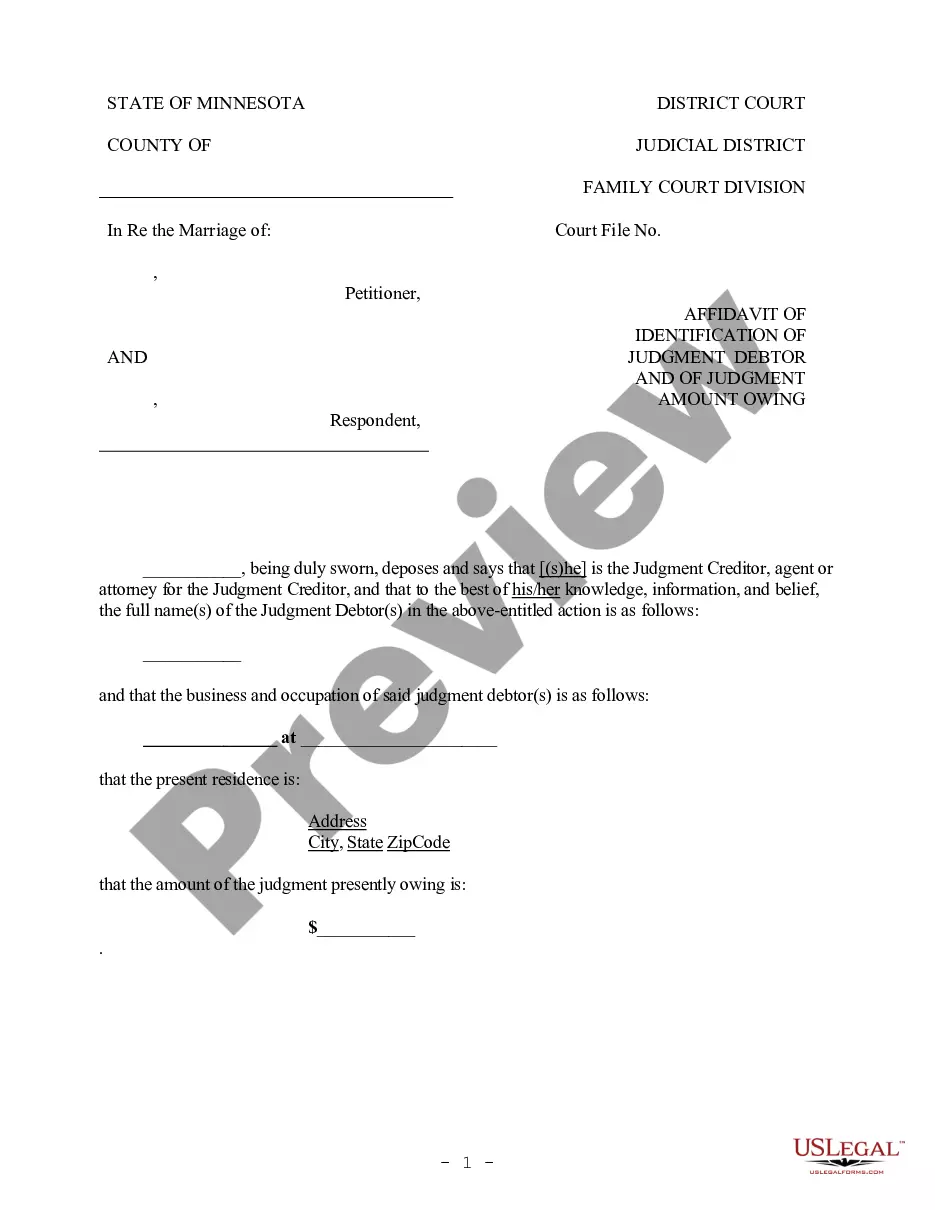

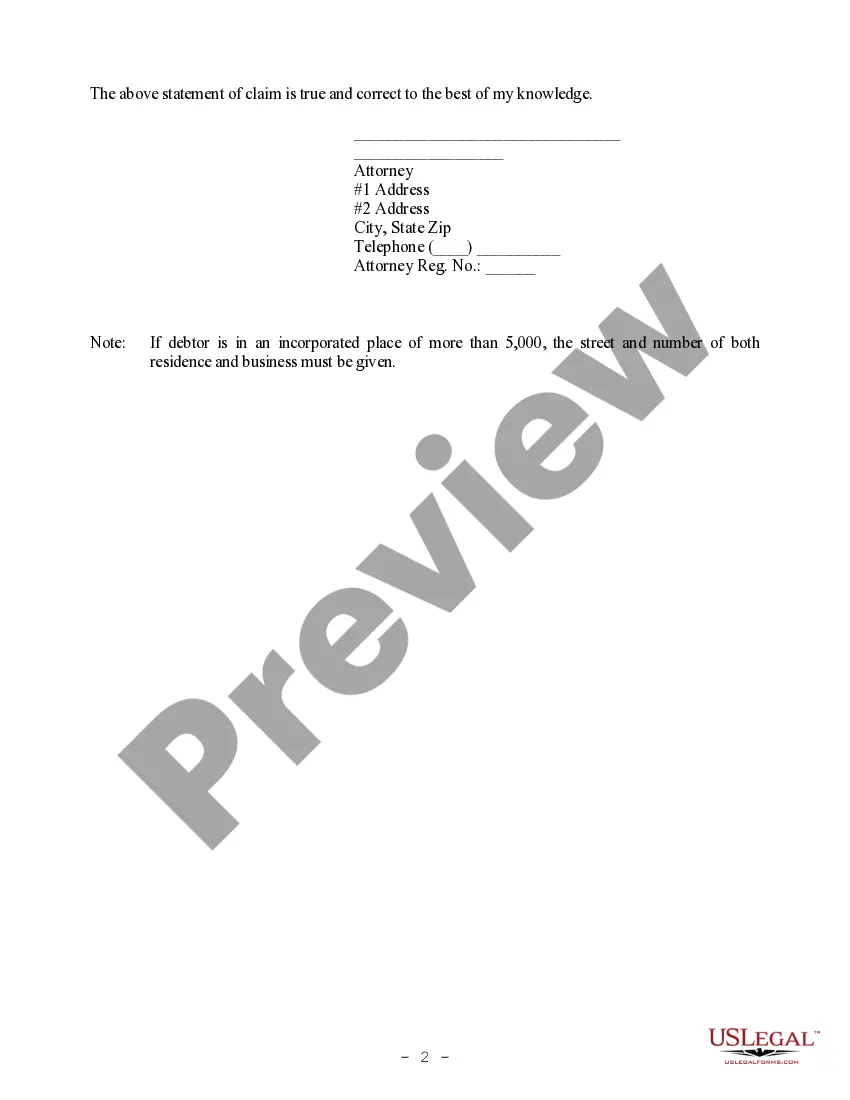

Minnesota Affidavit of Identification of Judgment Debtor and of Judgment Amount Owing

Description

How to fill out Minnesota Affidavit Of Identification Of Judgment Debtor And Of Judgment Amount Owing?

Have any form from 85,000 legal documents including Minnesota Affidavit of Identification of Judgment Debtor and of Judgment Amount Owing on-line with US Legal Forms. Every template is drafted and updated by state-accredited legal professionals.

If you already have a subscription, log in. Once you’re on the form’s page, click on the Download button and go to My Forms to get access to it.

If you have not subscribed yet, follow the tips listed below:

- Check the state-specific requirements for the Minnesota Affidavit of Identification of Judgment Debtor and of Judgment Amount Owing you need to use.

- Read description and preview the template.

- As soon as you are confident the template is what you need, click on Buy Now.

- Choose a subscription plan that works for your budget.

- Create a personal account.

- Pay in a single of two appropriate ways: by bank card or via PayPal.

- Pick a format to download the file in; two options are available (PDF or Word).

- Download the document to the My Forms tab.

- As soon as your reusable form is downloaded, print it out or save it to your gadget.

With US Legal Forms, you will always have instant access to the proper downloadable template. The platform gives you access to documents and divides them into categories to simplify your search. Use US Legal Forms to get your Minnesota Affidavit of Identification of Judgment Debtor and of Judgment Amount Owing easy and fast.

