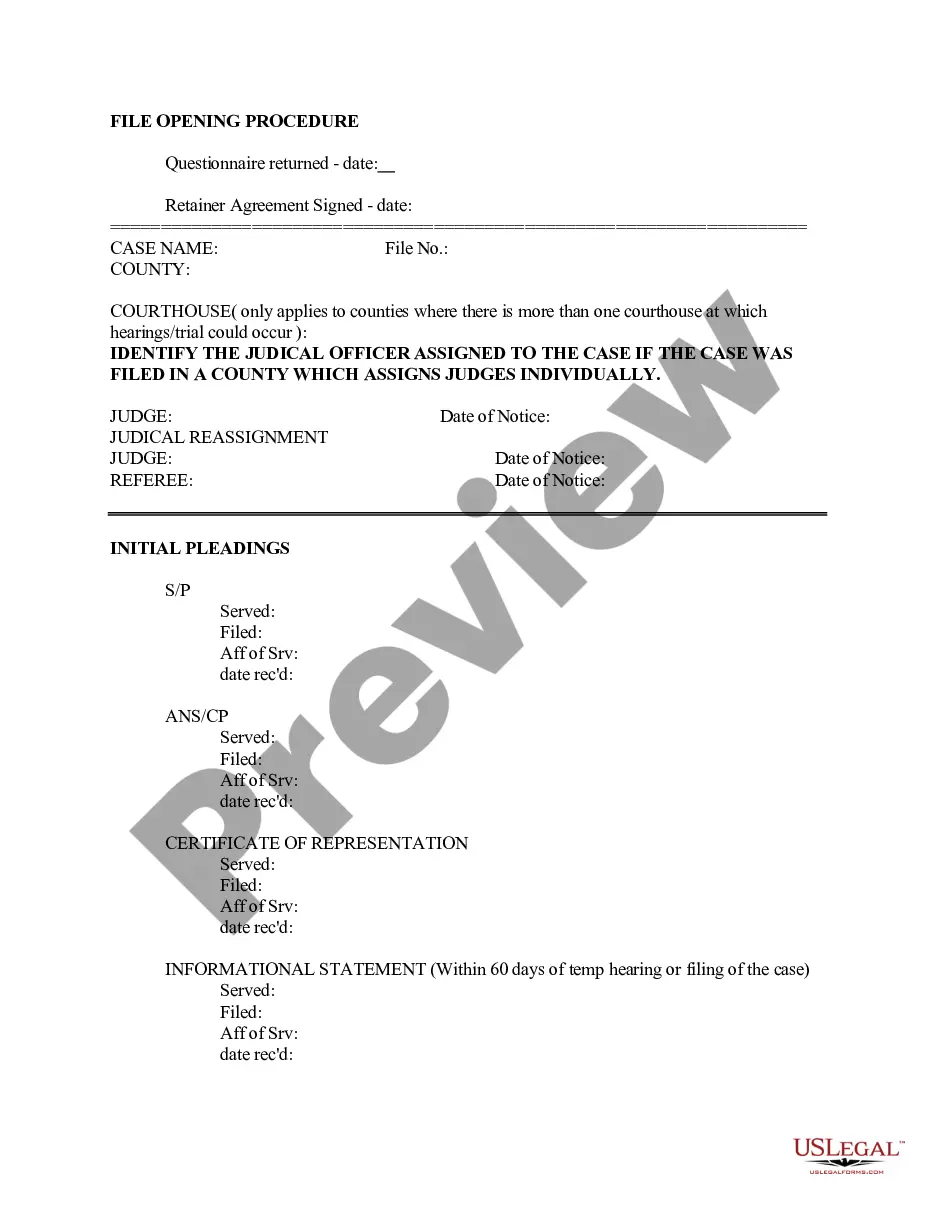

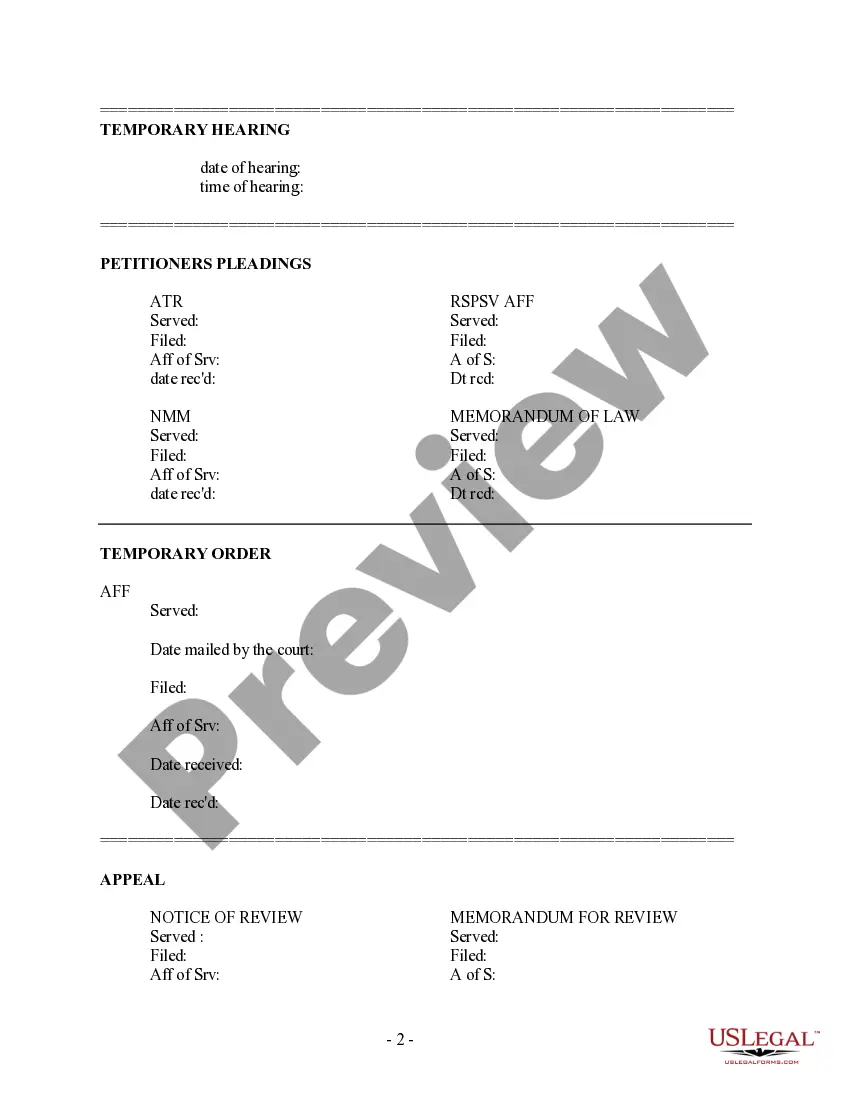

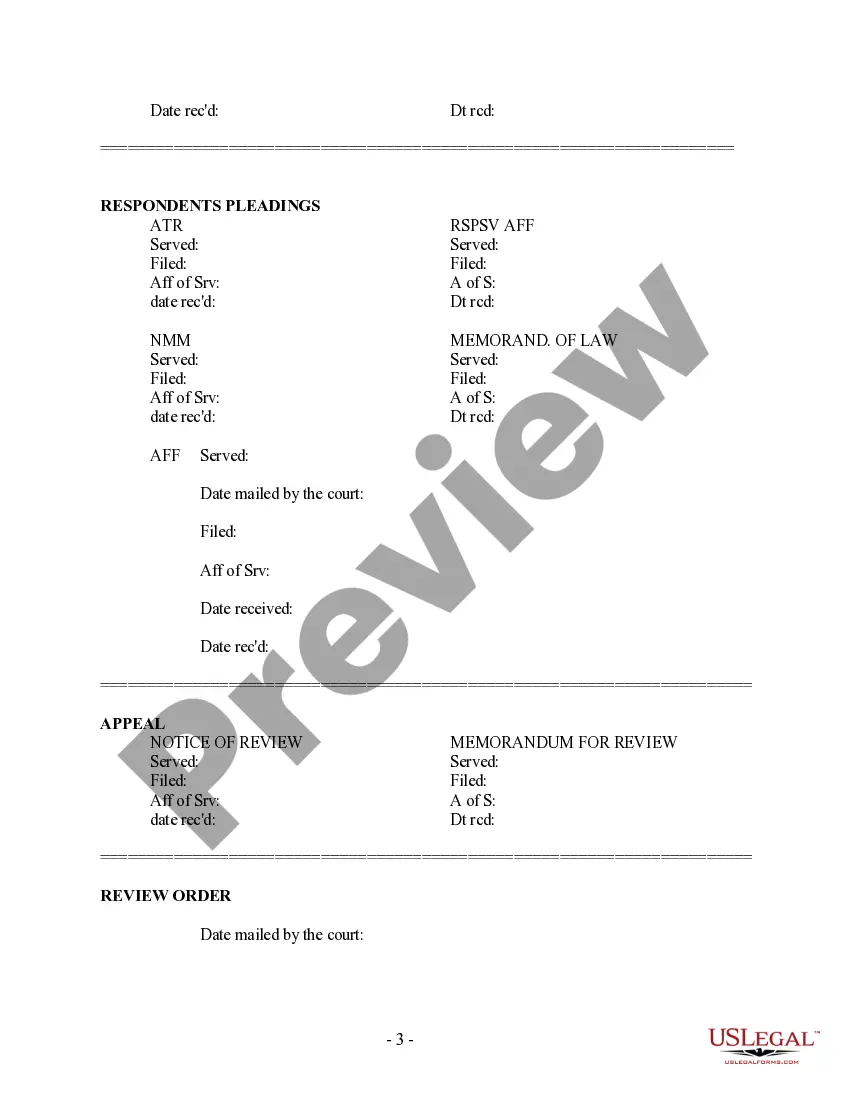

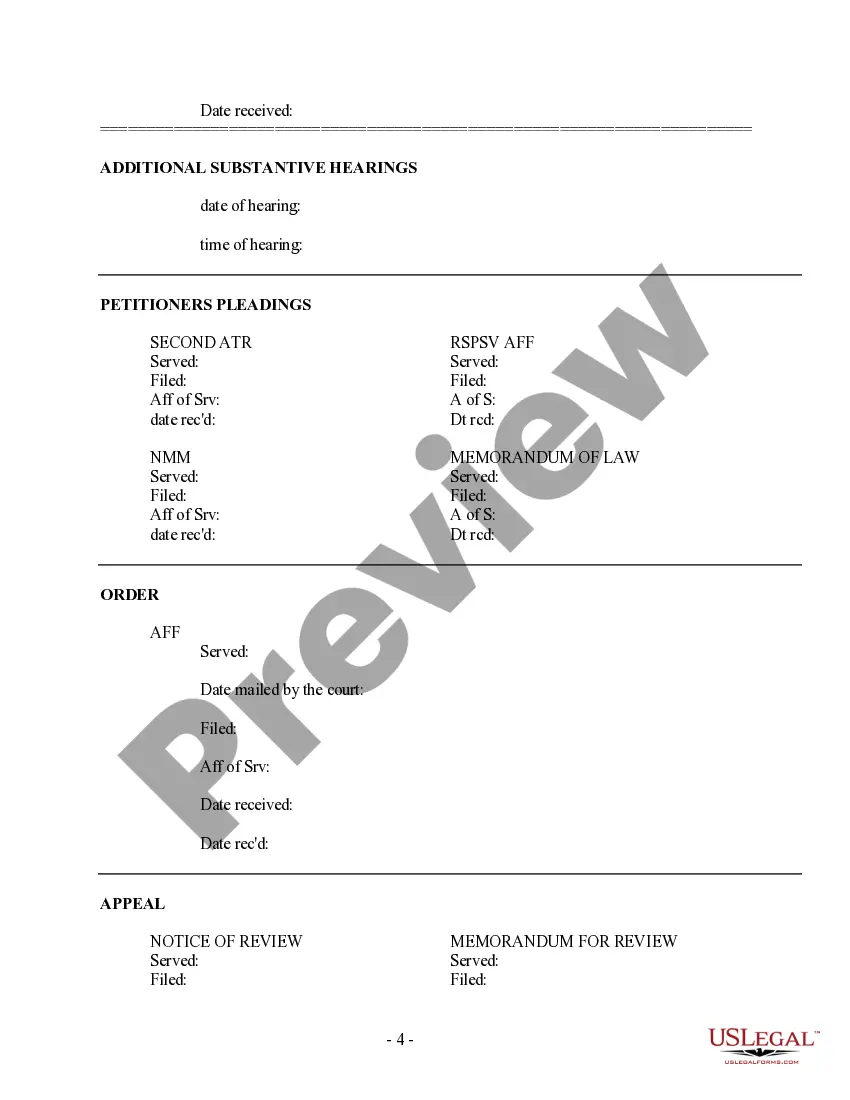

Minnesota File Opening Procedure

Description

How to fill out Minnesota File Opening Procedure?

Have any form from 85,000 legal documents such as Minnesota File Opening Procedure on-line with US Legal Forms. Every template is drafted and updated by state-accredited lawyers.

If you have already a subscription, log in. Once you’re on the form’s page, click on the Download button and go to My Forms to get access to it.

In case you have not subscribed yet, follow the steps listed below:

- Check the state-specific requirements for the Minnesota File Opening Procedure you need to use.

- Read description and preview the sample.

- When you are sure the sample is what you need, click on Buy Now.

- Select a subscription plan that works well for your budget.

