Minnesota Power of Attorney for Sale of Motor Vehicle

Description Mn Power Attorney Form Pdf

How to fill out Poa Power Vehicle?

Get any template from 85,000 legal documents including Minnesota Power of Attorney for Sale of Motor Vehicle online with US Legal Forms. Every template is drafted and updated by state-accredited attorneys.

If you have a subscription, log in. When you’re on the form’s page, click the Download button and go to My Forms to access it.

In case you haven’t subscribed yet, follow the tips below:

- Check the state-specific requirements for the Minnesota Power of Attorney for Sale of Motor Vehicle you want to use.

- Read description and preview the template.

- As soon as you are confident the template is what you need, simply click Buy Now.

- Select a subscription plan that works for your budget.

- Create a personal account.

- Pay in one of two suitable ways: by card or via PayPal.

- Choose a format to download the document in; two ways are available (PDF or Word).

- Download the document to the My Forms tab.

- Once your reusable form is ready, print it out or save it to your gadget.

With US Legal Forms, you will always have instant access to the appropriate downloadable sample. The platform gives you access to documents and divides them into categories to streamline your search. Use US Legal Forms to get your Minnesota Power of Attorney for Sale of Motor Vehicle easy and fast.

Mn Poa Form Form popularity

Executed Title Power Of Attorney Other Form Names

Attorney Motor Printable FAQ

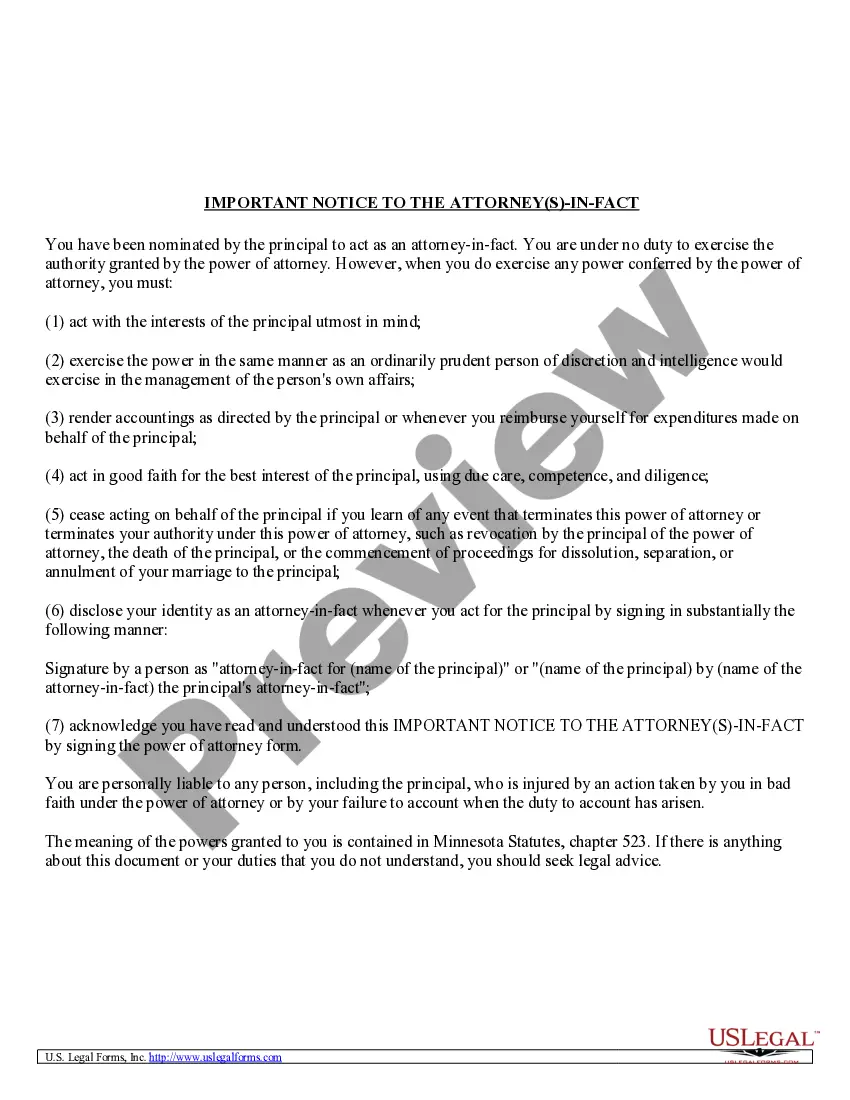

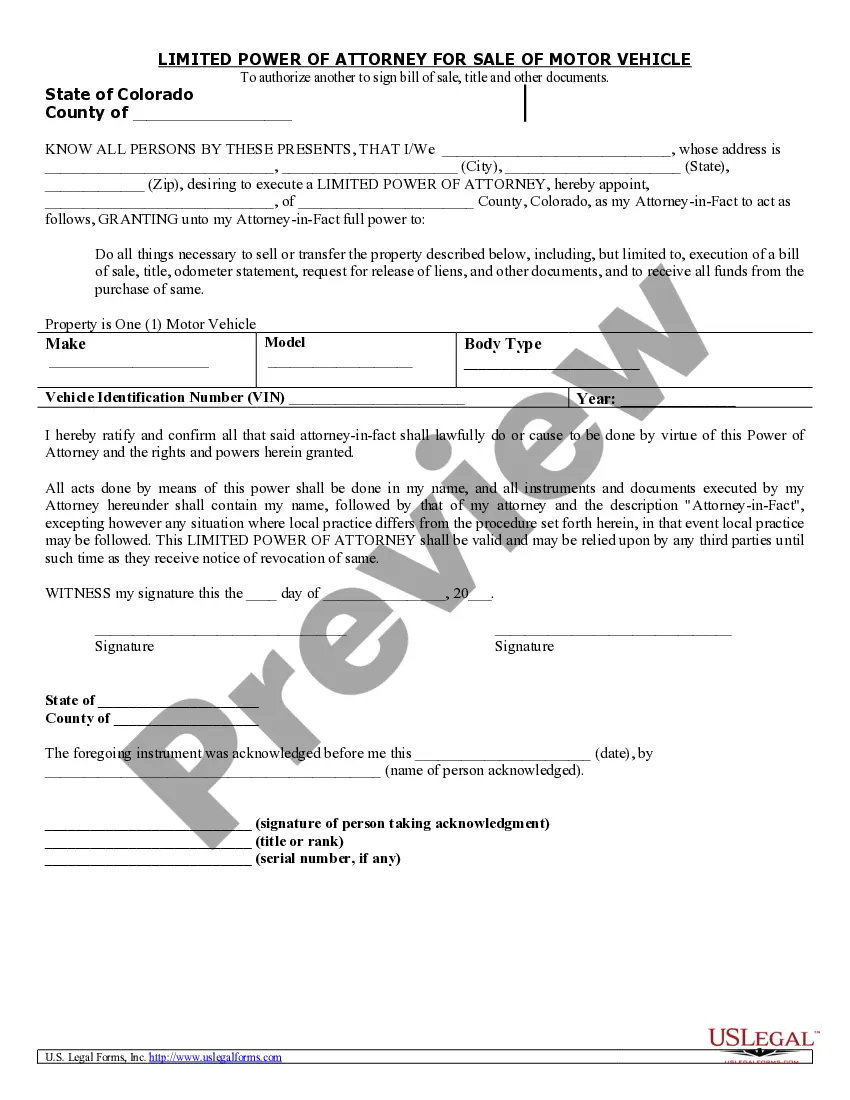

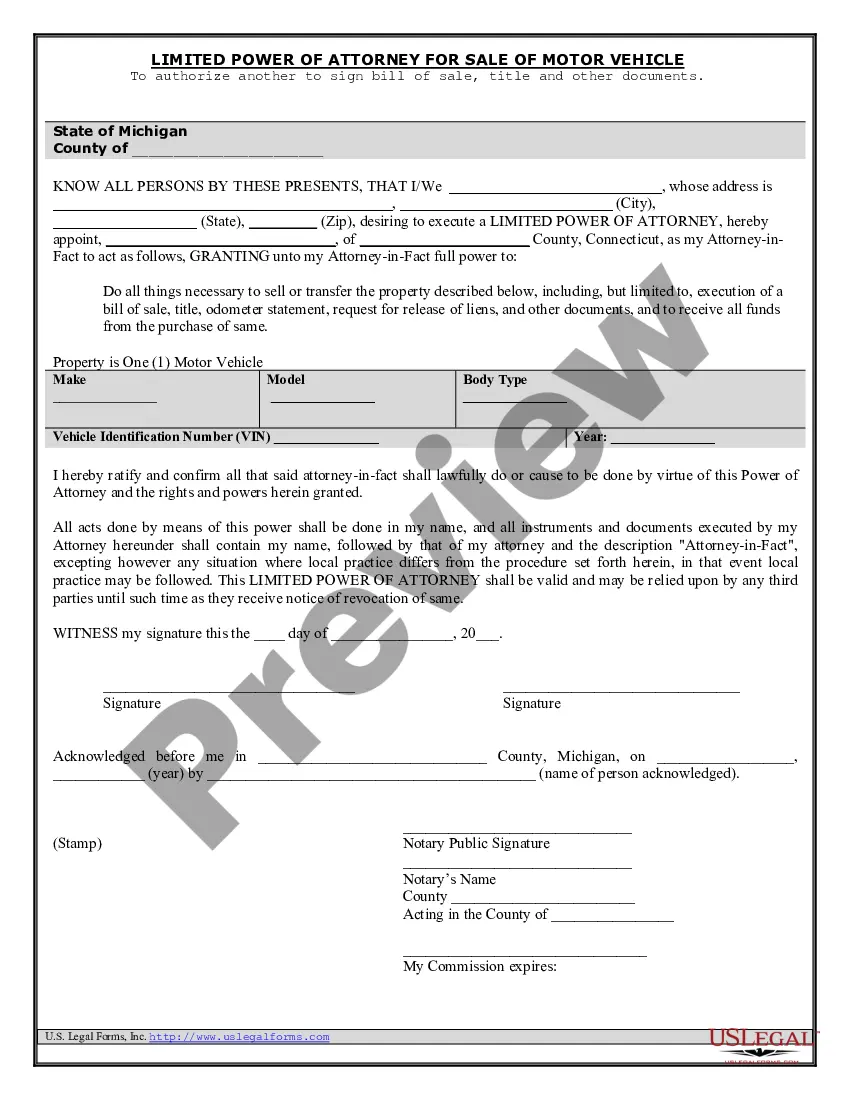

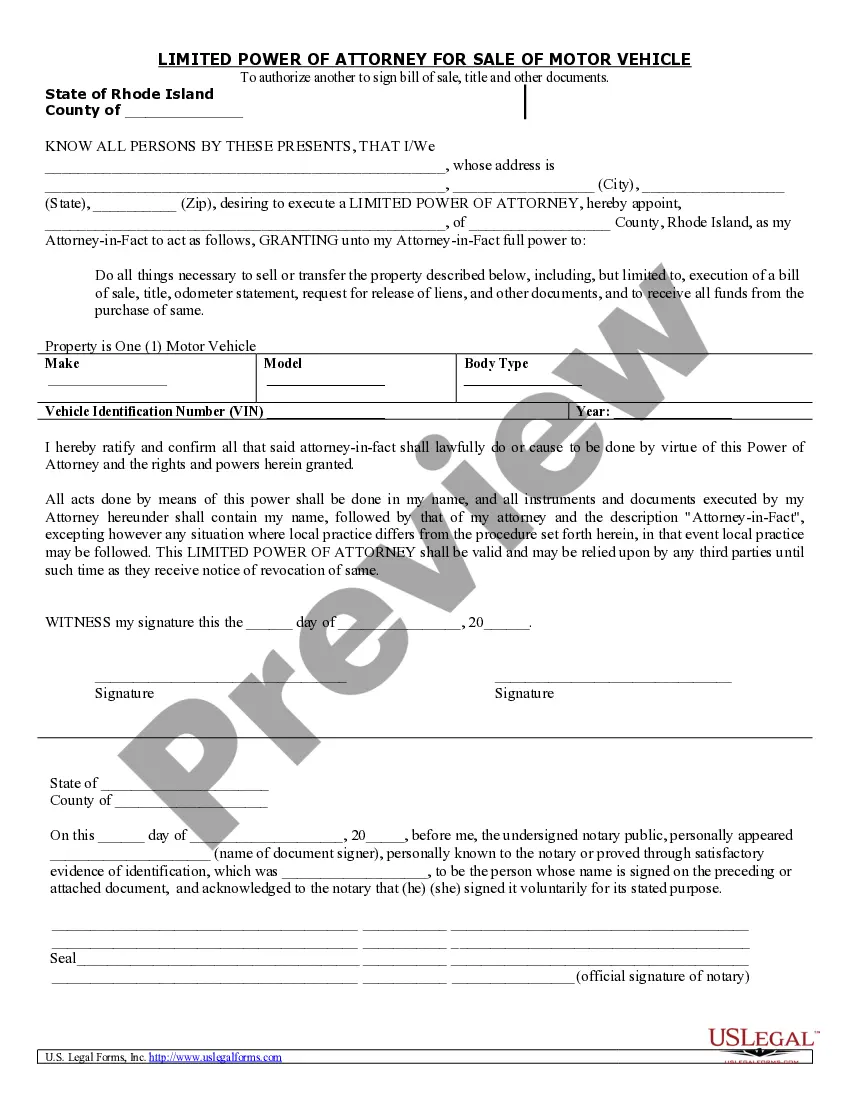

Most states offer simple forms to help you create a power of attorney for finances. Generally, the document must be signed, witnessed and notarized by an adult. If your agent will have to deal with real estate assets, some states require you to put the document on file in the local land records office.

