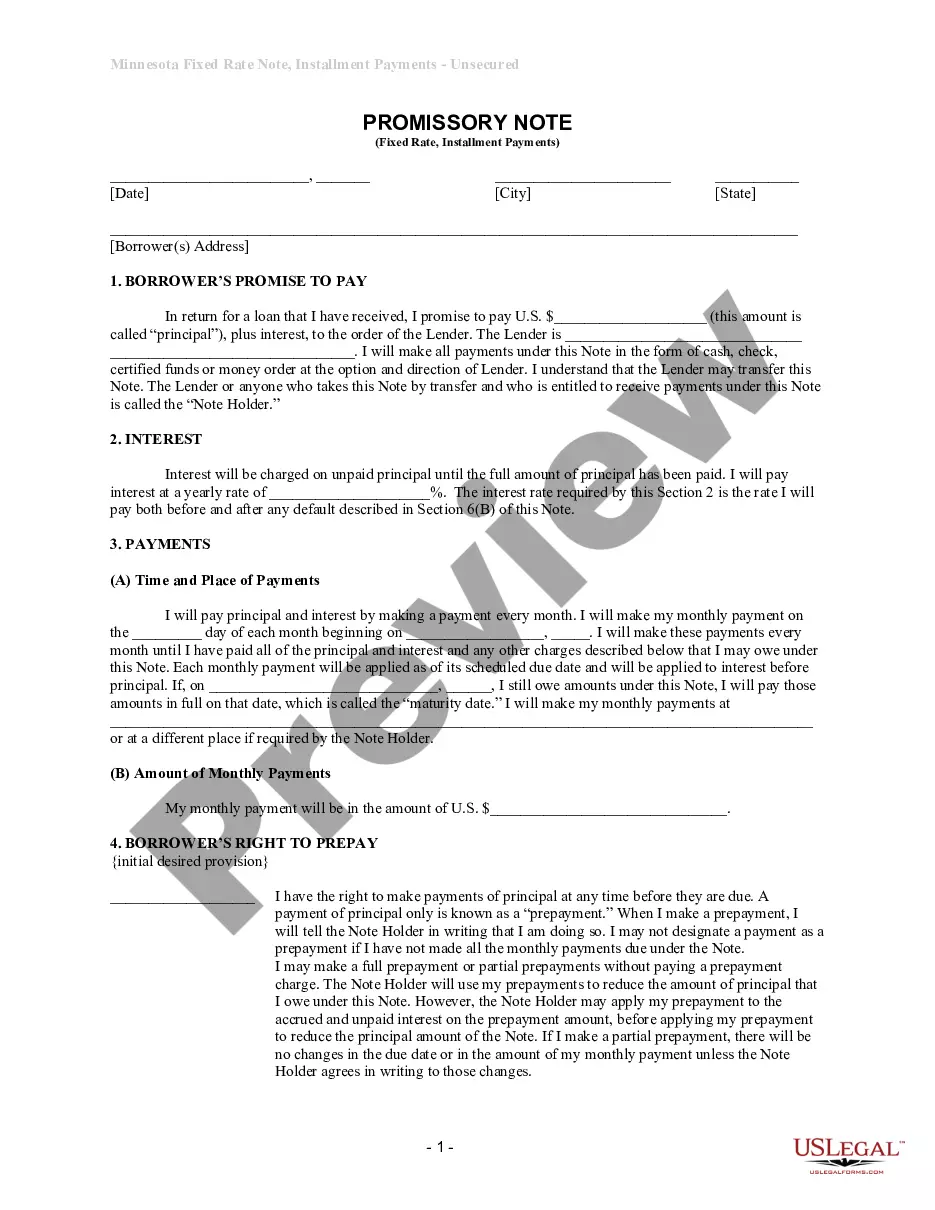

Minnesota Unsecured Installment Payment Promissory Note for Fixed Rate

Description Payment Promissory Note Online

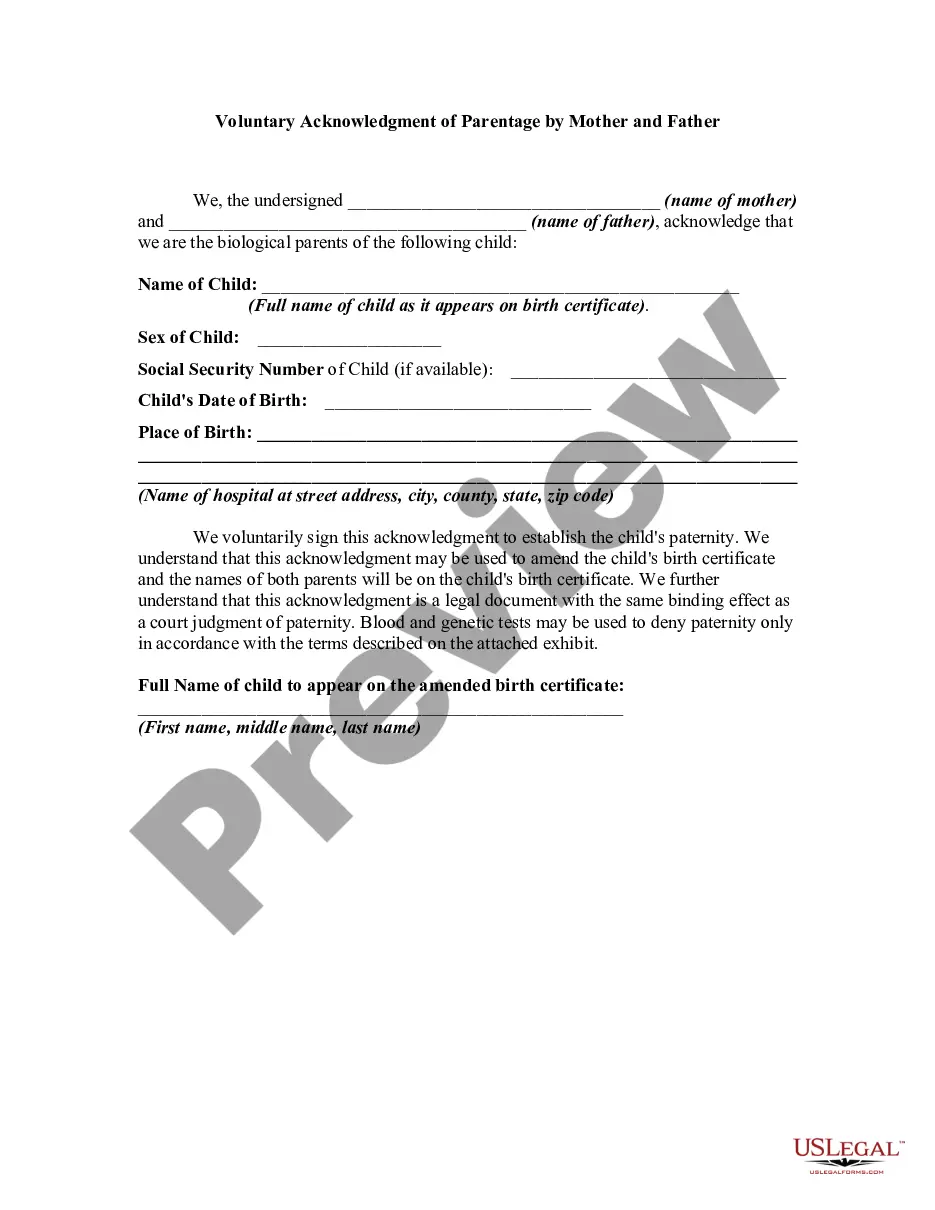

How to fill out Minnesota Unsecured Installment Payment Promissory Note For Fixed Rate?

Have any template from 85,000 legal documents including Minnesota Unsecured Installment Payment Promissory Note for Fixed Rate online with US Legal Forms. Every template is prepared and updated by state-licensed legal professionals.

If you have a subscription, log in. Once you are on the form’s page, click on the Download button and go to My Forms to get access to it.

