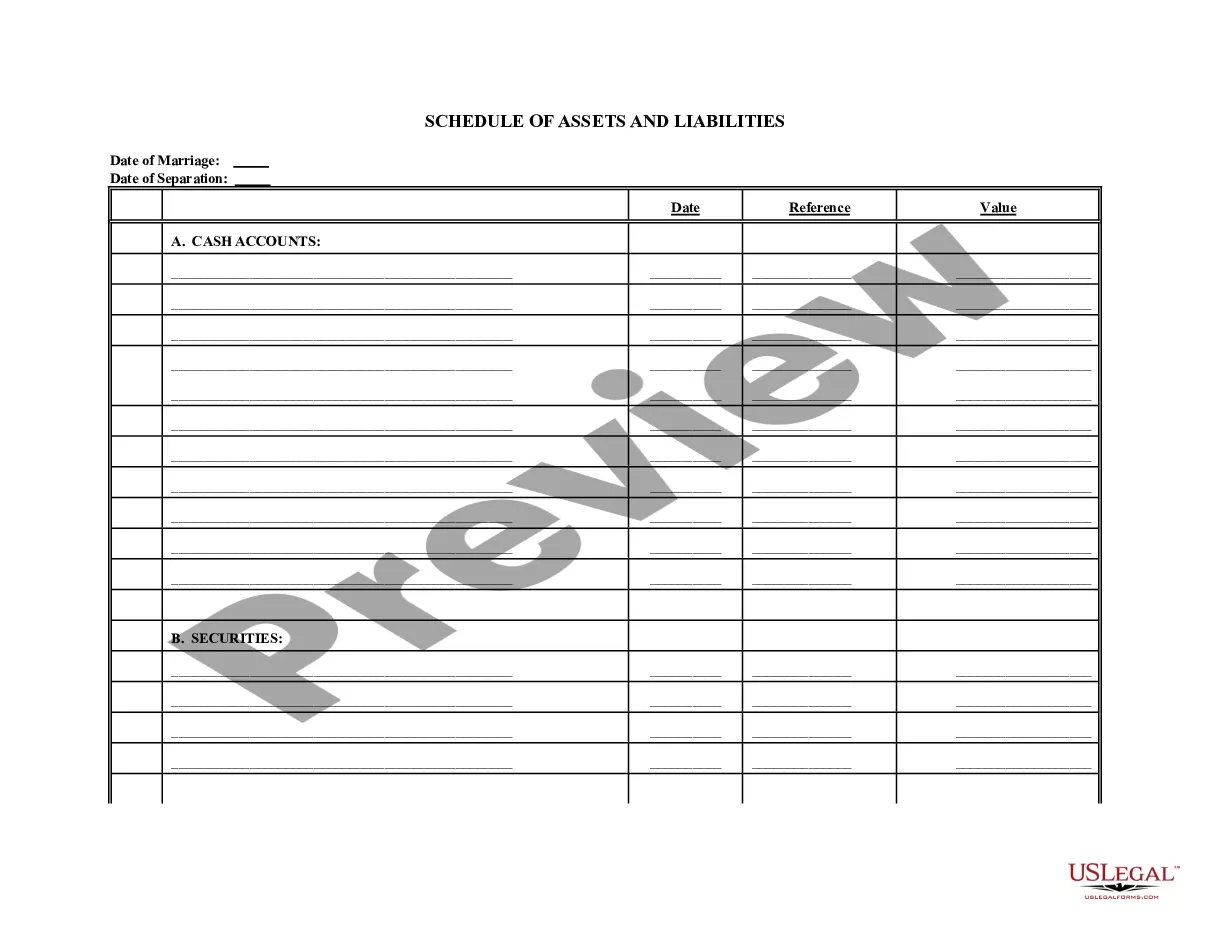

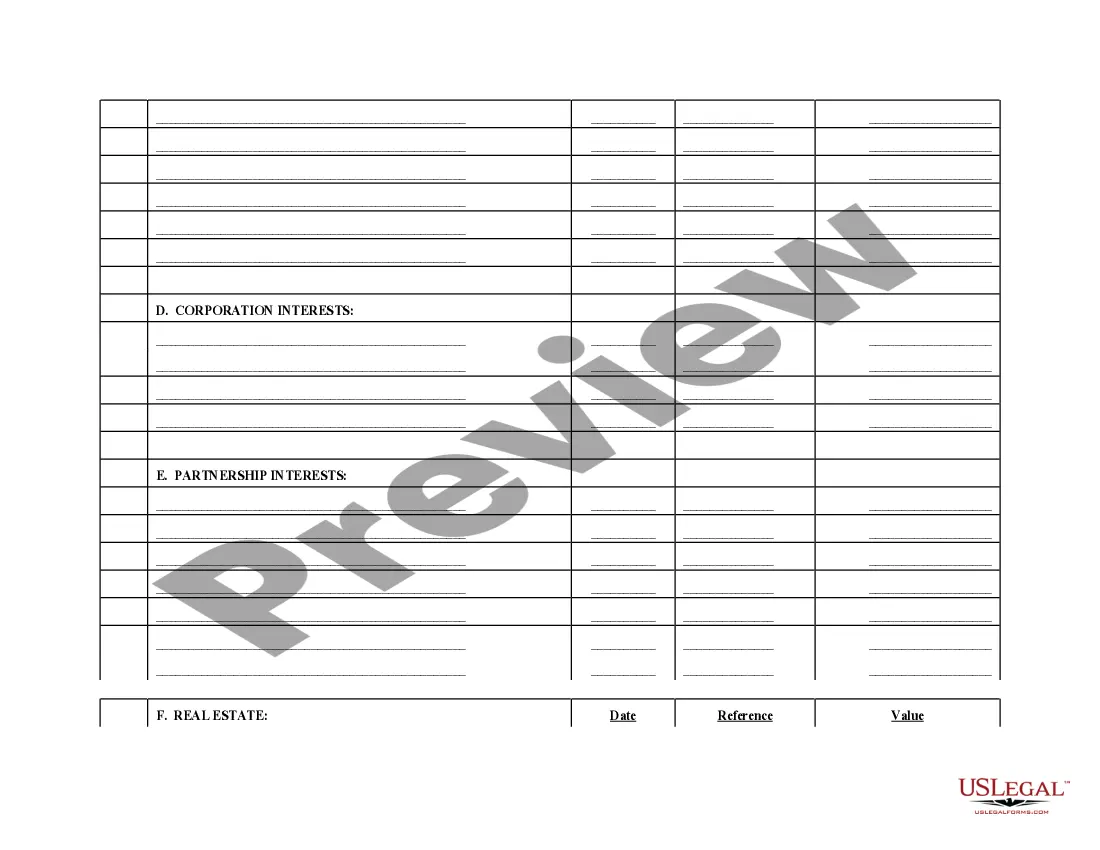

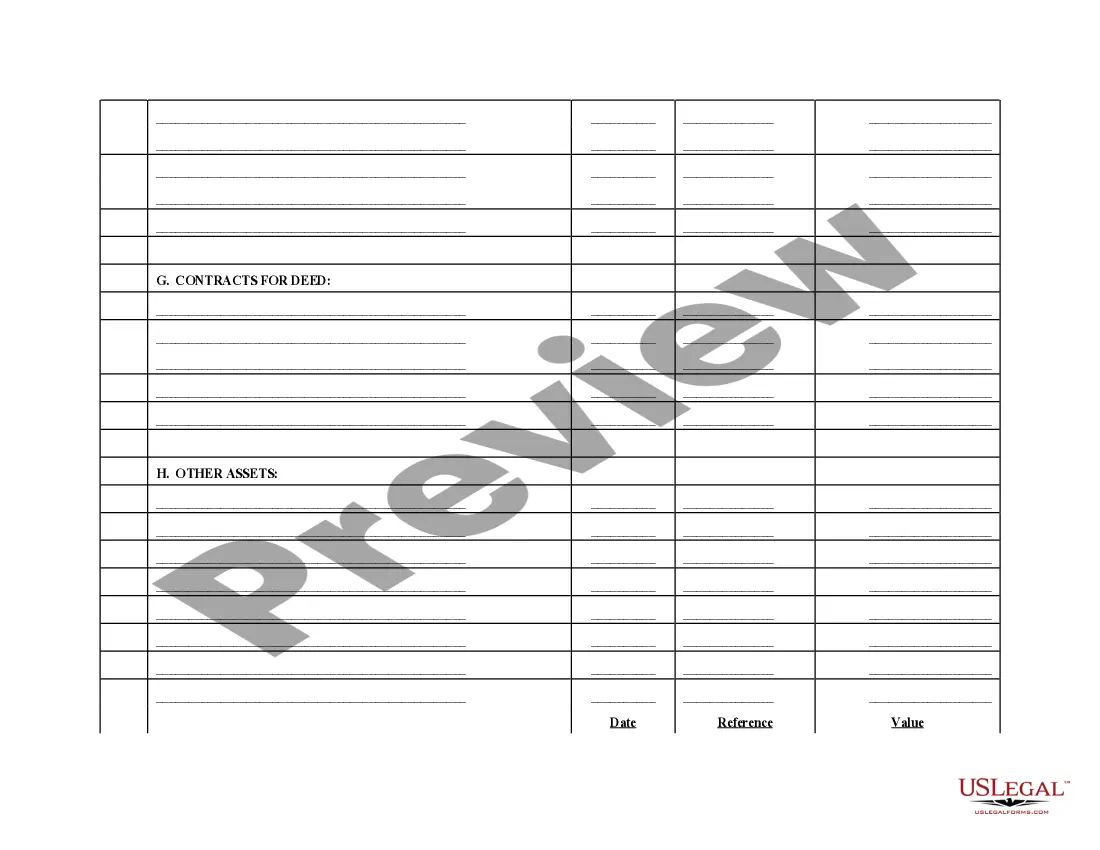

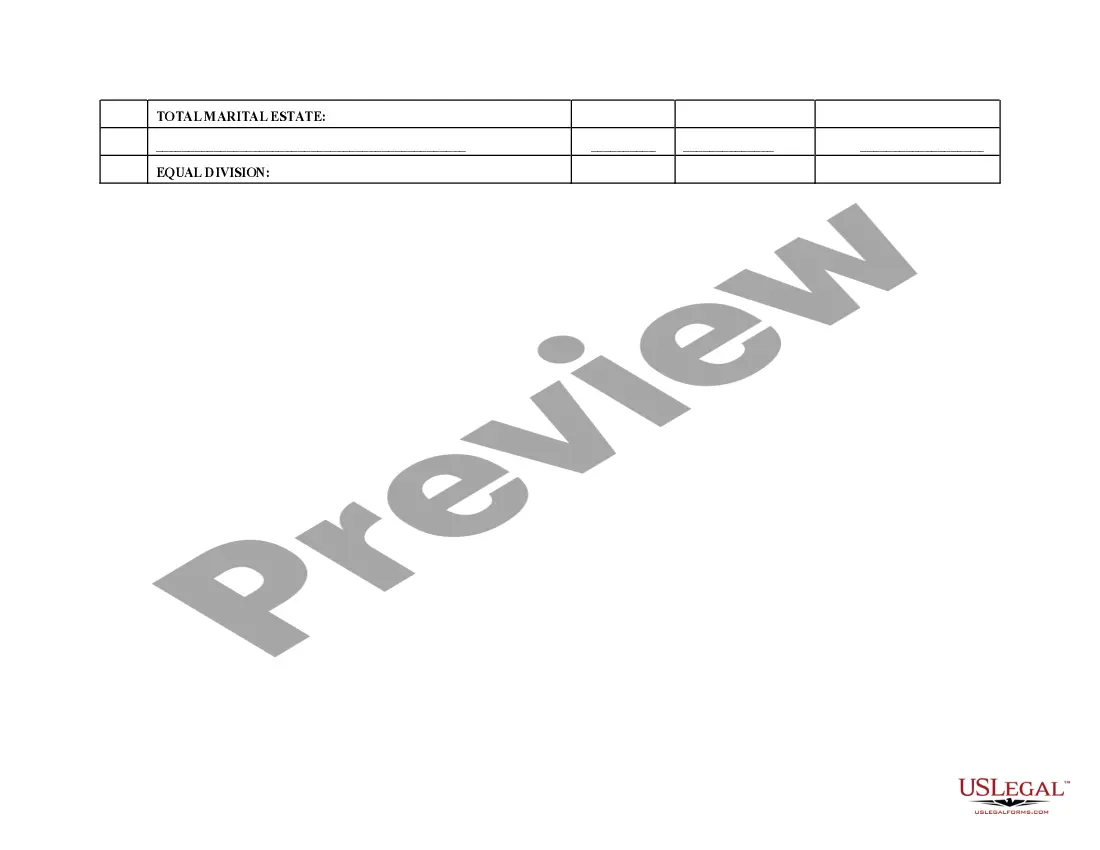

Minnesota Schedule of Assets and Liabilities

Description

How to fill out Minnesota Schedule Of Assets And Liabilities?

Get any form from 85,000 legal documents such as Minnesota Schedule of Assets and Liabilities online with US Legal Forms. Every template is drafted and updated by state-licensed lawyers.

If you have already a subscription, log in. When you are on the form’s page, click the Download button and go to My Forms to access it.

In case you haven’t subscribed yet, follow the tips below:

- Check the state-specific requirements for the Minnesota Schedule of Assets and Liabilities you would like to use.

