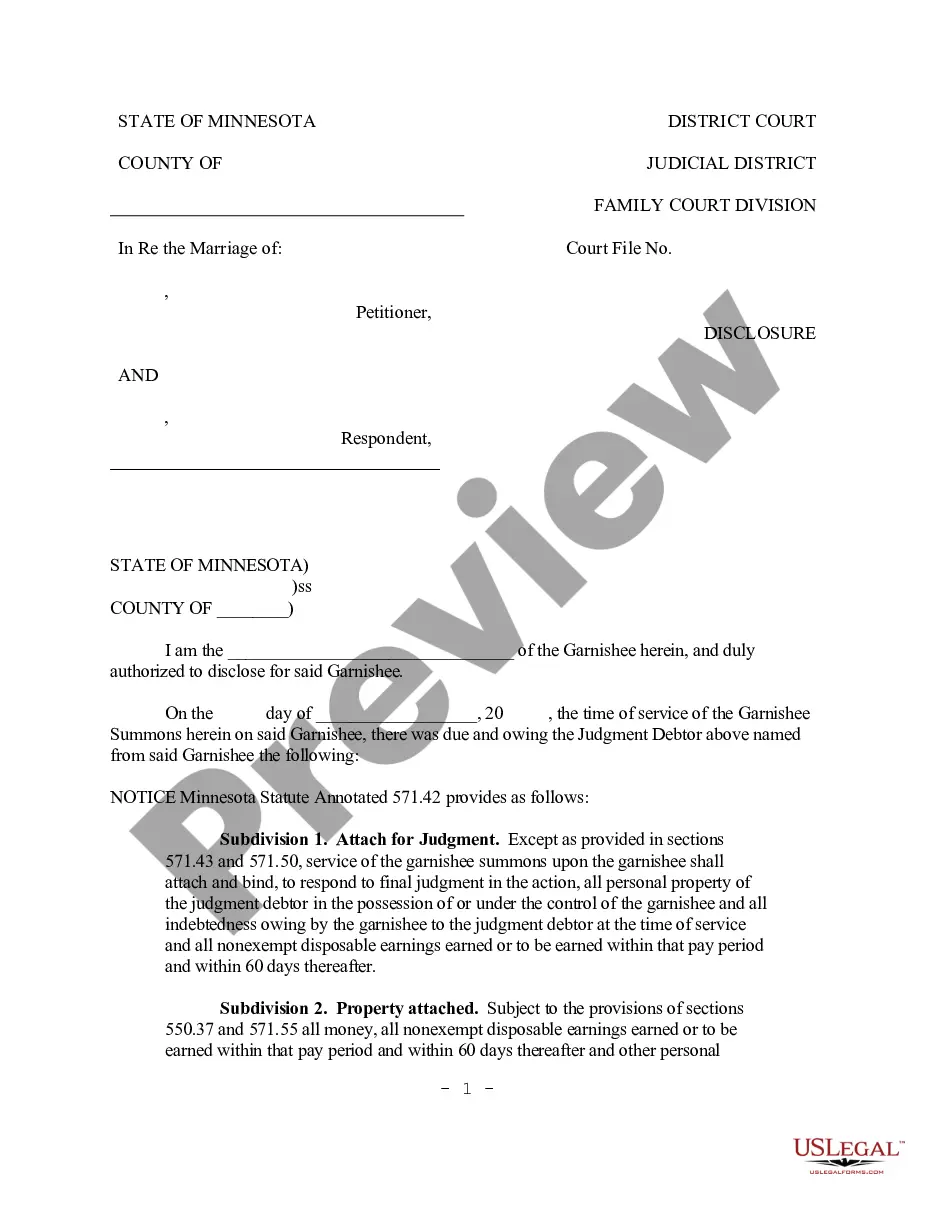

Minnesota Garnishment Disclosure

Description

How to fill out Minnesota Garnishment Disclosure?

Have any template from 85,000 legal documents including Minnesota Garnishment Disclosure on-line with US Legal Forms. Every template is drafted and updated by state-licensed legal professionals.

If you already have a subscription, log in. Once you’re on the form’s page, click the Download button and go to My Forms to access it.

In case you have not subscribed yet, follow the steps below:

- Check the state-specific requirements for the Minnesota Garnishment Disclosure you need to use.

