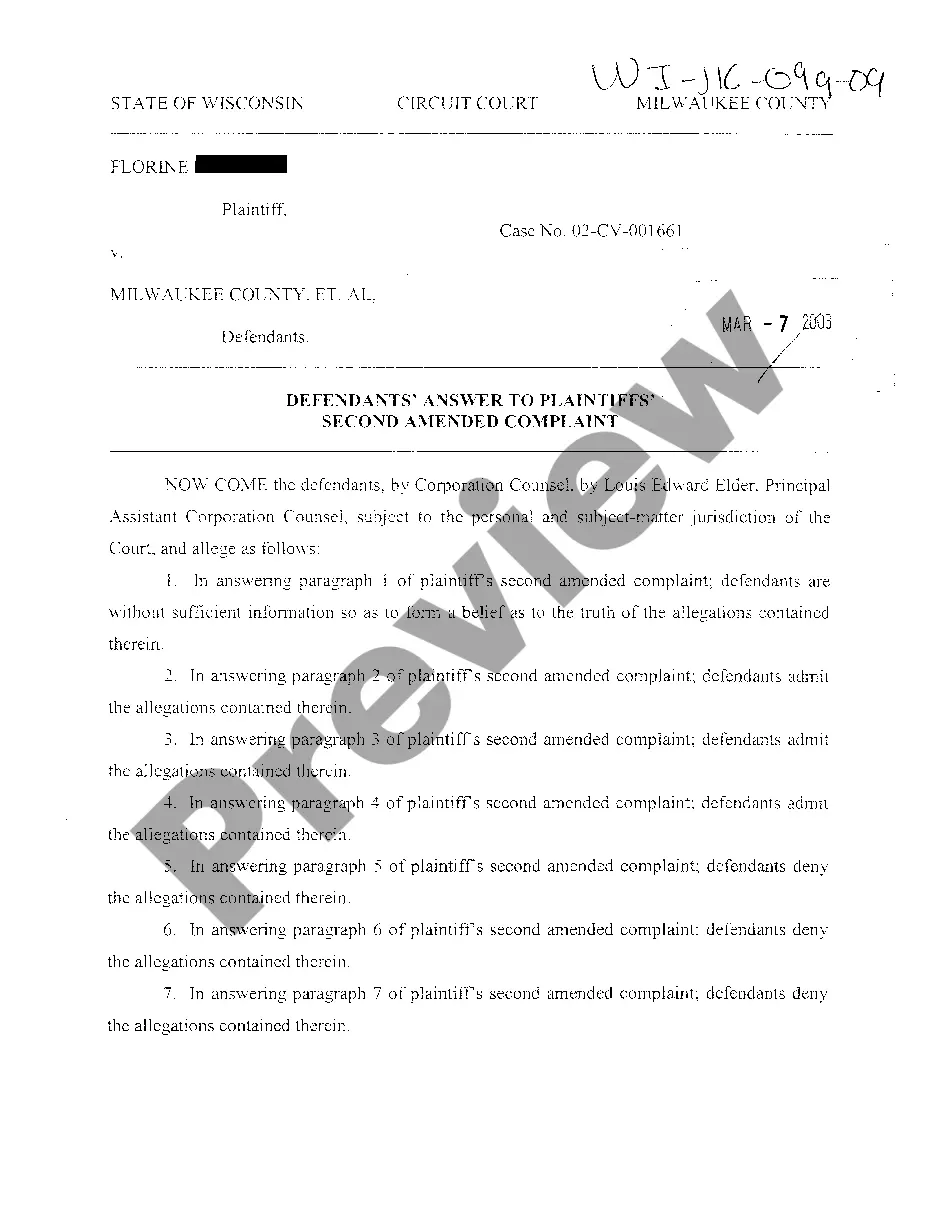

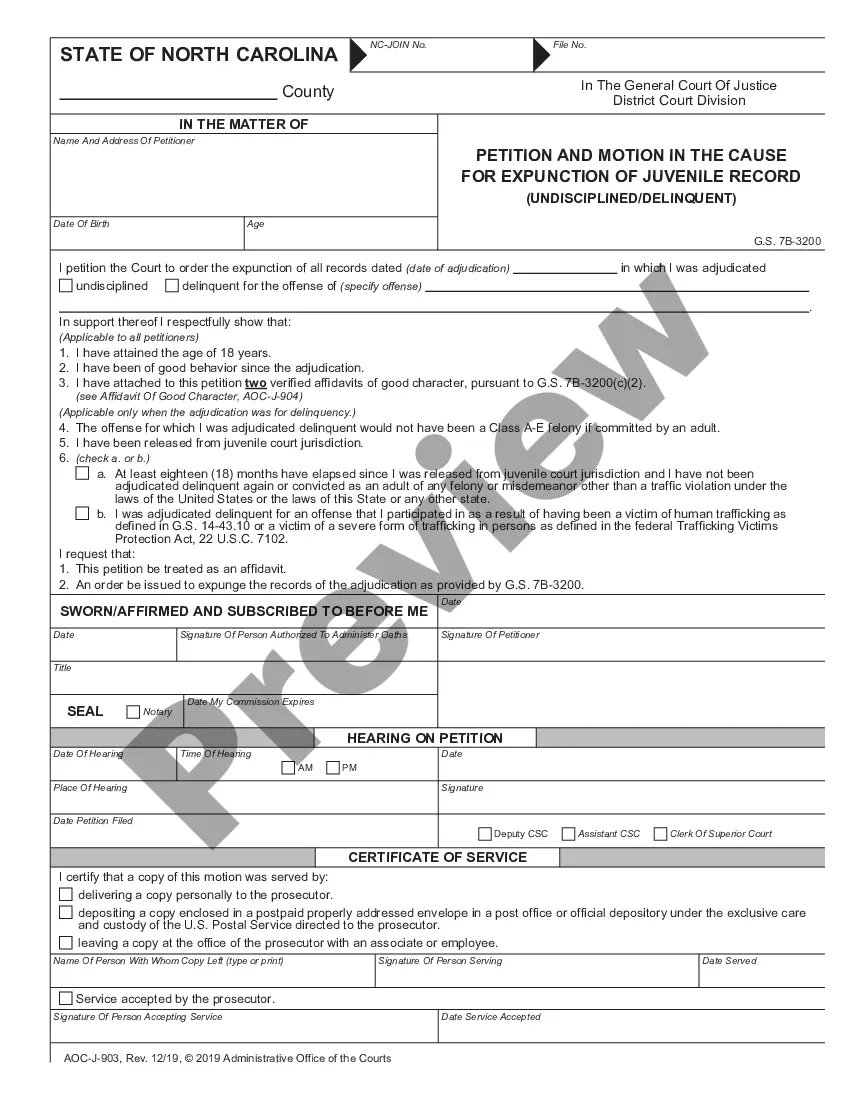

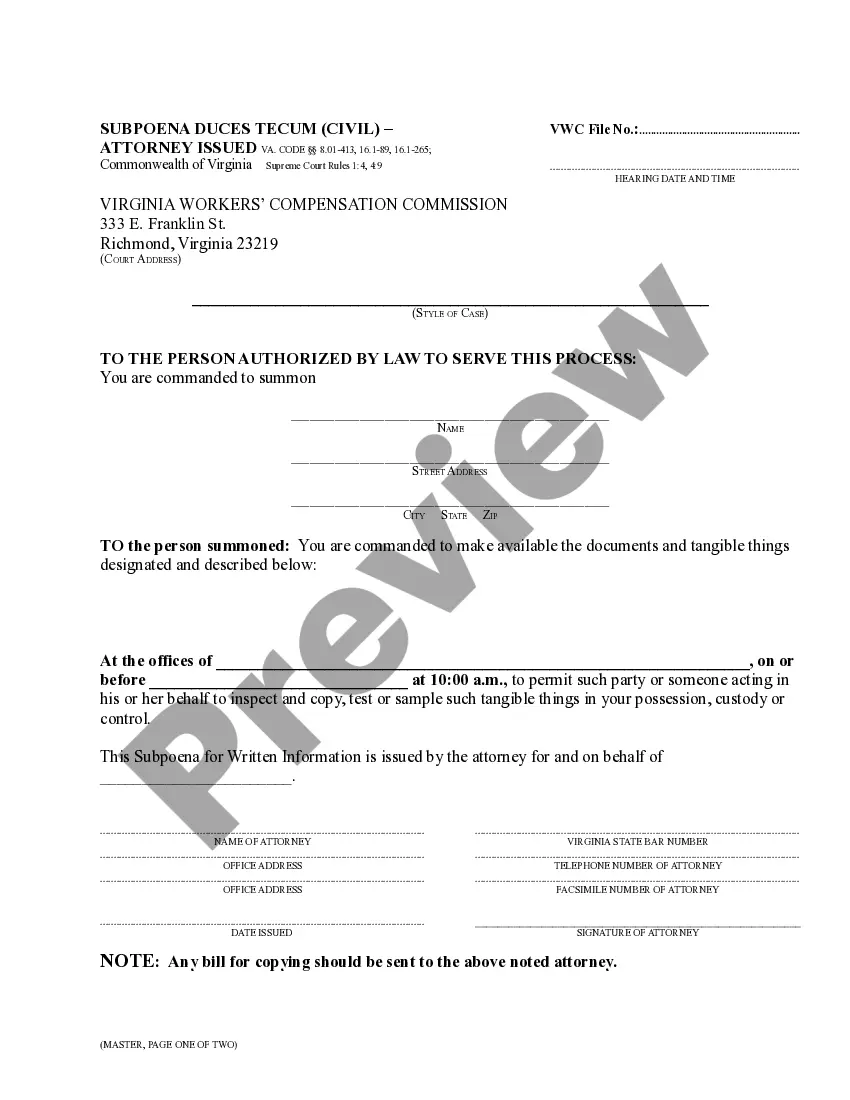

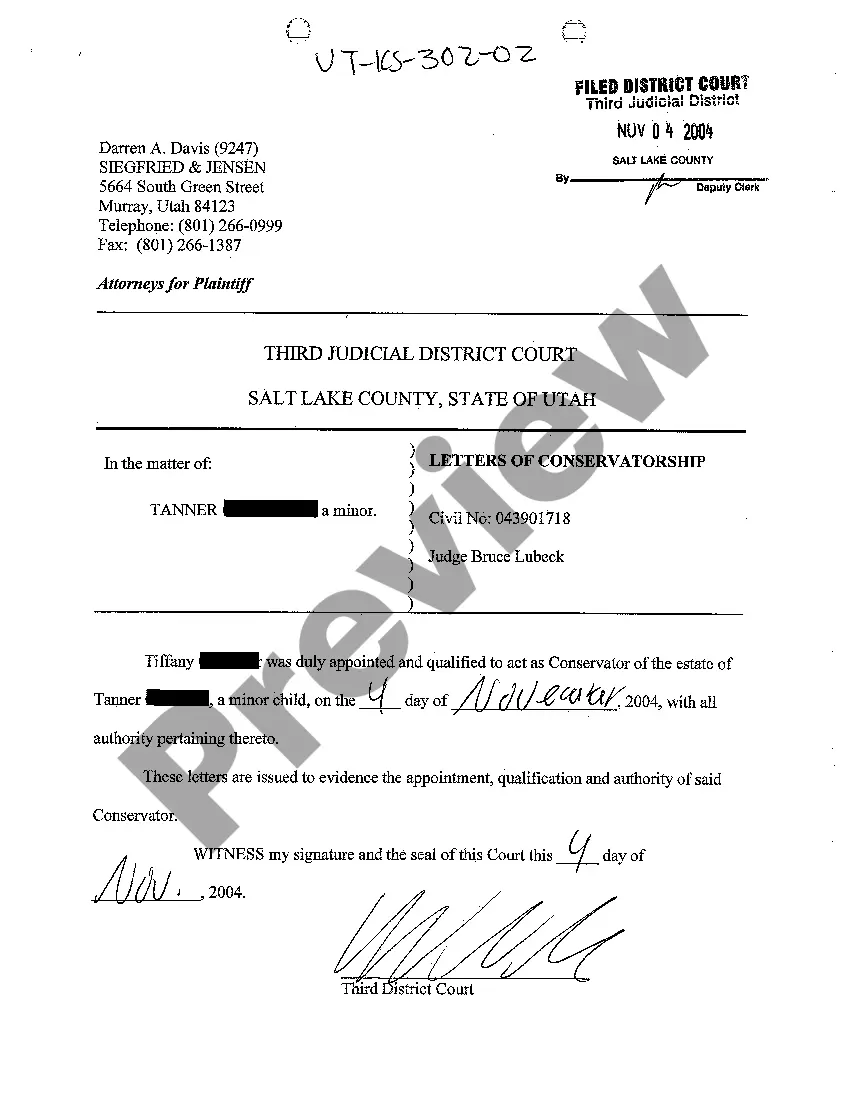

How to fill out Minnesota Satisfaction Of Mechanic's Lien By Business Entity - UCBC Form 40.3.2?

Get any form from 85,000 legal documents such as Minnesota Satisfaction of Mechanic's Lien By Business Entity - UCBC Form 40.3.2 online with US Legal Forms. Every template is drafted and updated by state-accredited attorneys.

