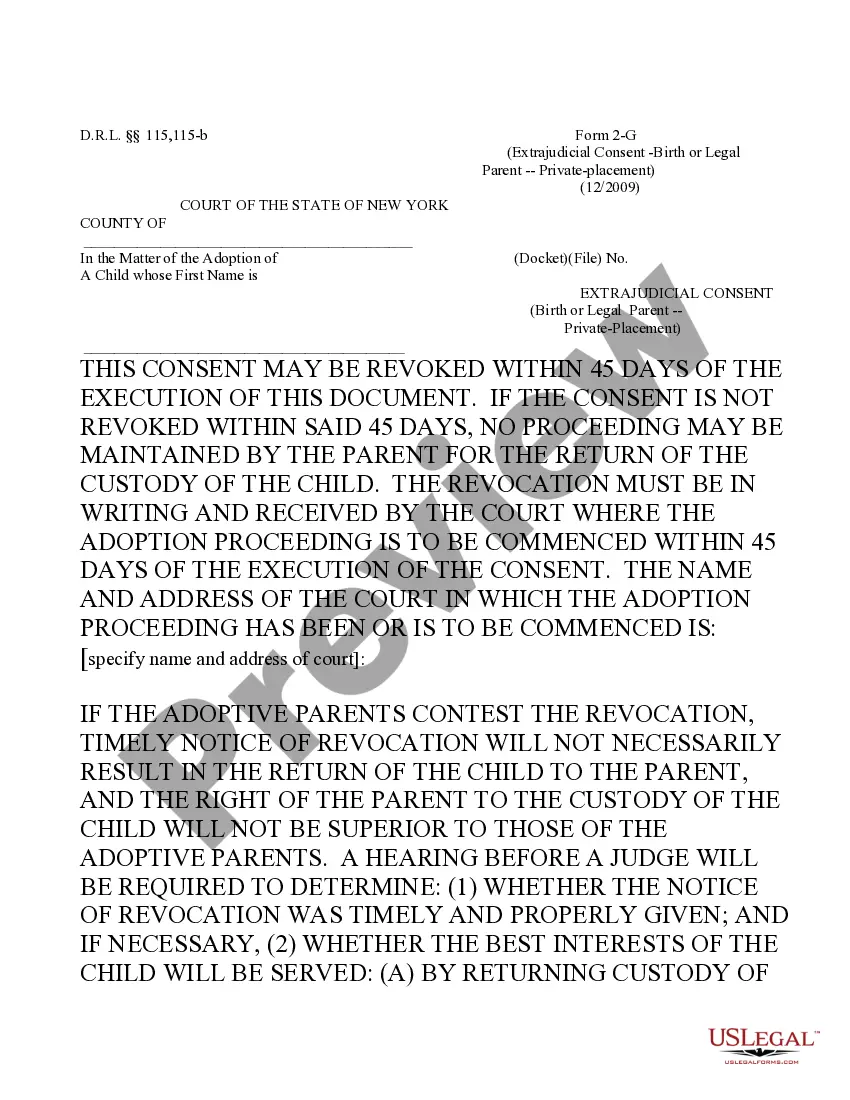

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

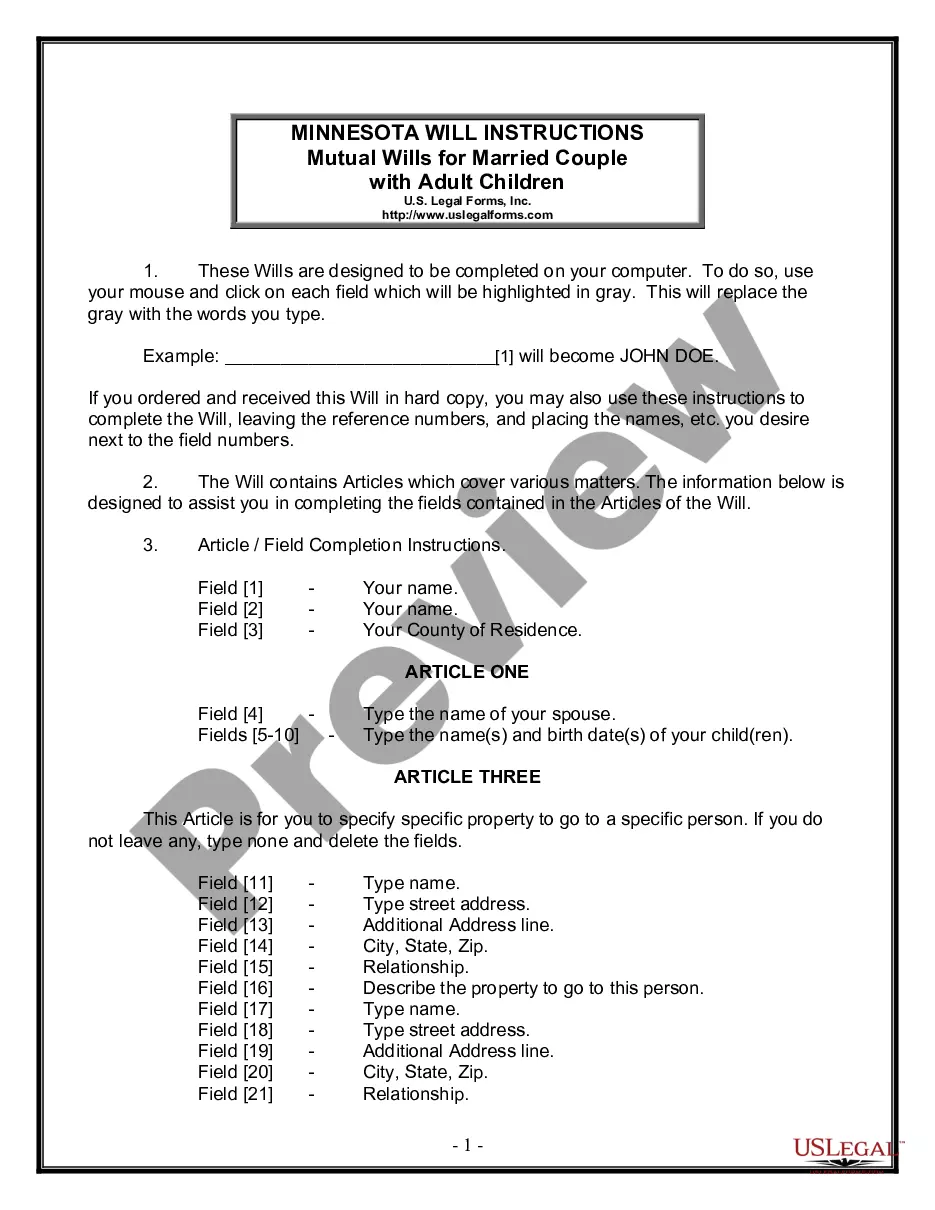

Minnesota Guaranty Attachment to Lease for Guarantor or Cosigner

Description Third Party Guarantor

How to fill out Minnesota Guaranty Attachment To Lease For Guarantor Or Cosigner?

Have any template from 85,000 legal documents including Minnesota Guaranty Attachment to Lease for Guarantor or Cosigner online with US Legal Forms. Every template is drafted and updated by state-licensed attorneys.

