Minnesota Demand Letter - Repayment of Promissory Note

Description Repayment Note Application

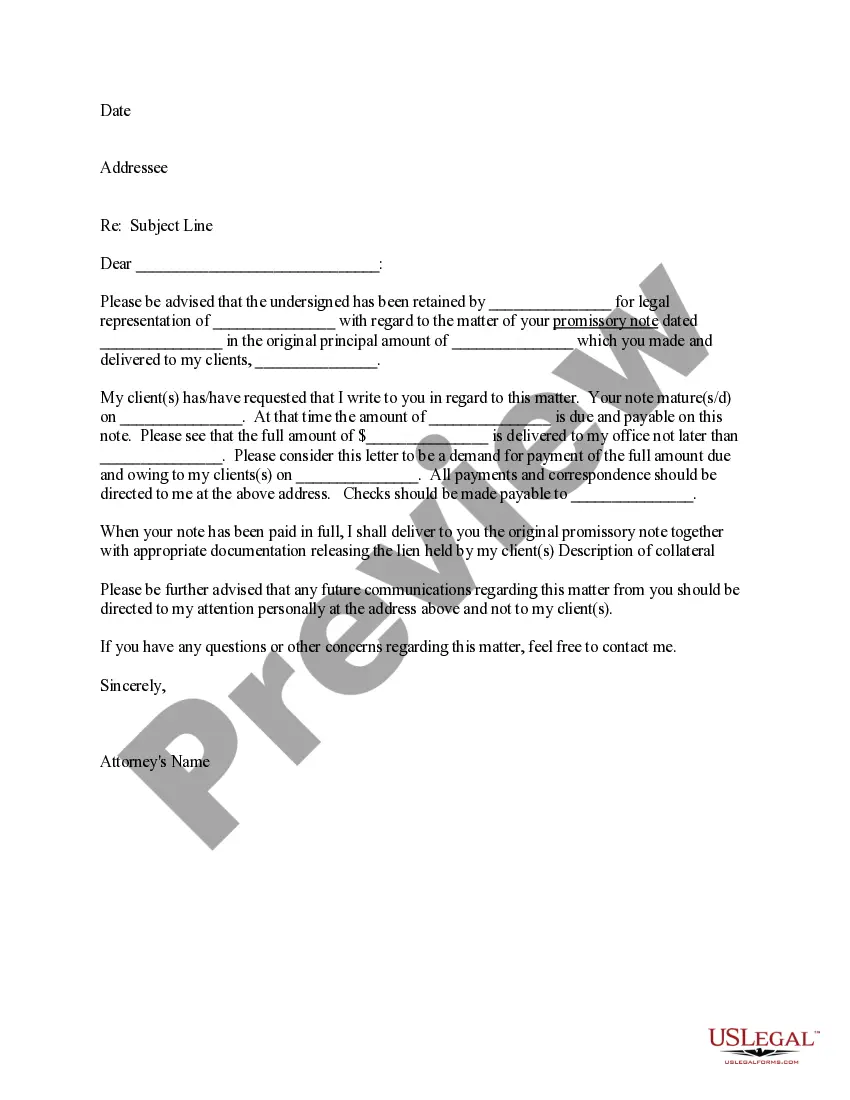

How to fill out Letter Repayment Sample?

Get any form from 85,000 legal documents including Minnesota Demand Letter - Repayment of Promissory Note on-line with US Legal Forms. Every template is drafted and updated by state-certified legal professionals.

If you have a subscription, log in. Once you’re on the form’s page, click the Download button and go to My Forms to access it.

If you have not subscribed yet, follow the steps listed below:

- Check the state-specific requirements for the Minnesota Demand Letter - Repayment of Promissory Note you would like to use.

- Read description and preview the template.

- When you’re confident the sample is what you need, click Buy Now.

- Select a subscription plan that actually works for your budget.

- Create a personal account.

- Pay in just one of two appropriate ways: by bank card or via PayPal.

- Choose a format to download the document in; two options are available (PDF or Word).

- Download the document to the My Forms tab.

- As soon as your reusable template is ready, print it out or save it to your gadget.

With US Legal Forms, you will always have immediate access to the right downloadable template. The platform will give you access to forms and divides them into groups to streamline your search. Use US Legal Forms to get your Minnesota Demand Letter - Repayment of Promissory Note easy and fast.

Demand Letter Repayment Sample Form popularity

Minnesota Promissory Note Form Other Form Names

Demand Repayment Agreement FAQ

A written, signed, unconditional promise to pay a certain amount of money on demand at a specified time.The individual who promises to pay is the maker, and the person to whom payment is promised is called the payee or holder. If signed by the maker, a promissory note is a negotiable instrument.

However, in California, the lender is not required to produce a Promissory Note to conduct a non-judicial foreclosure (also known as a Trustee's Sale).The Promissory Note is the debt instrument, just like an IOU. The person holding the original is the one the borrower has to pay.

