Minnesota Assignment to Living Trust

Description Mn Living Trust

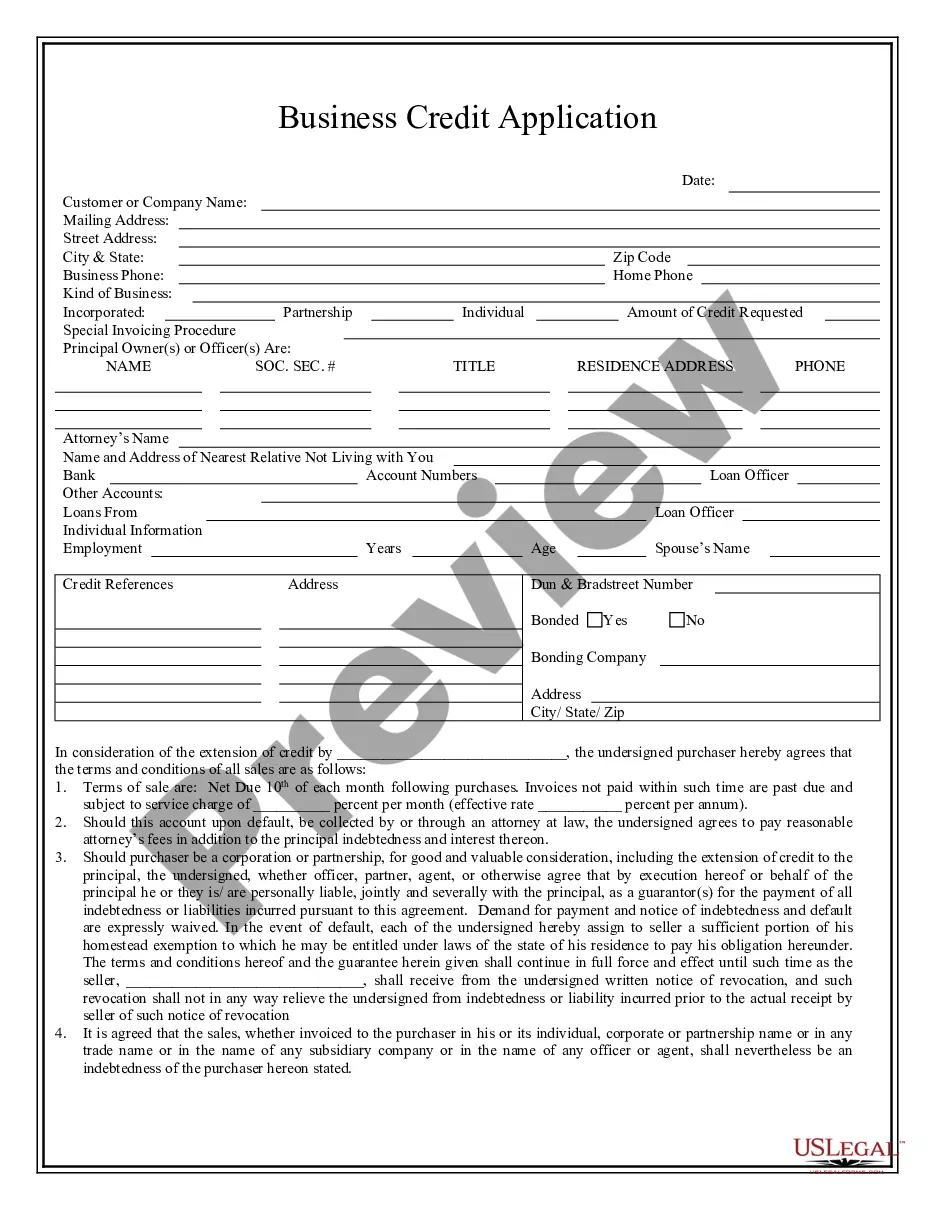

How to fill out Minnesota Assignment Trust?

Have any form from 85,000 legal documents including Minnesota Assignment to Living Trust on-line with US Legal Forms. Every template is prepared and updated by state-licensed lawyers.

If you already have a subscription, log in. Once you are on the form’s page, click on the Download button and go to My Forms to access it.

In case you haven’t subscribed yet, follow the steps below:

- Check the state-specific requirements for the Minnesota Assignment to Living Trust you want to use.

- Look through description and preview the template.

- Once you’re confident the sample is what you need, just click Buy Now.

- Select a subscription plan that works for your budget.

- Create a personal account.

- Pay out in a single of two suitable ways: by card or via PayPal.

- Choose a format to download the file in; two ways are available (PDF or Word).

- Download the document to the My Forms tab.

- When your reusable form is downloaded, print it out or save it to your gadget.

With US Legal Forms, you’ll always have instant access to the proper downloadable template. The service gives you access to documents and divides them into groups to streamline your search. Use US Legal Forms to get your Minnesota Assignment to Living Trust fast and easy.

Minnesota Living Trust Form popularity

Mn Assignment Other Form Names

Minnesota Assignment Purchase FAQ

When you create a DIY living trust, there are no attorneys involved in the process. You will need to choose a trustee who will be in charge of managing the trust assets and distributing them.You'll also need to choose your beneficiary or beneficiaries, the person or people who will receive the assets in your trust.

A living trust is a legal entity that owns property you transfer into it during your lifetime.A living trust is created with a trust document or instrument. You may be able to create this yourself, but it makes sense to work with an attorney to create your trust in some situations.

Sure you can write your own revocable living trust.The discussion of your need for a revocable living trust is in another of my articles, but it is safe to say that if you own real property and have a significant estate (over about $50,000), then you could use a trust and it would help your loved ones.

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.

Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries who will get the trust property. Create the trust document.

Trusts Are Not Public Record. Most states require a last will and testament to be filed with the appropriate state court when the person dies. When this happens, the will becomes a public record for anyone to read. However, trusts aren't recorded.

You should still have a durable power of attorney for finances.You may even want to empower your attorney-in-fact to transfer into your living trust any property that becomes yours after you become incapacitated. Only a durable power of attorney for finances can grant that authority.

A living trust is an important part of your estate plan. Most people can create a living trust without an attorney using software or an online service.

The process of funding your living trust by transferring your assets to the trustee is an important part of what helps your loved ones avoid probate court in the event of your death or incapacity. Qualified retirement accounts such as 401(k)s, 403(b)s, IRAs, and annuities, should not be put in a living trust.