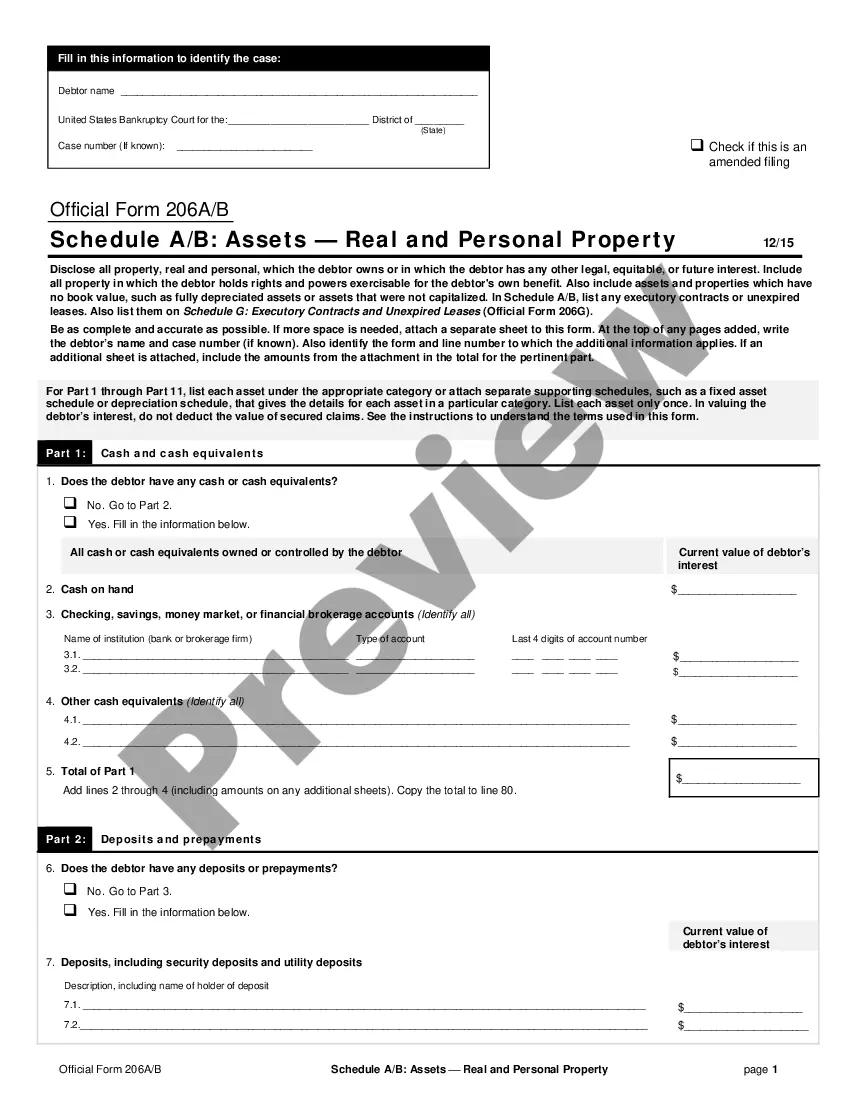

Minnesota Amended Schedule A and C To Correct Description of Realty Claimed Exempt are forms used to correct errors in the description of real estate claimed as exempt from taxation. It is used when the initial property description does not accurately reflect the property's current state or correct legal description. There are two types of Minnesota Amended Schedule A and C To Correct Description of Realty Claimed Exempt: Schedule A: This form is used to correct errors in the description of real estate that was initially claimed as exempt from taxation. It is completed by the taxpayer and requires the taxpayer to provide the name of the owner, the address of the property, the legal description of the property, and the reason for the amendment. Schedule C: This form is used to correct errors in the description of real estate that was initially claimed as exempt from taxation. It is completed by the assessor and requires the assessor to provide the name of the owner, the address of the property, the legal description of the property, and the reason for the amendment.

Minnesota Amended Schedule A and C To Correct Description of Realty Claimed Exempt

Description

How to fill out Minnesota Amended Schedule A And C To Correct Description Of Realty Claimed Exempt?

Engaging with legal documents demands vigilance, precision, and the use of correctly drafted templates. US Legal Forms has been assisting individuals nationwide in this regard for 25 years, ensuring that when you select your Minnesota Amended Schedule A and C To Correct Description of Realty Claimed Exempt template from our service, it complies with both federal and state regulations.

Utilizing our service is easy and quick. To acquire the necessary documents, all you need is an account with an active subscription. Here’s a brief guide for you to quickly obtain your Minnesota Amended Schedule A and C To Correct Description of Realty Claimed Exempt in just a few minutes.

All documents are designed for multiple uses, such as the Minnesota Amended Schedule A and C To Correct Description of Realty Claimed Exempt you see on this page. If you require them in the future, you can complete them without additional payment - simply access the My documents tab in your profile and finalize your document whenever necessary. Experience US Legal Forms and efficiently manage your business and personal paperwork while ensuring full legal compliance!

- Ensure to thoroughly review the content of the form and its alignment with general and legal standards by previewing it or reading its description.

- Look for an alternative formal template if the one you opened does not suit your circumstances or state laws (the option for that is located in the top page corner).

- Log in to your account and store the Minnesota Amended Schedule A and C To Correct Description of Realty Claimed Exempt in your preferred format. If this is your first time using our service, click Buy now to continue.

- Create an account, choose your subscription option, and make a payment using your credit card or PayPal.

- Select the format you wish to save your form in and click Download. Print the document or upload it to a professional PDF editor for a paperless preparation.

Form popularity

FAQ

Subdivision 1. If a potential conflict of interest presents itself and there is insufficient time to comply with clauses (1) to (3), the public or local official must orally inform the superior or the official body of service or committee of the body of the potential conflict.

Charitable includes relief of the poor, underprivileged, and distressed, the care of the sick, the infirm, or the aged; the or maintaining of public buildings and monuments; lessening of the burdens of government; lessening of neighborhood tensions; elimination of prejudice and discrimination; defense of human

When an item is exempt from sales or use tax by law, the seller does not have to show why no tax was charged, but must indicate the item was food, clothing, drugs, or another exempt good. The seller does not have to collect sales tax if the purchaser gives them a completed Form ST3, Certificate of Exemption.

Eligibility. As a general rule, all property in the state of Minnesota is taxable, except tribal lands, unless the property is owned and used for a public purpose, education, or religious or charitable ministration.

Most retail sales are taxable in Minnesota. A retail sale means any sale, lease, or rental of tangible personal property (goods) for any purpose other than resale, sublease, or subrent. A retail sale also includes services for any purpose other than for resale.

Nonprofit organizations may purchase some items exempt from sales tax only if they apply and are approved for Nonprofit Exempt Status ? Sales Tax. They must give their vendor a completed Form ST3, Certificate of Exemption.

Minnesota statute allows homeowners to claim up to $390,000 in property value, or $975,000 if agricultural, as a "homestead." State law limits this exemption to 160 acres, which in practice may apply to farms, but has removed what was once a half-acre limit on property within city limits.

All nonrefundable one-time initiation fees and periodic membership dues required to become a member or to remain a member of a club are taxable.