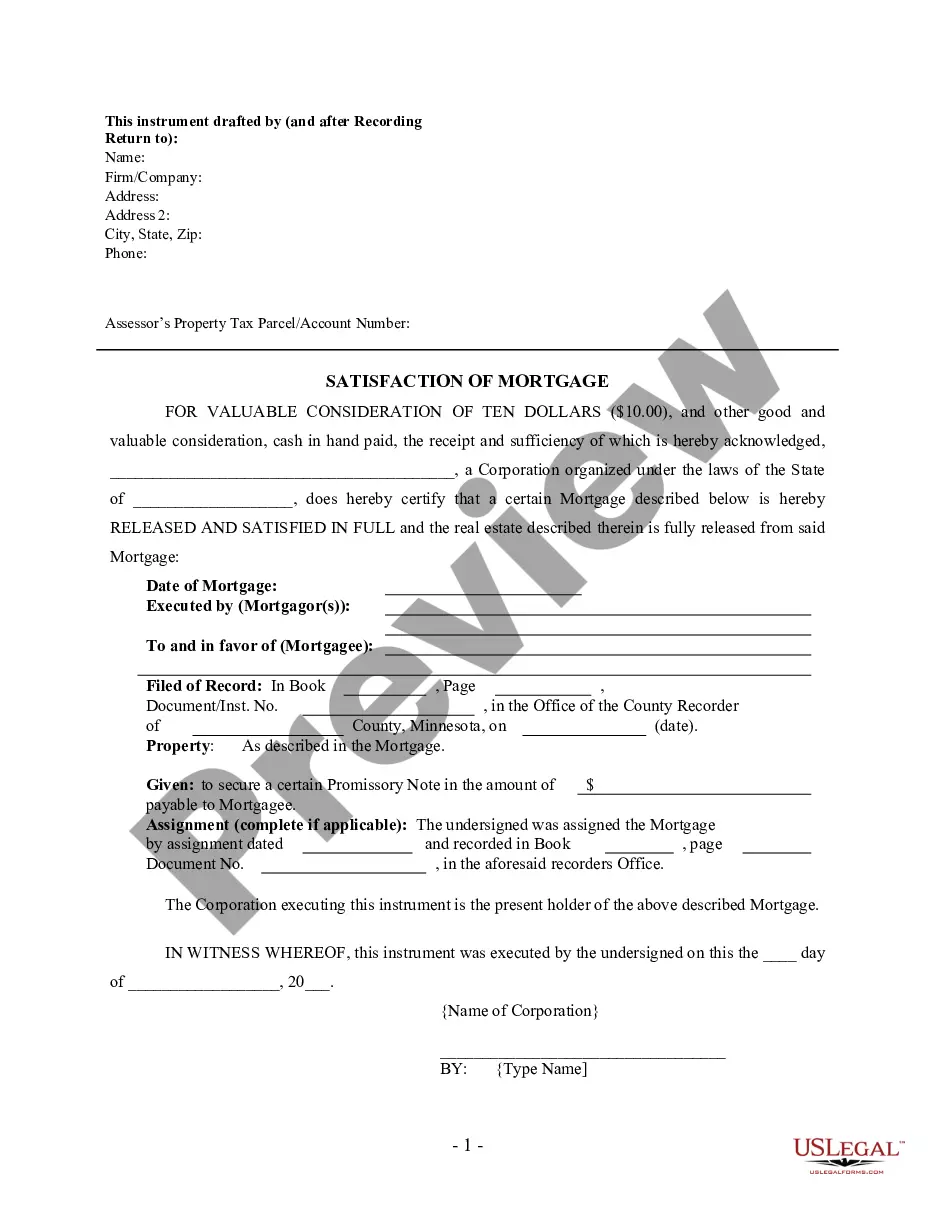

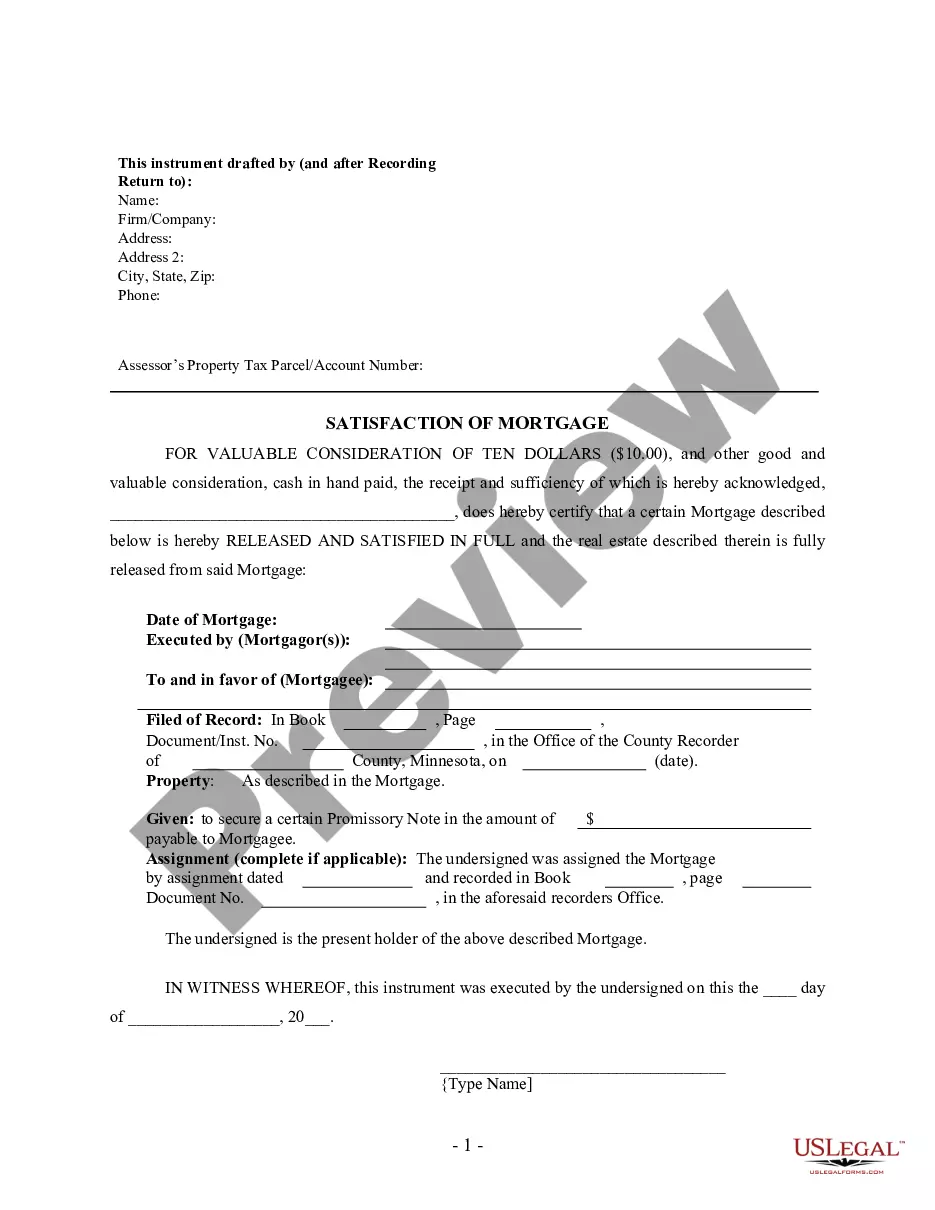

Satisfaction, Release or Cancellation of Mortgage by Corporation

Assignments Generally: Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds of trust to other lenders, or third parties. When this is done the assignee (person who received the assignment) steps into the place of the original lender or assignor. To effectuate an assignment, the general rules is that the assignment must be in proper written format and recorded to provide notice of the assignment.

Satisfactions Generally: Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage or deed of trust of record to show that the mortgage or deed of trust is no longer a lien on the property. The general rule is that the satisfaction must be in proper written format and recorded to provide notice of the satisfaction. If the lender fails to record a satisfaction within set time limits, the lender may be responsible for damages set by statute for failure to timely cancel the lien. Depending on your state, a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance. Some states still recognize marginal satisfaction but this is slowly being phased out. A marginal satisfaction is where the holder of the mortgage physically goes to the recording office and enters a satisfaction on the face of the the recorded mortgage, which is attested by the clerk.

Minnesota Law

Execution of Assignment or Satisfaction: Must be signed by the Mortgagee.

Assignment: An assignment must be in writing and recorded.

Demand to Satisfy: If mortgagor, by written request, demands satisfaction in 10 days (60 days if mortgagee is not a resident of Minnesota) pursuant to 507.41 (see below), mortgagor must pre-pay the mortgagee's reasonable expenses for recording satisfaction. However, if instead mortgagor, by written request, demands that a recordable certificate of satisfaction be delivered to mortgagor within 45 days pursuant to 47.208 (below), then mortgagor is not required to pay mortgagee's expenses for delivering same.

Recording Satisfaction: A mortgage may be discharged by filing for record a certificate of its satisfaction executed and acknowledged by the mortgagee.