Form popularity

FAQ

In most cases, judgments can stay on your credit reports for up to seven years. This means that the judgment will continue to have a negative effect on your credit score for a period of seven years. In some states, judgments can stay on as long as ten years, or indefinitely if they remain unpaid.

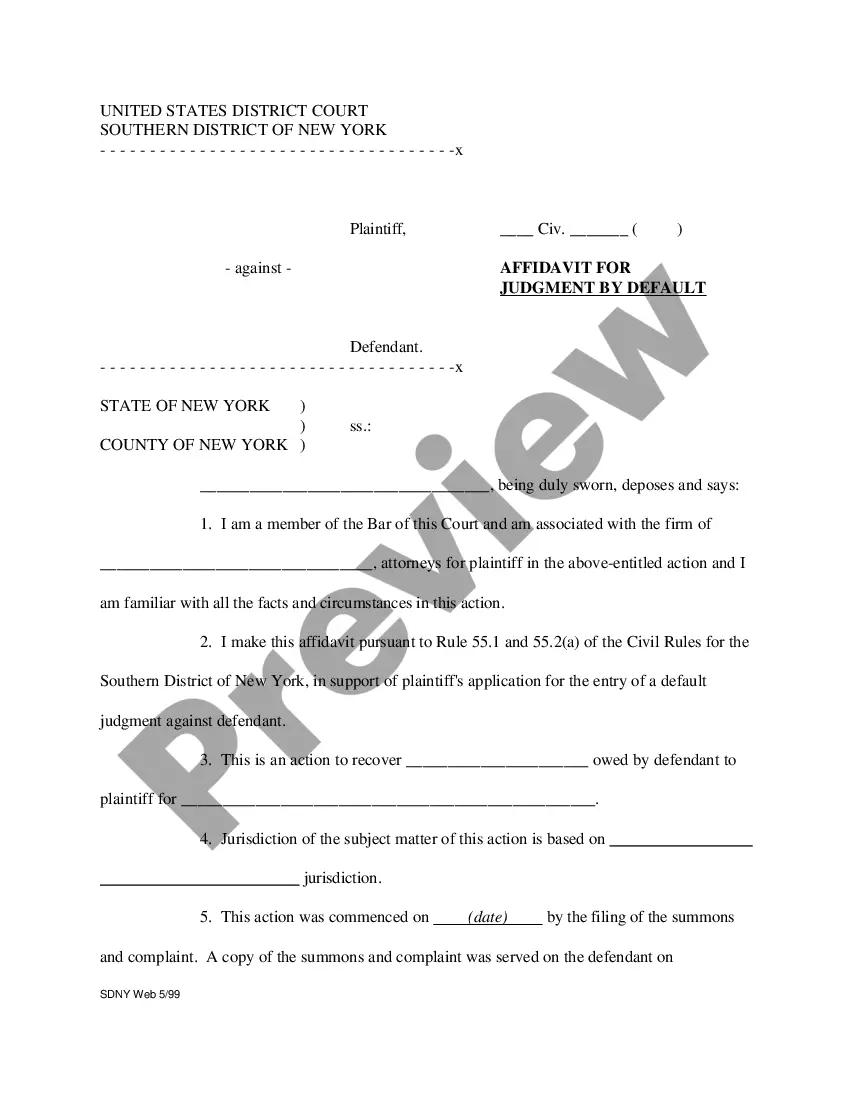

When a creditor sues you and wins, the court issues a money judgment against you. Once the creditor has a money judgment, it can use various methods to collect on that judgment. It can garnish your wages, place a levy on your bank account, or place a lien against any real estate that you own.

The exempt benefits are typically funds received from the government for a specific reason. For example, Veteran's Assistance benefits, Social Security, Workers' Compensation, Unemployment and Disability are benefits that cannot be seized in order to pay off outstanding debts.

If you lose a court case and the judge decides you must pay the creditor, a judgment will be entered against you. When a judgment has been entered against you, creditors can take some of your income or your assets to pay back the money you owe. Assets are things you own, like a bank account, a car, or jewelry.