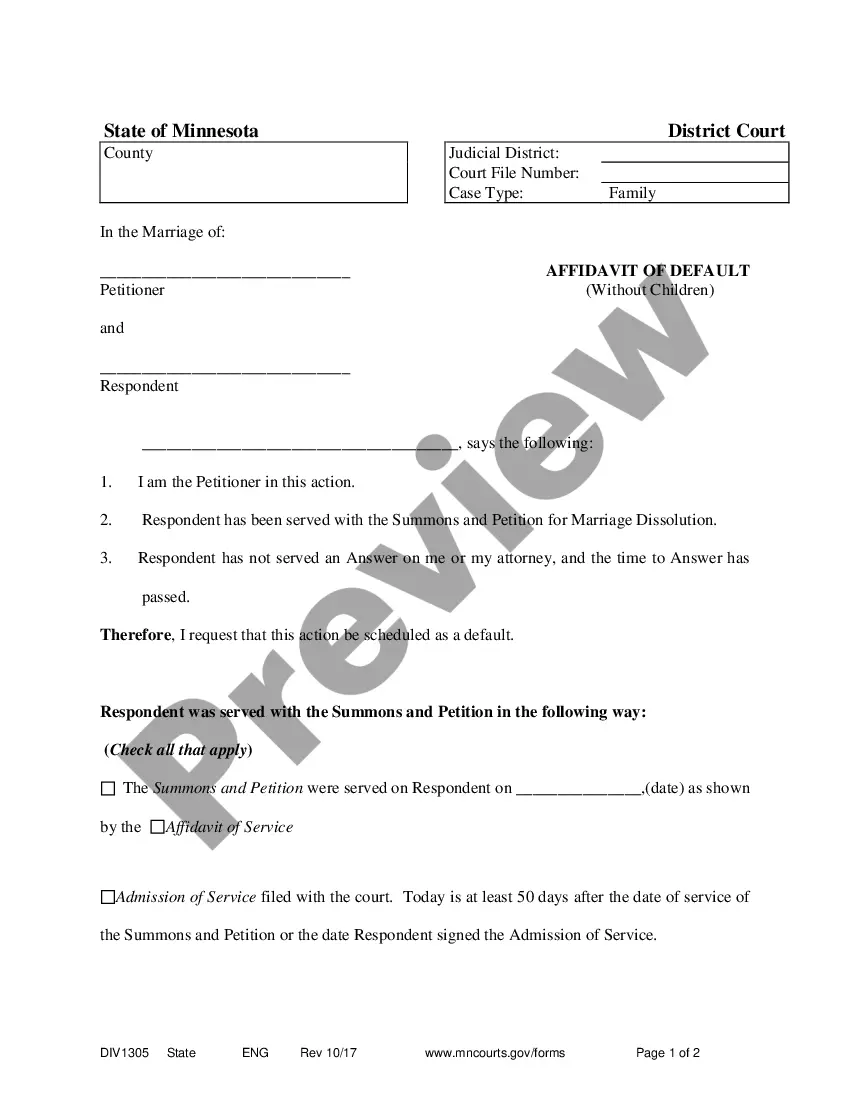

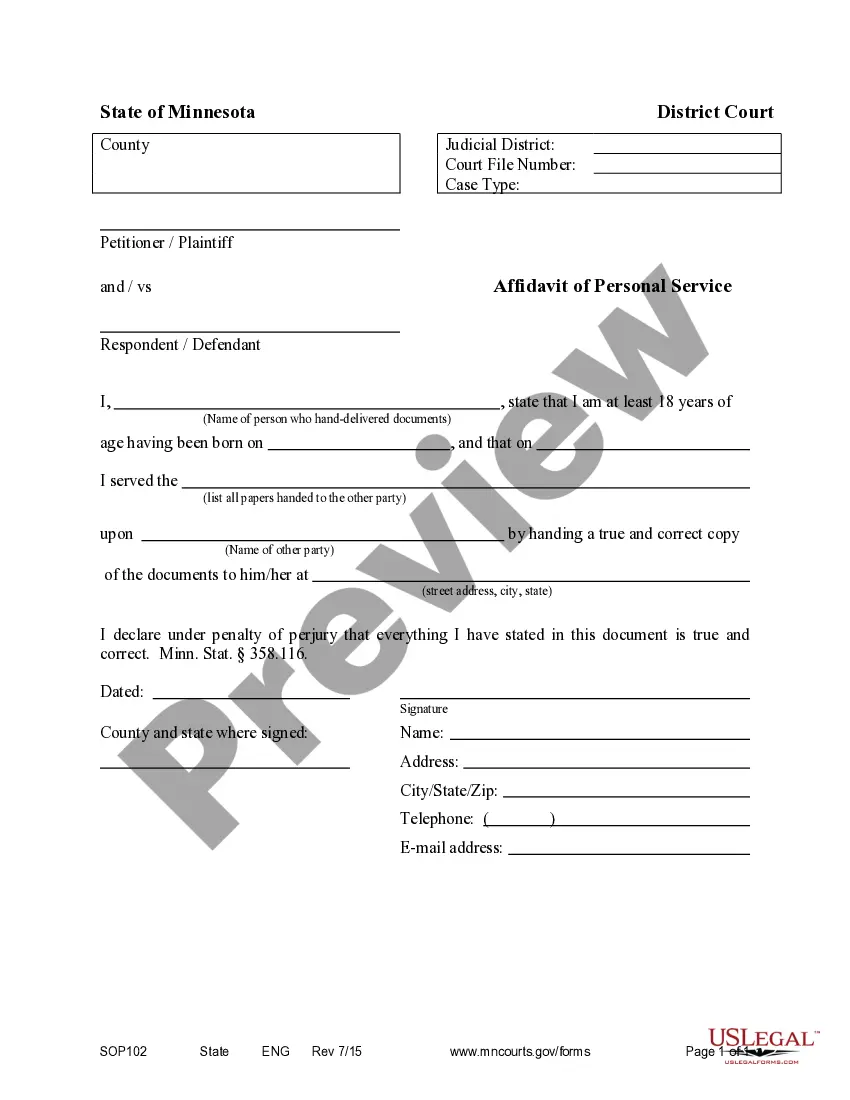

