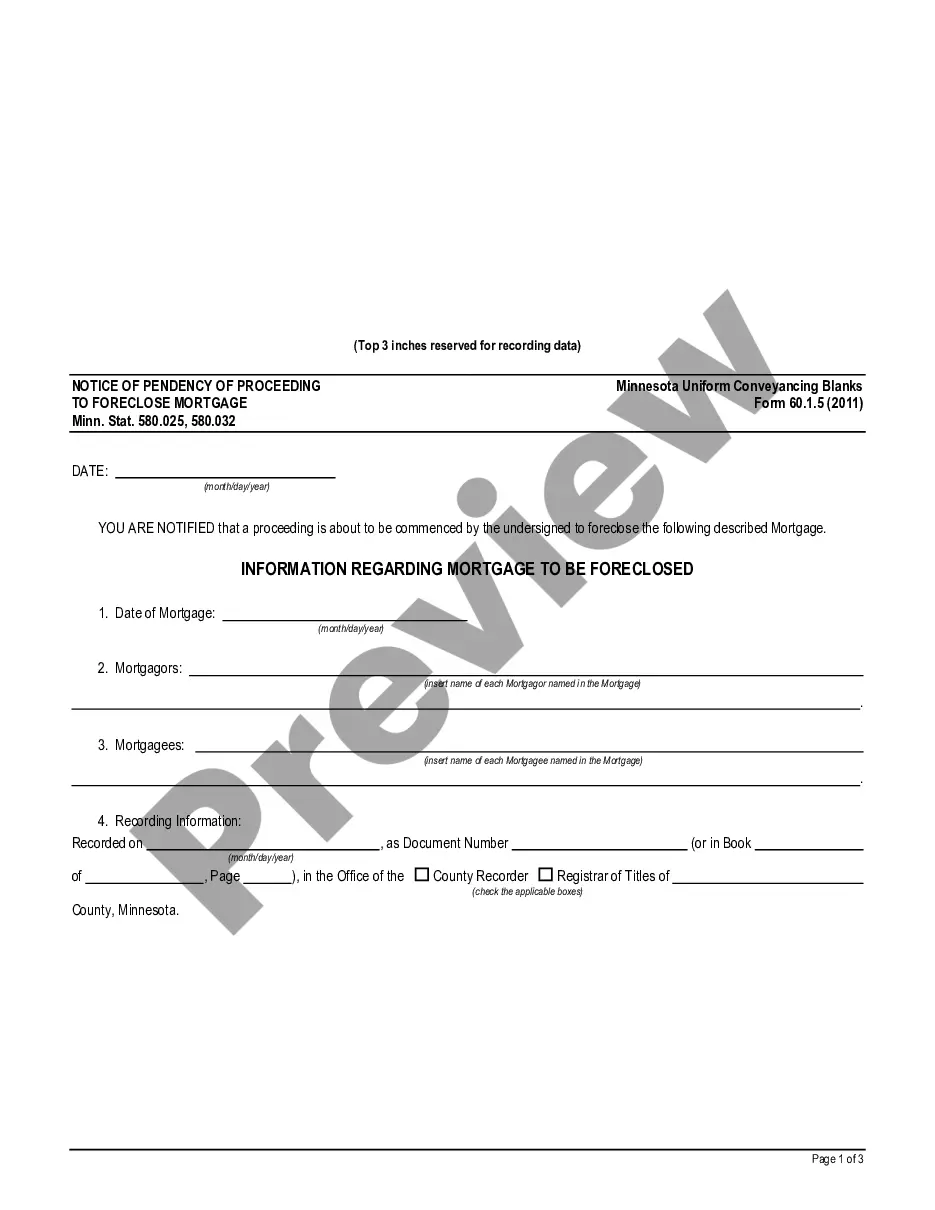

This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms, which pertain to the transfer of legal title of property from one person to another, or the granting of an encumbrance such as a mortgage or a lien, have been approved by the Commissioner of Commerce. The form is available here in PDF format.

Minnesota Notice of Pendency of Proceeding to Foreclosure Mortgage

Description

How to fill out Minnesota Notice Of Pendency Of Proceeding To Foreclosure Mortgage?

Get any template from 85,000 legal documents such as Minnesota Notice of Pendency of Proceeding to Foreclosure Mortgage on-line with US Legal Forms. Every template is drafted and updated by state-accredited legal professionals.

If you have already a subscription, log in. When you’re on the form’s page, click the Download button and go to My Forms to get access to it.

If you haven’t subscribed yet, follow the steps below:

- Check the state-specific requirements for the Minnesota Notice of Pendency of Proceeding to Foreclosure Mortgage you would like to use.

- Read description and preview the sample.

- As soon as you’re sure the sample is what you need, click Buy Now.

- Choose a subscription plan that works well for your budget.

- Create a personal account.

- Pay in just one of two appropriate ways: by card or via PayPal.

- Select a format to download the file in; two options are available (PDF or Word).

- Download the document to the My Forms tab.

- As soon as your reusable form is ready, print it out or save it to your gadget.

With US Legal Forms, you will always have instant access to the proper downloadable template. The service will give you access to forms and divides them into groups to simplify your search. Use US Legal Forms to obtain your Minnesota Notice of Pendency of Proceeding to Foreclosure Mortgage fast and easy.

Form popularity

FAQ

The homeowner can enter into a contract to sell the property, but the claim of the person who has filed the lis pendens has to be paid or settled before title can pass free and clear to the buyer. If the house closes, the buyer would ultimately have to accept the outcome of the pending litigation.

During foreclosure, the mortgage lender may seize the property and sell it to recoup the money it lost from the mortgage default. The lender is allowed to take back the home because a mortgage is a secured loan. That means the borrower guarantees repayment by providing collateral.

Foreclosure is what happens when a homeowner fails to pay the mortgage. More specifically, it's a legal process by which the owner forfeits all rights to the property. If the owner can't pay off the outstanding debt, or sell the property via short sale, the property then goes to a foreclosure auction.

How long it takes for your home to foreclose once you receive notice of lis pendens will depend on the state. In California, it might take a minimum of 120 days, and 180 days in Florida, while in New York it can take as long as 15 months after the notice is filed.

The length of the entire foreclosure process depends on state law and other factors, including whether negotiations are taking place between the lender and the borrower in an effort to stop the foreclosure. Overall, completing the foreclosure process can take from 6 months to more than a year.

"Commencement of Foreclosure" for HUD's purposes is the first public action required by law such as filing a complaint or petition, recording a notice of default, or publication of a notice of sale.

The borrower defaults on the loan. The lender issues a notice of default (NOD). A notice of trustee's sale is recorded in the county office. The lender tries to sell the property at a public auction.

In Minnesota, a court foreclosure begins when a lender notifies the borrower of the default. This is done through a letter that the bank representative drafts and sends to the home-owner. This letter is called a notice of default and is also referred to by Real Estate Agents and Investors as an N.O.D.

Lenders are usually unwilling to finance a mortgage until the lis pendens has been removed from the title. In addition, while a property can still be sold while there is a lis pendens, title companies will not insure the property, and that alone should be a deterrent to purchasing.