Minnesota Report of Work Ability for Workers' Compensation

Description

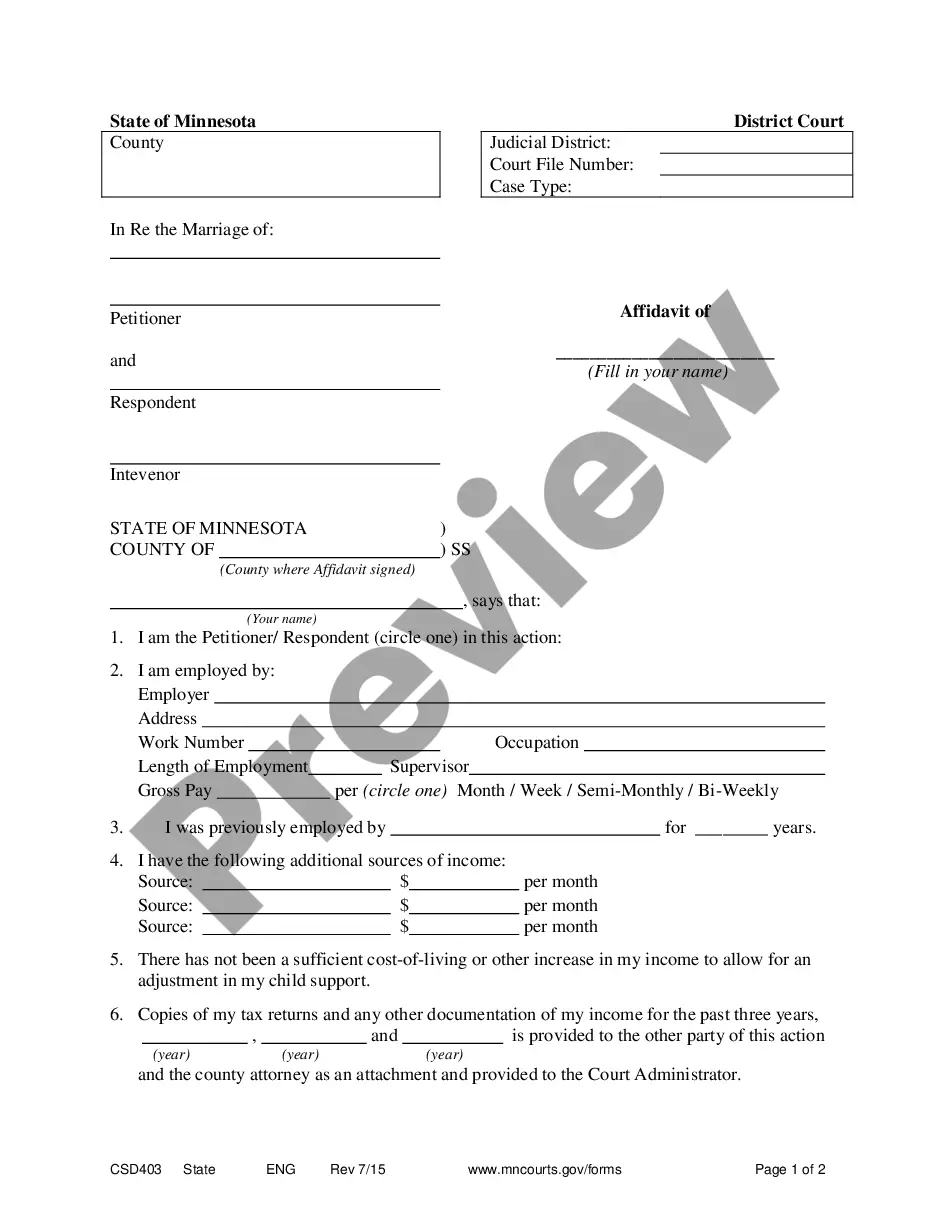

How to fill out Minnesota Report Of Work Ability For Workers' Compensation?

Get any form from 85,000 legal documents including Minnesota Report of Work Ability for Workers' Compensation online with US Legal Forms. Every template is prepared and updated by state-licensed legal professionals.

If you have a subscription, log in. When you’re on the form’s page, click the Download button and go to My Forms to access it.

In case you have not subscribed yet, follow the tips listed below:

- Check the state-specific requirements for the Minnesota Report of Work Ability for Workers' Compensation you need to use.