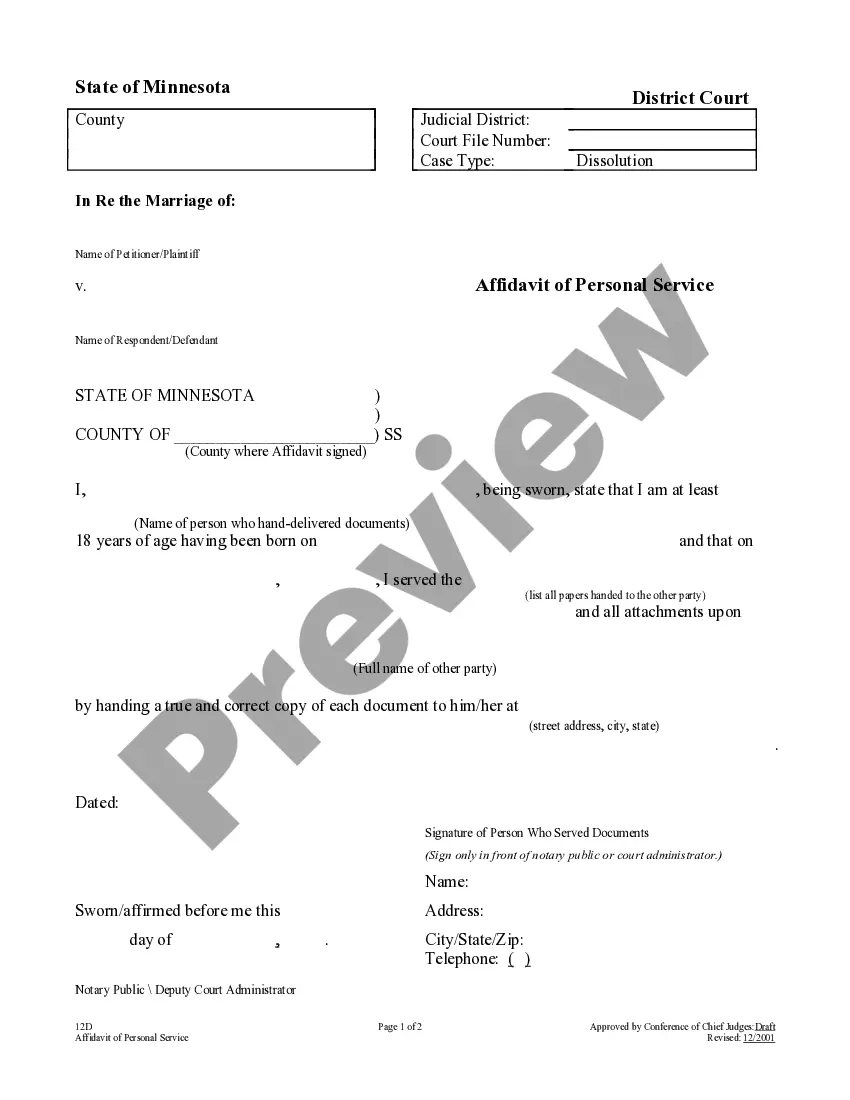

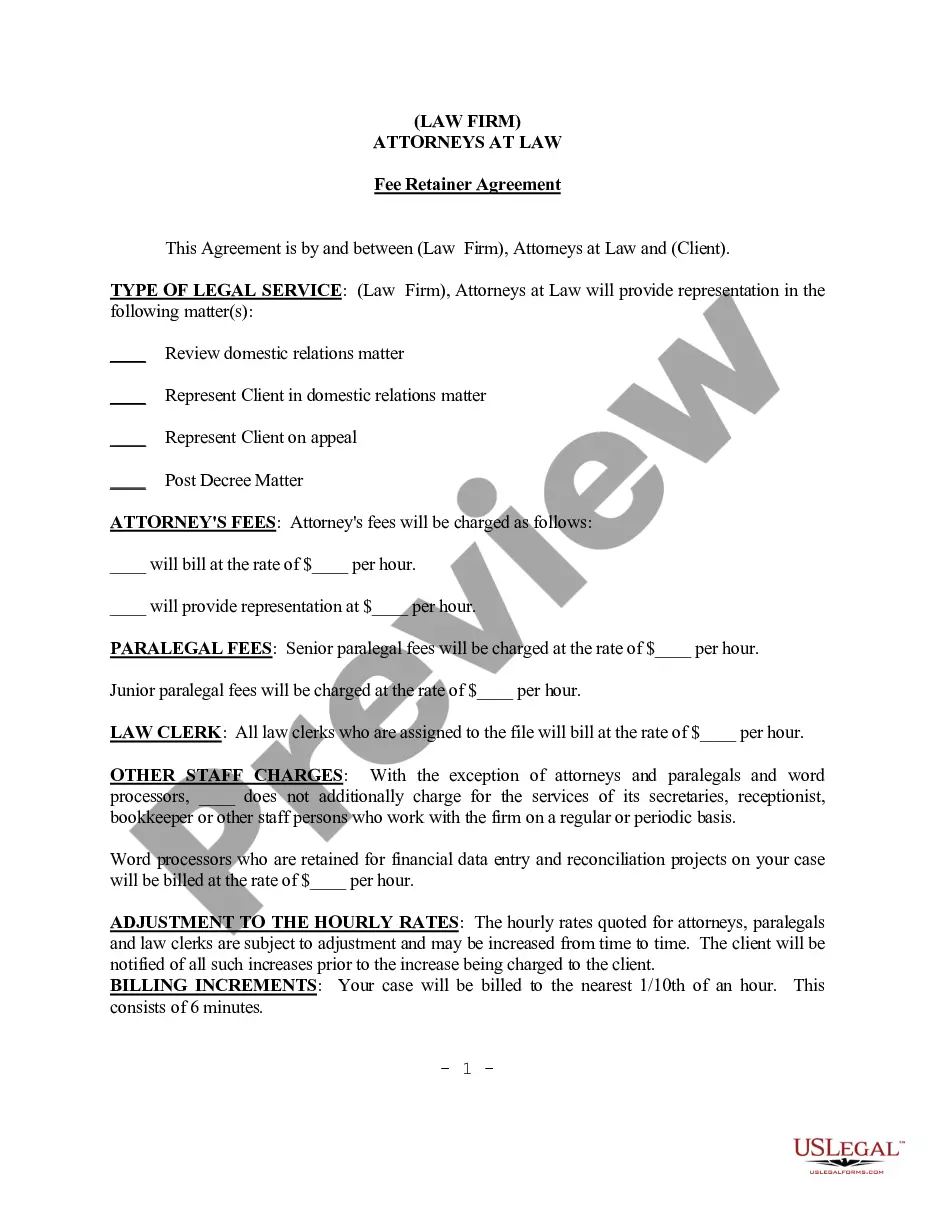

- Read through description and preview the template.

