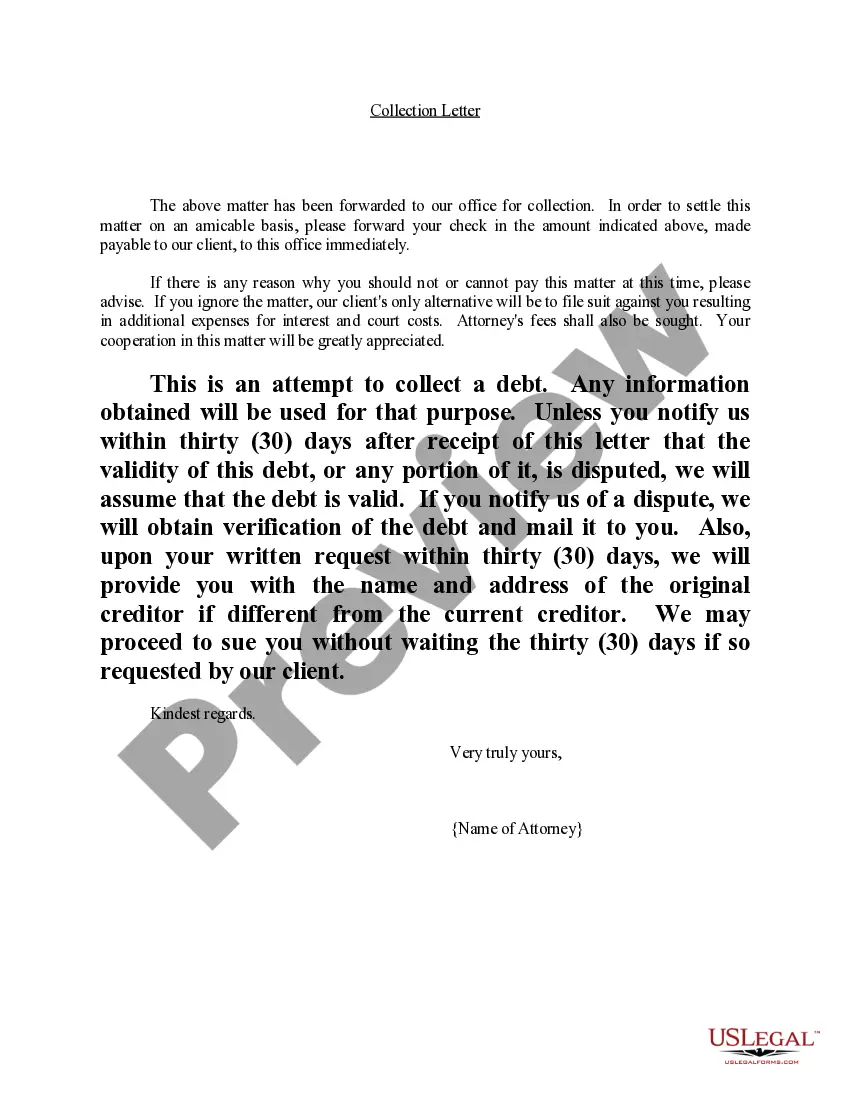

Minnesota Collection Letter

Description

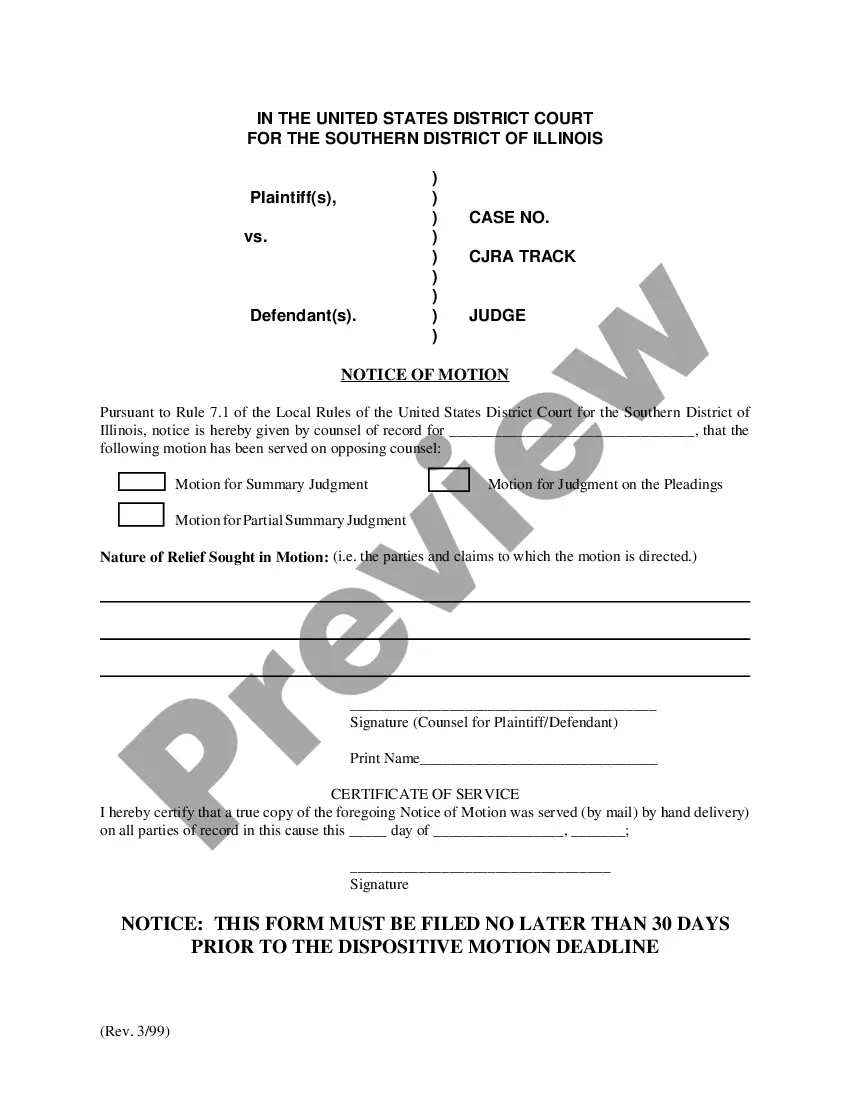

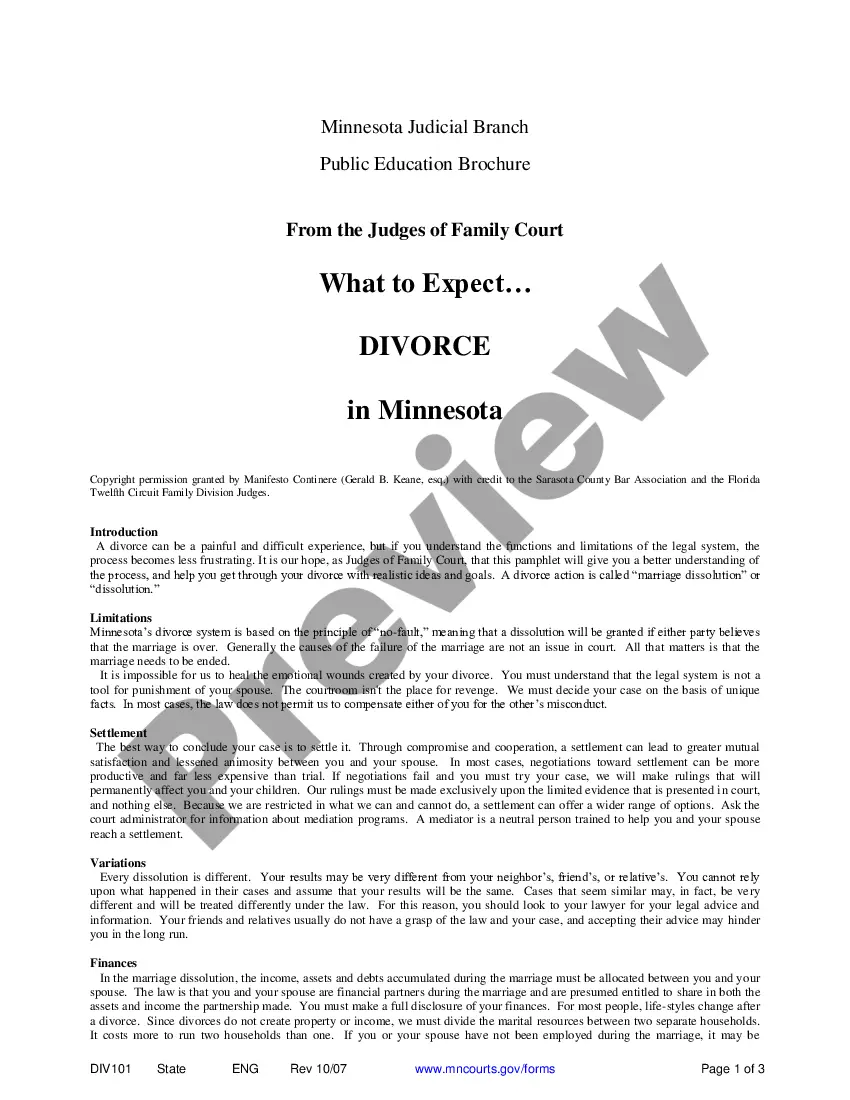