If you have not subscribed yet, follow the tips below:

- Check the state-specific requirements for the Minnesota Unsecured Installment Payment Promissory Note for Fixed Rate you need to use.

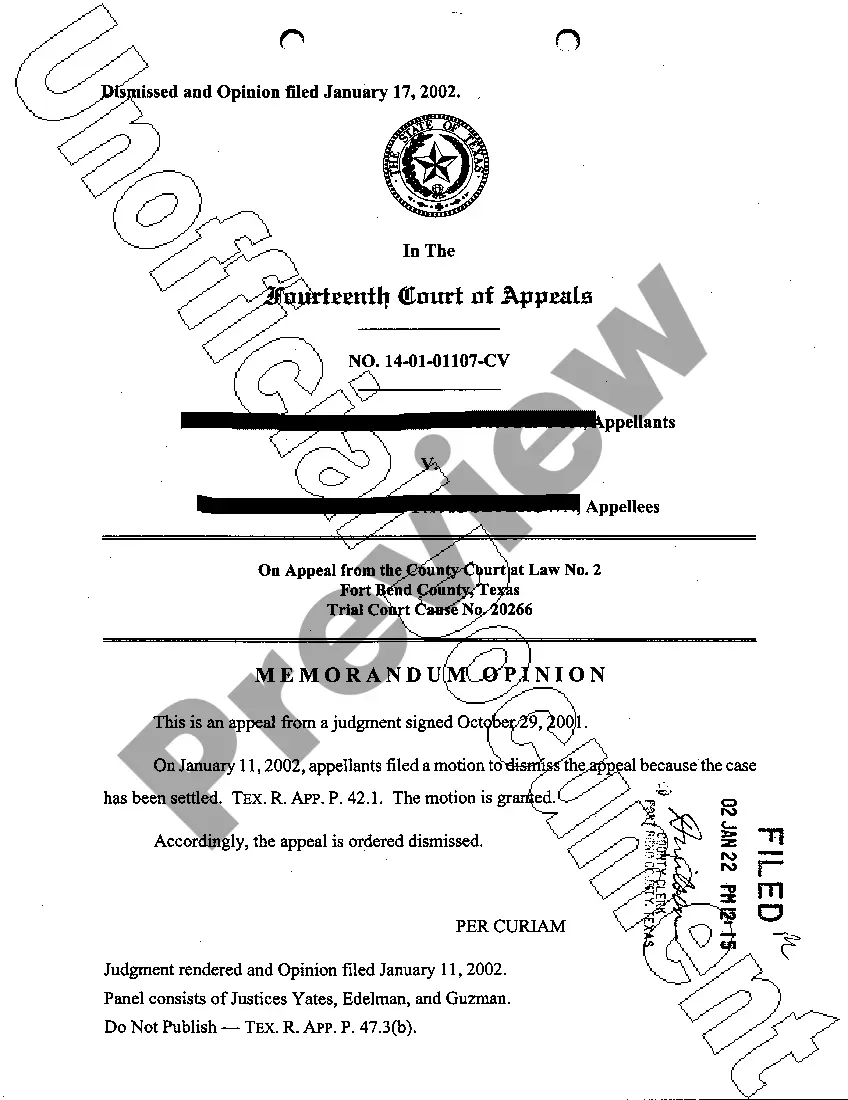

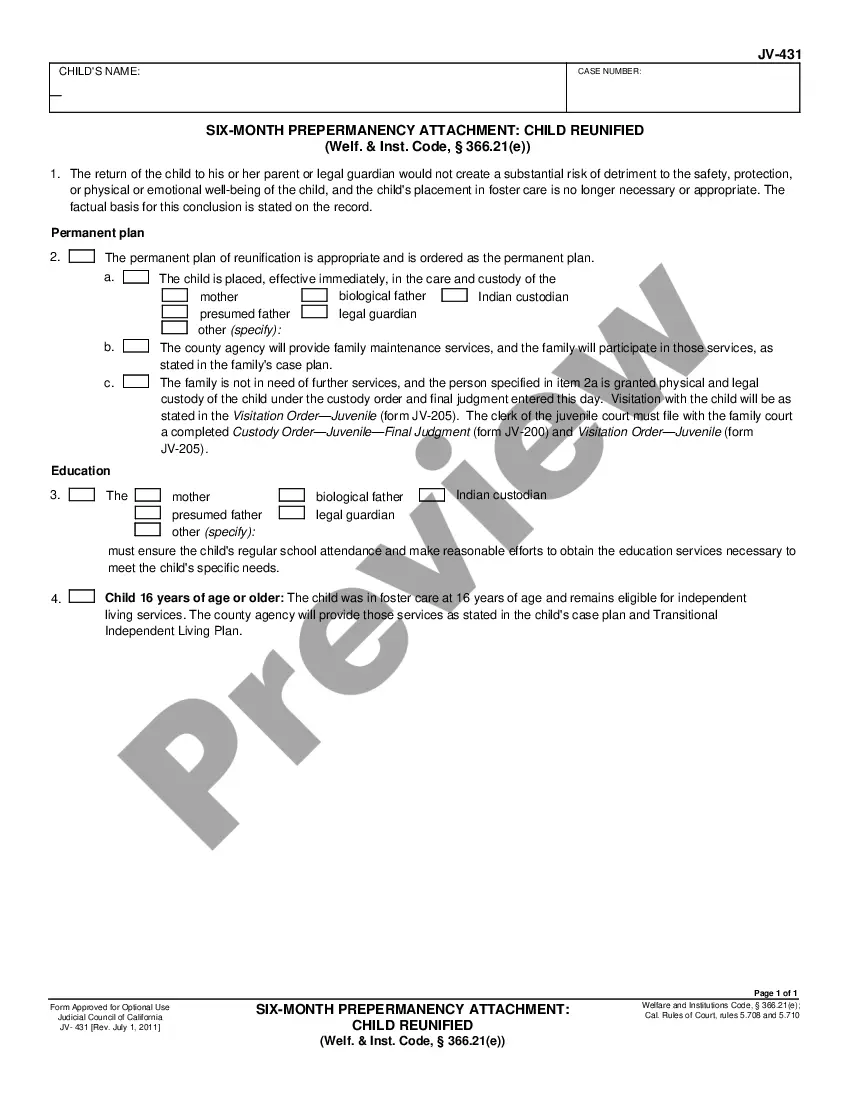

- Look through description and preview the sample.

- As soon as you’re sure the template is what you need, click on Buy Now.

- Choose a subscription plan that works well for your budget.

- Create a personal account.

- Pay out in a single of two appropriate ways: by credit card or via PayPal.

- Pick a format to download the file in; two options are available (PDF or Word).

- Download the file to the My Forms tab.

- Once your reusable form is ready, print it out or save it to your device.

With US Legal Forms, you will always have immediate access to the appropriate downloadable sample. The platform provides you with access to forms and divides them into groups to simplify your search. Use US Legal Forms to get your Minnesota Unsecured Installment Payment Promissory Note for Fixed Rate easy and fast.

Form popularity

FAQ

Although this case relates to state securities law claims, in applying the Reves test and holding that the Notes are not securities, the court has ruled squarely in favor of the long-held view in the loan industry that loans are not securities.

