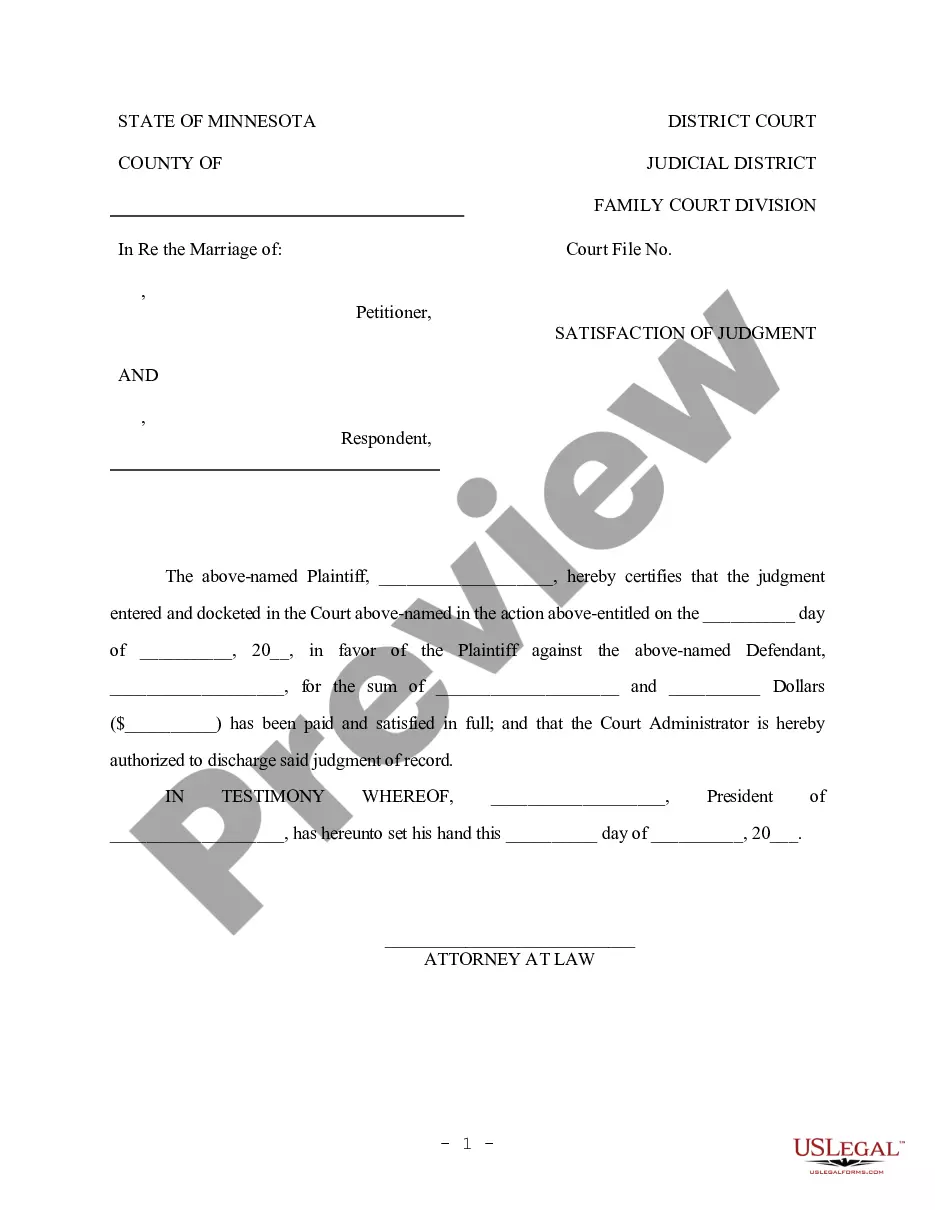

Minnesota Satisfaction of Judgment

Description

How to fill out Minnesota Satisfaction Of Judgment?

Get any template from 85,000 legal documents such as Minnesota Satisfaction of Judgment online with US Legal Forms. Every template is drafted and updated by state-licensed lawyers.

If you already have a subscription, log in. Once you’re on the form’s page, click on the Download button and go to My Forms to access it.

