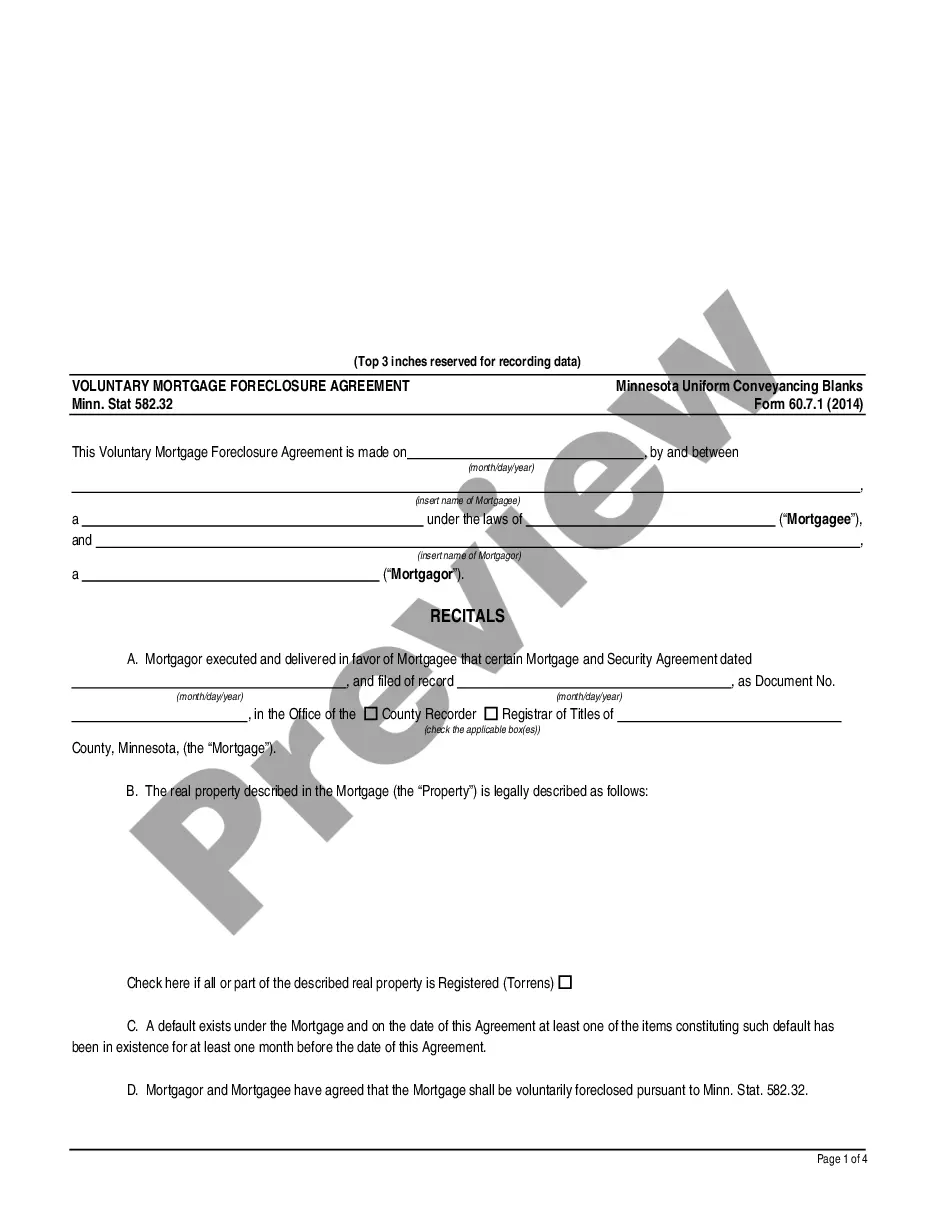

This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms, which pertain to the transfer of legal title of property from one person to another, or the granting of an encumbrance such as a mortgage or a lien, have been approved by the Commissioner of Commerce. The form is available here in PDF format.

Minnesota Voluntary Mortgage Foreclosure Agreement

Description

How to fill out Minnesota Voluntary Mortgage Foreclosure Agreement?

Get any template from 85,000 legal documents including Minnesota Voluntary Mortgage Foreclosure Agreement online with US Legal Forms. Every template is drafted and updated by state-accredited attorneys.

If you have already a subscription, log in. Once you are on the form’s page, click on the Download button and go to My Forms to access it.

If you haven’t subscribed yet, follow the tips listed below:

- Check the state-specific requirements for the Minnesota Voluntary Mortgage Foreclosure Agreement you need to use.

- Read through description and preview the template.

- When you are sure the template is what you need, click Buy Now.

- Select a subscription plan that actually works for your budget.

- Create a personal account.

- Pay out in one of two appropriate ways: by card or via PayPal.

- Select a format to download the file in; two ways are available (PDF or Word).

- Download the document to the My Forms tab.

- After your reusable template is downloaded, print it out or save it to your device.

With US Legal Forms, you will always have immediate access to the proper downloadable sample. The service gives you access to documents and divides them into categories to simplify your search. Use US Legal Forms to obtain your Minnesota Voluntary Mortgage Foreclosure Agreement fast and easy.

Form popularity

FAQ

When available, the right of redemption allows you to get your home back after a foreclosure. If you stop making your mortgage payments, the bank may use a process called foreclosure to sell your home and use the proceeds to repay the amount you borrowed, plus fees and costs.

A voluntary foreclosure refers to a foreclosure initiated by a borrower. The borrower willingly enters a foreclosure because they are unable to make loan payments, or they wish to avoid making any future payments.They can leave the property on their own terms and end their loan payments sooner.

Phase 1: Payment Default. Phase 2: Notice of Default. Phase 3: Notice of Trustee's Sale. Phase 4: Trustee's Sale. Phase 5: Real Estate Owned (REO) Phase 6: Eviction. The Bottom Line.

The term redemption period refers to the period of time after a foreclosure sale (sheriff's sale) has been held. For residential property in Minnesota, the redemption period is typically six months, but in some cases twelve months.

In a foreclosure by judicial sale, the redemption period is six months from the date of the foreclosure decree, unless the court orders a shorter time. Redemption is also available before the sale takes place, even if the initial redemption period expired.

In Minnesota, a court foreclosure begins when a lender notifies the borrower of the default. This is done through a letter that the bank representative drafts and sends to the home-owner. This letter is called a notice of default and is also referred to by Real Estate Agents and Investors as an N.O.D.

Generally, homeowners have to be more than 120 days delinquent before a foreclosure can begin. If you're behind in mortgage payments, you might be wondering how soon a foreclosure will start. Generally, a homeowner has to be at least 120 days delinquent before a mortgage servicer starts a foreclosure.

The length of the entire foreclosure process depends on state law and other factors, including whether negotiations are taking place between the lender and the borrower in an effort to stop the foreclosure. Overall, completing the foreclosure process can take from 6 months to more than a year.