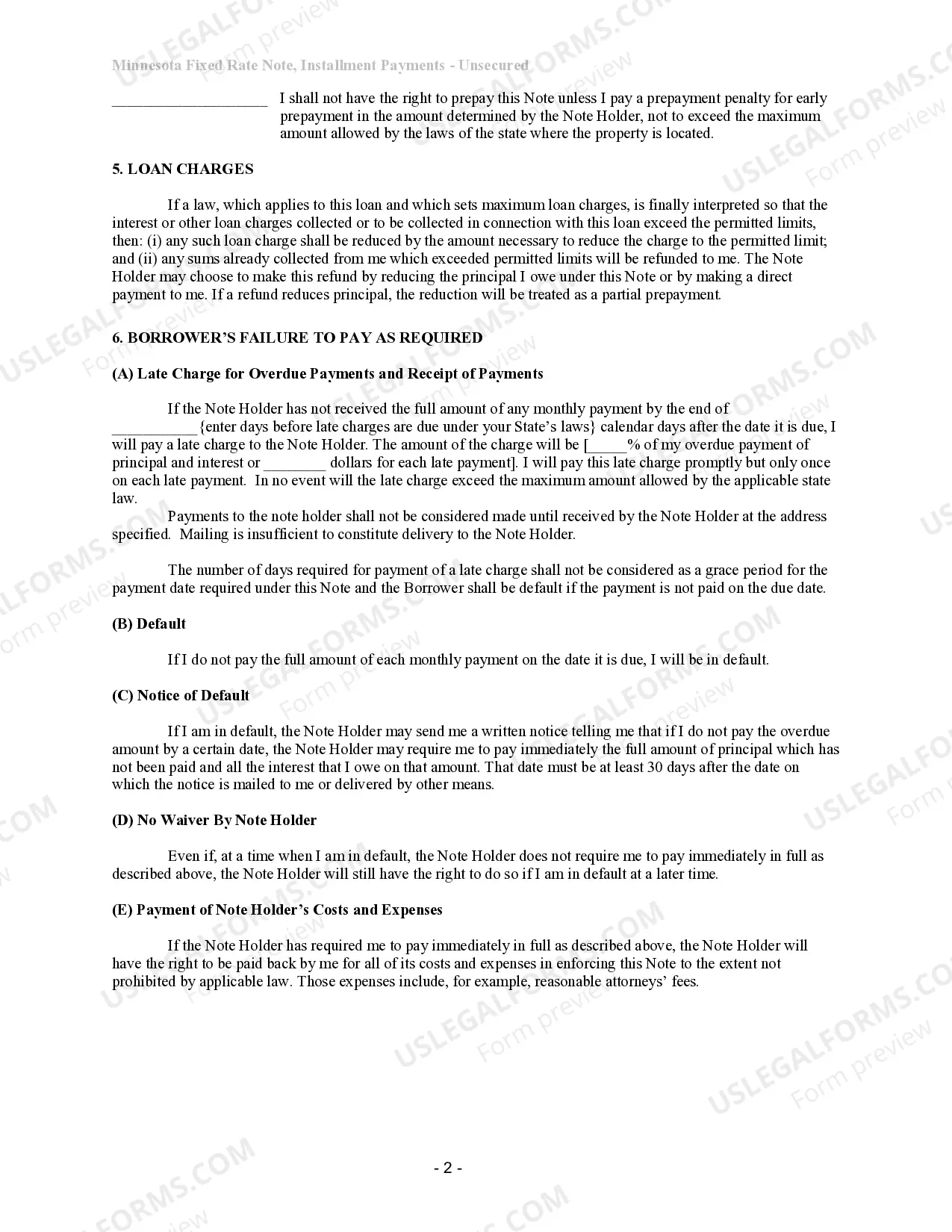

Promissory notes are legally binding whether the note is secured by collateral or based only on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral.

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.

Lenders, whether banks or individual sellers, typically require the persons who are borrowing money in order to finance the purchase of real estate to sign a "note" and a "security instrument." A note is a written, unconditional promise to pay a certain sum of money at a certain time or within a certain period of time.

The first step in enforcing an unsecured promissory note is to file a petition with the courts and get a judgment in your favor. Although this is a powerful legal enforcement of your rights under the promissory note, it does not in and of itself guarantee repayment of the note.

Secured or unsecured? Generally, promissory notes are unsecured which means it is more like a formal IOU. However, lenders can request some security for the loan. For personal secured promissory notes, a house or car is often used as collateral.

In general, under the Securities Acts, promissory notes are defined as securities, but notes with a maturity of 9 months or less are not securities.The US Supreme Court in Reves recognizes that most notes are, in fact, not securities.

A note is a debt security obligating repayment of a loan, at a predetermined interest rate, within a defined time frame.

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.