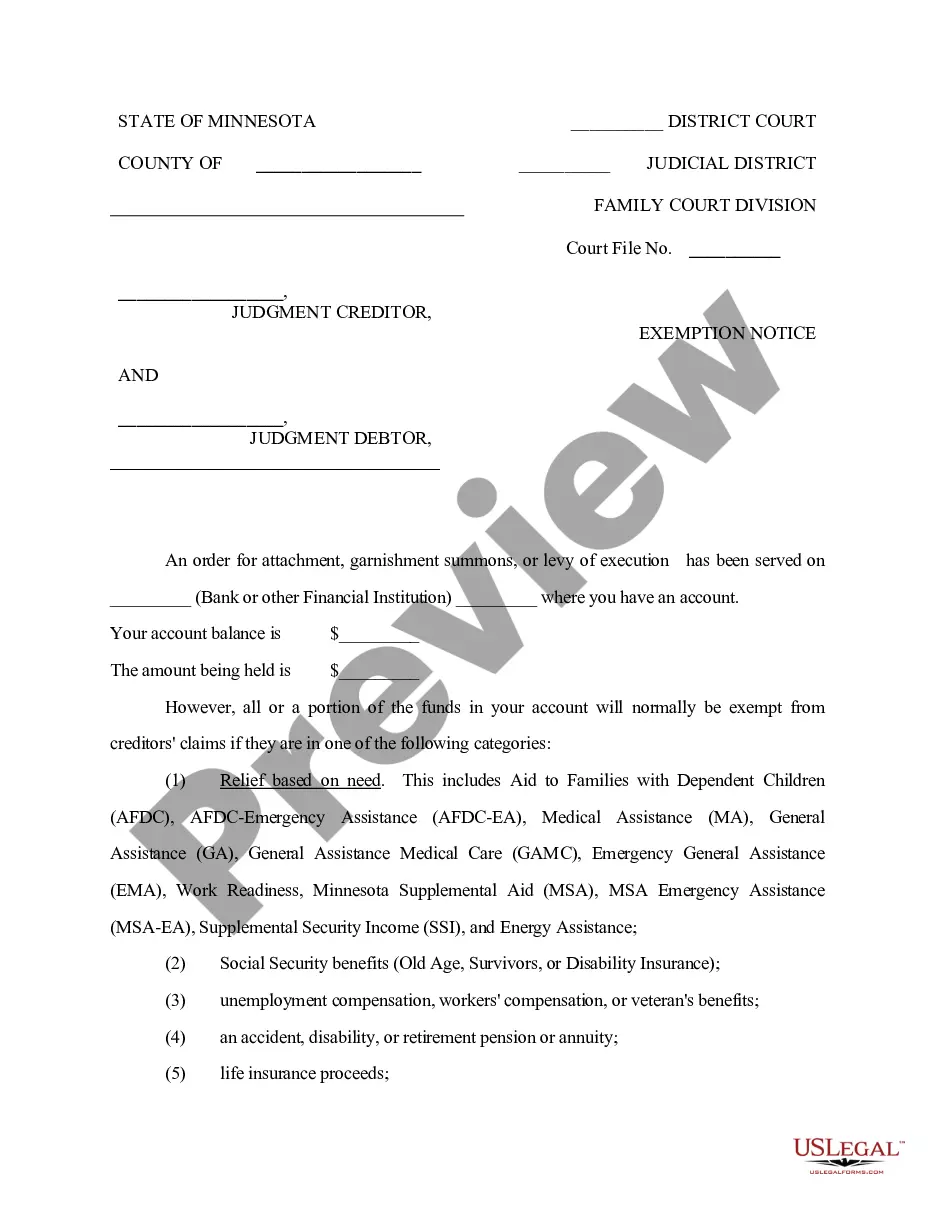

Minnesota Partial Exemption from Garnishment

Description

How to fill out Minnesota Partial Exemption From Garnishment?

Get any form from 85,000 legal documents including Minnesota Partial Exemption from Garnishment online with US Legal Forms. Every template is drafted and updated by state-certified legal professionals.

If you have a subscription, log in. Once you are on the form’s page, click the Download button and go to My Forms to get access to it.

If you haven’t subscribed yet, follow the tips listed below:

- Check the state-specific requirements for the Minnesota Partial Exemption from Garnishment you want to use.

- Read through description and preview the template.

- Once you’re confident the sample is what you need, just click Buy Now.

- Choose a subscription plan that really works for your budget.

- Create a personal account.

- Pay out in a single of two suitable ways: by credit card or via PayPal.

- Choose a format to download the document in; two ways are available (PDF or Word).

- Download the file to the My Forms tab.

- After your reusable template is ready, print it out or save it to your gadget.

With US Legal Forms, you’ll always have immediate access to the proper downloadable template. The service will give you access to documents and divides them into categories to streamline your search. Use US Legal Forms to get your Minnesota Partial Exemption from Garnishment fast and easy.

Form popularity

FAQ

You can also stop most garnishments by filing for bankruptcy. Your state's exemption laws determine the amount of income you'll be able to keep.

Include in your letter what steps you plan to take to address the default, such as making a reasonable effort at a payment plan. Mention any circumstances that have changed recently to make your ability to pay off the debt more likely. This conveys to the creditor your goodwill toward satisfying the debt.

Some of the ways to loweror even eliminatethe amount of a wage garnishment include: filing a claim of exemption. filing for bankruptcy, or. vacating the underlying money judgment.

The federal benefits that are exempt from garnishment include: Social Security Benefits. Supplemental Security Income (SSI) Benefits. Veterans' Benefits.