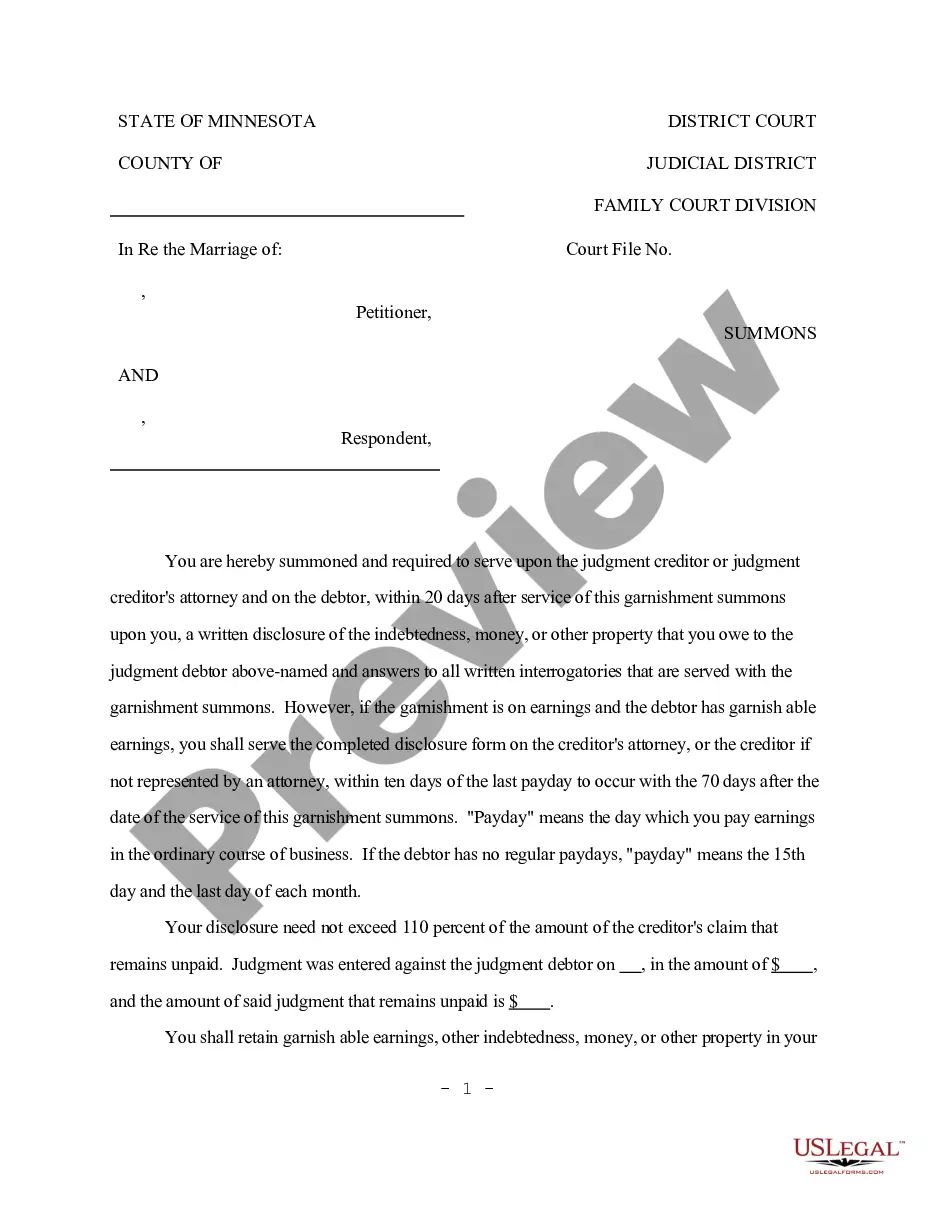

Minnesota Summons to Employer of Garnishee

Description

How to fill out Minnesota Summons To Employer Of Garnishee?

Get any template from 85,000 legal documents such as Minnesota Summons to Employer of Garnishee online with US Legal Forms. Every template is drafted and updated by state-accredited attorneys.

If you have a subscription, log in. Once you are on the form’s page, click the Download button and go to My Forms to access it.

If you haven’t subscribed yet, follow the tips listed below:

- Check the state-specific requirements for the Minnesota Summons to Employer of Garnishee you need to use.