- Create a personal account.

- Pay in just one of two appropriate ways: by credit card or via PayPal.

- Choose a format to download the file in; two options are available (PDF or Word).

- Download the document to the My Forms tab.

- When your reusable template is ready, print it out or save it to your device.

With US Legal Forms, you will always have quick access to the proper downloadable template. The platform provides you with access to forms and divides them into categories to streamline your search. Use US Legal Forms to obtain your Minnesota File Opening Procedure fast and easy.

Form popularity

FAQ

How much does it cost to form an LLC in Minnesota? The Minnesota Secretary of State charges $135 to file the Articles of Organization by mail and $155 to file online or in-person. You can file an LLC name reservation for $50 if filed by mail and $55 if filed online or in-person.

Expected filing schedule (monthly, quarterly, or annual). Accounting method (cash or accrual) Any local or special local taxes that may apply to your business.

To form an LLC by yourself, you need to reserve a business name, appoint a registered agent, file the Articles of Organization, obtain an Employer Identification Number, and open a business bank account. The time and money you need to file an LLC yourself depend on the state where you are filing.

Choose a business name. File a Certificate of Assumed Name with the Secretary of State. Obtain licenses, permits, and zoning clearance. Obtain an Employer Identification Number.

To start an LLC in Minnesota you will need to file the Articles of Organization with the Minnesota Secretary of State, which costs $155 online. You can apply online, by mail, or in-person. The Articles of Organization is the legal document that officially creates your Minnesota Limited Liability Company.

Step 1: Choose the Right Business Idea. Step 2: Plan Your Minnesota Business. Step 3: Get Funding. Step 4: Choose a Business Structure. Step 5: Register Your Minnesota Business. Step 6: Set up Business Banking, Credit Cards, and Accounting. Step 7: Get Insured. Step 8: Obtain Permits and Licenses.

No, you do not need an attorney to form an LLC. You can prepare the legal paperwork and file it yourself, or use a professional business formation service, such as .In all states, only one person is needed to form an LLC.

Expected filing schedule (monthly, quarterly, or annual). Accounting method (cash or accrual) Any local or special local taxes that may apply to your business.

Choose a Name for Your LLC. Appoint a Registered Agent. File Articles of Organization. Prepare an Operating Agreement. Comply With Other Tax and Regulatory Requirements. File Annual Renewals.