Annual Minutes for a Minnesota Professional Corporation

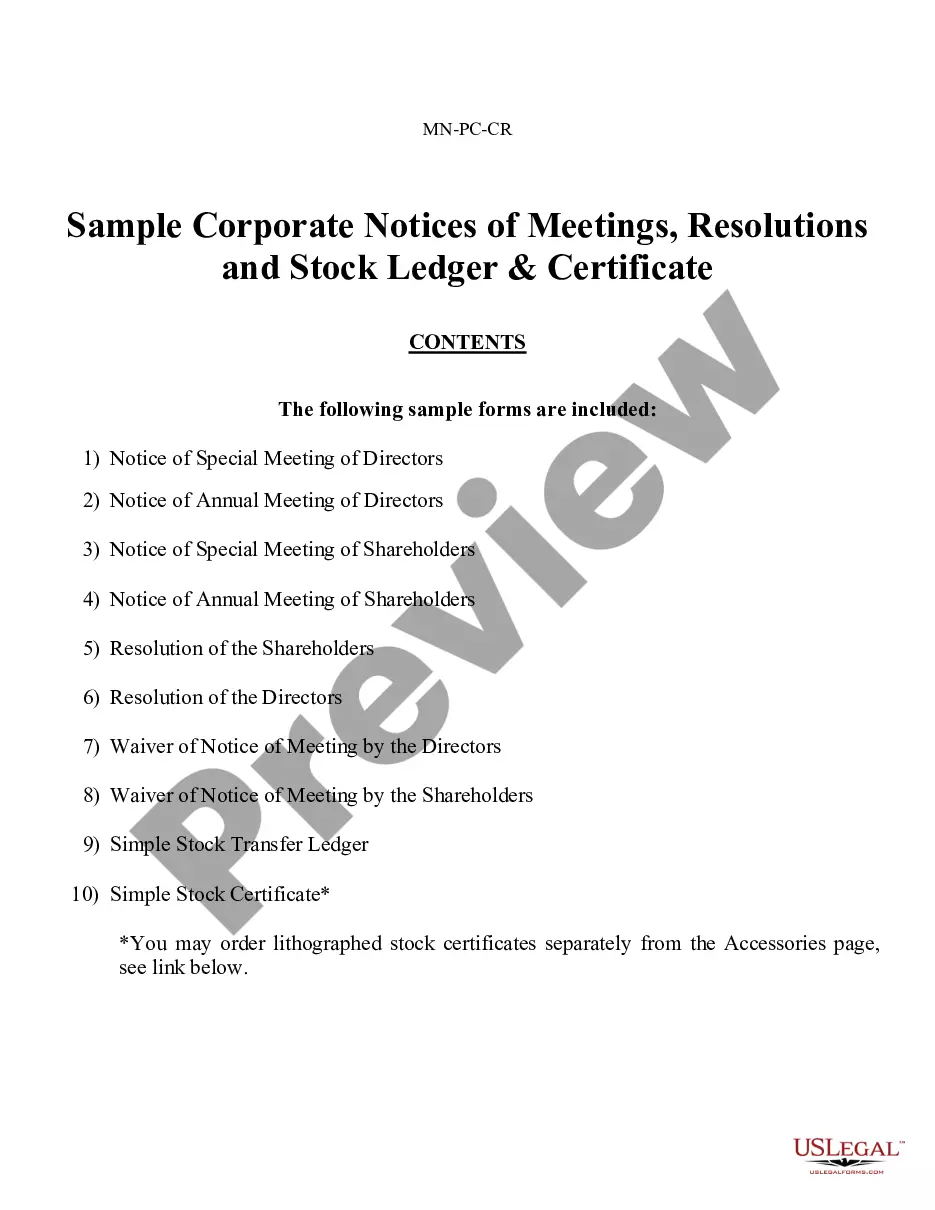

Description

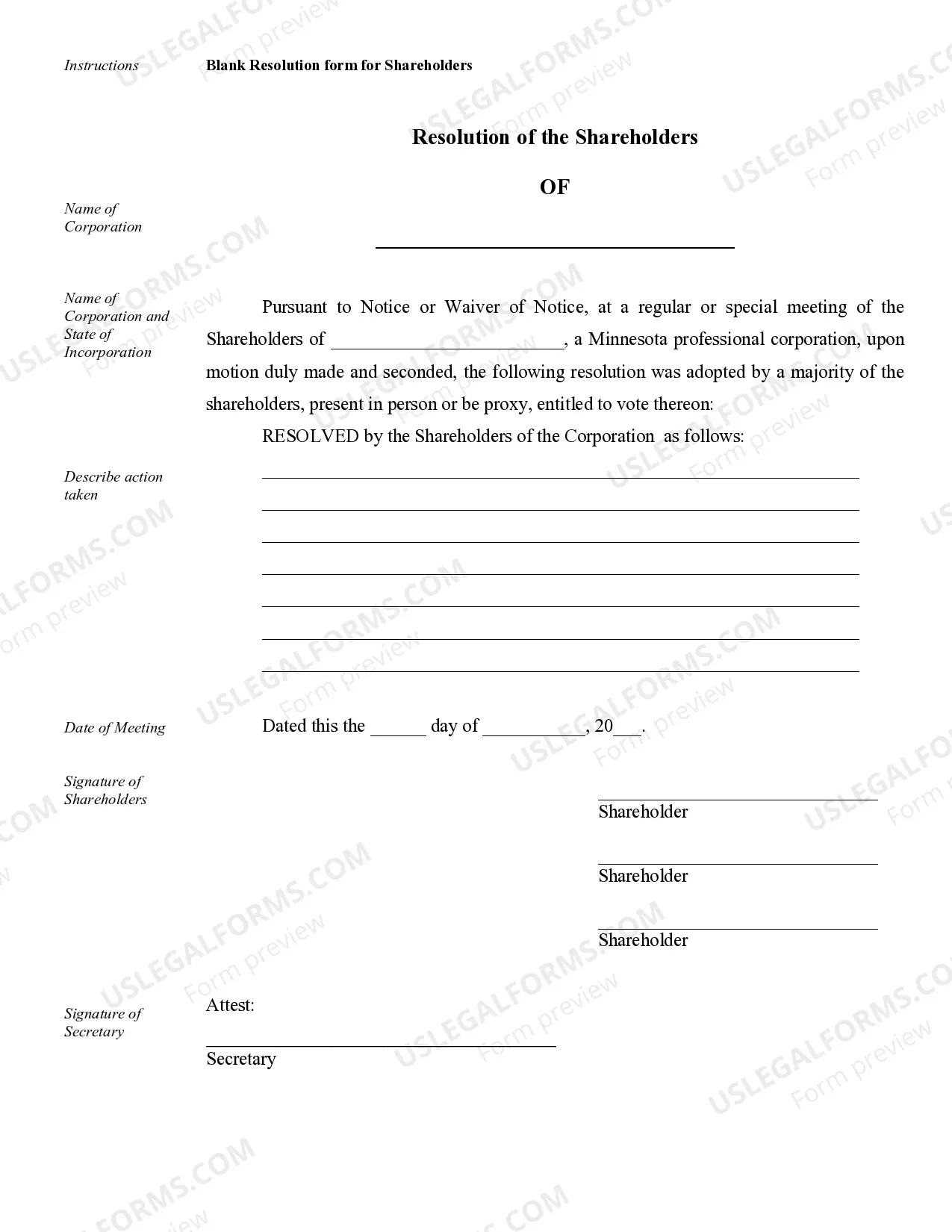

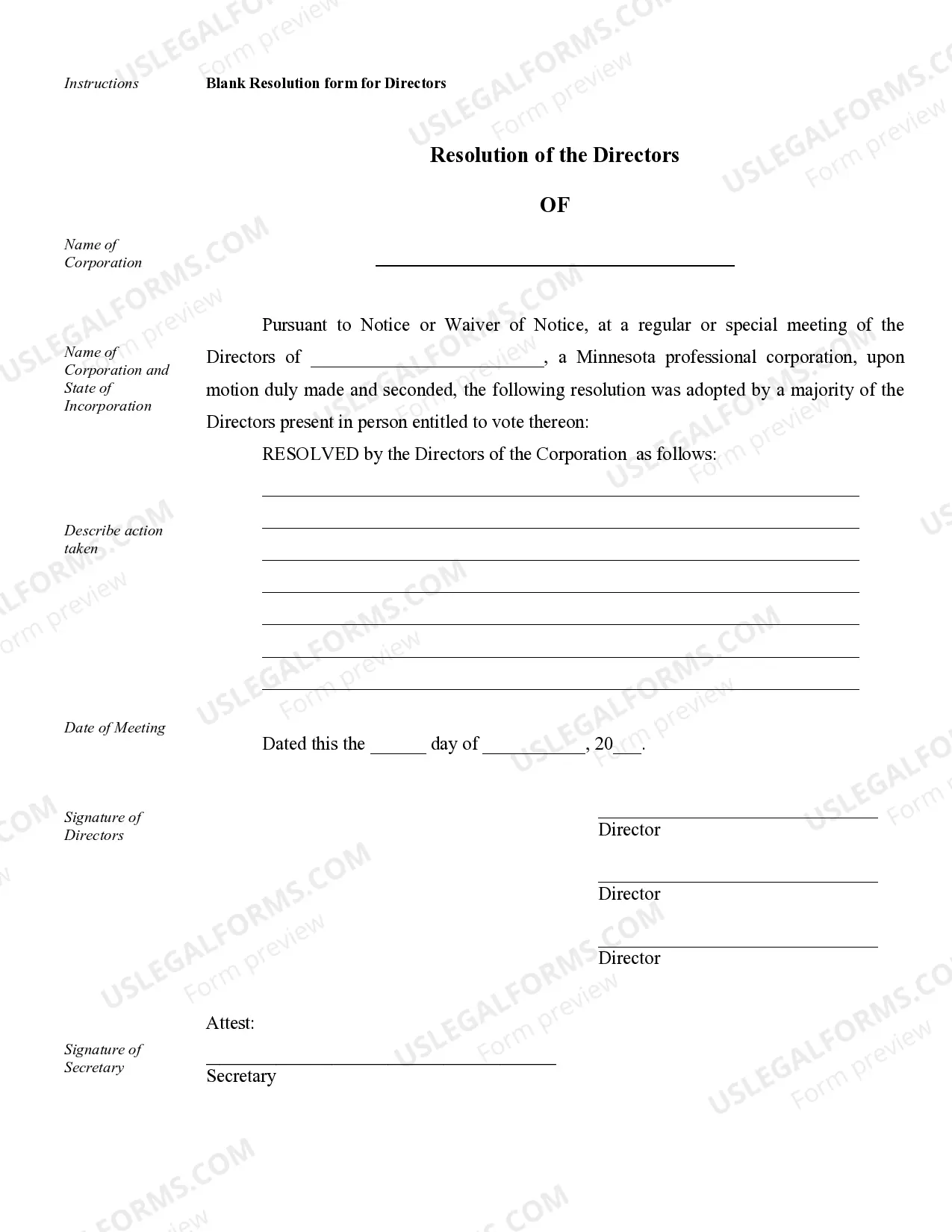

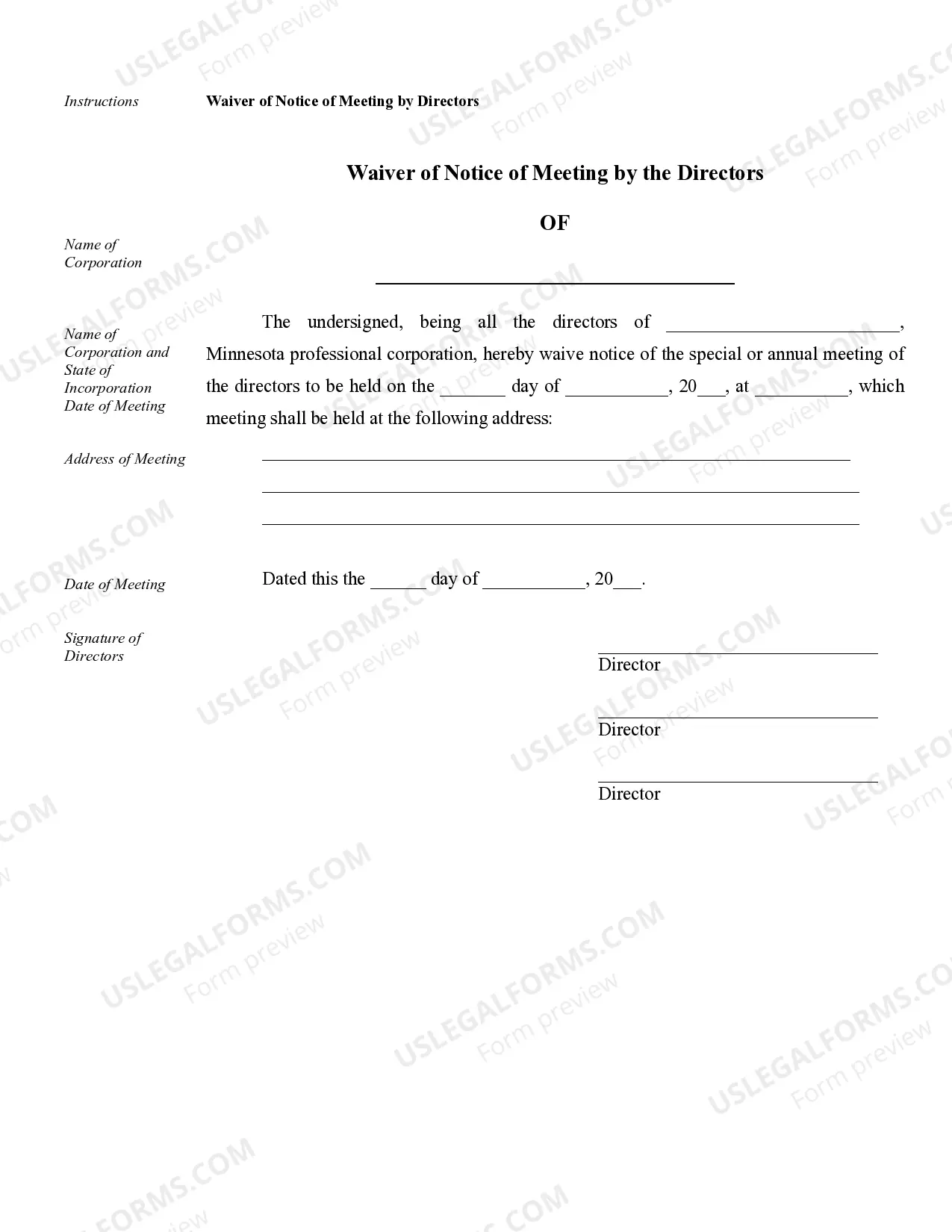

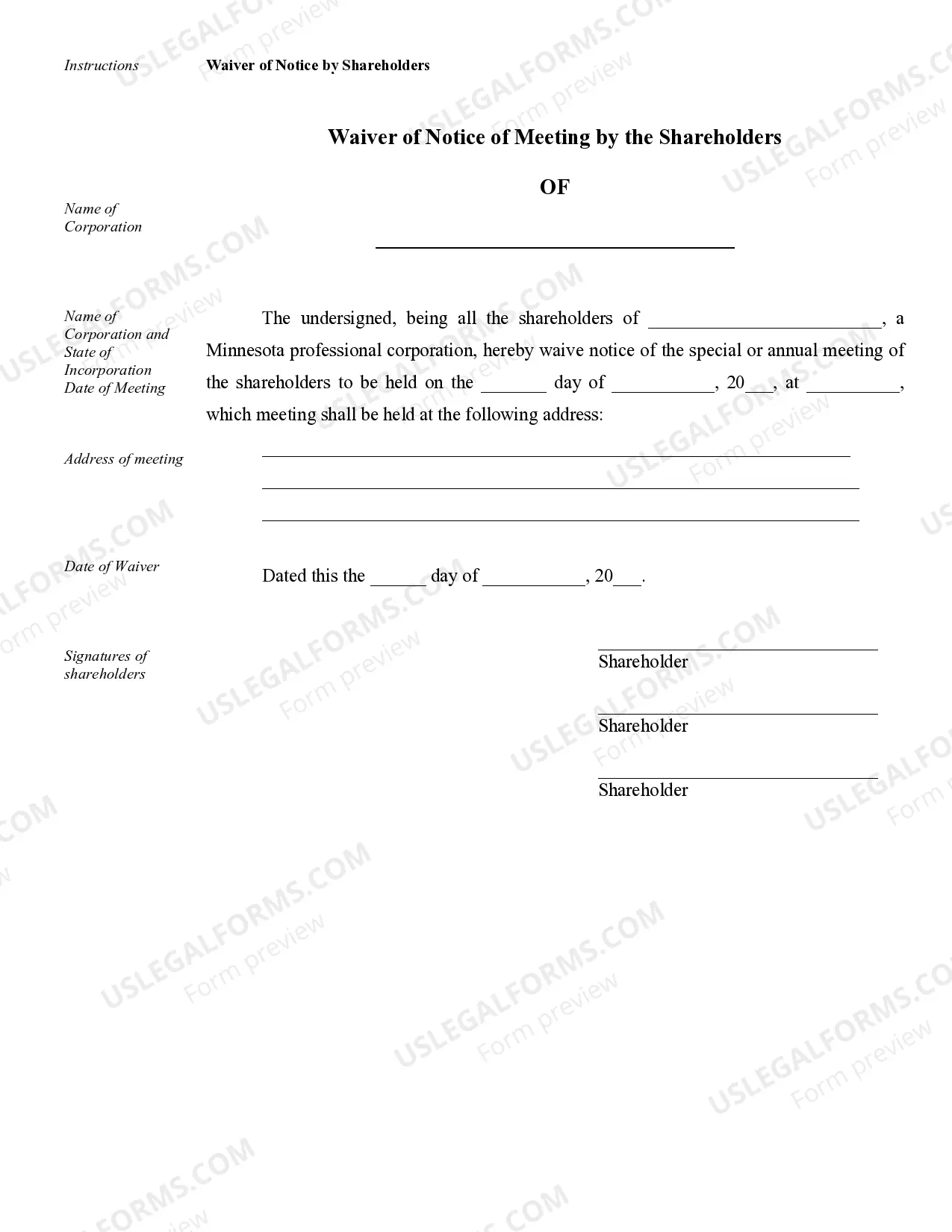

How to fill out Annual Minutes For A Minnesota Professional Corporation?

Have any form from 85,000 legal documents including Annual Minutes for a Minnesota Professional Corporation online with US Legal Forms. Every template is prepared and updated by state-licensed attorneys.

If you already have a subscription, log in. Once you’re on the form’s page, click on the Download button and go to My Forms to get access to it.

In case you haven’t subscribed yet, follow the tips listed below:

- Check the state-specific requirements for the Annual Minutes for a Minnesota Professional Corporation you would like to use.

- Look through description and preview the sample.

- Once you are sure the sample is what you need, just click Buy Now.

- Select a subscription plan that works well for your budget.

- Create a personal account.

- Pay out in just one of two appropriate ways: by card or via PayPal.

- Select a format to download the document in; two ways are available (PDF or Word).

- Download the document to the My Forms tab.

- As soon as your reusable form is downloaded, print it out or save it to your gadget.

With US Legal Forms, you will always have instant access to the right downloadable sample. The service will give you access to forms and divides them into categories to streamline your search. Use US Legal Forms to get your Annual Minutes for a Minnesota Professional Corporation easy and fast.

Form popularity

FAQ

Every corporation is required to hold an annual meeting; usually, the meeting is held just after the end of the company's fiscal year, at a time and place designated in the bylaws.