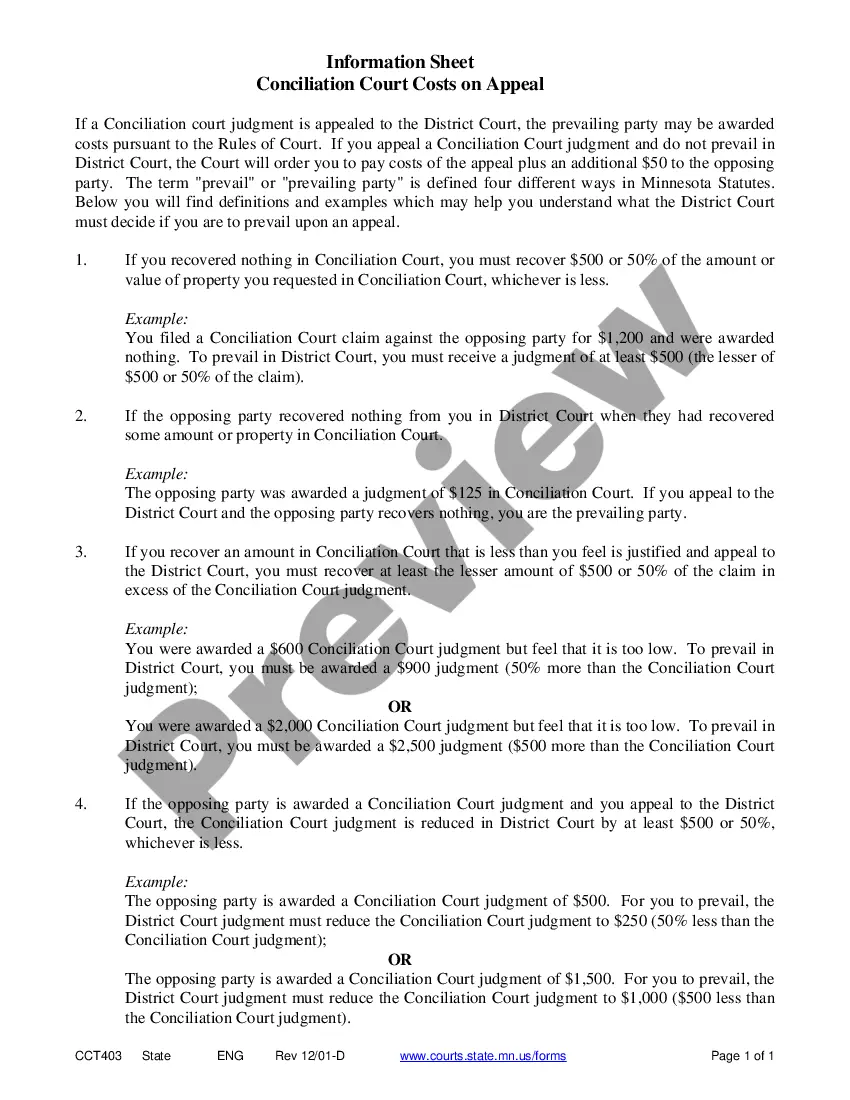

- Read through description and preview the sample.

- When you’re sure the template is what you need, simply click Buy Now.

- Select a subscription plan that works well for your budget.

- Create a personal account.

- Pay in a single of two suitable ways: by credit card or via PayPal.

- Choose a format to download the file in; two ways are available (PDF or Word).

- Download the file to the My Forms tab.

- When your reusable form is downloaded, print it out or save it to your gadget.

With US Legal Forms, you’ll always have quick access to the appropriate downloadable sample. The platform gives you access to documents and divides them into categories to simplify your search. Use US Legal Forms to get your Minnesota Schedule of Assets and Liabilities fast and easy.

Form popularity

FAQ

Are Gifts and Inheritances Non-Marital Property? Some property, even if it was acquired by a spouse during the marriage, is still considered non-marital. If an asset was a gift (from someone outside the marriage to one spouse) or an inheritance, it is considered separate property.

If you commingle your inheritance and live in a community property statea state where courts divide marital property 50/50 in a divorceyour spouse is entitled to half of that inheritance.

There is No Formula for Calculating Minnesota Spousal Maintenance. Unlike child support, which is calculated according to guidelines based on parents' incomes and other factors, there is no formula for calculating spousal maintenance.

In general, all income and assets earned during the marriage in a community property states belong to the parties equally and are divided on that basis when they divorce.Although Minnesota is an equitable division state, in practice it is very close to a community property state.

House. Car. Furniture. Clothing. Bank accounts and cash. Pension plans and retirement accounts. Business. Patents.

Per Minnesota divorce laws, all marital property shall be divided equitably between the divorcing spouses.If property is classified as non-marital, then that spouse is entitled to all of such property, without having to divide any portion of it with the other spouse.

Per Minnesota divorce laws, all marital property shall be divided equitably between the divorcing spouses.If property is classified as non-marital, then that spouse is entitled to all of such property, without having to divide any portion of it with the other spouse.

As stated early in this outline, Minnesota has adopted the Uniform Disposition of Community Property Rights at Death Act in 2013.

Because California law views both spouses as one party rather than two, marital assets and debts are split 50/50 between the couple, unless they can agree on another arrangement.