- When you’re confident the template is what you need, click on Buy Now.

- Choose a subscription plan that works well for your budget.

- Create a personal account.

- Pay out in one of two suitable ways: by bank card or via PayPal.

- Pick a format to download the file in; two options are available (PDF or Word).

- Download the file to the My Forms tab.

- As soon as your reusable template is ready, print it out or save it to your device.

With US Legal Forms, you will always have immediate access to the right downloadable template. The service gives you access to forms and divides them into categories to simplify your search. Use US Legal Forms to obtain your Minnesota Garnishment Disclosure fast and easy.

Form popularity

FAQ

Generally, state laws don't require employers to notify you in advance before garnishing wages. Nor are they required to give you a period of time to dispute the debt or garnishment. However, your employer should, as a courtesy, provide you with a copy of the notice.

You have some rights in the wage garnishment process, but in most states, it's your responsibility to be aware of and exercise these rights. You have to be legally notified of the garnishment. You can file a dispute if the notice has inaccurate information or you believe you don't owe the debt.

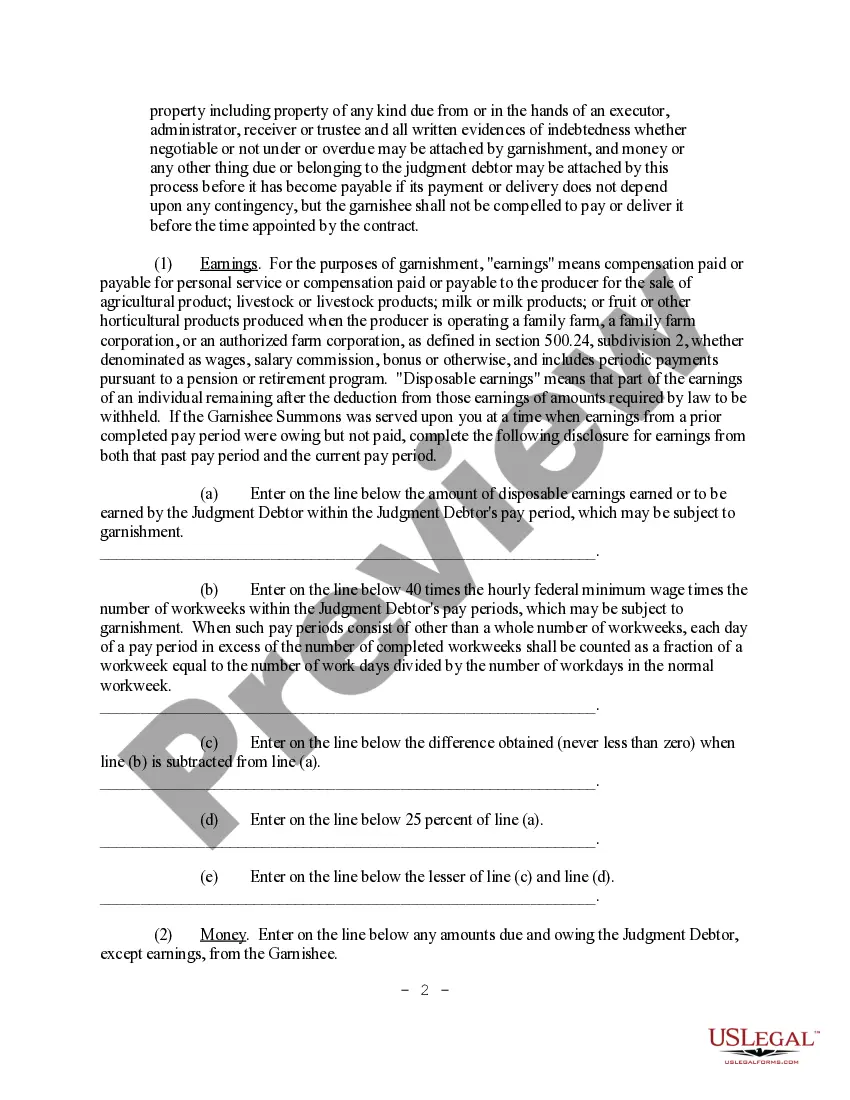

A creditor starts the garnishment process by serving a legal documentcalled a garnishment summonson the third party (called the garnishee) who the creditor believes to have money or property belonging to the debtor.

