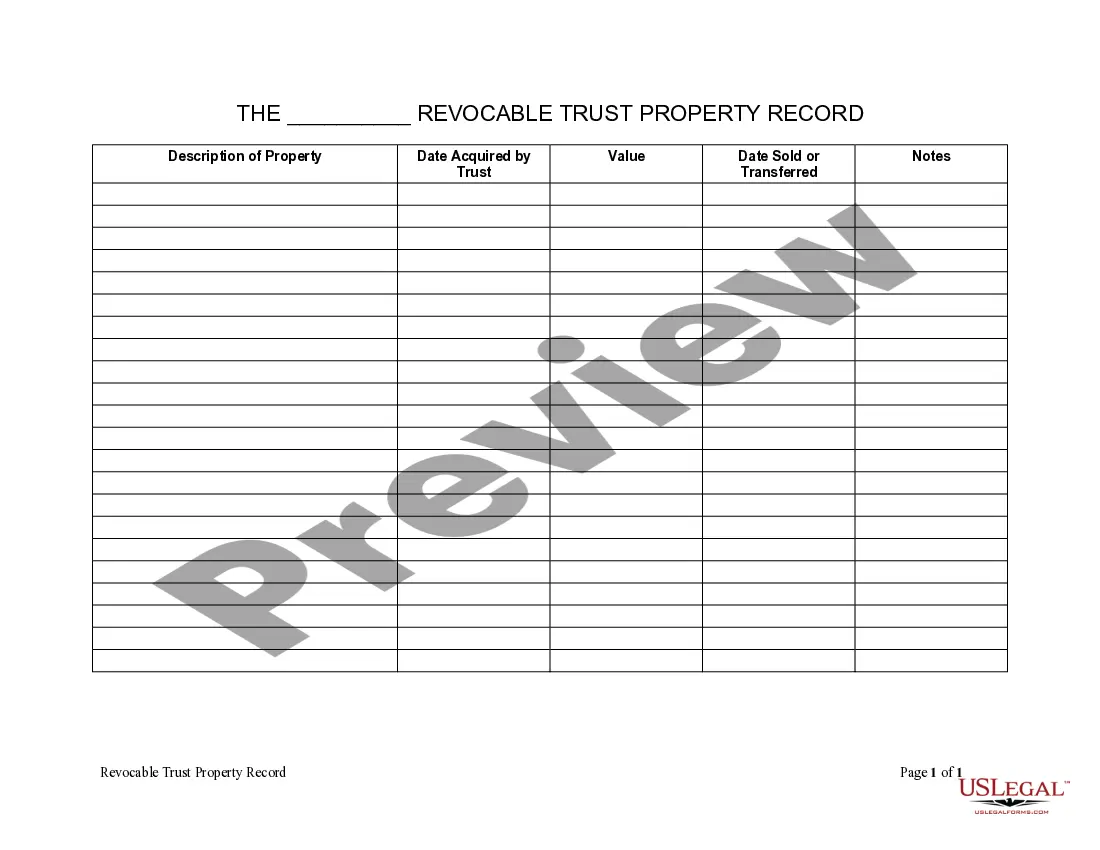

Minnesota Living Trust Property Record

Description Minnesota Living Trust

How to fill out Minnesota Living Trust Property Record?

Have any template from 85,000 legal documents including Minnesota Living Trust Property Record online with US Legal Forms. Every template is drafted and updated by state-certified attorneys.

If you have a subscription, log in. When you’re on the form’s page, click on the Download button and go to My Forms to access it.

If you have not subscribed yet, follow the tips listed below:

- Check the state-specific requirements for the Minnesota Living Trust Property Record you want to use.

- Look through description and preview the sample.

- When you are confident the template is what you need, simply click Buy Now.

- Select a subscription plan that really works for your budget.

- Create a personal account.

- Pay out in just one of two suitable ways: by bank card or via PayPal.

- Choose a format to download the file in; two options are available (PDF or Word).

- Download the document to the My Forms tab.

- Once your reusable template is ready, print it out or save it to your device.

With US Legal Forms, you’ll always have immediate access to the proper downloadable sample. The service gives you access to forms and divides them into categories to simplify your search. Use US Legal Forms to get your Minnesota Living Trust Property Record easy and fast.

Form popularity

FAQ

Trusts are private documents and they typically remain private even after someone dies. The only way to obtain a copy of the Trust is to demand a copy from the Trustee (or whoever has a copy of the documents, if not the Trustee).

Today clients who have living trusts normally keep the original copy. Having the attorney keep the original copy of the trust is not as important as keeping the original will used to be. At death, a copy of the trust generally suffices for all parties in place of the original.

What happens if you have lost your Trust?If a Trust is lost, and the decedent has assets titled in the name of the Trust, the court will require that the heirs/Successor Trustees spend a significant amount of time and money searching for the Trust and documenting the search process.

Trusts created during your lifetime, known as living trusts, do not go into the public record after you die. With rare exceptions, trusts remain private regardless of whether you have an irrevocable or revocable trust at the time of your death.

Legally your Trust now owns all of your assets, but you manage all of the assets as the Trustee. This is the essential step that allows you to avoid Probate Court because there is nothing for the courts to control when you die or become incapacitated.

Trusts aren't public record, so they're not usually recorded anywhere. Instead, the trust attorney determines who is entitled to receive a copy of the document, even if state law doesn't require it.

If you can't find original living trust documents, you can contact the California Bar Association for assistance. Trusts aren't recorded anywhere, so you can't go to the County Recorder's office in the courthouse to ask to see a copy of the trust.

If you can't find original living trust documents, you can contact the California Bar Association for assistance. Trusts aren't recorded anywhere, so you can't go to the County Recorder's office in the courthouse to ask to see a copy of the trust.

The process of funding your living trust by transferring your assets to the trustee is an important part of what helps your loved ones avoid probate court in the event of your death or incapacity. Qualified retirement accounts such as 401(k)s, 403(b)s, IRAs, and annuities, should not be put in a living trust.