Minnesota Letter to Debt Collector Re Fair Debt Collection and Practices Act

Description

How to fill out Minnesota Letter To Debt Collector Re Fair Debt Collection And Practices Act?

Get any template from 85,000 legal documents including Minnesota Letter to Debt Collector Re Fair Debt Collection and Practices Act on-line with US Legal Forms. Every template is prepared and updated by state-certified attorneys.

If you have a subscription, log in. When you’re on the form’s page, click the Download button and go to My Forms to get access to it.

In case you haven’t subscribed yet, follow the steps listed below:

- Check the state-specific requirements for the Minnesota Letter to Debt Collector Re Fair Debt Collection and Practices Act you want to use.

- Look through description and preview the sample.

- When you are confident the template is what you need, click on Buy Now.

- Select a subscription plan that really works for your budget.

- Create a personal account.

- Pay out in just one of two suitable ways: by credit card or via PayPal.

- Choose a format to download the document in; two ways are available (PDF or Word).

- Download the document to the My Forms tab.

- After your reusable template is downloaded, print it out or save it to your device.

With US Legal Forms, you will always have quick access to the appropriate downloadable template. The platform gives you access to forms and divides them into groups to simplify your search. Use US Legal Forms to get your Minnesota Letter to Debt Collector Re Fair Debt Collection and Practices Act fast and easy.