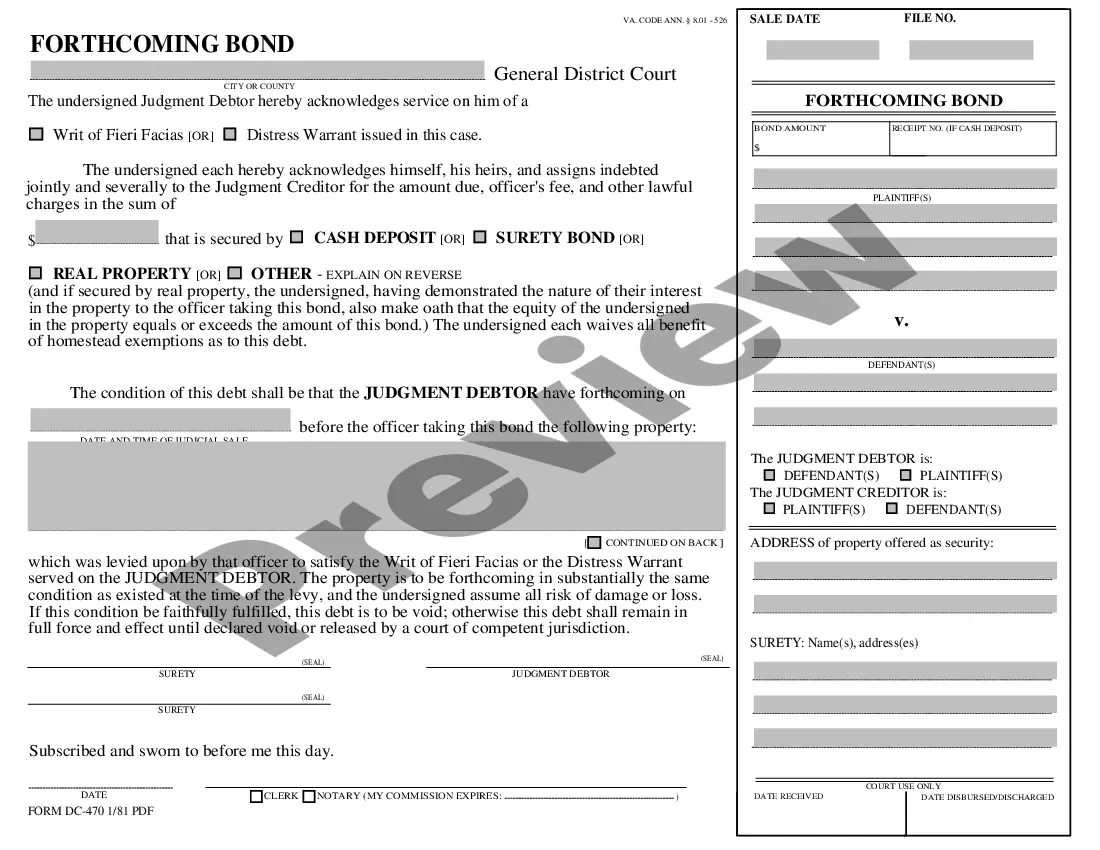

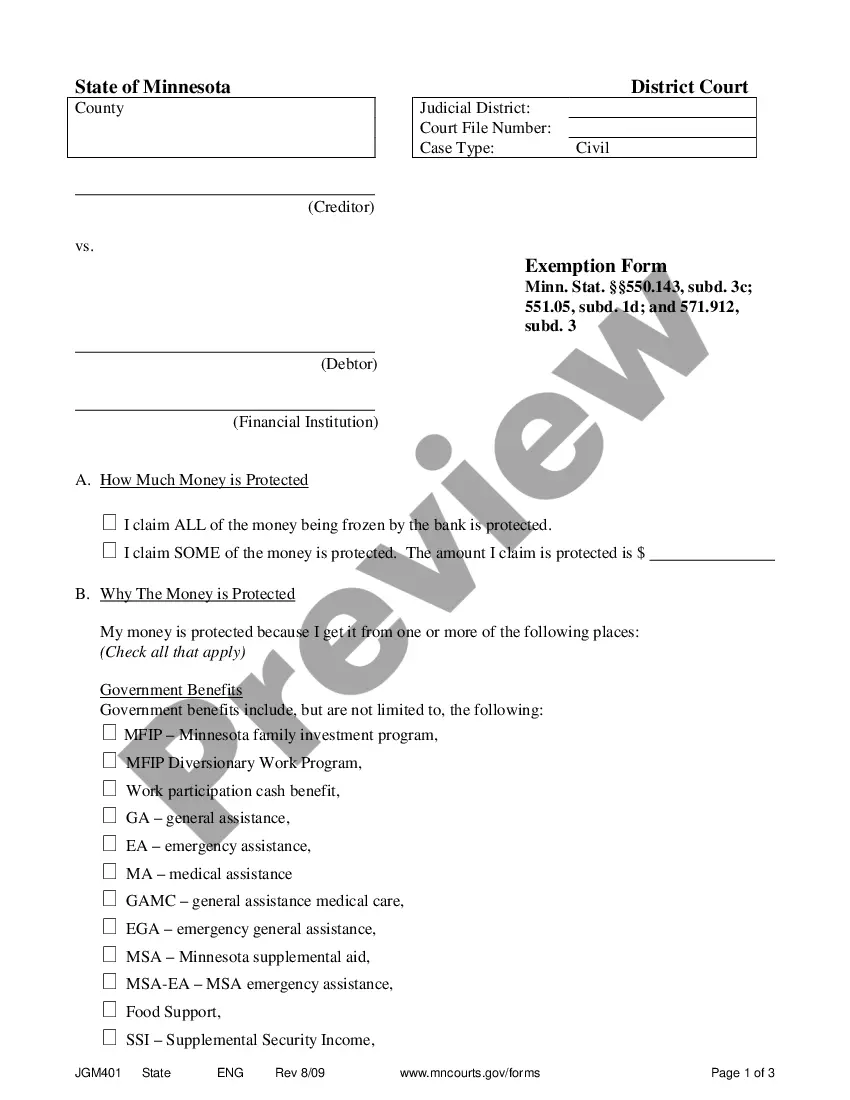

How to fill out Minnesota Collection Letter?

Get any form from 85,000 legal documents including Minnesota Collection Letter online with US Legal Forms. Every template is drafted and updated by state-certified attorneys.

If you have already a subscription, log in. Once you’re on the form’s page, click on the Download button and go to My Forms to access it.

