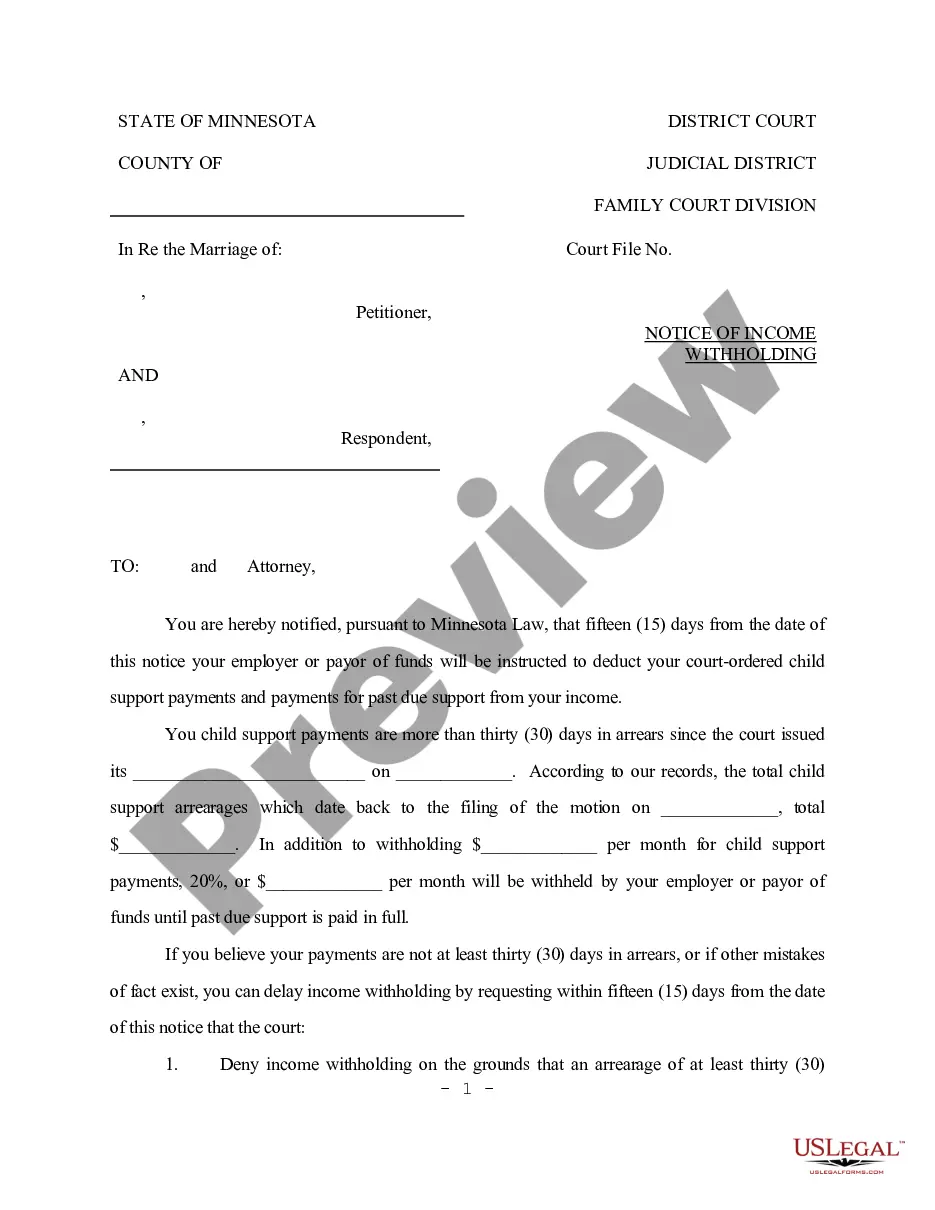

Minnesota Notice of Income Withholding

Description

How to fill out Minnesota Notice Of Income Withholding?

Have any template from 85,000 legal documents such as Minnesota Notice of Income Withholding on-line with US Legal Forms. Every template is drafted and updated by state-licensed attorneys.

If you already have a subscription, log in. Once you’re on the form’s page, click on the Download button and go to My Forms to access it.

If you have not subscribed yet, follow the tips below:

- Check the state-specific requirements for the Minnesota Notice of Income Withholding you want to use.

- Look through description and preview the template.

- As soon as you are confident the template is what you need, click Buy Now.

- Select a subscription plan that works well for your budget.

- Create a personal account.

- Pay out in just one of two appropriate ways: by bank card or via PayPal.

- Pick a format to download the document in; two options are available (PDF or Word).

- Download the document to the My Forms tab.

- Once your reusable template is downloaded, print it out or save it to your gadget.

With US Legal Forms, you’ll always have instant access to the proper downloadable sample. The service provides you with access to forms and divides them into groups to simplify your search. Use US Legal Forms to get your Minnesota Notice of Income Withholding easy and fast.

Form popularity

FAQ

Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. Step 2: Add Multiple Jobs or a Working Spouse. Step 3: Add Dependents. Step 4: Add Other Adjustments. Step 5: Sign and Date W-4 Form.

Step 1: Personal information. Enter your name, address, Social Security number and tax-filing status. Step 2: Account for multiple jobs. Step 3: Claim dependents, including children. Step 4: Refine your withholdings. Step 5: Sign and date your W-4.

Box A: Your Social Security number, which the IRS uses to identify you. Box B: The employer identification number, or EIN, which the IRS uses to identify your employer. Box C: Your employer's name, address and ZIP code. Box D: Box E: Your legal name. Box F: Your address and ZIP code.

1. You can choose to have taxes taken out.By placing a 0 on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

The W-2 you got from your employer will have four lines for box 12 labeled 12a, 12b, 12c, and 12d. Any amount on a box 12 line will also have an upper-case (capital) letter code associated with it. (If there aren't any capital letter codes in box 12, skip it and move on to box 13.)

Box A: Employee's Social Security number. Box B: Employer Identification Number (EIN) Box C: Employer's name, address, and ZIP code. Box D: Boxes E and F: Employee's name, address, and ZIP code. Box 1: Wages, tips, other compensation. Box 2: Federal income tax withheld. Box 3: Social Security wages.

You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form, depending on what you're eligible for. Generally, the more allowances you claim, the less tax will be withheld from each paycheck. The fewer allowances claimed, the larger withholding amount, which may result in a refund.

Box A: Employee's Social Security number. Box B: Employer Identification Number (EIN) Box C: Employer's name, address, and ZIP code. Box D: Boxes E and F: Employee's name, address, and ZIP code. Box 1: Wages, tips, other compensation. Box 2: Federal income tax withheld. Box 3: Social Security wages.

1. You can choose to have taxes taken out.By placing a 0 on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.