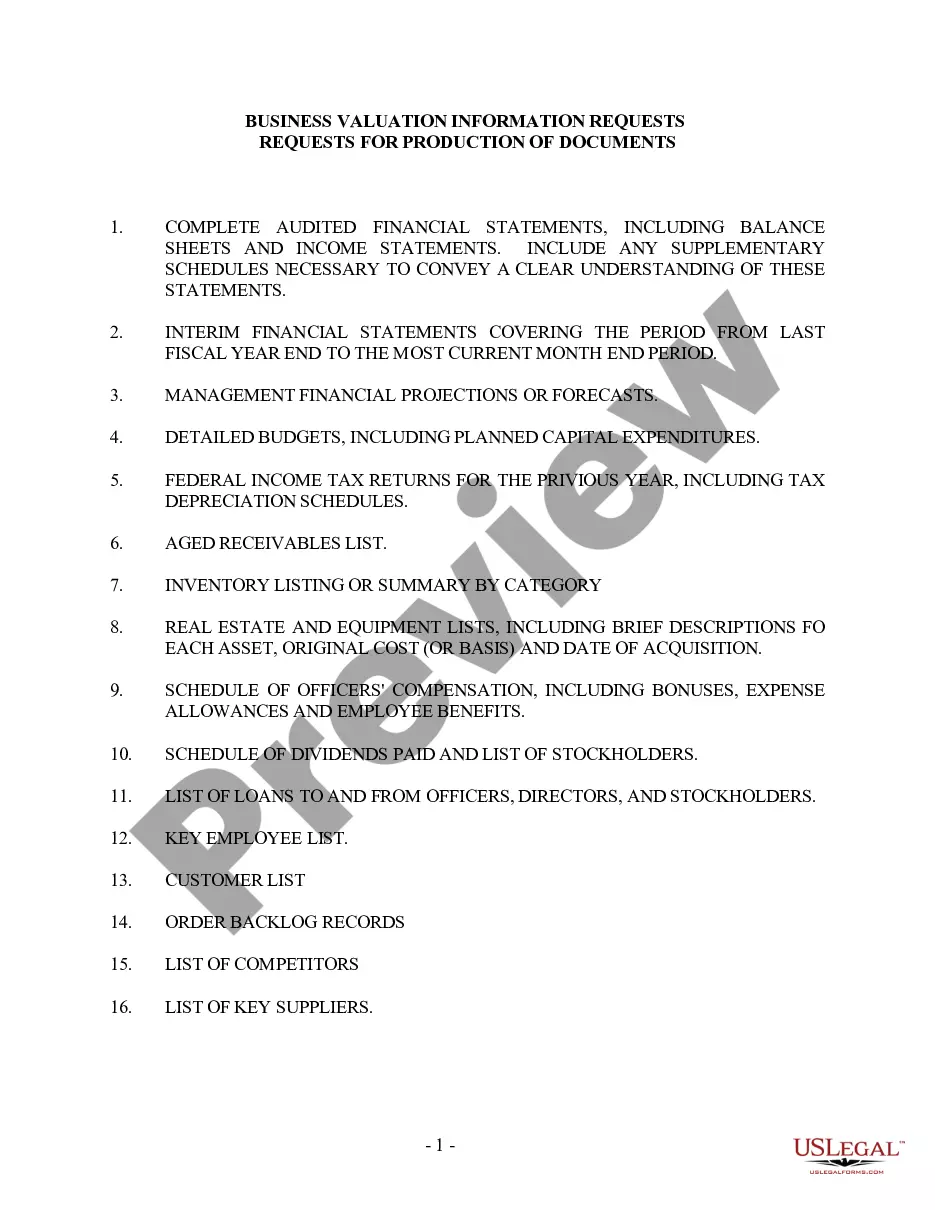

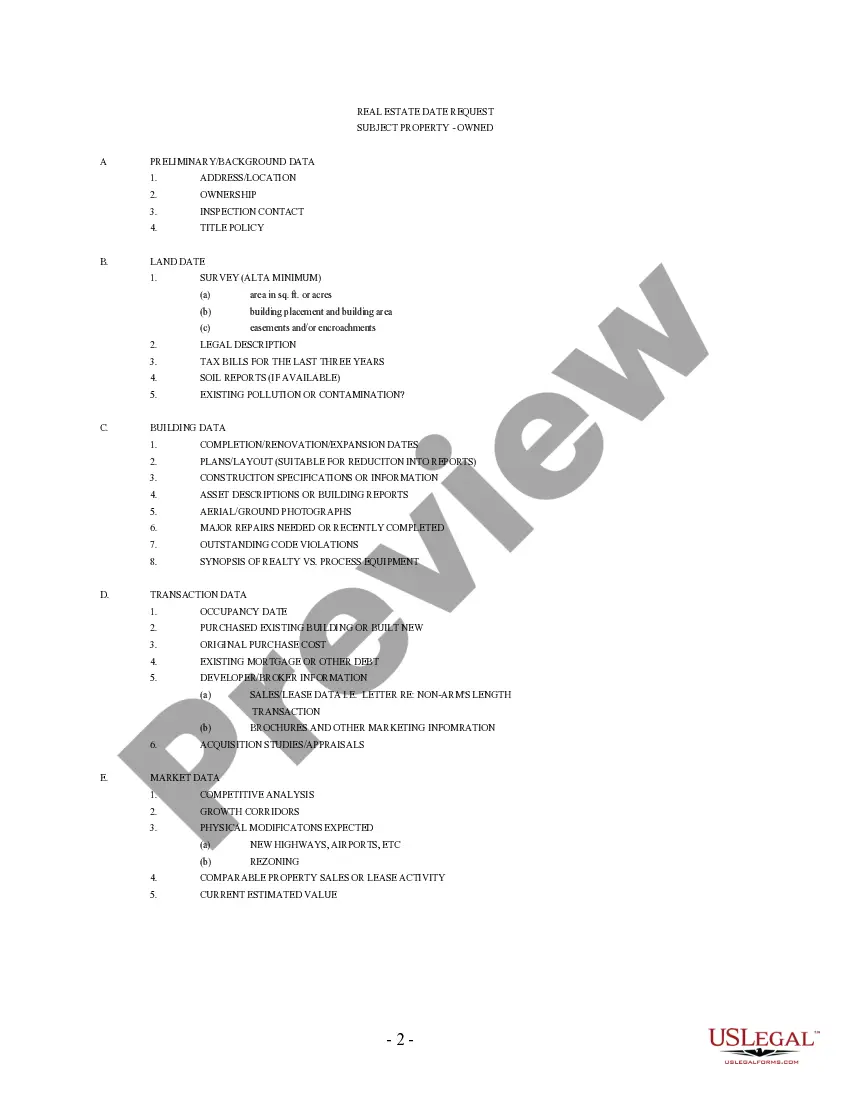

Minnesota Discovery - Requests for Business Valuation Information

Description

How to fill out Minnesota Discovery - Requests For Business Valuation Information?

Get any form from 85,000 legal documents including Minnesota Discovery - Requests for Business Valuation Information online with US Legal Forms. Every template is drafted and updated by state-certified lawyers.

If you have already a subscription, log in. When you’re on the form’s page, click on the Download button and go to My Forms to get access to it.

If you haven’t subscribed yet, follow the steps listed below:

- Check the state-specific requirements for the Minnesota Discovery - Requests for Business Valuation Information you want to use.

- Look through description and preview the sample.

- When you are confident the template is what you need, click on Buy Now.

- Select a subscription plan that really works for your budget.

- Create a personal account.

- Pay in a single of two suitable ways: by card or via PayPal.

- Pick a format to download the document in; two ways are available (PDF or Word).

- Download the document to the My Forms tab.

- Once your reusable form is ready, print it out or save it to your gadget.

With US Legal Forms, you’ll always have quick access to the proper downloadable template. The platform will give you access to documents and divides them into groups to simplify your search. Use US Legal Forms to obtain your Minnesota Discovery - Requests for Business Valuation Information fast and easy.

Form popularity

FAQ

Businesses where the owner is actively-involved typically sell for 2-3 times the annual earnings of the company. A business that earns $100,000 per year should sell for $200,000-$300,000. This is consistent with most listings on BizBuySell, a small business brokering site with thousands of companies available for sale.

