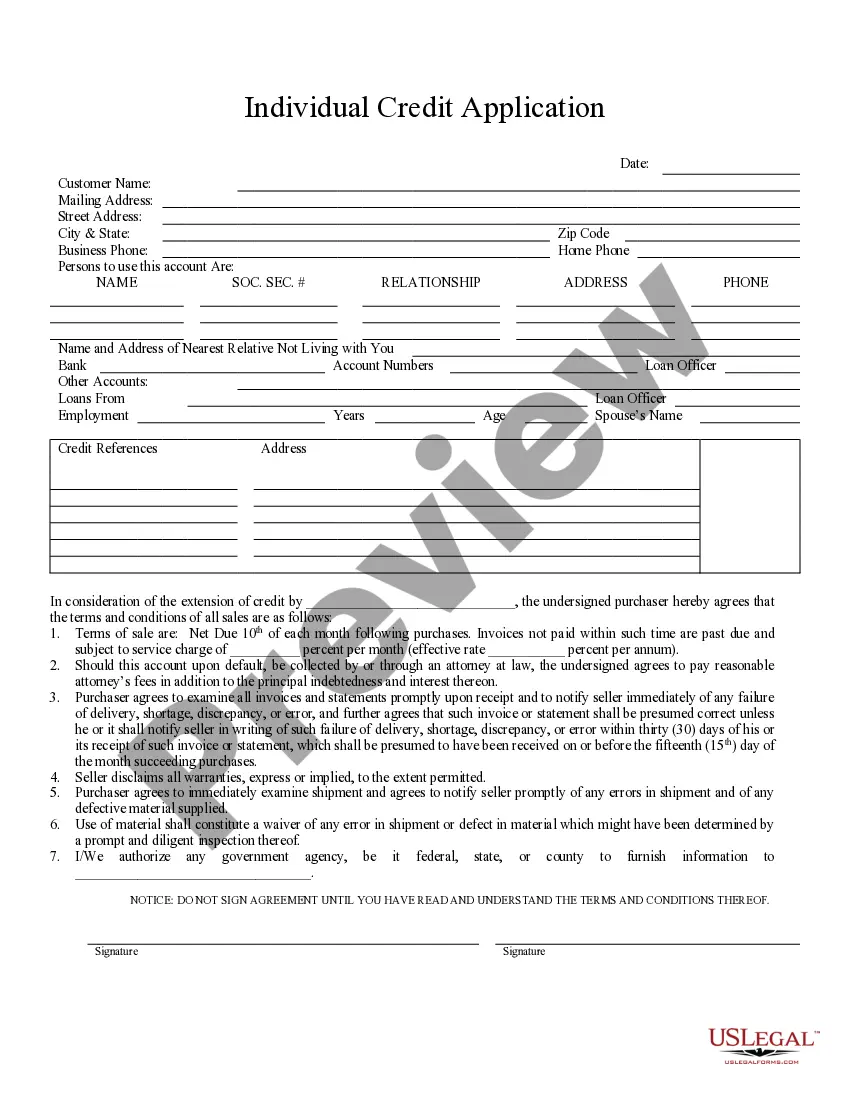

Minnesota Individual Credit Application

Description

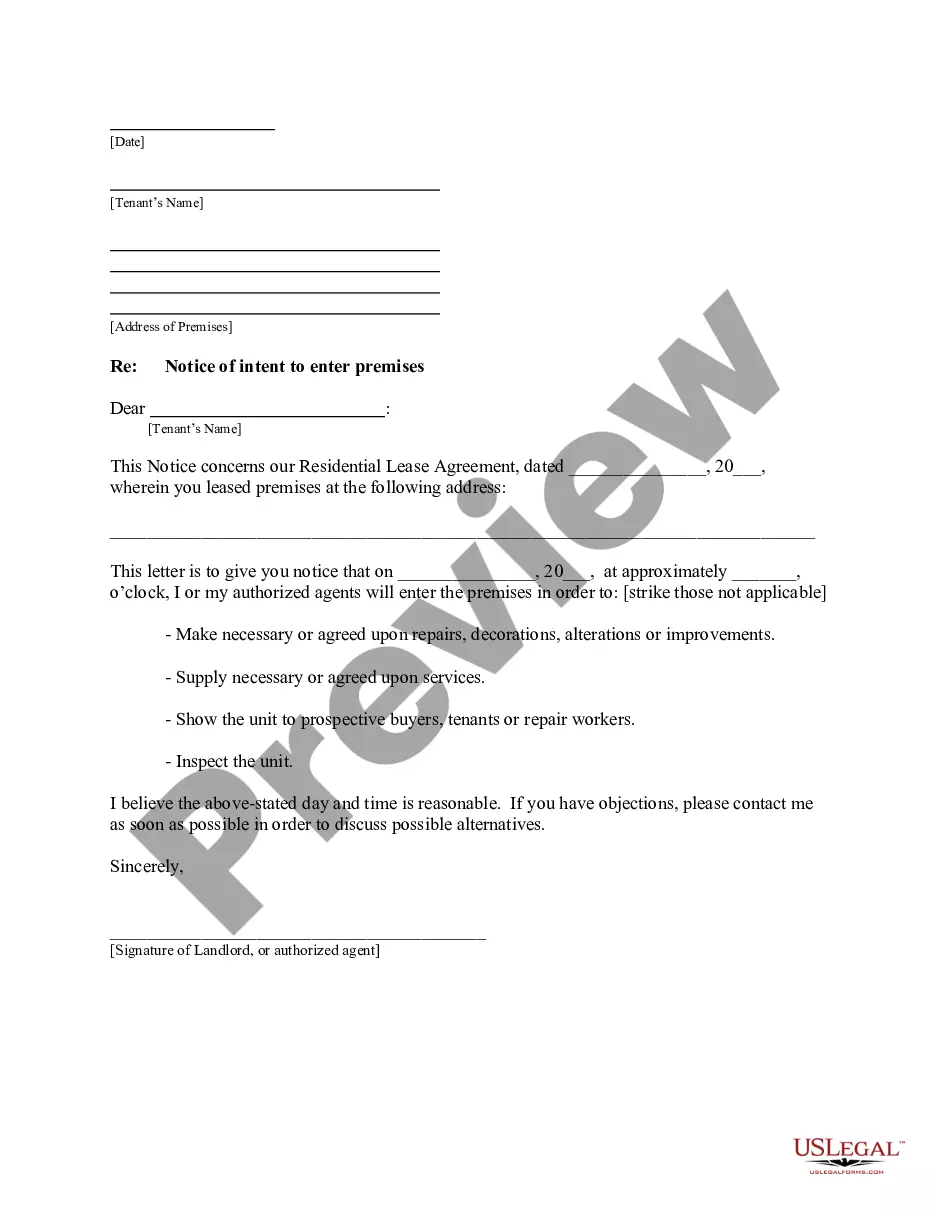

How to fill out Minnesota Individual Credit Application?

Get any form from 85,000 legal documents including Minnesota Individual Credit Application online with US Legal Forms. Every template is prepared and updated by state-licensed attorneys.

If you have already a subscription, log in. Once you are on the form’s page, click on the Download button and go to My Forms to get access to it.

If you haven’t subscribed yet, follow the steps below:

- Check the state-specific requirements for the Minnesota Individual Credit Application you need to use.

- Look through description and preview the template.

- As soon as you are confident the template is what you need, just click Buy Now.

- Select a subscription plan that actually works for your budget.

- Create a personal account.

- Pay in just one of two appropriate ways: by bank card or via PayPal.

- Choose a format to download the document in; two ways are available (PDF or Word).

- Download the file to the My Forms tab.

- After your reusable template is downloaded, print it out or save it to your device.

With US Legal Forms, you will always have quick access to the proper downloadable template. The platform provides you with access to forms and divides them into groups to streamline your search. Use US Legal Forms to obtain your Minnesota Individual Credit Application fast and easy.

Form popularity

FAQ

- The Minnesota Department of Revenue reminds homeowners and renters to file for their 2017 property tax refund before it expires on Aug. 15, 2019. Claims for 2018 property tax refunds can also be filed on or before Aug. 15, 2019, though those claims for refund do not expire until next August.

