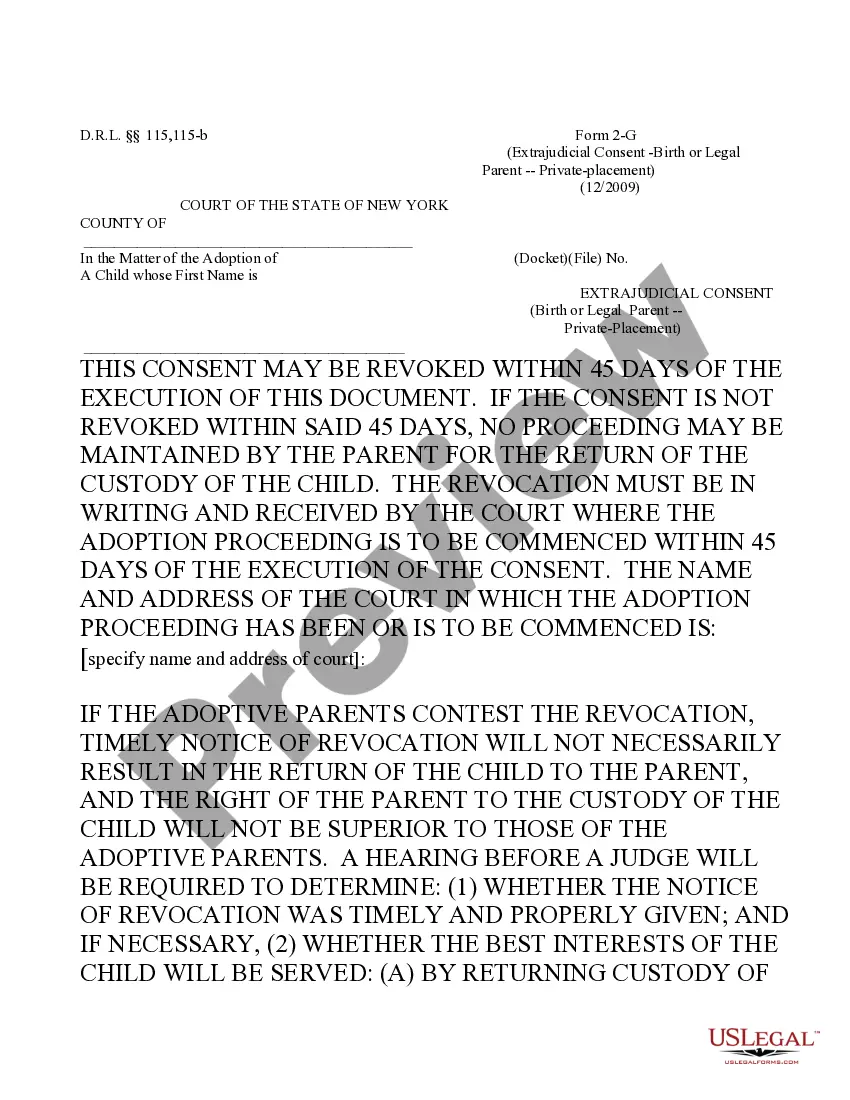

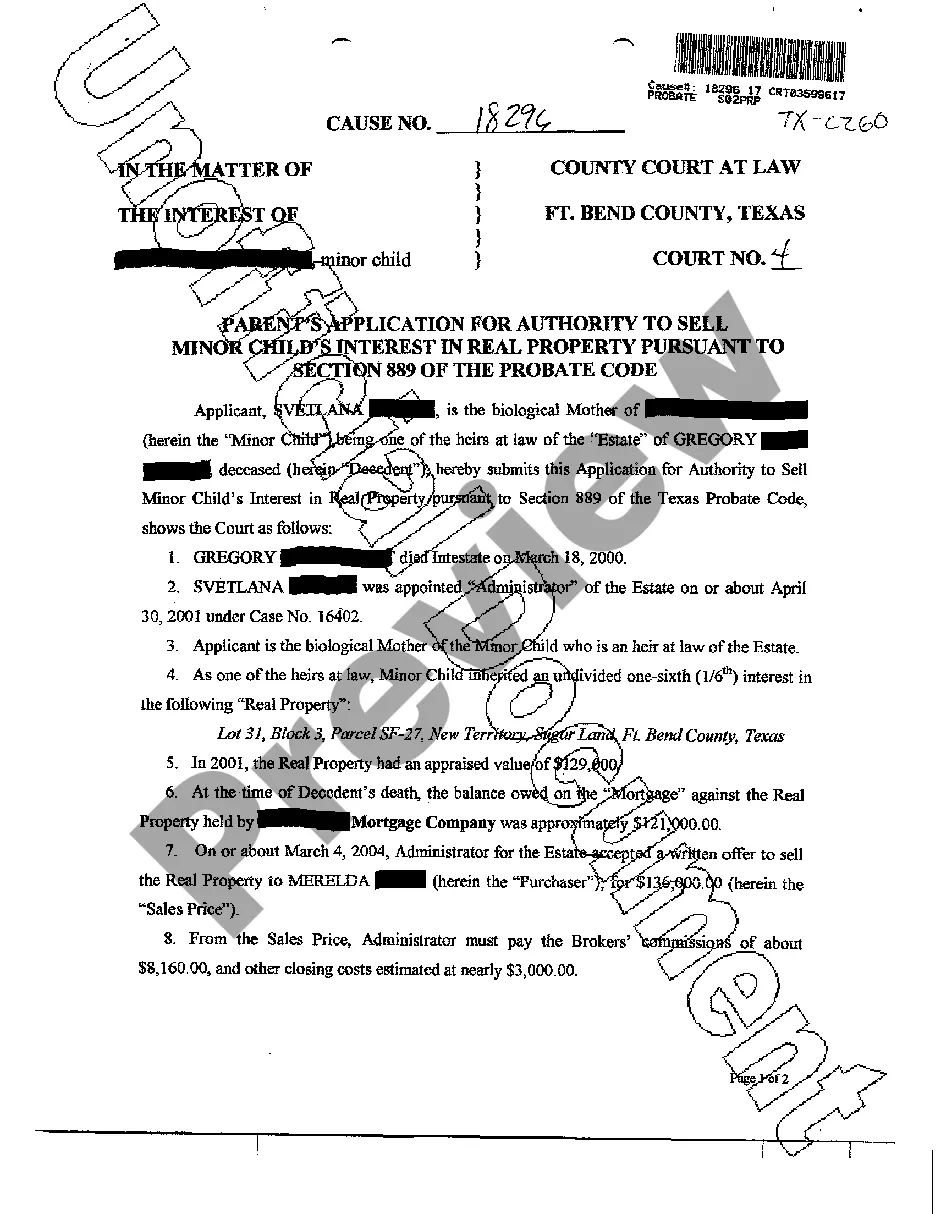

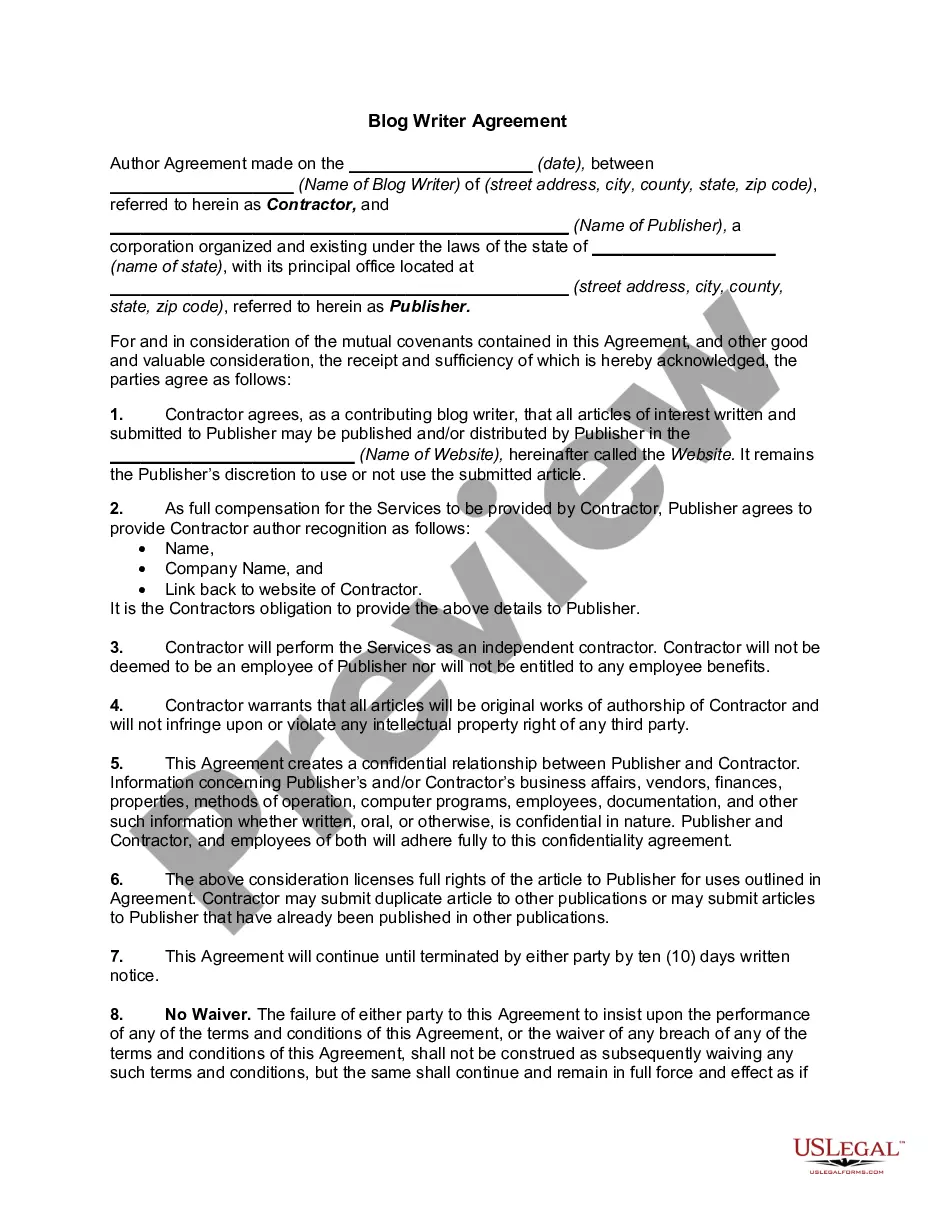

This is an official Minnesota court form for use in a divorce case, a Notice of Intent to Proceed to Judgment with Children. USLF amends and updates these forms as is required by Minnesota Statutes and Law.

Minnesota Notice of Intent to Proceed to Judgment with Children

Description

How to fill out Minnesota Notice Of Intent To Proceed To Judgment With Children?

Have any form from 85,000 legal documents such as Minnesota Notice of Intent to Proceed to Judgment with Children online with US Legal Forms. Every template is prepared and updated by state-licensed legal professionals.

If you have a subscription, log in. When you’re on the form’s page, click the Download button and go to My Forms to get access to it.

If you haven’t subscribed yet, follow the tips below:

- Check the state-specific requirements for the Minnesota Notice of Intent to Proceed to Judgment with Children you want to use.

- Read description and preview the sample.

- Once you’re confident the template is what you need, click on Buy Now.

- Select a subscription plan that actually works for your budget.

- Create a personal account.

- Pay out in one of two appropriate ways: by bank card or via PayPal.

- Choose a format to download the file in; two ways are available (PDF or Word).

- Download the file to the My Forms tab.