If you have a subscription, log in. When you are on the form’s page, click on the Download button and go to My Forms to get access to it.

If you have not subscribed yet, follow the tips listed below:

- Check the state-specific requirements for the Minnesota Satisfaction of Mechanic's Lien By Business Entity - UCBC Form 40.3.2 you would like to use.

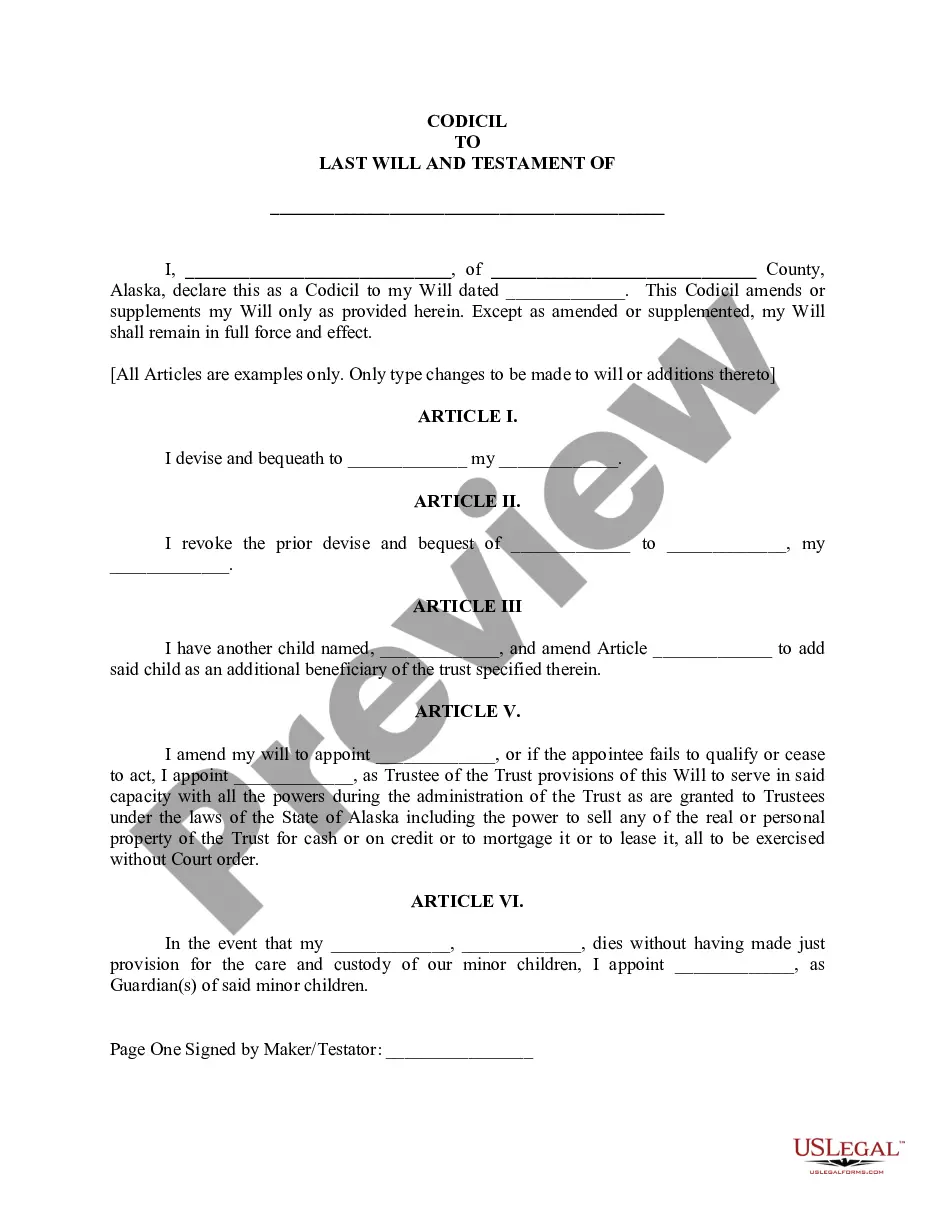

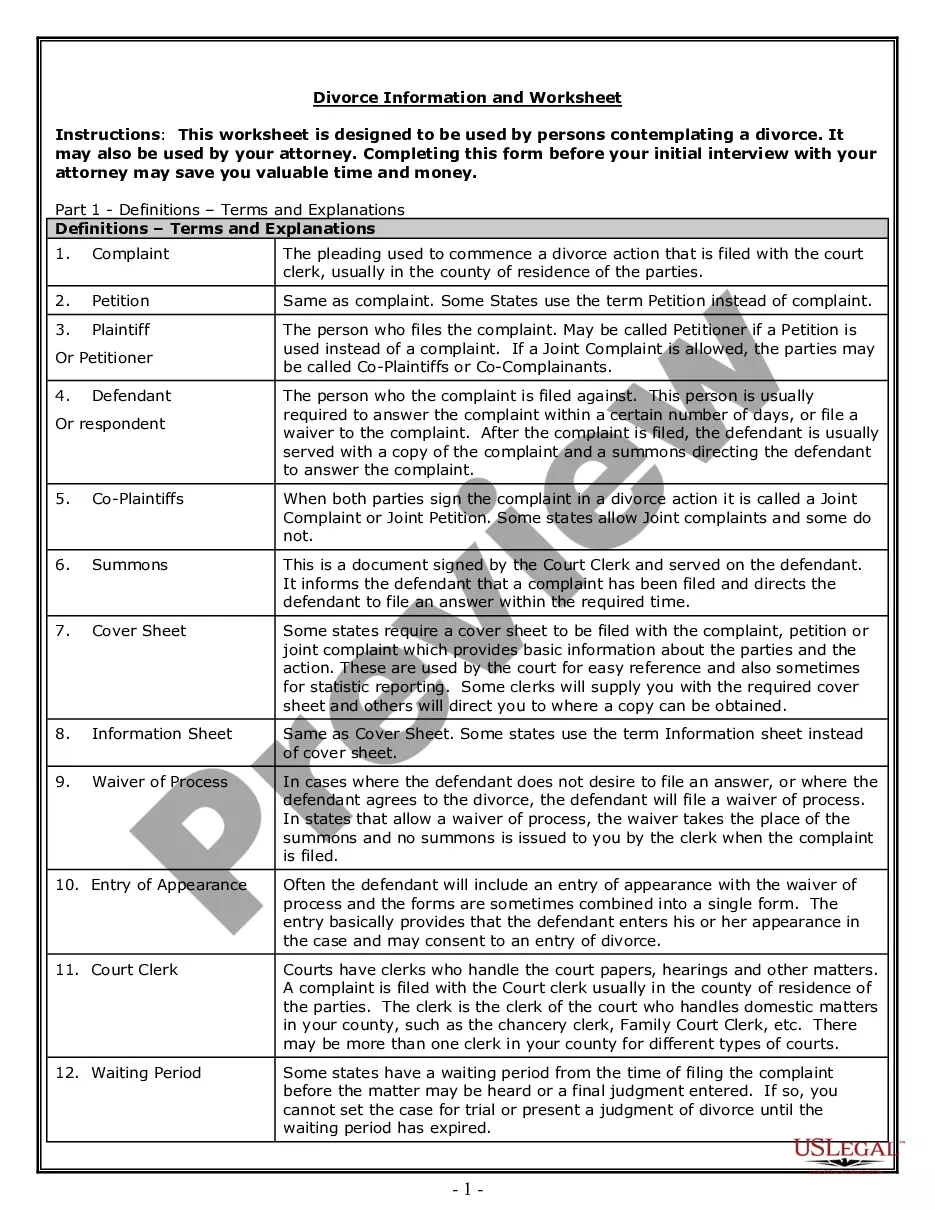

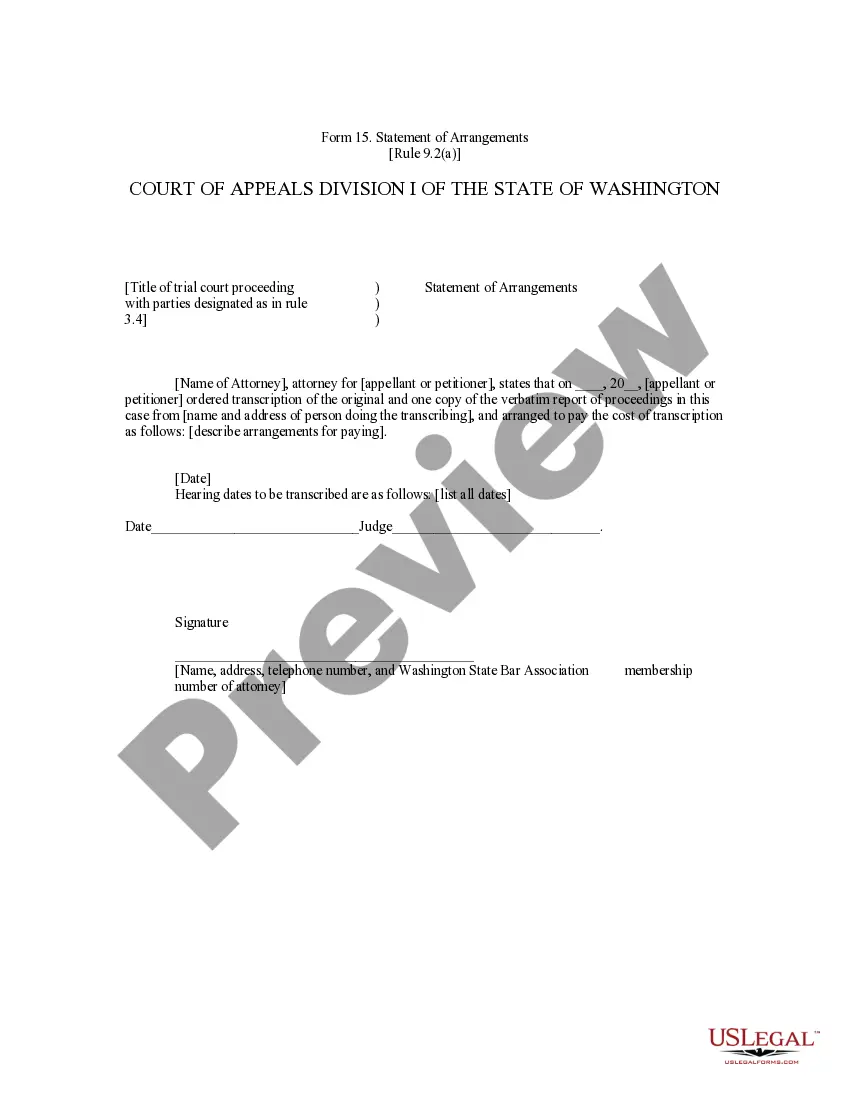

- Read through description and preview the template.

- When you are sure the template is what you need, simply click Buy Now.

- Choose a subscription plan that works well for your budget.

- Create a personal account.

- Pay in a single of two suitable ways: by bank card or via PayPal.

- Select a format to download the file in; two ways are available (PDF or Word).

- Download the file to the My Forms tab.

- After your reusable form is downloaded, print it out or save it to your device.

With US Legal Forms, you’ll always have immediate access to the appropriate downloadable sample. The platform gives you access to forms and divides them into categories to streamline your search. Use US Legal Forms to get your Minnesota Satisfaction of Mechanic's Lien By Business Entity - UCBC Form 40.3.2 easy and fast.