Homeowners with household income of $116,180 or less can claim a refund up to $2,840. Homeowners and mobile home owners: must have owned and lived in your home on January 2, 2021. must have the property classified as your homestead (or applied for the classification)

The refund is based on taxes payable after subtracting any targeting refund claimed by the homeowner. What are the maximums? For refund claims filed in 2021, based on property taxes payable in 2021 and 2020 household income, the maximum refund is $2,840.

Renters with household income of $62,960 or less can claim a refund up to $2,210. You must have lived in a building where the owner of the building: was accessed the property tax.made property tax payments to a local government in place of property taxes.

Send it to: Minnesota Property Tax Refund St. Paul, MN 55145-0020. You should get your refund within 90 days after August 15, 2019.

Use Form M1PR, Homestead Credit Refund (for Homeowners) and Renter's Property Tax Refund. See the Form M1PR instructions for filing details. Use our Where's My Refund? system to check the status of your refund after July 1.

Include your dependent's CRP(s) and all of your CRPs, along with an explanation when you file. Enter only your income on line 1 of Form M1PR. lived together for the entire year File using your income and your spouse's income to apply for one refund.

Phone: 651-296-3781 or 1-800-652-9094 (toll-free) Email: individual.incometax@state.mn.us. If you request an RPA by email, only include the last four digits of Social Security Numbers.

Use Form M1PR, Homestead Credit Refund (for Homeowners) and Renter's Property Tax Refund. See the Form M1PR instructions for filing details. Use our Where's My Refund? system to check the status of your refund after July 1.