In case you have not subscribed yet, follow the tips below:

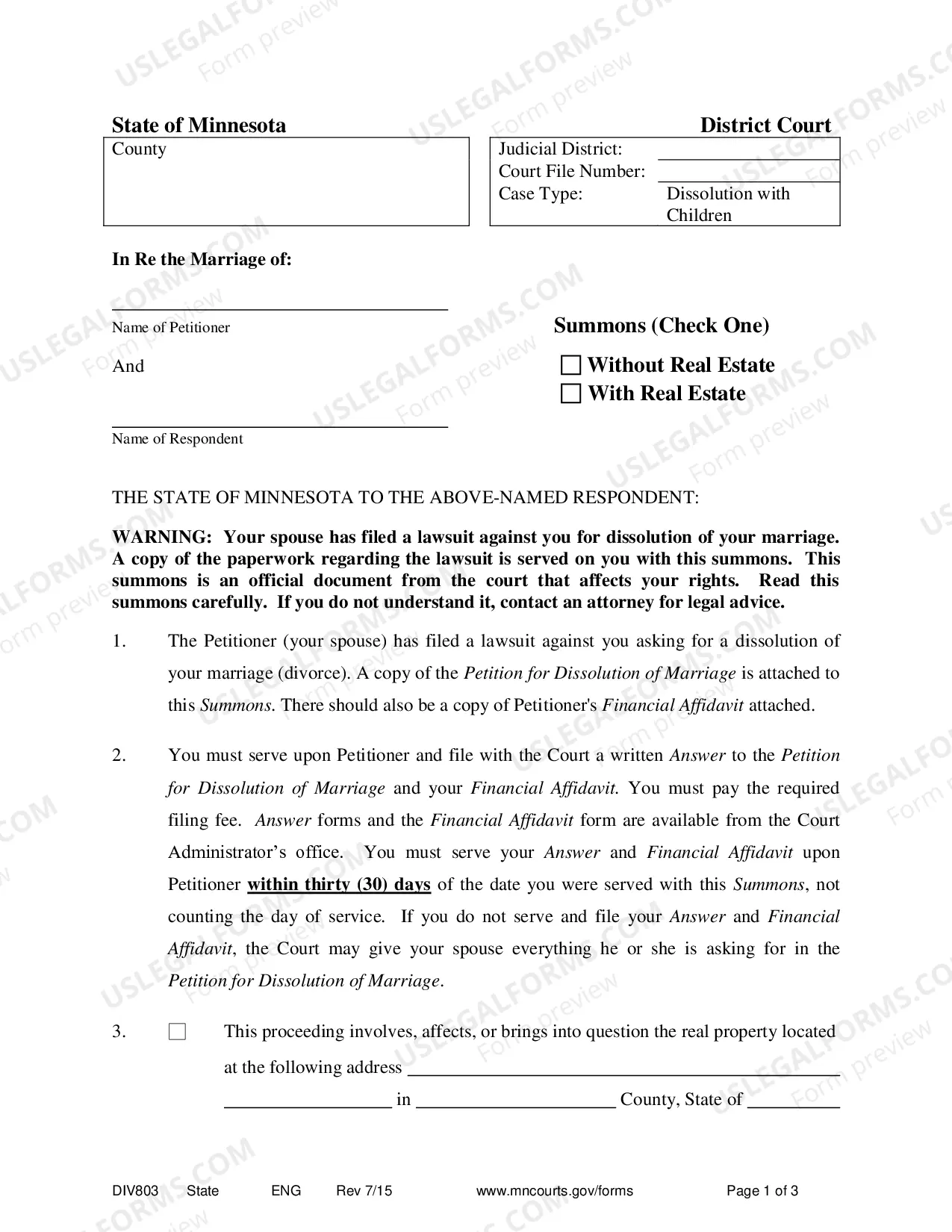

- Check the state-specific requirements for the Minnesota Collection Letter you want to use.

- Read description and preview the template.

- When you’re confident the template is what you need, simply click Buy Now.

- Select a subscription plan that really works for your budget.

- Create a personal account.

- Pay out in one of two suitable ways: by card or via PayPal.

- Select a format to download the document in; two options are available (PDF or Word).

- Download the document to the My Forms tab.

- As soon as your reusable template is downloaded, print it out or save it to your device.

With US Legal Forms, you’ll always have instant access to the appropriate downloadable template. The platform provides you with access to documents and divides them into categories to simplify your search. Use US Legal Forms to obtain your Minnesota Collection Letter easy and fast.