Most certified business appraisers quote a project fee or an hourly rate, with outside expenses billed separately. Depending on the scope of the valuation, a valuation can cost anywhere from $5,000 to more than $20,000.

Tally the value of assets. Add up the value of everything the business owns, including all equipment and inventory. Base it on revenue. Use earnings multiples. Do a discounted cash-flow analysis. Go beyond financial formulas.

How much does a business valuation cost. Most certified business appraisers quote a project fee or an hourly rate, with outside expenses billed separately. Depending on the scope of the valuation, a valuation can cost anywhere from $5,000 to more than $20,000.

Tally the value of assets. Add up the value of everything the business owns, including all equipment and inventory. Base it on revenue. How much does the business generate in annual sales? Use earnings multiples. Do a discounted cash-flow analysis. Go beyond financial formulas.

Bizbuysell says, nationally the average business sells for around 0.6 times its annual revenue. But many other factors come into play. For example, a buyer might pay three or four times earnings if a business has market leadership and strong management.

The most commonly used rule of thumb is simply a percentage of the annual sales, or better yet, the last 12 months of sales/revenues.Another rule of thumb used in the Guide is a multiple of earnings. In small businesses, the multiple is used against what is termed Seller's Discretionary Earnings (SDE).

A business valuation might include an analysis of the company's management, its capital structure, its future earnings prospects or the market value of its assets.Common approaches to business valuation include a review of financial statements, discounting cash flow models and similar company comparisons.