If you haven’t subscribed yet, follow the steps listed below:

- Check the state-specific requirements for the Minnesota Satisfaction of Judgment you would like to use.

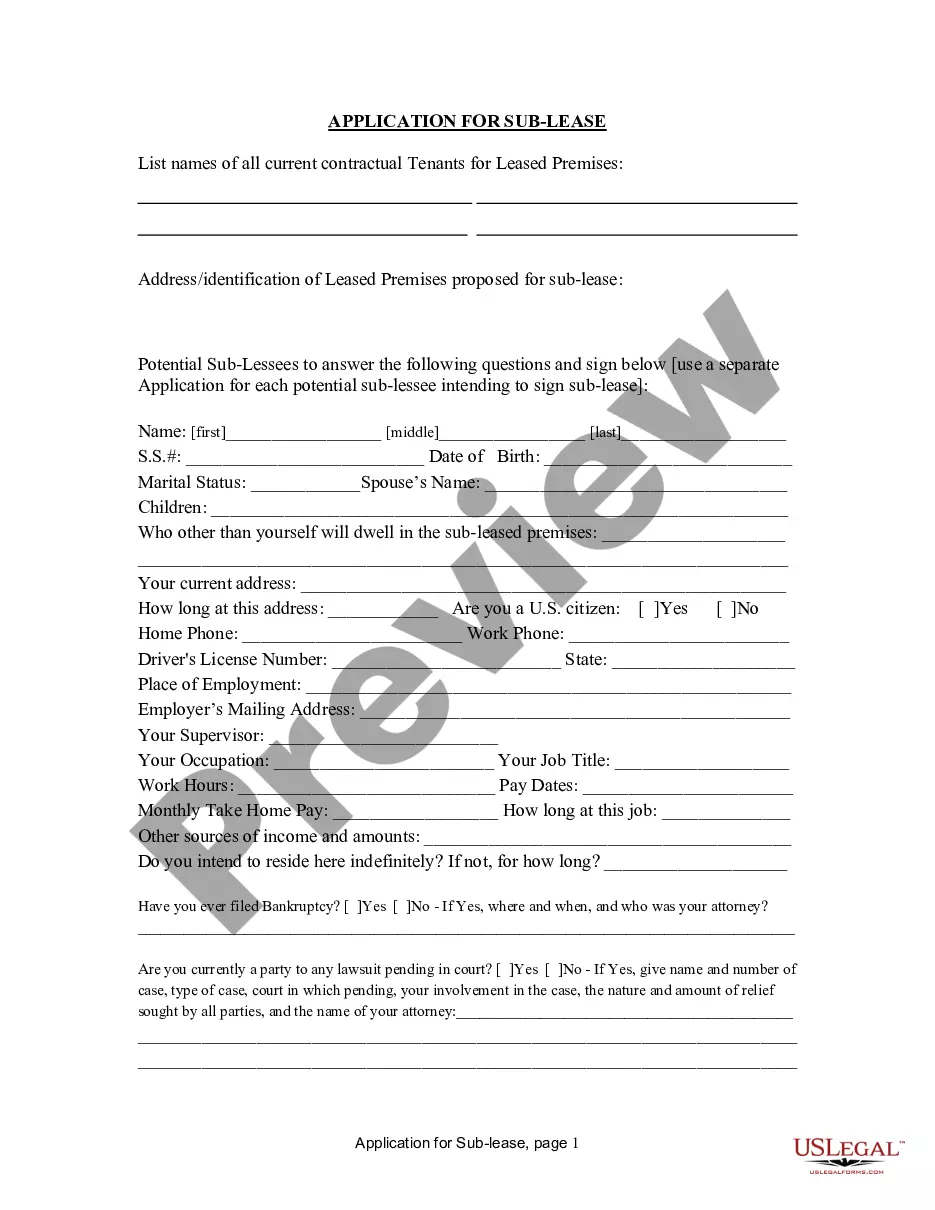

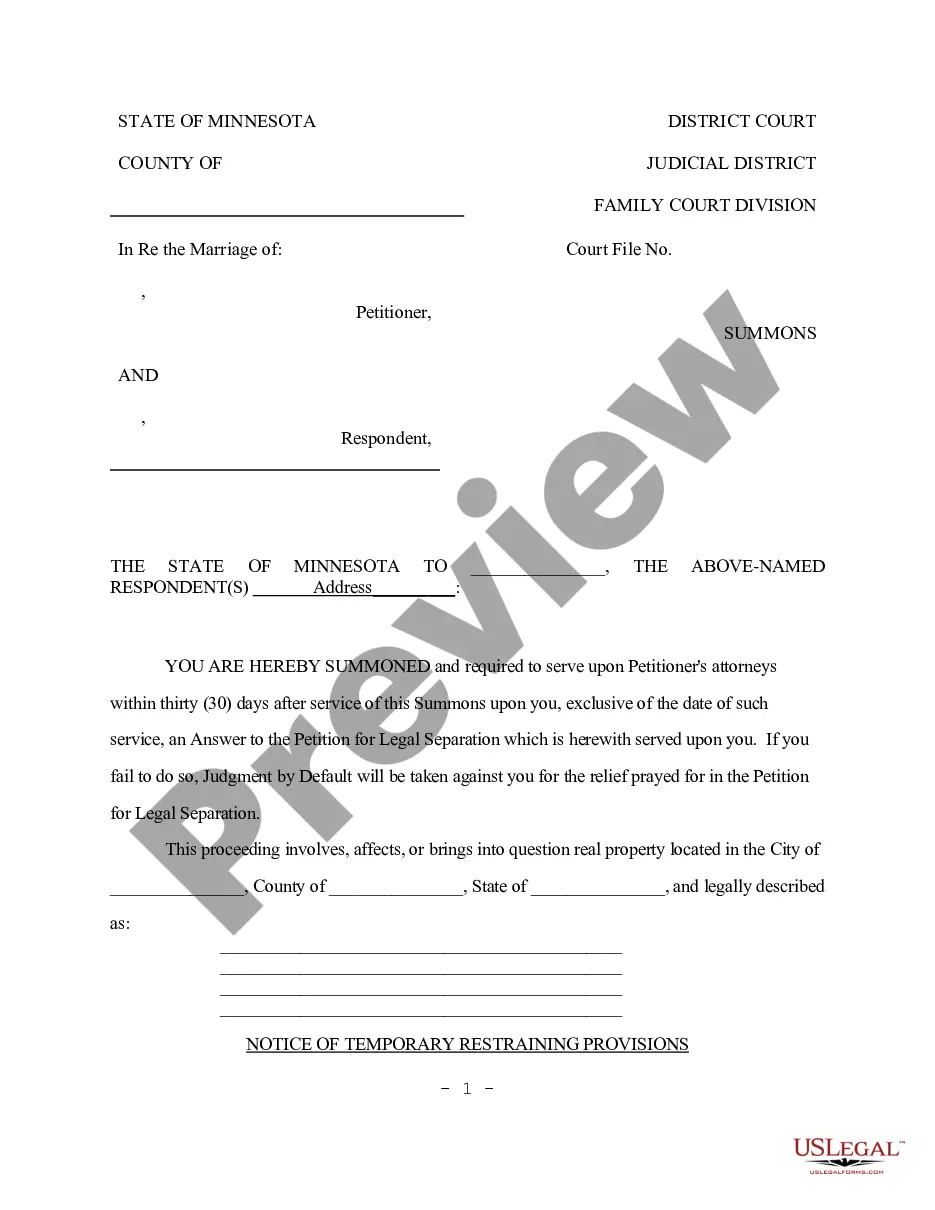

- Read description and preview the template.

- When you are confident the template is what you need, click on Buy Now.

- Choose a subscription plan that works for your budget.

- Create a personal account.

- Pay out in just one of two appropriate ways: by card or via PayPal.

- Select a format to download the file in; two options are available (PDF or Word).

- Download the file to the My Forms tab.

- As soon as your reusable form is ready, print it out or save it to your device.

With US Legal Forms, you’ll always have quick access to the appropriate downloadable template. The service provides you with access to forms and divides them into groups to streamline your search. Use US Legal Forms to obtain your Minnesota Satisfaction of Judgment easy and fast.

