Minnesota Letter regarding Agreement for Monthly Temporary Maintenance Payments

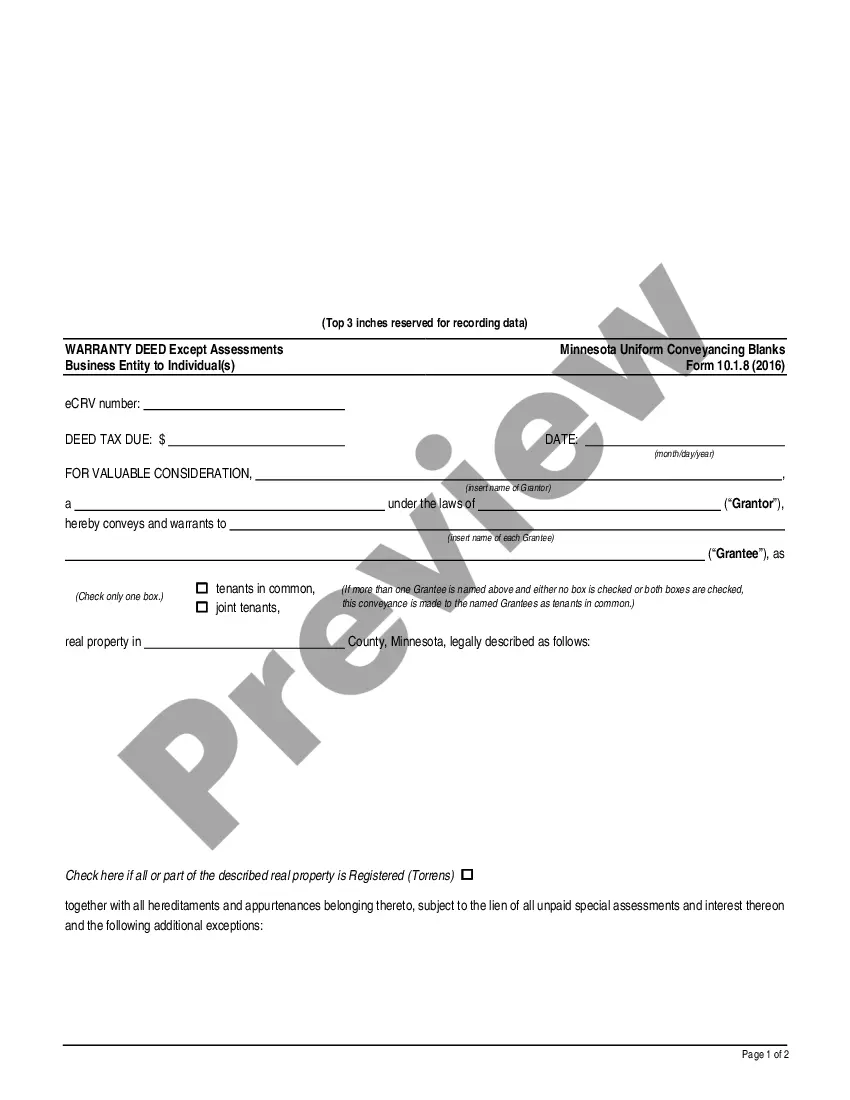

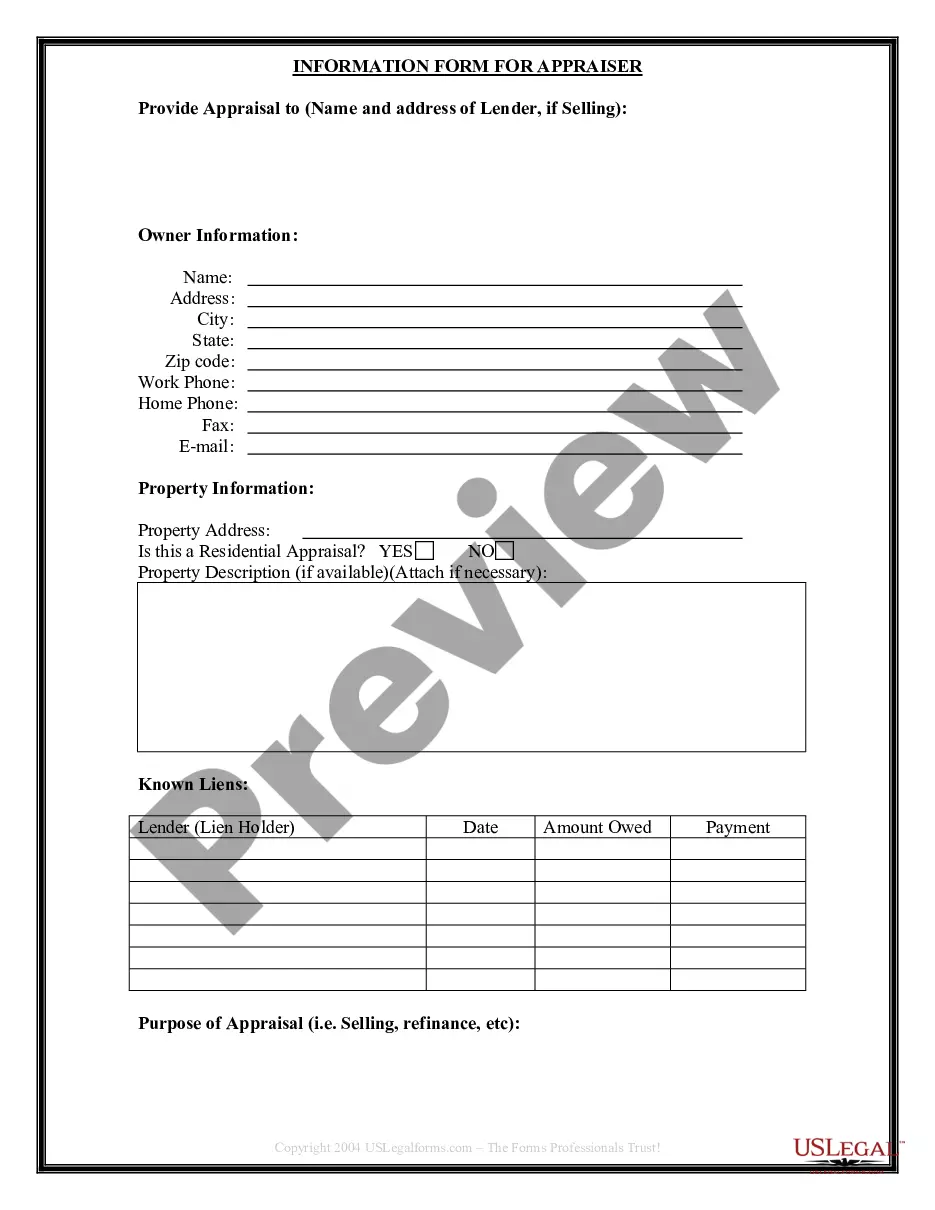

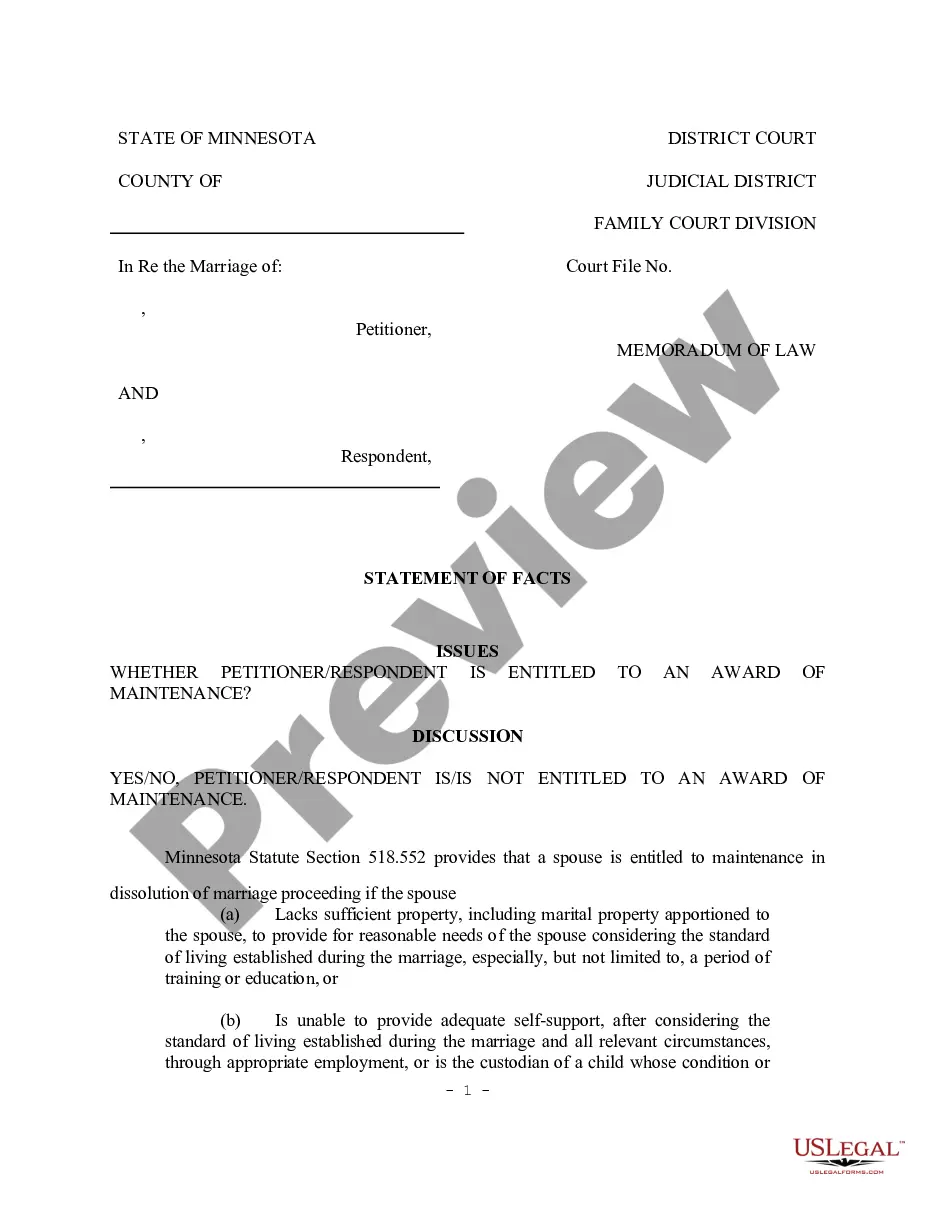

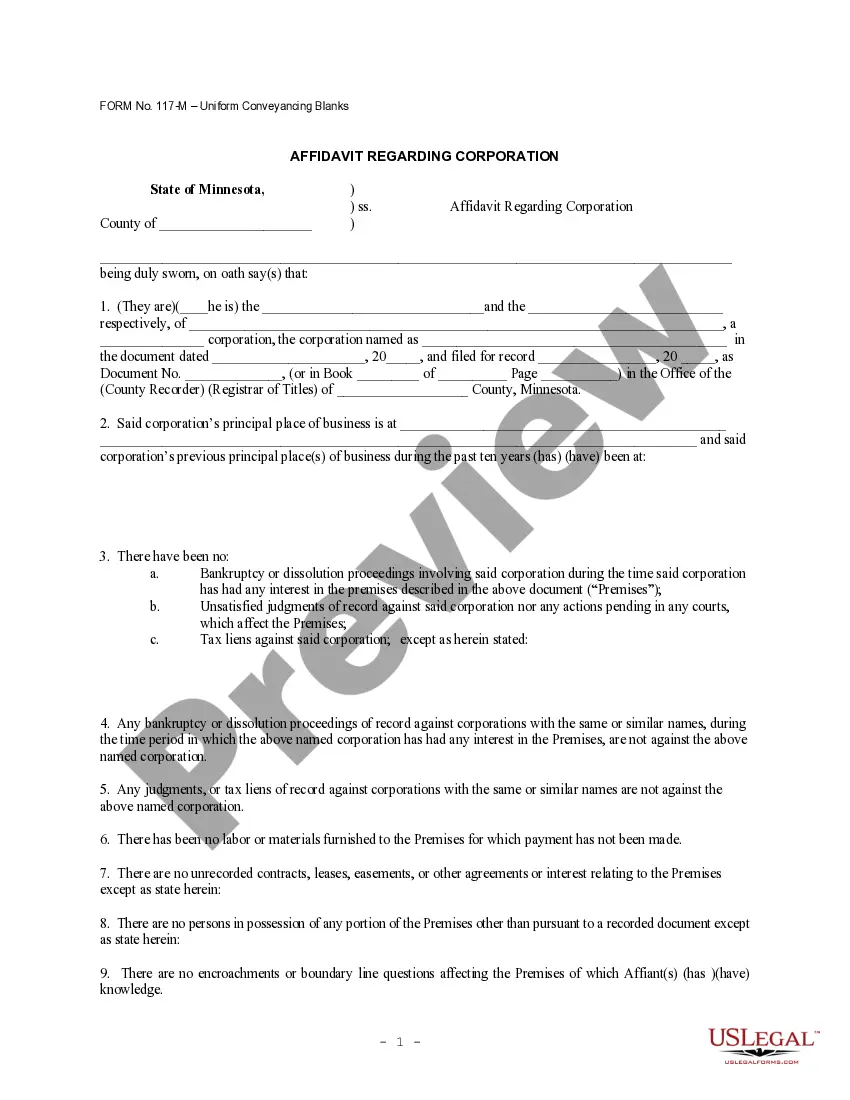

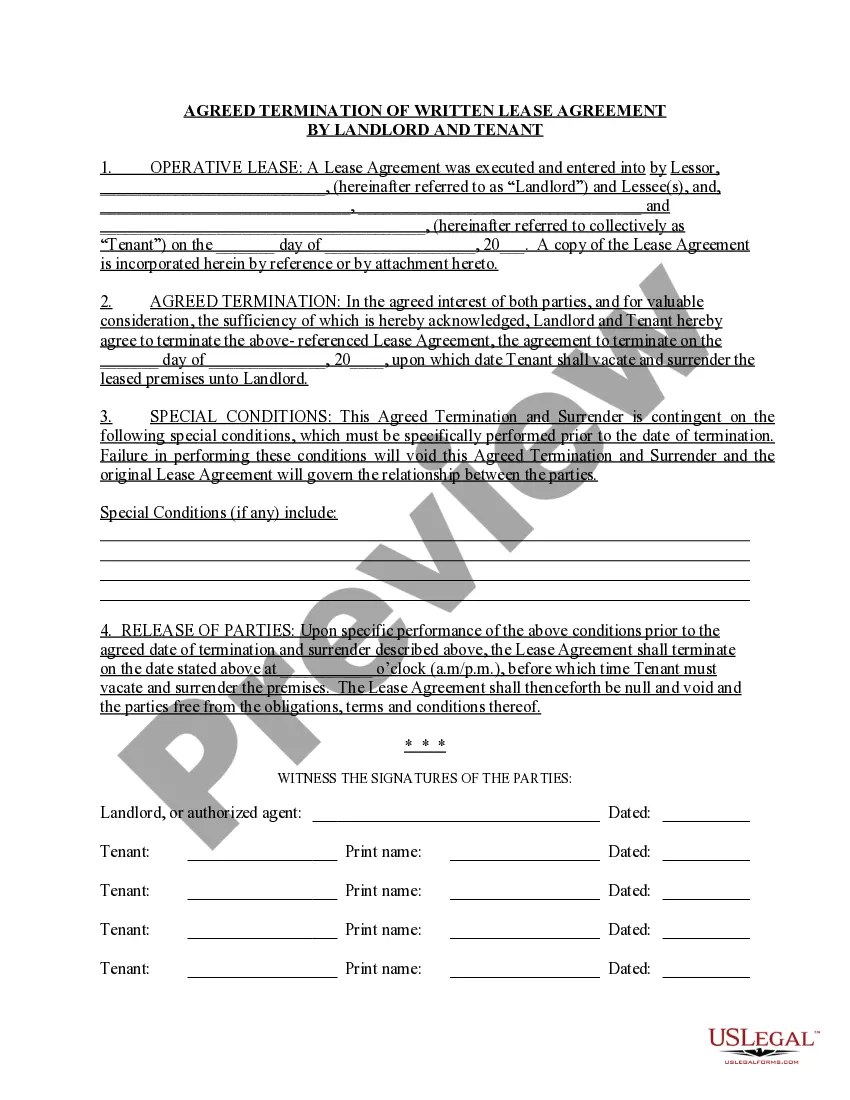

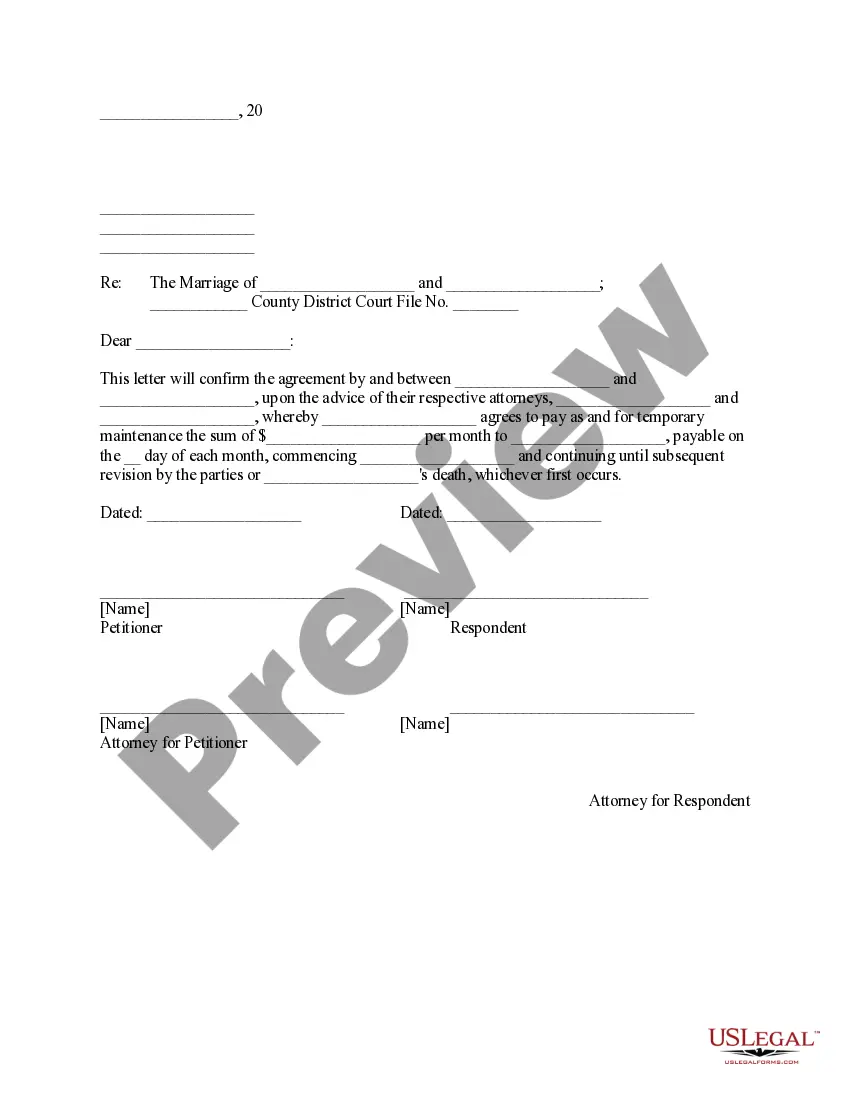

Description

How to fill out Minnesota Letter Regarding Agreement For Monthly Temporary Maintenance Payments?

Get any template from 85,000 legal documents including Minnesota Letter regarding Agreement for Monthly Temporary Maintenance Payments online with US Legal Forms. Every template is drafted and updated by state-licensed attorneys.