Form popularity

FAQ

Go to the Business Filings Online page to get started. Search by Business Name: type the Business Name in the search box, click Search Search by File Number: click File Number (above the search box), enter the file number, and click Search

Online Go to Business Tax Registration. By phone Call 651-282-5225 or 1-800-657-3605 (toll-free)

How much does it cost to form an LLC in Minnesota? The Minnesota Secretary of State charges $135 to file the Articles of Organization by mail and $155 to file online or in-person. You can file an LLC name reservation for $50 if filed by mail and $55 if filed online or in-person.

Go to the Online Business Services page. Scroll down to the list titled File a New Business or Nonprofit." Click on the business structure your business will be set up and registered as.

What Is the Cheapest State to Incorporate? Delaware remains one of the more affordable states in which to form an LLC (14th lowest filing fee of 50 states). Delaware also ranks well for incorporation fees (17th lowest filing fee of 50 states).

If you want to check to see if a California LLC is still active, you can use the free online business entity search tool offered by the California Secretary of State's Office. Go to the California Secretary of State's business entity search tool (See Resources).

Choose a Corporate Name. Prepare and File Articles of Incorporation. Appoint a Registered Agent. Set Up a Corporate Records Book. Prepare Corporate Bylaws. Appoint Initial Corporate Directors. Hold Your First Board of Directors Meeting. Issue Stock.

Minnesota is known for its lakes and forests, but it's also home to the Twin Cities: Saint Paul and Minneapolis. The Twin Cities are home to many Fortune 500 companies, including Best Buy, General Mills, Target, and Land 'o Lakes. The Mall of America in Bloomington, Minnesota is the largest mall in the United States.

Sole proprietors can incorporate themselves, and there are a number of benefits to doing so.When you learn how to incorporate yourself, it becomes easier to manage income, separate your personal income from business income, and legally distance yourself from the corporation, making tax time less of an issue.