Form popularity

FAQ

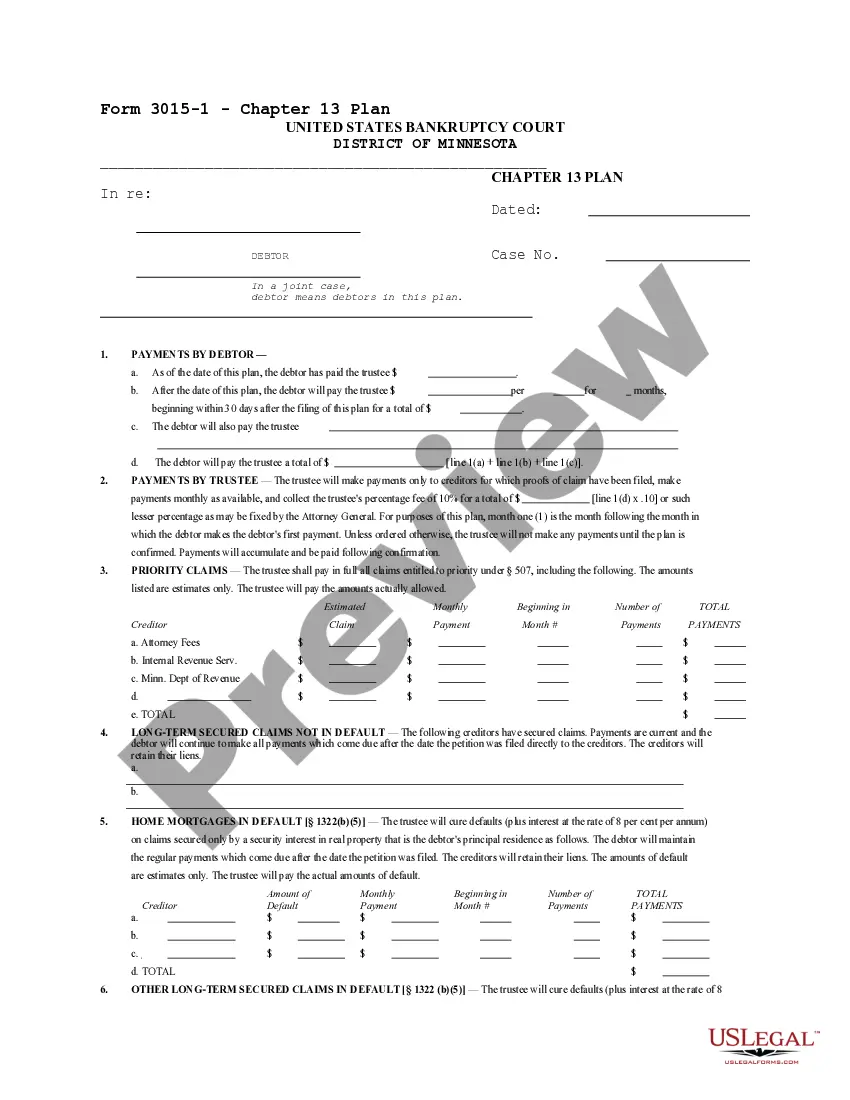

The statute of limitations for bringing a lawsuit for breach of contract under Minnesota law is six (6) years. This means that a creditor or debt collector can sue you anytime within six (6) years from the date of your last purchase or last payment, whichever was later.

Never Give Them Your Personal Information. A call from a debt collection agency will include a series of questions. Never Admit That The Debt Is Yours. Even if the debt is yours, don't admit that to the debt collector. Never Provide Bank Account Information.

You'll get notices and possibly calls seeking payment. At some point, usually after 180 days, the creditor such as a credit card company, bank or medical provider gives up on trying to collect. The original creditor may then sell the debt to a collections agency to recoup losses.

In most cases, the statute of limitations for a debt will have passed after 10 years. This means that a debt collector may still attempt to pursue it, but they can't typically take legal action against you.