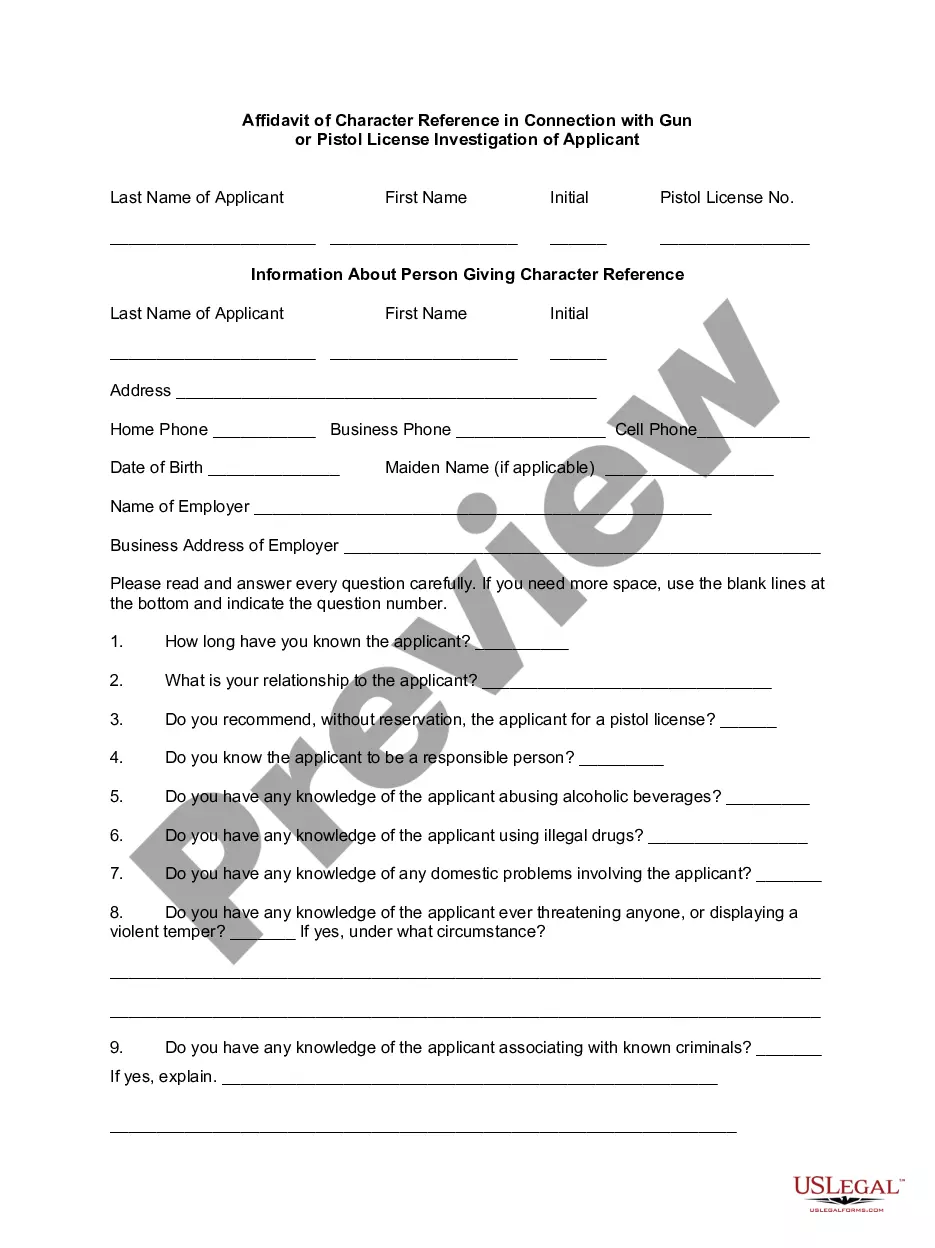

- Read through description and preview the sample.

- As soon as you are confident the sample is what you need, simply click Buy Now.

- Select a subscription plan that actually works for your budget.

- Create a personal account.

- Pay in one of two appropriate ways: by card or via PayPal.

- Select a format to download the file in; two options are available (PDF or Word).

- Download the document to the My Forms tab.

- When your reusable form is ready, print it out or save it to your gadget.

With US Legal Forms, you will always have quick access to the appropriate downloadable sample. The service will give you access to forms and divides them into categories to streamline your search. Use US Legal Forms to get your Minnesota Report of Work Ability for Workers' Compensation fast and easy.

Form popularity

FAQ

Most often, benefits are calculated and paid based on the average weekly wage. This is calculated by multiplying the employee's daily wage by the number of days worked in a full year. That number is then divided by 52 weeks to get the average weekly wage.

Once the 500-week period ends, your employer will seek to suspend or terminate your workers' compensation benefits, but you may still have the right to continue receiving benefits if your injuries persist.

The maximum time frame for temporary total disability benefits is 130 weeks. Compensation time depends on your injury, but you may be able to predict the results by consulting with your doctor regarding healing time and any rehabilitation time.

About workers' compensationWorkers' compensation is a no-fault system designed to provide benefits to employees who are injured as a result of their employment activities.Because it is a no-fault system, the employee does not need to prove negligence on the part of the employer to establish liability.

The minimum compensation rate is $130 per week, or your actual wage if it is lower than $130. The maximum number of weeks you can receive temporary total disability benefits is 130. The second major type of wage loss benefit is temporary partial disability (TPD) benefits.

If you've been injured as a result of your work, you should be able to collect workers compensation benefits.Your employer or its workers' comp insurance company does not have to agree to settle your claim, and you do not have to agree with a settlement offer proposed by your employer or its insurance company.

You are not required to pay income taxes on your work comp benefits, regardless of whether you received them on a weekly basis or as a lump sum settlement. Minnesota workers' compensation benefits are considered to be compensation for a personal injury under the Federal Tax Code and are therefore non-taxable.