If a person is deemed judgment proof, it likely means that they have no assets and no job. Creditors cannot seize the assets of someone who the court names judgment proof. Social security, disability, and unemployment benefits do not count as assets that can be taken by creditors.

Garnishment is the legal process whereby money or property that is owed to the Debtor or that is being held by someone (the Garnishee) for the Debtor, is taken to pay a Judgment. Wages and bank accounts are the most commonly garnished property.

Most garnishments are judgments for consumer debt. These include debts from credit cards, doctor bills, hospital bills, utility bills, phone bills, personal loans from a bank or credit union, debts owed to a landlord or former landlord, or any other debt for personal, family, or household purposes.

To fight a creditor's attempts to gain a judgement against you, you'll need to respond to the Summons and Complaint by providing an Answer to the court within the appropriate amount of time. Your Answer should include a request for the creditor to prove the validity of the debt.

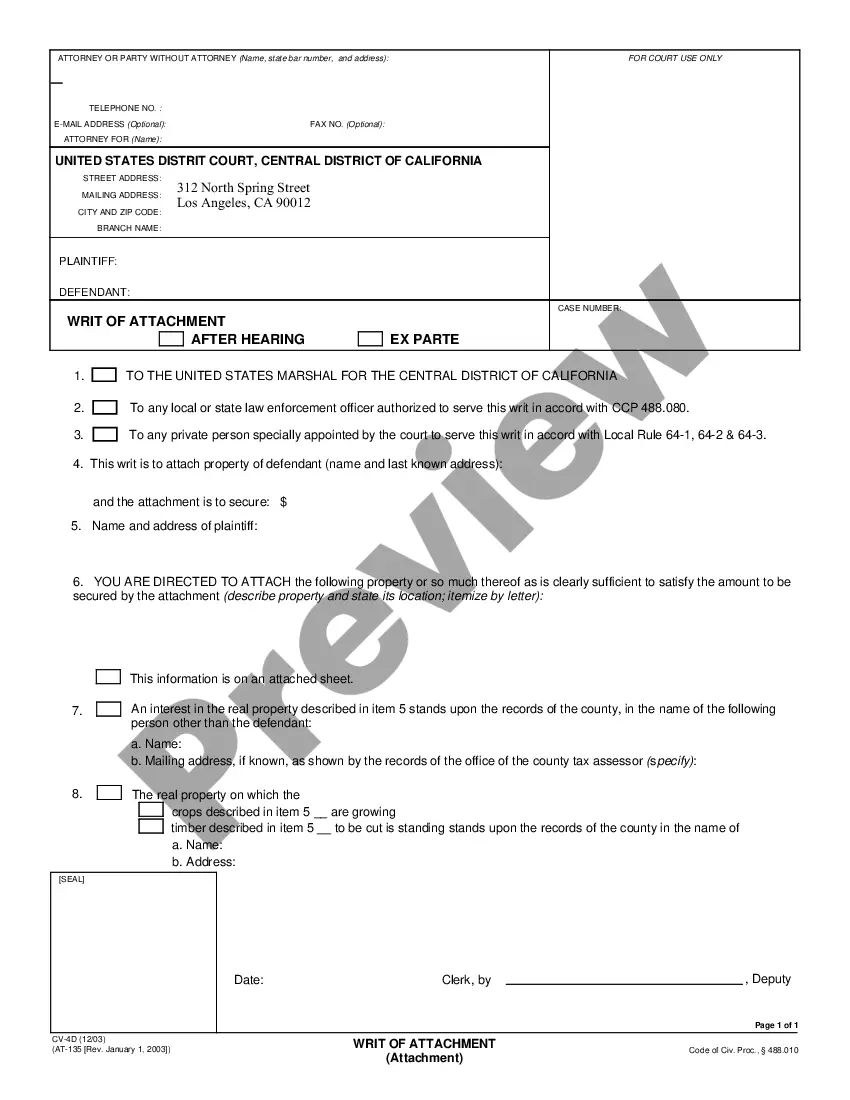

California allows the judgment to last ten years and it can be renewed for an additional ten years if the creditor files the required forms in a timely fashion. Failure to renew the judgment prior to the ten-year time limit voids the judgment forever.