This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms, which pertain to the transfer of legal title of property from one person to another, or the granting of an encumbrance such as a mortgage or a lien, have been approved by the Commissioner of Commerce. The form is available here in PDF format.

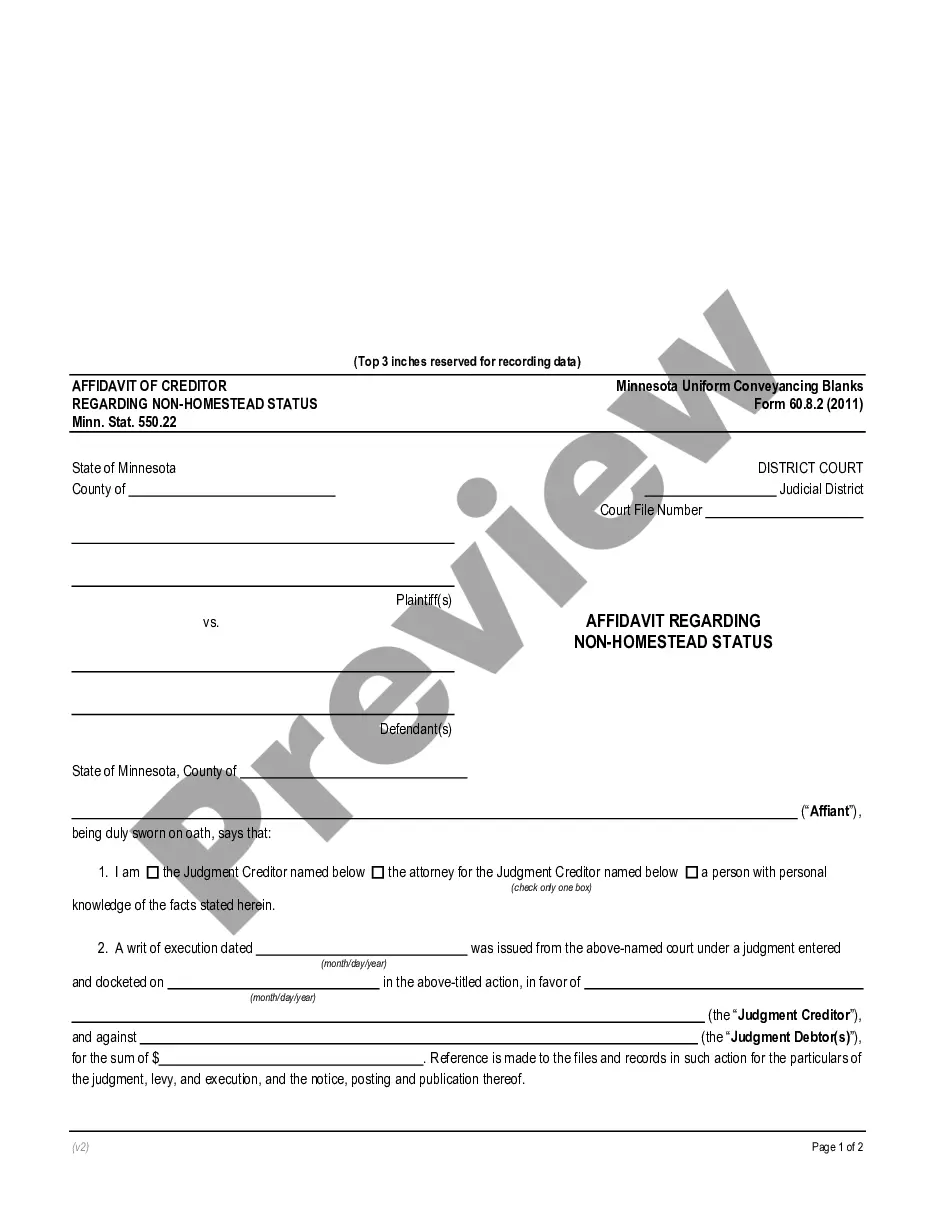

Minnesota Affidavit of Creditor Regarding Non-Homestead Status

Description

How to fill out Minnesota Affidavit Of Creditor Regarding Non-Homestead Status?

Have any template from 85,000 legal documents such as Minnesota Affidavit of Creditor Regarding Non-Homestead Status online with US Legal Forms. Every template is drafted and updated by state-certified attorneys.

If you already have a subscription, log in. Once you are on the form’s page, click on the Download button and go to My Forms to get access to it.

In case you haven’t subscribed yet, follow the steps listed below:

- Check the state-specific requirements for the Minnesota Affidavit of Creditor Regarding Non-Homestead Status you want to use.

- Read description and preview the sample.

- As soon as you’re confident the template is what you need, simply click Buy Now.

- Select a subscription plan that works well for your budget.

- Create a personal account.

- Pay in a single of two suitable ways: by bank card or via PayPal.

- Select a format to download the document in; two options are available (PDF or Word).

- Download the file to the My Forms tab.

- Once your reusable form is downloaded, print it out or save it to your device.

With US Legal Forms, you will always have quick access to the appropriate downloadable template. The platform will give you access to forms and divides them into categories to simplify your search. Use US Legal Forms to obtain your Minnesota Affidavit of Creditor Regarding Non-Homestead Status fast and easy.

Form popularity

FAQ

Collecting a judgment can be just as challenging as winning the lawsuit in some cases. If the defendant has stable finances, they should pay the judgment uneventfully.Most often, the judgment debtor will need to pay the judgment as a lump sum, but sometimes a debtor will ask to pay it in installments.

The statute of limitations for bringing a lawsuit for breach of contract under Minnesota law is six (6) years. This means that a creditor or debt collector can sue you anytime within six (6) years from the date of your last purchase or last payment, whichever was later.

How long does a judgment last? A creditor has ten (10) years from the date the judgment was entered to collect the money owed to them by the debtor. A judgment can be "renewed" by the creditor if it is not satisfied (paid) within the 10 years.

California state court money judgments automatically expire 10 years after they become final. After that date, the judgment is unenforceable.If these forms are timely filed and served, the judgment is renewed for another 10 years.

If you have found the judgment debtor's assets such as an active bank account or employment, collection can be made by a levy on the bank account or garnishment of wages. This is done by obtaining a Writ of Execution from the Court for a fee of $55.00.

Give your sheriff or other local official (known as a levying officer) information about the judgment and where the debtor works. This officer will collect the money and give it to you.

Affiant acknowledges the Homestead Property as legally sufficient to qualify as his legal homestead. This Affidavit is made to induce Lender to make a mortgage loan on the Non-Homestead Property, or to grant other financial accommodations, secured by a Deed of Trust on the Non-Homestead Property.

In many situations, one of the best ways to collect a judgment after winning a case is to put a lien on the debtor's property. This gives you a claim to the property and, in some cases, the property will be sold at public auction in order to satisfy the debt that is owed.