Promissory Notes In addition to the amount and the signature, any interest charged for the amount may also be stipulated in the note, as well as the name of the payee. If a promissory note has a date on it and the date has passed, that note can also be considered to be payable on demand.

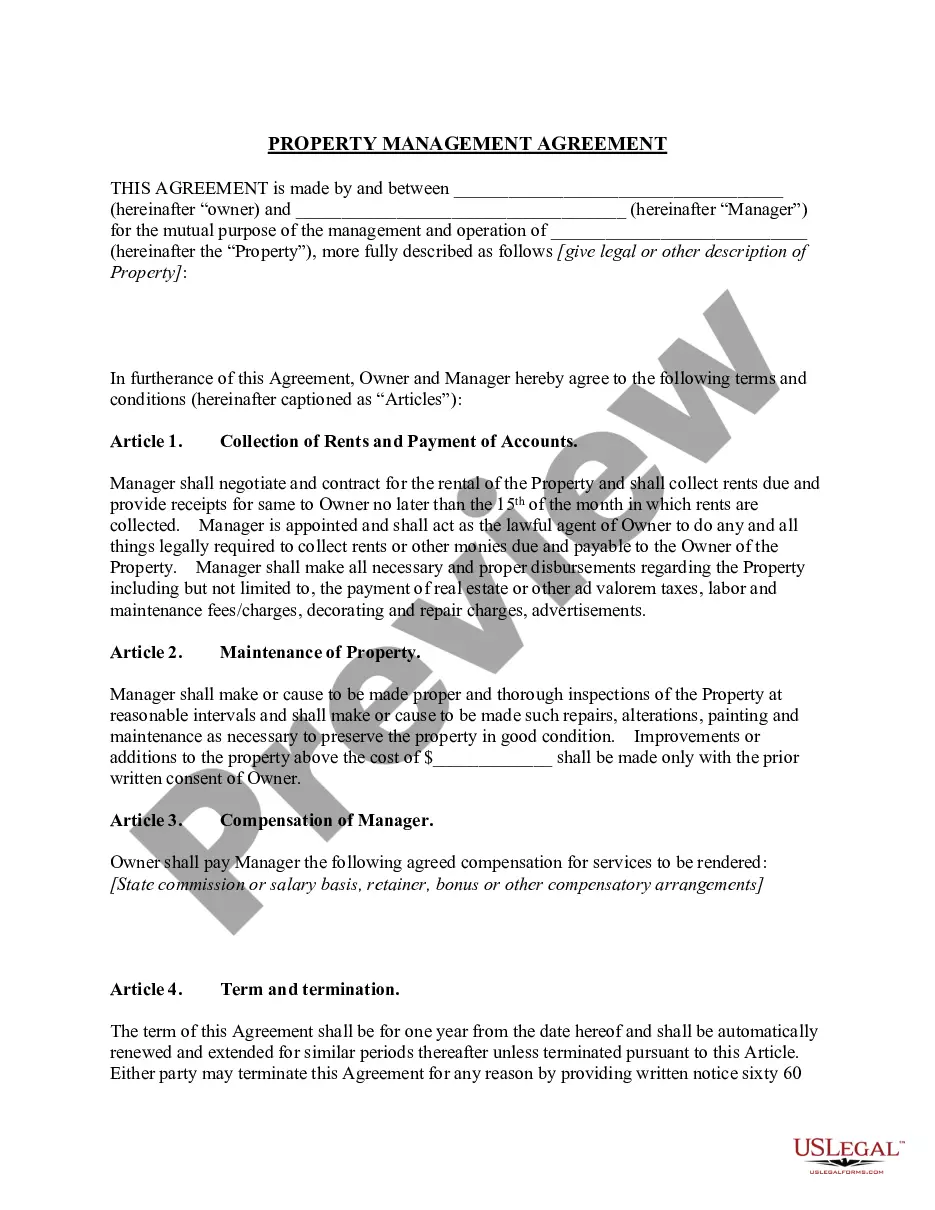

Use a letterhead. Outline the facts/story leading up to the demand letter in a chronological manner. State the legal basis for your claim. State how you will pursue legal action if your demand is not met, and include a timeline within which the demand is to be met.

The date of the letter. The names of the borrower and lender. The original amount of the loan. The date of the promissory note and any reference number or account number it contains. The payment schedule that was agreed upon.

Full names of parties (borrower and lender) Repayment amount (principal and interest) Payment plan. Consequences of non-payment (default and collection) Notarization (if necessary) Other common details.

Demand promissory notes are notes that do not carry a specific maturity date, but are due on demand of the lender. Usually the lender will only give the borrower a few days' notice before the payment is due. Promissory notes may be used in combination with security agreements.

Amount of the debt. Date the debt was due. Date of the Letter of Demand. Description of the debt (such as what the money is owed for), and.

Type your letter. Concisely review the main facts. Be polite. Write with your goal in mind. Ask for exactly what you want. Set a deadline. End the letter by stating you will promptly pursue legal remedies if the other party does not meet your demand. Make and keep copies.