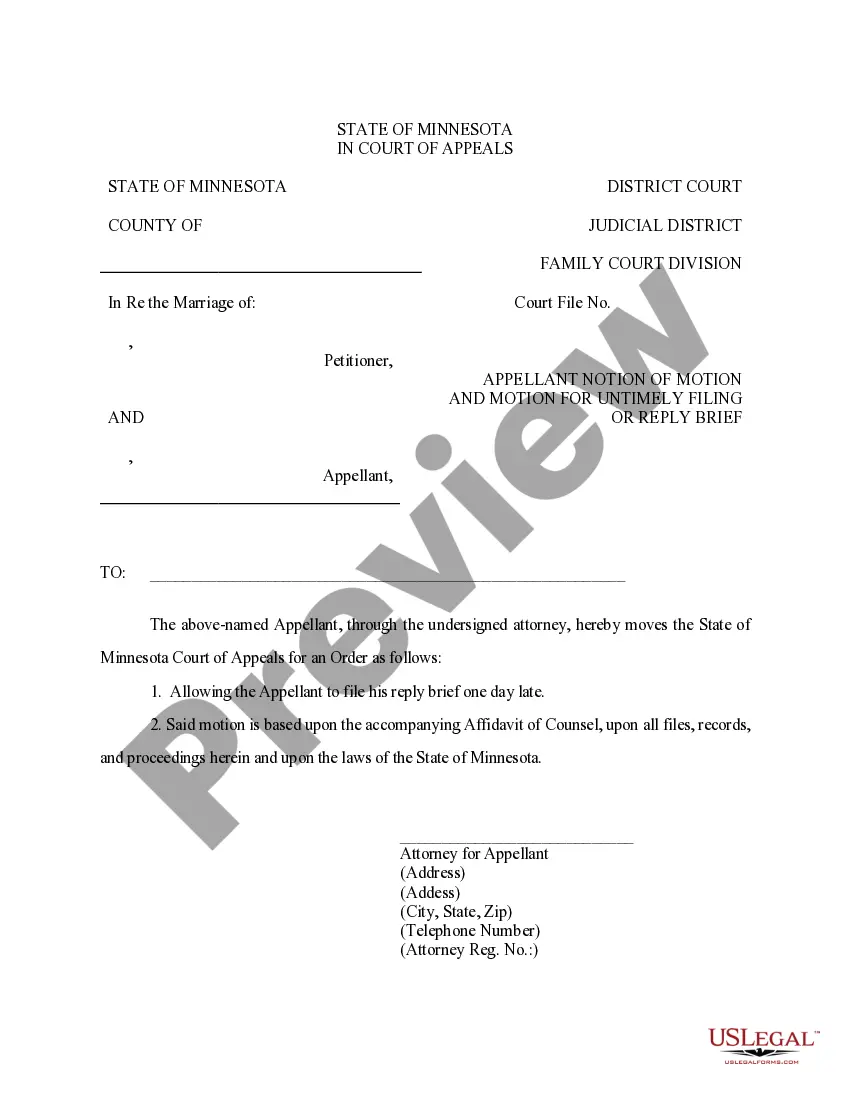

Minnesota Appellant's Notice of Motion and Motion for Late Filing of Reply Brief

Description

How to fill out Minnesota Appellant's Notice Of Motion And Motion For Late Filing Of Reply Brief?

Get any form from 85,000 legal documents such as Minnesota Appellant's Notice of Motion and Motion for Late Filing of Reply Brief on-line with US Legal Forms. Every template is drafted and updated by state-licensed legal professionals.

If you have already a subscription, log in. When you’re on the form’s page, click the Download button and go to My Forms to access it.

In case you haven’t subscribed yet, follow the tips below:

- Check the state-specific requirements for the Minnesota Appellant's Notice of Motion and Motion for Late Filing of Reply Brief you want to use.

- Look through description and preview the sample.

- As soon as you are sure the sample is what you need, just click Buy Now.

- Choose a subscription plan that works for your budget.

- Create a personal account.

- Pay in one of two suitable ways: by bank card or via PayPal.

- Select a format to download the file in; two options are available (PDF or Word).

- Download the document to the My Forms tab.

- When your reusable template is downloaded, print it out or save it to your device.

With US Legal Forms, you’ll always have instant access to the proper downloadable sample. The platform will give you access to forms and divides them into categories to streamline your search. Use US Legal Forms to obtain your Minnesota Appellant's Notice of Motion and Motion for Late Filing of Reply Brief fast and easy.

Form popularity

FAQ

Minnesota is allowing additional time for making 2020 state individual income tax filings and payments to May 17, 2021, without any penalty and interest being applied. This grace period does not include individual estimated tax payments.

You can file your Minnesota Individual Income Tax return electronically or by mail.You may qualify for free electronic filing if your income is $72,000 or less.

According to Minnesota Instructions, If you are a full-year Minnesota resident, you must file a Minnesota income tax return if you need to file a federal income tax return. If you are a Part year resident or nonresident, you must file if your Minnesota gross income meets the state's minimum filing requirement.

- Minnesota taxpayers can begin filing their state income tax returns today, Monday, January 27, 2020. This is the same date the Internal Revenue Service will begin accepting federal income tax returns. Taxpayers have until Wednesday, April 15, 2020, to file and pay their state and federal income taxes.