- When your reusable form is ready, print it out or save it to your device.

With US Legal Forms, you’ll always have instant access to the right downloadable template. The service gives you access to documents and divides them into groups to streamline your search. Use US Legal Forms to obtain your Minnesota Notice of Intent to Proceed to Judgment with Children easy and fast.

Form popularity

FAQ

The regulation is silent on this matter. It states you can obtain the intent to proceed in any manner that the consumer chooses as long as it's documented. The only section that dictates that all consumers primarily liable have to sign is the section on waiving the waiting period prior to consummation.

Does a good faith estimate mean you're approved? Receiving a Loan Estimate or Good Faith Estimate does not mean you're approved for a mortgage. As the CFPB puts it, Loan Estimate shows you what loan terms the lender expects to offer if you decide to move forward.

At the consumer-protection level, the Intent To Proceed is you saying you agree to the loan terms and conditions and plan on moving forward with the loan if everything gets approved and now the lender can legally start charging you non-refundable fees- specifically the cost of pulling your credit report and home

A good faith estimate (or a loan estimate) is a standard form intended to be used to compare different offers (or quotes) from different lenders or brokers. The estimate must include an itemized list of fees and costs associated with the loan and must be provided within 3 business days of applying for a loan.

Intending to proceed initiates your transaction with a lender. Potential lenders will give you Loan Estimates to give you a clear picture of the interest rates and other costs that you'll need to pay for the amount you plan to borrow.

A good faith estimate provided borrowers the chance to compare the costs of a loan between lenders in order to shop around for the best deal. The good faith estimate is no longer used in the lending industry; since October 2015, it is known as a loan estimate form.

The intent to proceed simply authorizes the lender to start working on your file. You are free to examine opportunities until your loan funds. Sure you can, as Amber said above you can back out right up until everything is completed.You are not obligated to complete the loan process.

Until October 2015, the Good Faith Estimate was the standard form that the Real Estate Settlement Procedures Act required all lenders to use to inform borrowers of mortgage terms. The Good Faith Estimate is still used for reverse mortgages and lists basic terms about the mortgage offer and estimated costs for the loan.

A Good Faith Estimate, also called a GFE, is a form that a lender must give you when you apply for a reverse mortgage.The GFE includes the estimated costs for the mortgage loan. The Good Faith Estimate provides you with basic information about the loan, which helps you: Compare offers.