Form popularity

FAQ

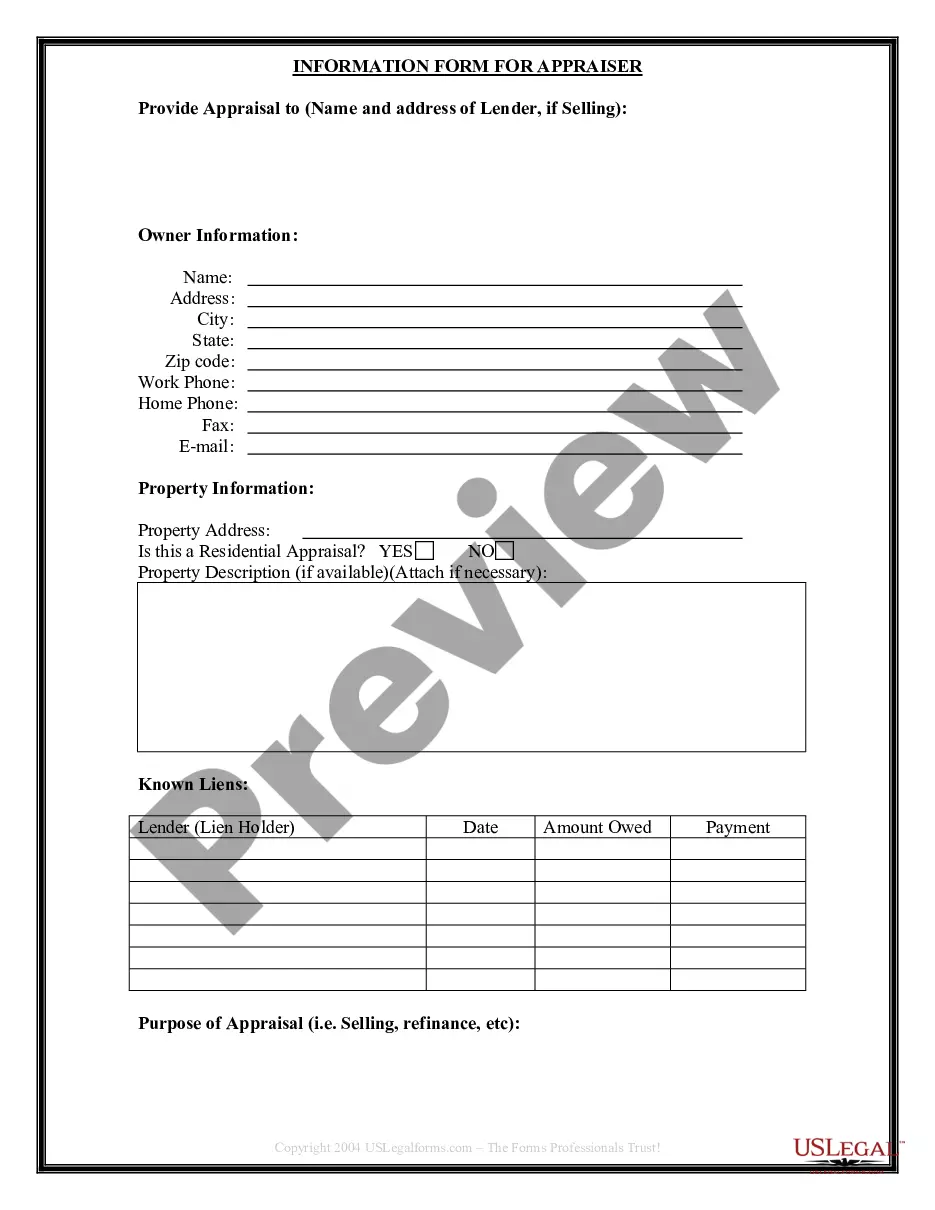

Creditors do not have to respond to every debt verification letter sent to them. Under the FDCPA, if a collector contacts you about a debt, you have 30 days to request validation. If you send a verification request within that time, the creditor is legally obligated to respond to you.

Refused Offers A creditor isn't required to negotiate a settlement offer with a debtor, according to the Federal Trade Commission, but does so at its own discretion. This applies to a collection agency as well.The agency can choose to refuse your settlement offer and instead request payment of the debt in full.

If you pay the collection agency directly, the debt is removed from your credit report in six years from the date of payment. If you don't pay, it purges six years from the last activity date, but you may be at risk for wage garnishment.

You might get sued. The debt collector may file a lawsuit against you if you ignore the calls and letters. If you then ignore the lawsuit, this could lead to a judgment and the collection agency may be able to garnish your wages or go after the funds in your bank account. (Learn more about Creditor Lawsuits.)

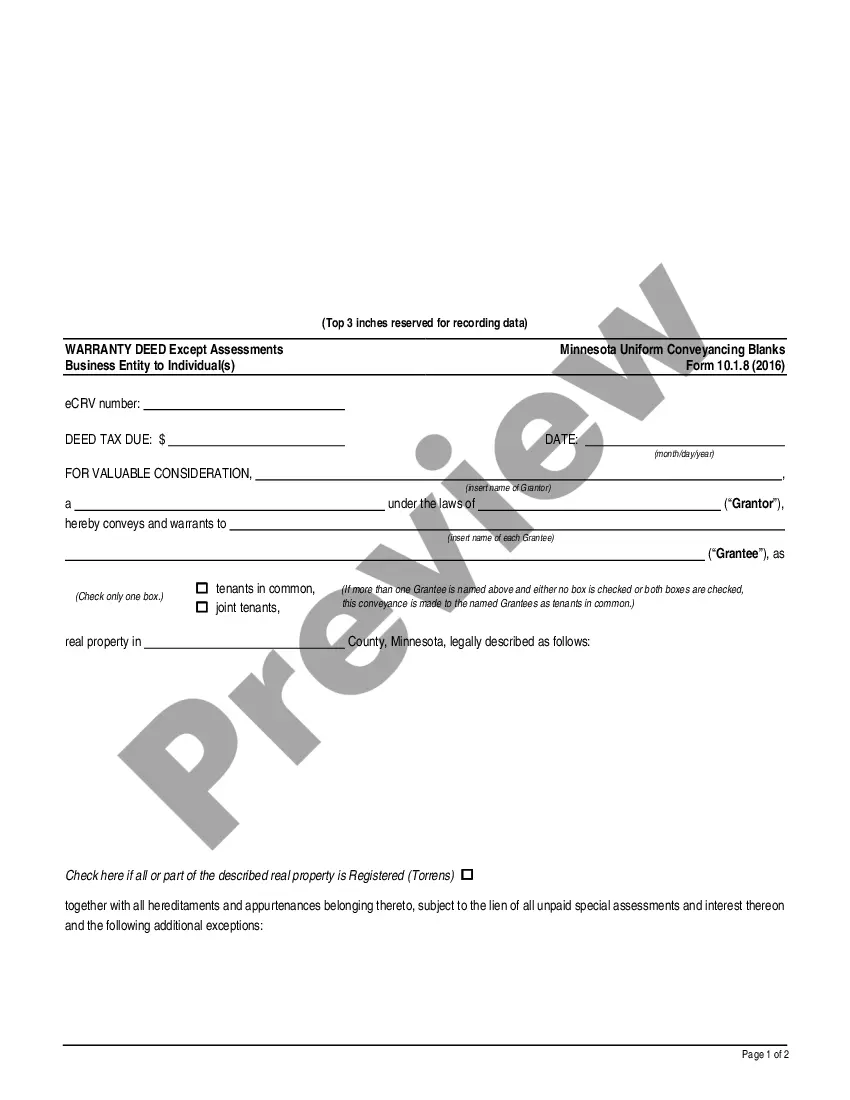

The statute of limitations for bringing a lawsuit for breach of contract under Minnesota law is six (6) years. This means that a creditor or debt collector can sue you anytime within six (6) years from the date of your last purchase or last payment, whichever was later.