Form popularity

FAQ

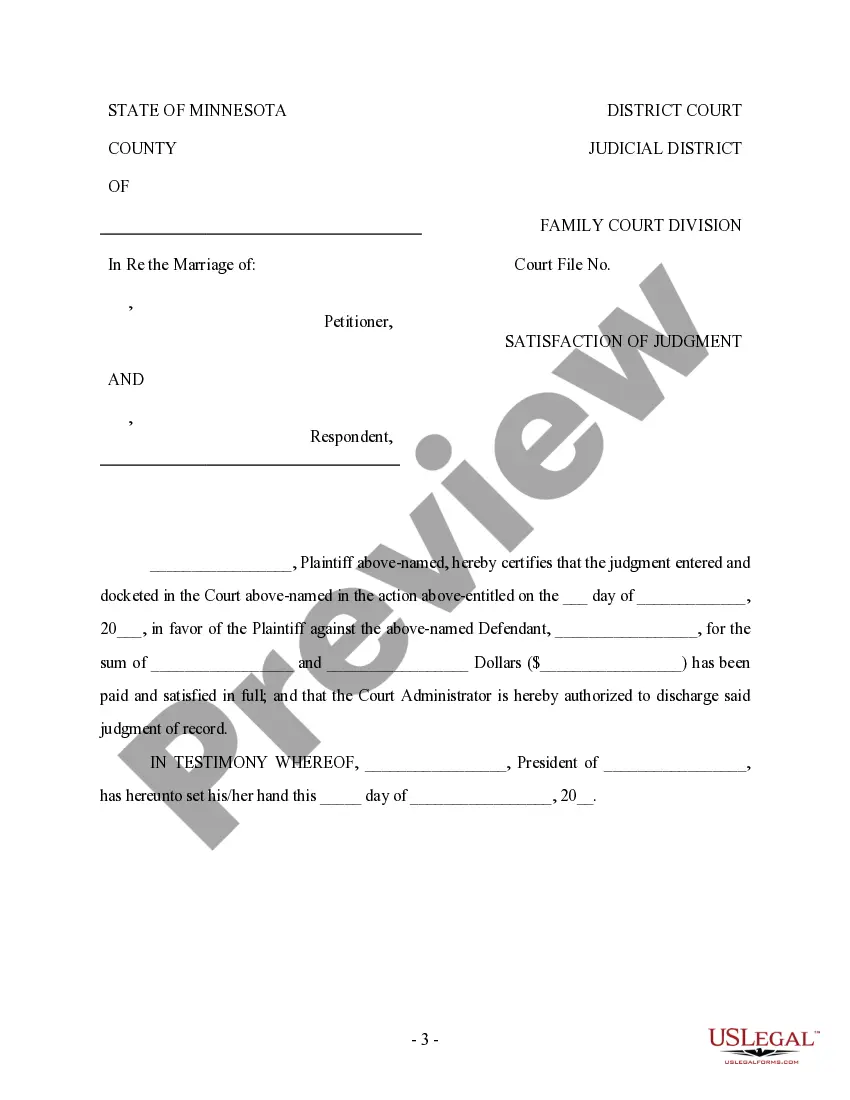

A document signed by the party who is owed money under a court judgment (called the judgment creditor) stating that the full amount due on the judgment has been paid.

You may ask your judgment creditor to file a satisfaction of judgment form. The length of time gives to the creditor to file the form varies from state to state, but it is usually between 14 and 30 days after your request.