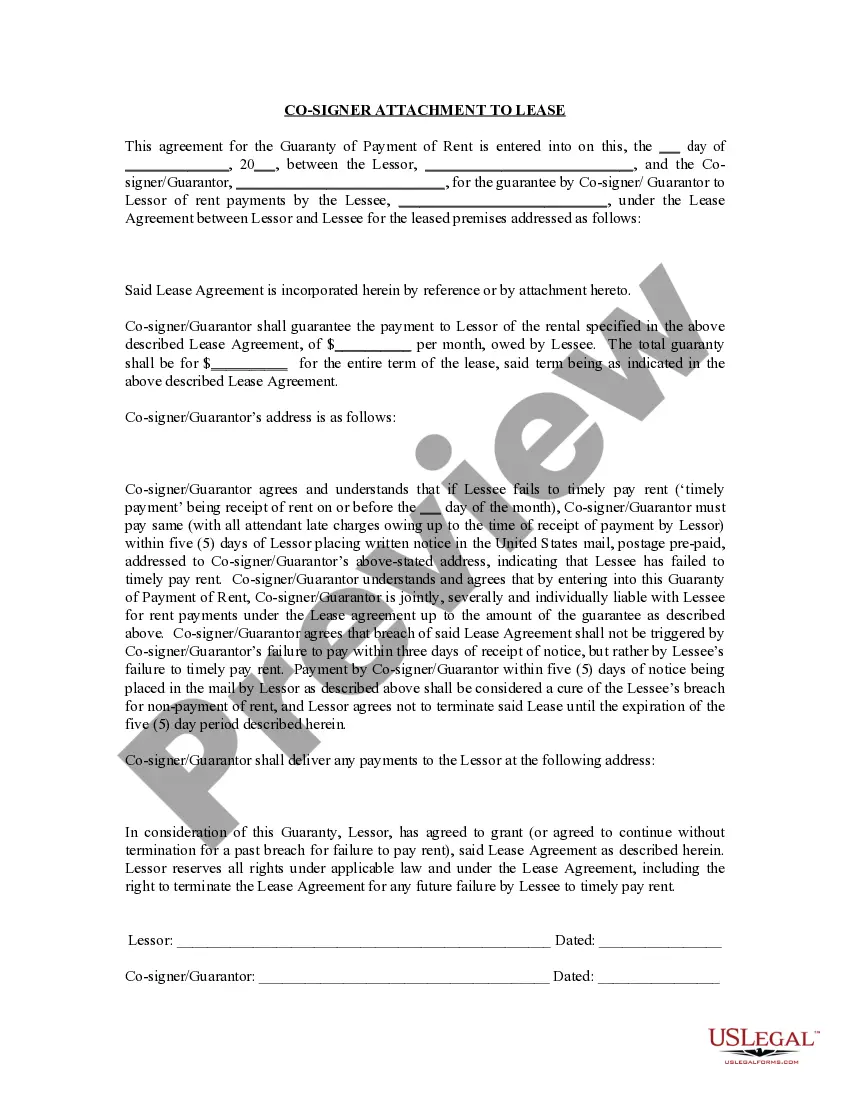

If you already have a subscription, log in. Once you’re on the form’s page, click the Download button and go to My Forms to access it.

In case you haven’t subscribed yet, follow the tips listed below:

- Check the state-specific requirements for the Minnesota Guaranty Attachment to Lease for Guarantor or Cosigner you would like to use.

- Look through description and preview the sample.

- When you’re confident the sample is what you need, simply click Buy Now.

- Select a subscription plan that actually works for your budget.

- Create a personal account.

- Pay in a single of two suitable ways: by credit card or via PayPal.

- Pick a format to download the file in; two options are available (PDF or Word).

- Download the document to the My Forms tab.

- As soon as your reusable form is downloaded, print it out or save it to your gadget.

With US Legal Forms, you’ll always have quick access to the proper downloadable sample. The service provides you with access to documents and divides them into groups to simplify your search. Use US Legal Forms to get your Minnesota Guaranty Attachment to Lease for Guarantor or Cosigner easy and fast.

Lease Guaranty Form Form popularity

Lease Guarantor Form Other Form Names

Guarantor Companies FAQ

The Basics: A Co-signor is part owner of the property, may or may not live in the property and is responsible for the debt repayment. A Guarantor is responsible for the debt repayment if the borrower (applicant) is unable to pay but has no benefits of owning any part of the property.

The cosigner, simply by signing on to the debt, is liable for the debt without the creditor needing to to take any additional actions. The guarantor is only liable for the debt after the creditor has exhausted all other options of collections from the original borrower.

Ask the owner whether he allows for co-signers. Schedule a meeting with the owner and your co-signer. Sign the lease or rental agreement once the co-signer passes the property owner's requirements. Ask the landlord whether he objects to another tenant moving into the home.

In other situations, it may be a short amendment or secondary contract. The guarantor usually receives a full copy of the entire lease agreement, since he or she will be responsible for its conditions, just as you are as the primary leaseholder.

The guarantor signs the lease with the tenant and stands as reassurance to the property manager or landlord that rent will be paid if you (the tenant) default on payment. A guarantor is not always necessary, but there are circumstances when renters rely on them to be approved for an apartment.

A co-signer, on the other hand, will usually have their name on the title of the home or automobile. Guarantors are usually liable for default only when the lender has done everything possible to get the primary borrower to make the payments.

Guarantors sign the lease and are responsible for the payments under the law, but they don't occupy the apartment nor are they entitled to occupy it.

A lease guaranty is a separate contract under which a third party guarantor agrees to meet the obligations of the Tenant to the Landlord.If the Tenant fails to pay rent, the Landlord can recover the arrears from the guarantor, usually before seeking damages from Tenant.

Co-signers have equal responsibility for payment of monthly rental costs, while a guarantor is generally sought for payment only when the primary signer is unable to make the rental payment.