Never Give Them Your Personal Information. A call from a debt collection agency will include a series of questions. Never Admit That The Debt Is Yours. Even if the debt is yours, don't admit that to the debt collector. Never Provide Bank Account Information.

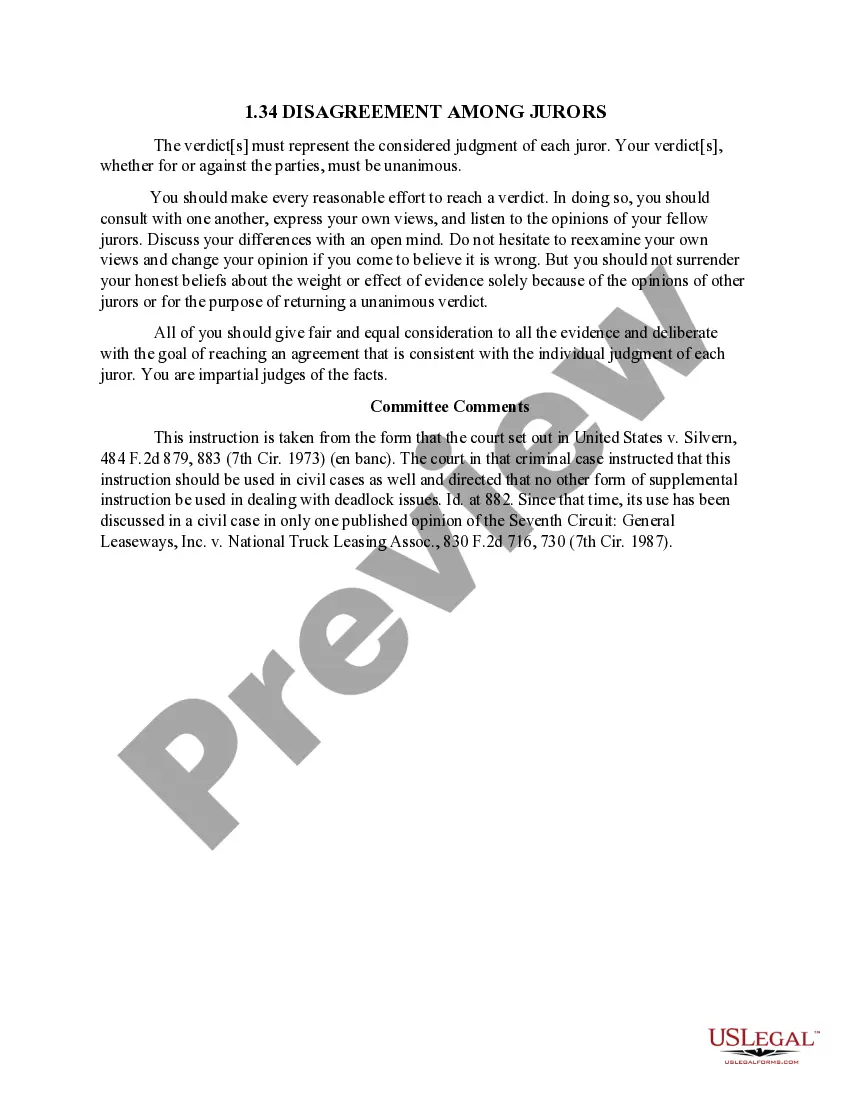

The Fair Debt Collection Practices Act (FDCPA) is the main federal law that governs debt collection practices. The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you. The FDCPA covers the collection of: Mortgages.

Improve Your Credit Score After seven years, collection accounts drop off your credit report, even if you never pay them. 1 But if the accounts are less than seven years old and not approaching the credit reporting time limit, a paid collection is better for your credit score than an unpaid one.

You're protected from harassing or abusive practices The Fair Debt Collection Practices Act prohibits debt collectors from using any harassing or abusive practices in an attempt to collect the debt.Along with other restrictions, debt collectors cannot: Use profane language. Threaten or use violence.