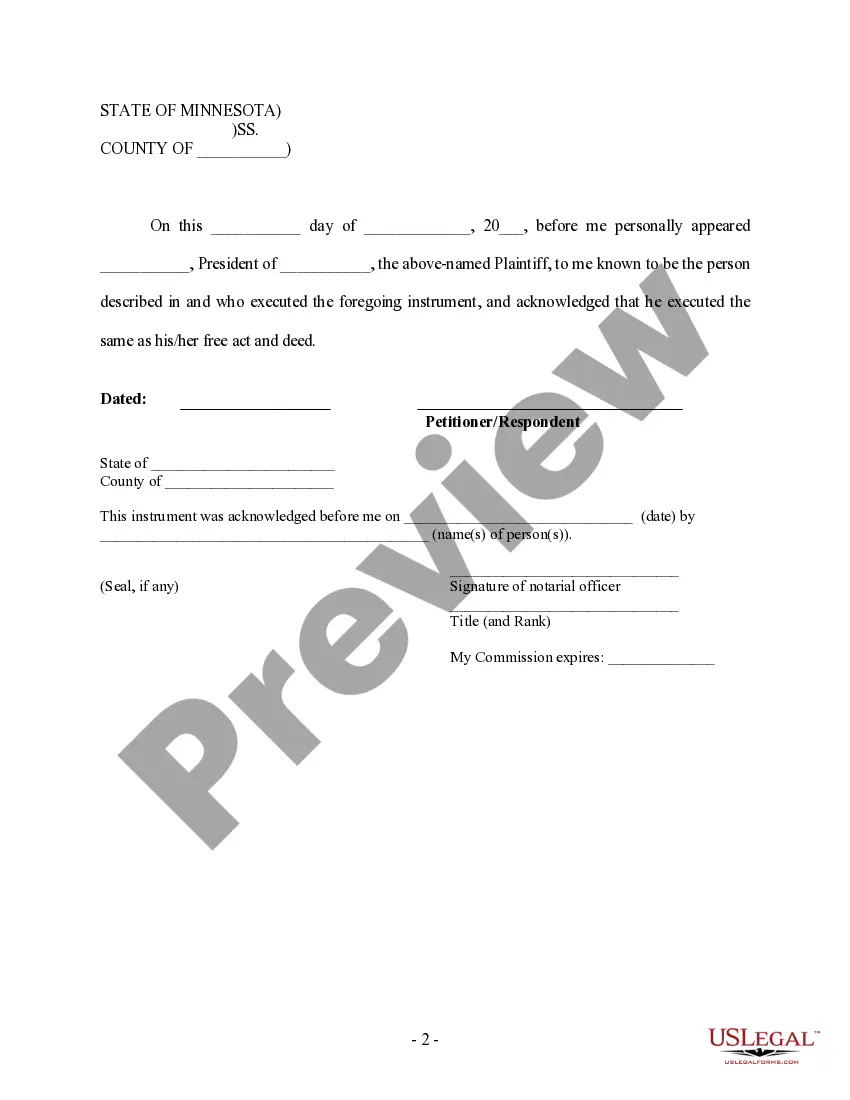

You will need one original, notarized copy for the judgment debtor. If you recorded an abstract of judgment to place a lien against the debtor's real property, you will need an original, notarized copy of your Acknowledgment of Satisfaction of Judgment (EJ-100) for each county where you placed a lien.

A Satisfaction of Judgment is a document signed by one party acknowledge receipt of the payment. The Satisfaction of Judgment is then filed with the court. This is beneficial to the paying party for multiple reasons. One, the court is put on notice that the debt has been satisfied.

Judgments are no longer factored into credit scores, though they are still public record and can still impact your ability to qualify for credit or loans.You should pay legitimate judgments and dispute inaccurate judgments to ensure these do not affect your finances unduly.

There are a few ways you can satisfy or avoid a lien altogether. The firstand most obviousoption is to repay the debt. If you pay off your obligation, the creditor will remove the lien. This is done by filing a release through the same place the lien was recordedthe county or state.

A document signed by the party who is owed money under a court judgment (called the judgment creditor) stating that the full amount due on the judgment has been paid.

Once a judgment is paid, whether in installments or a lump sum, a judgment creditor (the person who won the case) must acknowledge that the judgment has been paid by filing a Satisfaction of Judgment form with the court clerk.

While a vacated judgment is typically the best-case scenario, the unfortunate truth is most legitimate judgments satisfied or not aren't going away anytime soon. In fact, judgments will generally remain on your credit report for seven years from the judgment date (the day the judgment was filed) before expiring.

Once a judgment is paid, whether in installments or a lump sum, a judgment creditor (the person who won the case) must acknowledge that the judgment has been paid by filing a Satisfaction of Judgment form with the court clerk.