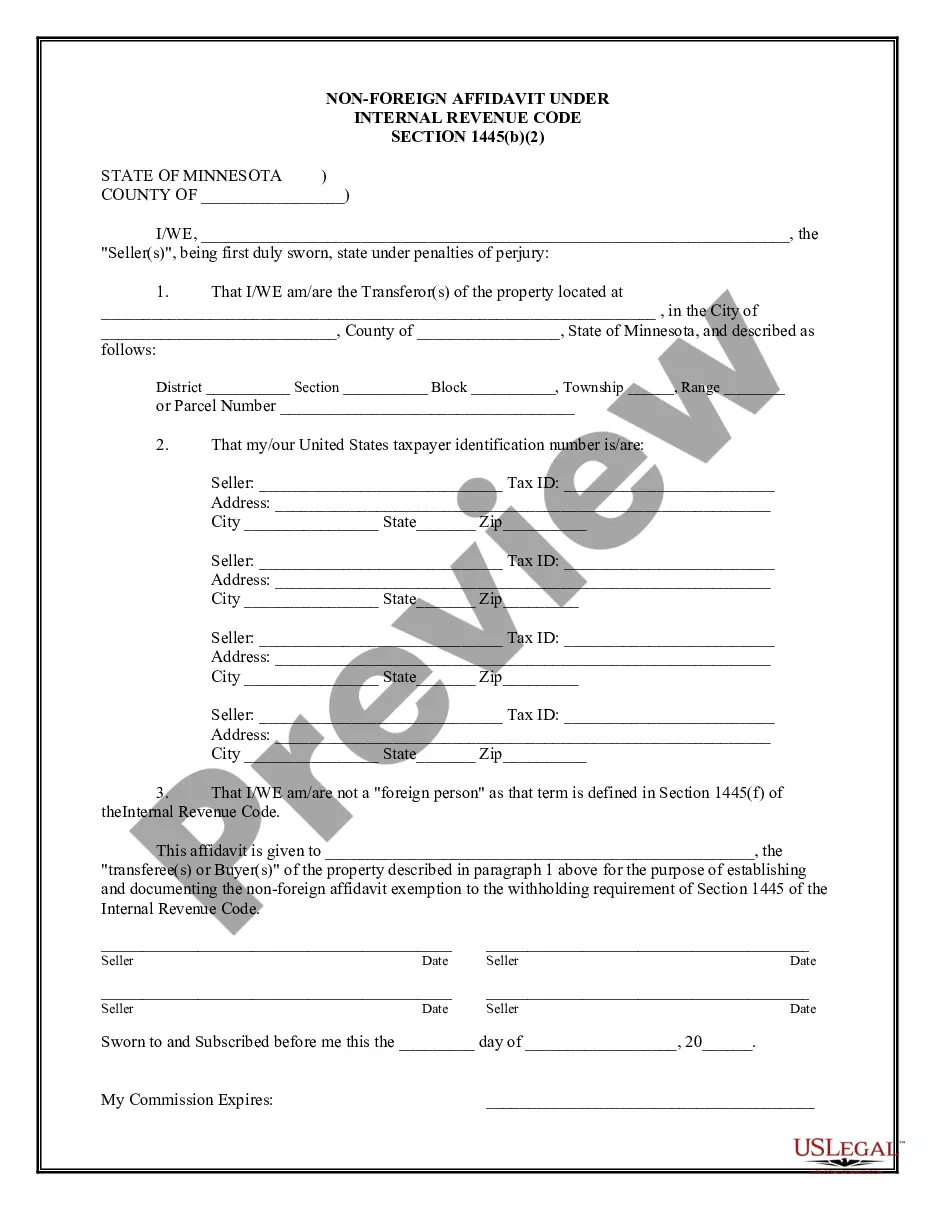

Minnesota Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Minnesota Non-Foreign Affidavit Under IRC 1445?

Get any form from 85,000 legal documents such as Minnesota Non-Foreign Affidavit Under IRC 1445 online with US Legal Forms. Every template is prepared and updated by state-accredited legal professionals.

If you have a subscription, log in. When you’re on the form’s page, click the Download button and go to My Forms to get access to it.

If you have not subscribed yet, follow the steps listed below:

- Check the state-specific requirements for the Minnesota Non-Foreign Affidavit Under IRC 1445 you would like to use.

- Look through description and preview the template.

- Once you are sure the template is what you need, click Buy Now.

- Choose a subscription plan that works for your budget.

- Create a personal account.

- Pay out in a single of two appropriate ways: by credit card or via PayPal.

- Choose a format to download the document in; two options are available (PDF or Word).

- Download the file to the My Forms tab.

- As soon as your reusable form is downloaded, print it out or save it to your gadget.

With US Legal Forms, you’ll always have immediate access to the proper downloadable template. The service provides you with access to forms and divides them into categories to simplify your search. Use US Legal Forms to get your Minnesota Non-Foreign Affidavit Under IRC 1445 easy and fast.

Form popularity

FAQ

What Is a Certification of Non-Foreign Status? With a Certification of Non-Foreign Status, the seller of real estate is certifying under penalty of perjury, that the seller is not foreign. Therefore, the seller and the transaction will not have the withholding requirements.

This document, included in the seller's opening package, requests that the seller swears under penalty of perjury that they are not a non-resident alien for purposes of United States income taxation. A Seller unable to complete this affidavit may be subject to withholding up to 15%.

A withholding certificate is an application for a reduced withholding based on the gain of a sale instead of the selling price. If 15% of the selling price is more than the tax you will owe on this sale, then a withholding certificate may be ideal for you.

A foreign person includes a nonresident alien individual, foreign corporation, foreign partnership, foreign trust, foreign estate, and any other person that is not a U.S. person. It also includes a foreign branch of a U.S. financial institution if the foreign branch is a qualified intermediary.

The disposition of a U.S. real property interest by a foreign person (the transferor) is subject to income tax withholding (IRC section 1445). The transferee is the withholding agent.If the transferor is a foreign person and you fail to withhold, you may be held liable for the tax.

You or a member of your family must have definite plans to reside at the property for at least 50% of the number of days the property is used by any person during each of the first two 12-month periods following the date of transfer.

The disposition of a U.S. real property interest by a foreign person (the transferor) is subject to the Foreign Investment in Real Property Tax Act of 1980 (FIRPTA) income tax withholding. FIRPTA authorized the United States to tax foreign persons on dispositions of U.S. real property interests.