Minnesota Chapter 13 Plan

Description

How to fill out Minnesota Chapter 13 Plan?

Get any template from 85,000 legal documents including Minnesota Chapter 13 Plan online with US Legal Forms. Every template is drafted and updated by state-accredited legal professionals.

If you already have a subscription, log in. When you’re on the form’s page, click on the Download button and go to My Forms to get access to it.

In case you have not subscribed yet, follow the steps below:

- Check the state-specific requirements for the Minnesota Chapter 13 Plan you want to use.

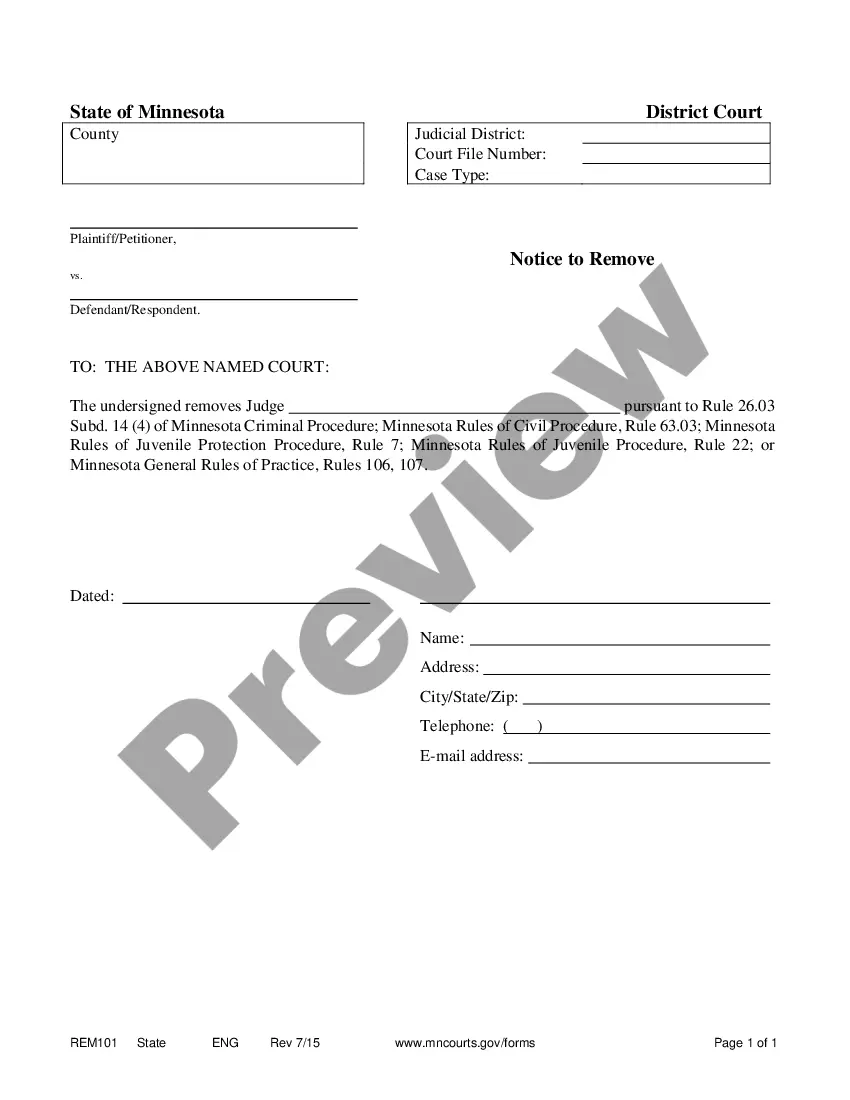

- Read through description and preview the sample.

- As soon as you’re confident the sample is what you need, just click Buy Now.

- Select a subscription plan that actually works for your budget.

- Create a personal account.

- Pay out in a single of two suitable ways: by bank card or via PayPal.

- Choose a format to download the document in; two options are available (PDF or Word).

- Download the document to the My Forms tab.

- When your reusable template is downloaded, print it out or save it to your device.

With US Legal Forms, you’ll always have immediate access to the proper downloadable template. The platform will give you access to documents and divides them into categories to streamline your search. Use US Legal Forms to obtain your Minnesota Chapter 13 Plan fast and easy.

Form popularity

FAQ

You take and complete a credit counseling course. You'll prepare the bankruptcy petition and the proposed Chapter 13 plan. You file your bankruptcy petition, proposed plan, and other required documents. The court appoints a bankruptcy trustee to administer your case. The automatic stay takes effect.

To qualify for Chapter 13 bankruptcy: You must have regular income. Your unsecured debt cannot exceed $394,725, and your secured debt cannot exceed $1,184,200. You must be current on tax filings.

Generally speaking, the funds you have in your bank accounts are safe when you file for Chapter 13 bankruptcy.Chapter 13 also allows debtors to keep bank account funds in excess of the allowable exemption amount provided the excess amounts are worked into the Chapter 13 plan and paid back over the life of the plan.

The difference between your income on Schedule I and your expenses on Schedule J will be your Chapter 13 plan payment. Your unsecured creditors will receive a percentage of the disposable income that remains after secured and priority creditors receive payment.

The Overall Chapter 13 Average Payment. The average payment for a Chapter 13 case overall is probably about $500 to $600 per month. This information, however, may not be very helpful for your particular situation.

In Chapter 13 bankruptcy, you pay your unsecured creditors an amount between 0 and 100% of what you owe them. The exact amount is depends on these rules: (1) The minimum amount you must pay is equal to the amount your unsecured creditors would have received had you filed for Chapter 7 bankruptcy.

Debts You Must Pay in Full Through Your Plan. Add up the following debts and divide by the number of months your plan will last. Secured Debt Payments on Property You Want to Keep. Unsecured Debts. Length of Your Repayment Plan.

Chapter 13 typically lasts for 3 to 5 years and involves a repayment plan, where you pay some or all of the money owed to your creditors over the length of the plan. Written by Attorney Eva Bacevice. A Chapter 13 bankruptcy case will typically take between three and five years to complete.