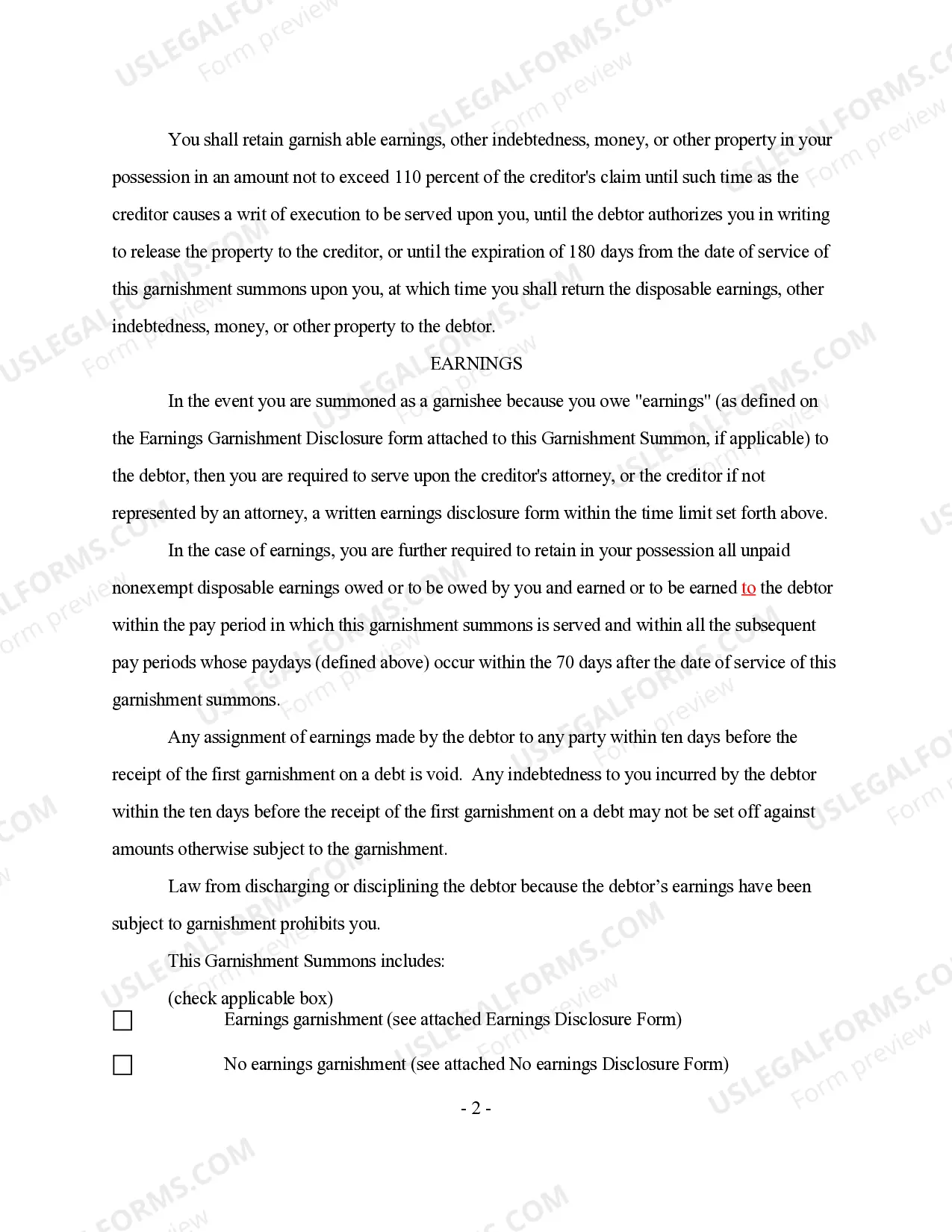

- Read description and preview the template.

- As soon as you’re sure the template is what you need, simply click Buy Now.

- Choose a subscription plan that works well for your budget.

- Create a personal account.

- Pay in a single of two suitable ways: by card or via PayPal.

- Pick a format to download the document in; two ways are available (PDF or Word).

- Download the file to the My Forms tab.

- After your reusable form is downloaded, print it out or save it to your gadget.

With US Legal Forms, you’ll always have quick access to the appropriate downloadable template. The service will give you access to documents and divides them into categories to simplify your search. Use US Legal Forms to obtain your Minnesota Summons to Employer of Garnishee fast and easy.

Form popularity

FAQ

If you are served with a garnishment summons, do not ignore these documents because they do not directly involve a debt that you owe. Instead, you should immediately freeze any payments to the debtor, retain the necessary property, and provide the required written disclosure.

Garnishment is a proceeding by a creditor (a person or entity to whom money is owed) to collect a debt by taking the property or assets of a debtor (a person who owes money). Wage garnishment is a court procedure where a court orders a debtor's employer to hold the debtor's earnings in order to pay a creditor.

A Garnishee Summons notifies the garnishee that they should pay the amount of the judgment directly to you rather than to the debtor. A Garnishee Summons form can be found on the Alberta Courts website (https://www.albertacourts.ca/qb/areas-of-law/civil/forms).The amount that the debtor owes to you, the creditor.

In most states, employers answer a writ of garnishment by filling out the paperwork attached to the judgment and returning it to the creditor or the creditor's attorney.

Regular creditors cannot garnish your wages without first suing you in court and obtaining a money judgment. That means that if you owe money to a credit card company, doctor, dentist, furniture company, or the like, you don't have to worry about garnishment unless those creditors sue you in court.

If it's already started, you can try to challenge the judgment or negotiate with the creditor. But, they're in the driver's seat, and if they don't allow you to stop a garnishment by agreeing to make voluntary payments, you can't really force them to. You can, however, stop the garnishment by filing a bankruptcy case.

If the employer still refuses to comply, the creditor can file an action against the employer for contempt.After the EWO is served, the creditor can determine the amount of wages garnished by reviewing the memorandum of garnishee completed and returned by the employer.

Respond to the Creditor's Demand Letter. Seek State-Specific Remedies. Get Debt Counseling. Object to the Garnishment. Attend the Objection Hearing (and Negotiate if Necessary) Challenge the Underlying Judgment. Continue Negotiating.

Most creditors cannot garnish your wages or a bank account without a court order. There are very rare exceptions such as the IRS or a student loan but for the most part, if you're talking about credit cards, they would need to obtain a judgment against you by a court of law before they could garnish your wages.