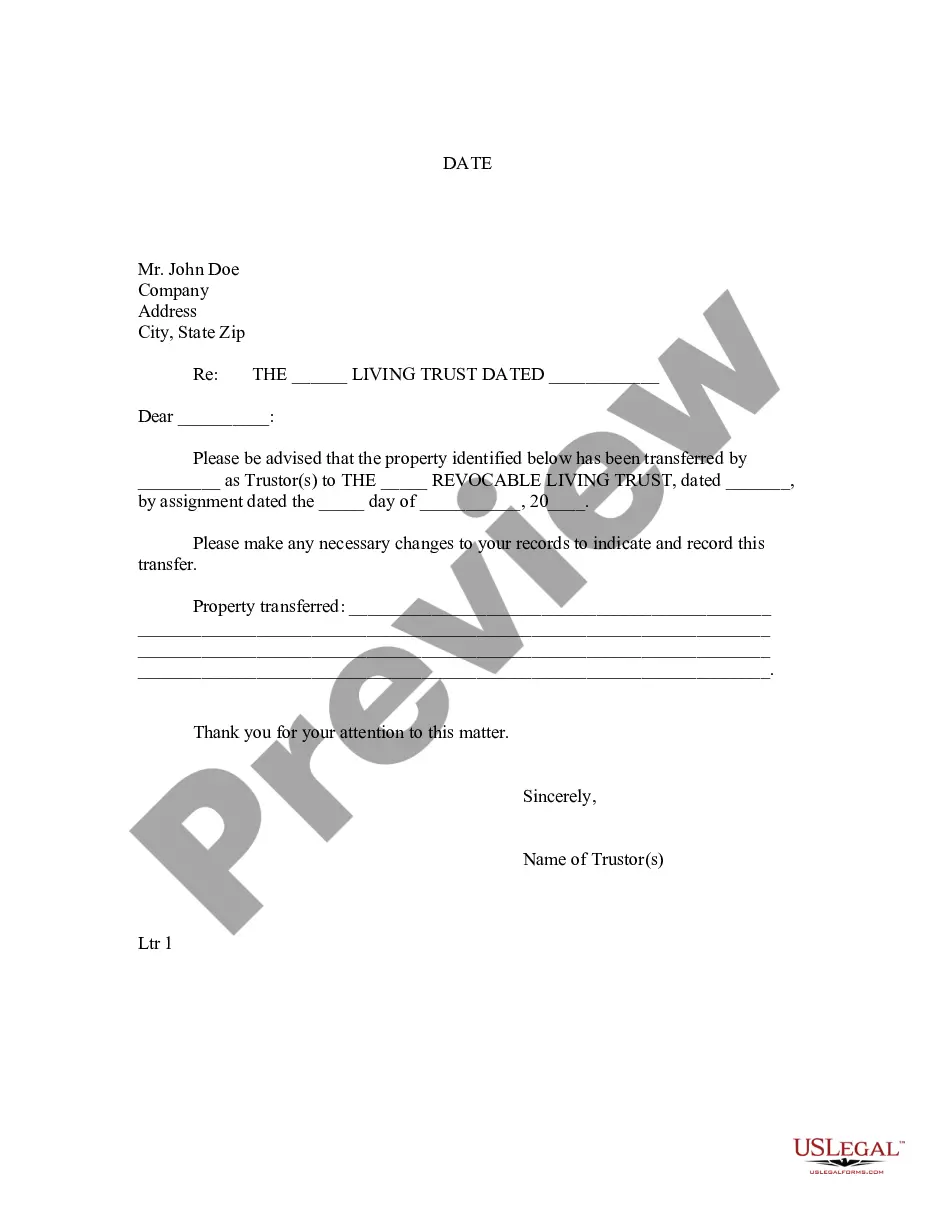

Minnesota Letter to Lienholder to Notify of Trust

Description

How to fill out Minnesota Letter To Lienholder To Notify Of Trust?

Get any form from 85,000 legal documents such as Minnesota Letter to Lienholder to Notify of Trust online with US Legal Forms. Every template is prepared and updated by state-licensed attorneys.

If you already have a subscription, log in. When you’re on the form’s page, click on the Download button and go to My Forms to get access to it.

In case you have not subscribed yet, follow the tips below:

- Check the state-specific requirements for the Minnesota Letter to Lienholder to Notify of Trust you would like to use.

- Read through description and preview the template.

- As soon as you’re confident the sample is what you need, just click Buy Now.

- Choose a subscription plan that really works for your budget.

- Create a personal account.

- Pay out in one of two suitable ways: by bank card or via PayPal.

- Pick a format to download the file in; two ways are available (PDF or Word).

- Download the document to the My Forms tab.

- When your reusable form is downloaded, print it out or save it to your gadget.

With US Legal Forms, you’ll always have quick access to the right downloadable sample. The platform provides you with access to forms and divides them into categories to streamline your search. Use US Legal Forms to obtain your Minnesota Letter to Lienholder to Notify of Trust easy and fast.

Form popularity

FAQ

All sellers must handprint their name and sign in the assignment area of the title. The seller must list the sales price of the vehicle in the sales tax declaration area on the back of the certificate of title. The seller must enter the date of sale and complete any disclosure statements that apply.

There are only nine title-holding states: Kentucky, Maryland, Michigan, Minnesota, Missouri, Montana, New York, Oklahoma, Wisconsin. In the other 41 states, titles are issued to the lien holder of your vehicle until the loan is fully paid off.

Gifts. The transfer of a motor vehicle between specifically identified individuals is not charged sales tax if the transfer is a gift for no monetary or other consideration, or other expectation of consideration. The specific individuals are: spouses, parents and children, and grandparents and grandchildren.

Typical fees to transfer and title a vehicle: Title Fee: $8.25 (plus $2 for each lien recorded) Transfer Tax: $10. Public Safety Vehicle Fee: $3.50. Technology Surcharge: $2.25.

The notice must inform the homeowner of the contractor's right to lien the property, and the right to pay off any subcontractors that haven't been paid by the general contractor.

You will write in the following information on the front of the title. On the title, the seller should fill in the name and address of the purchaser, the odometer information, selling price, and the date sold in the "Transfer of Title by Seller" section.

When a contractor files a mechanics' (construction) lien on your home, the lien makes your home into what's called security for an outstanding debt, which the contractor claims is due and unpaid for services or materials.

If a lien is filed against your property (in the form of a lien statement), it must be filed with the county recorder and a copy delivered to you, the property owner, either personally or by certified mail, within 120 days after the last material or labor is furnished for the job.