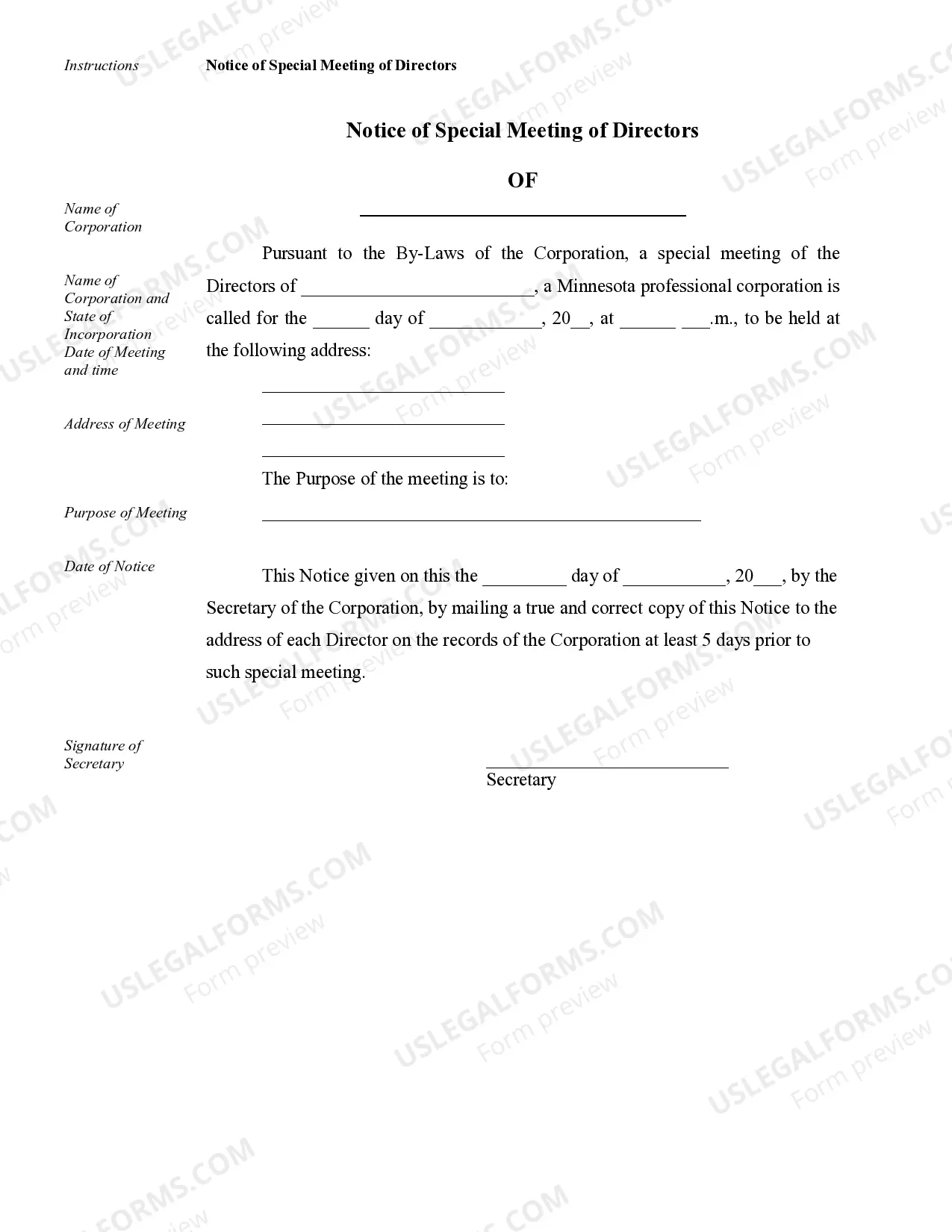

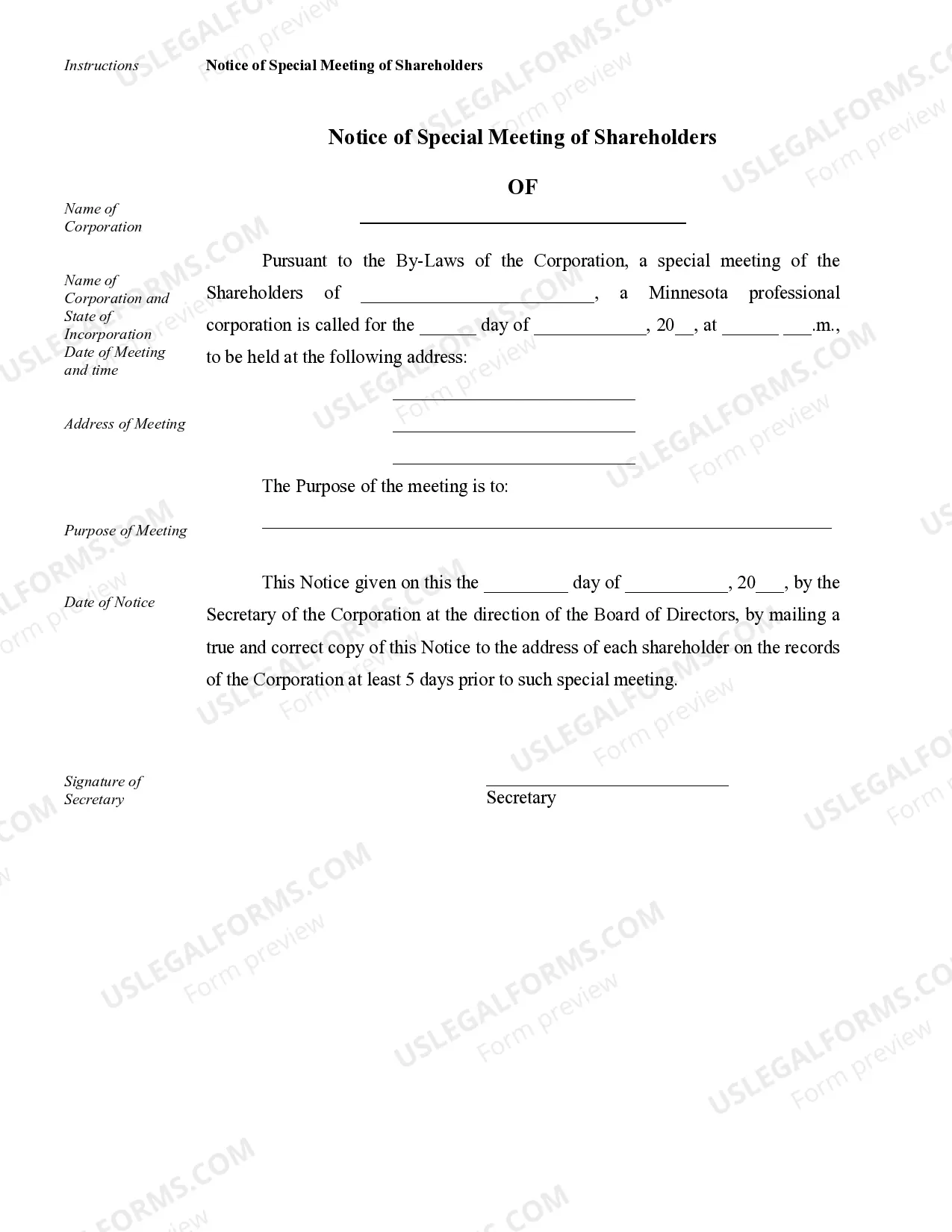

Shareholder meetings are a regulatory requirement which means most public and private companies must hold them. Notification of the meeting's date and time is often accompanied by the meeting's agenda.

Corporate annual meeting minutes serve as a record of a business's annual meeting.Meeting agenda items with a brief description of each. Details about what was discussed during the meeting. Results of any voting actions taken. The time when the meeting adjourned.

So how often should you hold a board meeting and what should be on the agenda? A board meeting should be held every month to review the previous month's financial results against your budget. Or forecast and identify what actions are needed in the next period.

If you run an S corporation, you are not required by law to keep meeting minutes. However, they can be a good way to record the progress your company makes toward meeting corporate objectives. Minutes can also be useful as a legal record of corporate activities in the event of a lawsuit or tax audit.

What Are Corporate Meeting Minutes? Corporate meeting minutes are a record that's taken at formal meetings of managers of corporations. The minutes describe the actions and decisions that managers take at company meetings.

Scheduled meetings Your business should hold at least one annual shareholders' meeting. You can have more than one per year, but one per year is often the required minimum. An annual board of directors meeting is often also held in conjunction with the shareholders' meeting as well.

Taking Meeting Notes. Type Meeting Notes - Type up a full version of the meeting minutes. Circulate a Draft - Follow your corporation's policy about who must review the draft notes. Distribute Minutes to Board - Usually in advance of the next meeting.

A business should keep its minutes for at least seven years, and make them available to members of the corporation (e.g., shareholders, directors, and officers) who make a reasonable request to review them.