Penalty: Mortgagee liable for all actual damages for failure to record satisfaction under 507.41 or 47.208. In addition, a $500 penalty applies when failing to meet the deadline of 47.208.

Acknowledgment: An assignment or satisfaction must contain a proper Minnesota acknowledgment, or other acknowledgment approved by Statute.

Minnesota Statutes

47.208 Delivery of satisfaction of mortgage.

§ Subdivision 1.Delivery required.

Upon written request, a good and valid satisfaction of mortgage in recordable form shall be delivered to any party paying the full and final balance of a mortgage indebtedness that is secured by Minnesota real estate; such delivery shall be in hand or by certified mail postmarked within 45 days of the receipt of the written request to the holder of any interest of record in said mortgage and within 45 days of the payment of all sums due thereon.

§ Subd. 2.Penalty.

If a lender fails to comply with the requirements of subdivision 1, the lender may be held liable to the party paying the balance of the mortgage debt, for a civil penalty of up to $500, in addition to any actual damages caused by the violation.

507.40 Mortgages, how discharged.

A mortgage may be discharged by filing for record a certificate of its satisfaction executed and acknowledged by the mortgagee, the mortgagee's personal representative, or assignee, as in the case of a conveyance. In all cases the discharge shall be entered in the reception book and indexes as conveyances are entered. If a mortgage be recorded in more than one county and discharged of record in one of them, a certified copy of such discharge may be recorded in another county with the same effect as the original. If the discharge be by marginal entry, heretofore made, such copy shall include the record of the mortgage.

507.401 Title insurance company; mortgage release certificate.

§ Subdivision 1.Definitions.

(a) The definitions in this subdivision apply to this section.

(b) "Assignment of rents and profits" means an assignment, whether in a separate document or in a mortgage, of any of the benefits accruing under a recorded or unrecorded lease or tenancy existing, or subsequently created, on property encumbered by a mortgage, which is given as additional security for the debt secured by the mortgage.

(c) "Mortgage" means a mortgage or mortgage lien, including any assignment of rents and profits given as additional security for the debt secured by that lien, on an interest in real property in this state given to secure a loan in the original principal amount of $1,500,000 or less.

(d) "Mortgagee" means:

(1) the grantee of a mortgage; or

(2) if a mortgage has been assigned of record, the last person to whom the mortgage has been assigned of record.

(e) "Mortgage servicer" means the last person to whom a mortgagor or the mortgagor's successor in interest has been instructed by a mortgagee to send payments on a loan secured by a mortgage. A person transmitting a payoff statement is the mortgage servicer for the mortgage described in the payoff statement.

(f) "Mortgagor" means the grantor of a mortgage.

(g) "Partial release" means the release of specified parcels of land from a mortgage.

(h) "Payoff statement" means a statement of the amount of:

(1) the unpaid balance of a loan secured by a mortgage, including principal, interest, and any other charges properly due under or secured by the mortgage, and interest on a per day basis for the unpaid balance; or

(2) the portion of the unpaid balance of the loan secured by the mortgage required by the mortgagee or mortgage servicer to be paid as a condition for the issuance of a partial release.

(i) "Record" means to record with the county recorder or file with the registrar of titles.

(j) "Title insurer " means a corporation or other business entity authorized and licensed to transact the business of insuring titles to interests in real property in this state under chapter 68A.

§ Subd. 2.Certificate of release.

An officer or duly appointed agent of a title insurer may, on behalf of a mortgagor or a person who acquired from the mortgagor title to all or a part of the property described in a mortgage, execute a certificate of release that complies with the requirements of this section and record the certificate of release in the real property records of each county in which the mortgage is recorded if a satisfaction or release of the mortgage has not been executed and recorded after the date payment in full of the loan secured by the mortgage was sent in accordance with a payoff statement furnished by the mortgagee or the mortgage servicer.

§ Subd. 3.Contents.

A certificate of release executed under this section must contain substantially all of the following:

(1) the name of the mortgagor, the name of the original mortgagee, and, if applicable, the mortgage servicer, the date of the mortgage, the date of recording, and volume and page or document number in the real property records where the mortgage is recorded, together with similar information for the last recorded assignment of the mortgage;

(2) if applicable, the date of any assignment of rents and profits, the date of its recording, and its volume and page or document number in the real property records where it has been recorded or filed, together with similar information for the last recorded assignment thereof;

(3) a statement that the mortgage was in the original principal amount of $1,500,000 or less;

(4) a statement that the person executing the certificate of release is an officer or a duly appointed agent of a title insurer authorized and licensed to transact the business of insuring titles to interests in real property in this state under chapter 68A;

(5) a statement that the certificate of release is made on behalf of the mortgagor or a person who acquired title from the mortgagor to all or a part of the property described in the mortgage;

(6) a statement that the mortgagee or mortgage servicer provided a payoff statement which was used to make full or partial payment of the unpaid balance of the loan secured by the mortgage;

(7) a statement that full or partial payment of the unpaid balance of the loan secured by the mortgage was made in accordance with the written or verbal payoff statement; and

(8) where the certificate of release affects only a portion of the land encumbered by the mortgage, a legal description of the portion being released.