If you already have a subscription, log in. When you are on the form’s page, click the Download button and go to My Forms to get access to it.

In case you haven’t subscribed yet, follow the tips listed below:

- Check the state-specific requirements for the Minnesota Letter regarding Agreement for Monthly Temporary Maintenance Payments you would like to use.

- Look through description and preview the template.

- When you are sure the template is what you need, simply click Buy Now.

- Select a subscription plan that really works for your budget.

- Create a personal account.

- Pay in a single of two suitable ways: by card or via PayPal.

- Choose a format to download the file in; two ways are available (PDF or Word).

- Download the file to the My Forms tab.

- As soon as your reusable template is downloaded, print it out or save it to your gadget.

With US Legal Forms, you will always have immediate access to the appropriate downloadable sample. The platform gives you access to forms and divides them into categories to streamline your search. Use US Legal Forms to get your Minnesota Letter regarding Agreement for Monthly Temporary Maintenance Payments easy and fast.

Form popularity

FAQ

The standard refund time frame for a direct deposit from the IRS is 8-14 days. Generally speaking, the IRS deposits money on a Friday. However, your bank may take a day or two extra to post it to your account. If you chose to have a check mailed to you, it will take approximately 10 days longer.

You can pay Minnesota estimated tax through any of the following ways: Pay through our e-Services Payment System - It's secure, easy, and convenient. You can make a single payment or schedule all four payments at once. On the Welcome page, select No, I am not using a Letter ID.

During the eFile.com process, you can pay your taxes owed via electronic fund withdrawal from a bank account (direct debit) or check/money order. You can only submit tax payments for the current tax year, not previous or future tax years.

If you get MinnesotaCare, it will pay for a broad range of medical services, including all services that the government considers Essential Health Benefits (EHBs).Here is a list of the main services that MinnesotaCare provides: Alcohol and drug treatment. Chiropractic care. Dental care (limited for nonpregnant adults)

You may pay online using the Minnesota Department of Revenue's e-Services system or pay by phone, credit or debit card, or check. When paying electronically, you must use an account that is not associated with any foreign banks.

You may pay online using the Minnesota Department of Revenue's e-Services system or pay by phone, credit or debit card, or check. When paying electronically, you must use an account that is not associated with any foreign banks.

You may have to pay a monthly premium for MinnesotaCare. The exact amount you pay depends on your family's income and household size and the most you would have to pay is $80 per family member.

You may have to pay a monthly premium for MinnesotaCare. The exact amount you pay depends on your family's income and household size and the most you would have to pay is $80 per family member.

You can pay Minnesota estimated tax through any of the following ways: Pay through our e-Services Payment System - It's secure, easy, and convenient. You can make a single payment or schedule all four payments at once. On the Welcome page, select No, I am not using a Letter ID.