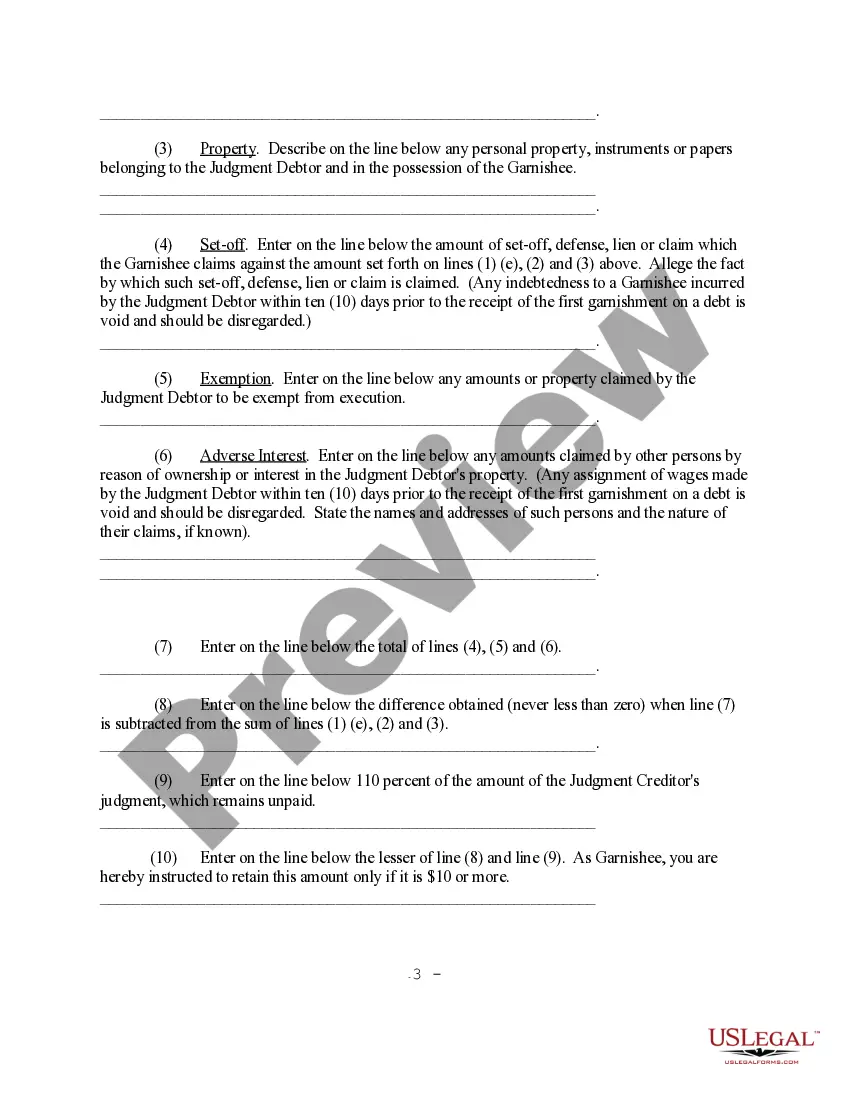

What Happens When a Garnishment Summons Is Served?In the case of a nonearnings garnishment, the garnishee must provide a written disclosure to the creditor within 20 days after service of the garnishment summons that identifies all indebtedness, money, or property that the garnishee owes to the debtor.

Garnishment is a proceeding by a creditor (a person or entity to whom money is owed) to collect a debt by taking the property or assets of a debtor (a person who owes money). Wage garnishment is a court procedure where a court orders a debtor's employer to hold the debtor's earnings in order to pay a creditor.

Wage garnishment is sometimes ordered by federal or state courts when you owe back taxes, alimony, child support and certain other debts.This garnishment cannot be strictly "confidential" because the employer must be informed about it in order to garnish the wages.

Once a garnishment is approved in court, the creditor will notify you before contacting your bank to begin the actual garnishment. However, the bank itself has no legal obligation to inform you when money is withdrawn due to an account garnishment.