§ Subd. 4.Execution.

(a) A certificate of release authorized by subdivision 2 must be executed and acknowledged as required by law in the case of a deed and may be executed by a duly appointed agent of a title insurer, but such delegation to an agent by a title insurer shall not relieve the title insurer of any liability for damages caused by its agent for the wrongful or erroneous execution of a certificate of release.

(b) The appointment of agent must be executed and acknowledged as required by law in the case of a deed and must state:

(1) the title insurer as the grantor;

(2) the identity of the person, partnership, or corporation authorized to act as agent to execute and record certificates of release provided for in this section on behalf of the title insurer;

(3) that the agent has the full authority to execute and record certificates of release provided for in this section on behalf of the title insurer;

(4) the term of appointment of the agent; and

(5) that the agent has consented to and accepts the terms of the appointment.

(c) A single appointment of agent may be recorded in each county in each recording or filing office. A separate appointment of agent shall not be necessary for each certificate of release. For registered land the appointment of agent shall be shown as a memorial on each certificate of title on which a mortgage to be released by a certificate of release under this section is a memorial. The appointment of agent may be rerecorded where necessary to establish authority of the agent, but such authority shall continue until a revocation of appointment is recorded in the office of the county recorder, or registrar of titles, where the appointment of agent was recorded.

§ Subd. 5.Effect.

For purposes of releasing the mortgage, a certificate of release containing the information and statements provided for in subdivision 3 and executed as provided in this section is prima facie evidence of the facts contained in it, is entitled to be recorded with the county recorder or registrar of titles, and operates as a release of the mortgage described in the certificate of release. The county recorder and the registrar of titles shall rely upon it to release the mortgage. Recording of a wrongful or erroneous certificate of release by a title insurer or its agent shall not relieve the mortgagor, or the mortgagor’s successors or assigns, from any personal liability on the loan or other obligations secured by the mortgage. In addition to any other remedy provided by law, a title insurer wrongfully or erroneously recording a certificate of release under this section shall be liable to the mortgagee for actual damage sustained due to the recordings of the certificate of release.

§ Subd. 6.Recording.

If a mortgage is recorded in more than one county and a certificate of release is recorded in one of them, a certified copy of the certificate of release may be recorded in another county with the same effect as the original. In all cases, the certificate of release shall be entered and indexed as satisfactions of mortgage and releases of assignments of rents and profits are entered and indexed.

§ Subd. 7.Application.

This section applies only to a mortgage in the original principal amount of $1,500,000 or less.

507.41 Penalty for failure to discharge.

When any mortgagee, mortgagee’s personal representative or assignee, upon full performance of the conditions of the mortgage, shall fail to discharge the same within ten days after being thereto requested and after tender of the mortgagee’s reasonable charges therefor, that mortgagee shall be liable to the mortgagor, the mortgagor’s heirs or assigns, for all actual damages thereby occasioned; and a claim for such damages may be asserted in an action for discharge of the mortgage. If the defendant be not a resident of the state, such action may be maintained upon the expiration of 60 days after the conditions of the mortgage have been performed, without such previous request or tender.

507.411 Corporate change noted in assignment, satisfaction, or release.

When a change in the name or identity of a corporate mortgagee or assignee of the mortgagee is caused by or results from a merger, consolidation, amendment to charter or articles of incorporation, or conversion of articles of incorporation or charter from federal to state, from state to federal, or from one form of entity to another, a mortgage assignment, satisfaction, or release that is otherwise recordable and that specifies in the body of the instrument the merger, consolidation, amendment, or conversion event causing the change in name or identity is in recordable form. The assignment, satisfaction, or release is entitled to be recorded in the office of the county recorder or filed with the registrar of titles, without further evidence of corporate merger, consolidation, amendment, or conversion. For purposes of assigning, satisfying, or releasing the mortgage, the assignment, satisfaction, or release is prima facie evidence of the facts stated in it with respect to the corporate merger, consolidation, amendment, or conversion, and the county recorder and the registrar of titles shall rely upon it to assign, satisfy, or release the mortgage.