The time limits for civil claims and other actions in Minnesota vary from two years for personal injury claims to 10 years for judgments. Fraud, injury to personal property, and trespassing claims have a six-year statute of limitations, as do both written and oral contracts.

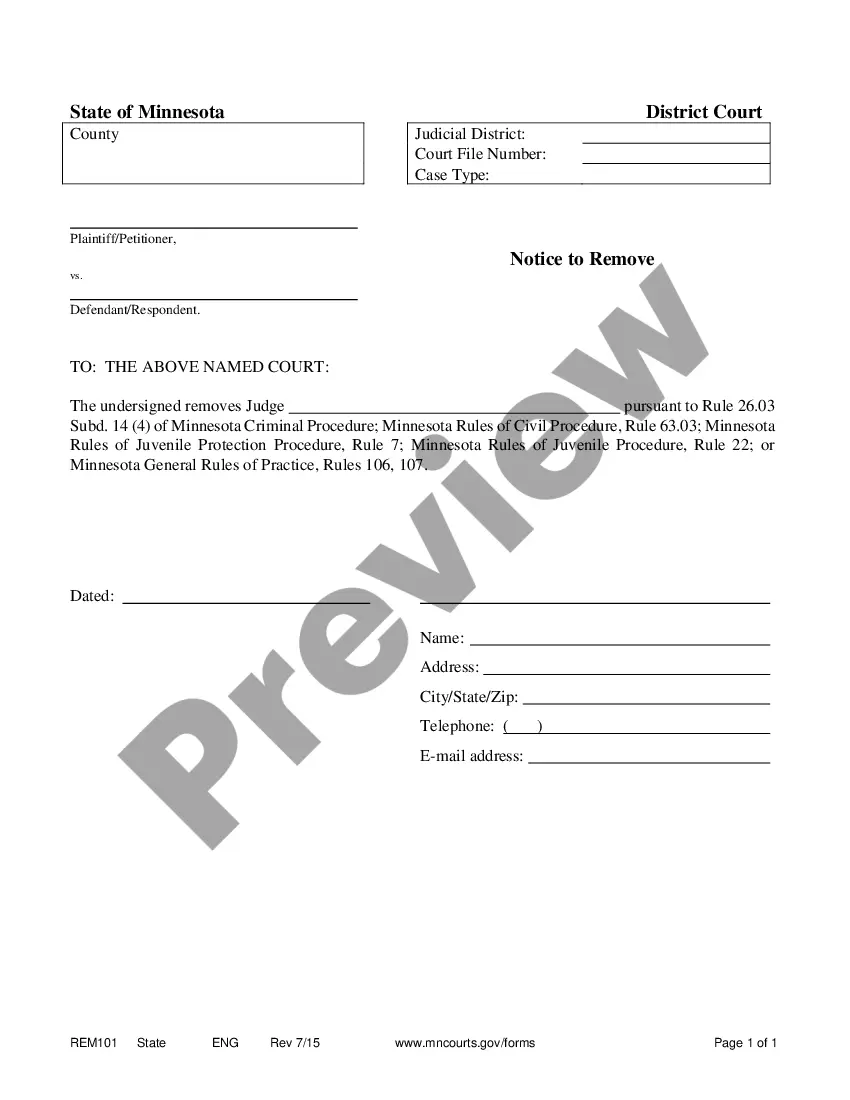

You received a letter in the mail. The agency is licensed in your state. The collector can verify your personal details. You can request information about the debt. There's more than one method of payment. A company works with you, not against you.

Refused Offers A creditor isn't required to negotiate a settlement offer with a debtor, according to the Federal Trade Commission, but does so at its own discretion. This applies to a collection agency as well.The agency can choose to refuse your settlement offer and instead request payment of the debt in full.

You might get sued. The debt collector may file a lawsuit against you if you ignore the calls and letters. If you then ignore the lawsuit, this could lead to a judgment and the collection agency may be able to garnish your wages or go after the funds in your bank account. (Learn more about Creditor Lawsuits.)

If you pay the collection agency directly, the debt is removed from your credit report in six years from the date of payment. If you don't pay, it purges six years from the last activity date, but you may be at risk for wage garnishment.