Under the Minnesota power of attorney statutes, the principal's signature on a Minnesota Power of Attorney document need not be acknowledged before a notary public. However, third parties may require it, and a Minnesota Statutory Short Form Power of Attorney document will look incomplete without such an acknowledgment.

Remember that all of the authorized agents under the power of attorney or representatives in an estate must sign the listing agreement, disclosure documents, etc. For example, when there are two executors in an estate, then they both must sign the Listing Contract.

Choose the limited power of attorney made for your state. Input personal information about both the principal and the agent or attorney-in-fact. Explain the powers of the agent. Include the date the limited power of attorney expires or will be revoked.

Most states do not require a POA to be in writing in order to be effective, except in specific cases established by statute.As a result, most POAs can be executed electronically with or without authorization under the eCommerce laws, since there is no writing or signature requirement to begin with.

A power of attorney (or POA) is a legal document that grants a person or organization the legal authority to act on another's behalf and make certain decisions for them.A power of attorney needs to be signed in front of a licensed notary public in order to be legally binding.

While laws vary between states, a POA can't typically add or remove signers from your bank account unless you include this responsibility in the POA document.If you don't include a clause giving the POA this authority, then financial institutions won't allow your POA to make ownership changes to your accounts.

When you're ready to have the title transferred, make sure the agent signs the title or deed in their capacity as your agent. They should sign either: a) Jane Smith principal's name, by Sally Stevens agent's name under Power of Attorney, or b) Sally Stevens, attorney-in-fact for Jane Smith.

In many states, notarization is required by law to make the durable power of attorney valid. But even where law doesn't require it, custom usually does. A durable power of attorney that isn't notarized may not be accepted by people with whom your attorney-in-fact tries to deal.