Minnesota Taxation of Costs and Disbursements is the taxation of court costs and disbursements, or expenses, paid by a party in a civil lawsuit. It also applies to appellate proceedings. The taxation of costs and disbursements arises when a party brings an action in court and the court assesses the costs and disbursements to the prevailing party. The taxation of costs and disbursements is governed by Minnesota Statutes, section 548.14. The prevailing party must file a statement of costs and disbursements with the court and serve it upon the other party. The court will then tax the costs and disbursements and enter an order for the non-prevailing party to pay the taxed costs and disbursements to the prevailing party. Types of Minnesota Taxation of Costs and Disbursements include: 1. Filing Fees: These are fees assessed by the court for filing a complaint, a motion, or other documents. 2. Service Fees: These are fees associated with serving a summons, complaint, or other documents. 3. Witness Fees: These are fees paid to witnesses for appearances or depositions. 4. Transcript Fees: These are fees paid for court transcripts. 5. Other Costs: These are costs that are not specifically listed, such as attorney fees and other related expenses.

Minnesota Taxation of Costs and Disbursements

Description

How to fill out Minnesota Taxation Of Costs And Disbursements?

If you’re looking for a way to properly complete the Minnesota Taxation of Costs and Disbursements without hiring a legal professional, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reputable library of formal templates for every individual and business situation. Every piece of paperwork you find on our online service is designed in accordance with nationwide and state regulations, so you can be certain that your documents are in order.

Follow these straightforward instructions on how to obtain the ready-to-use Minnesota Taxation of Costs and Disbursements:

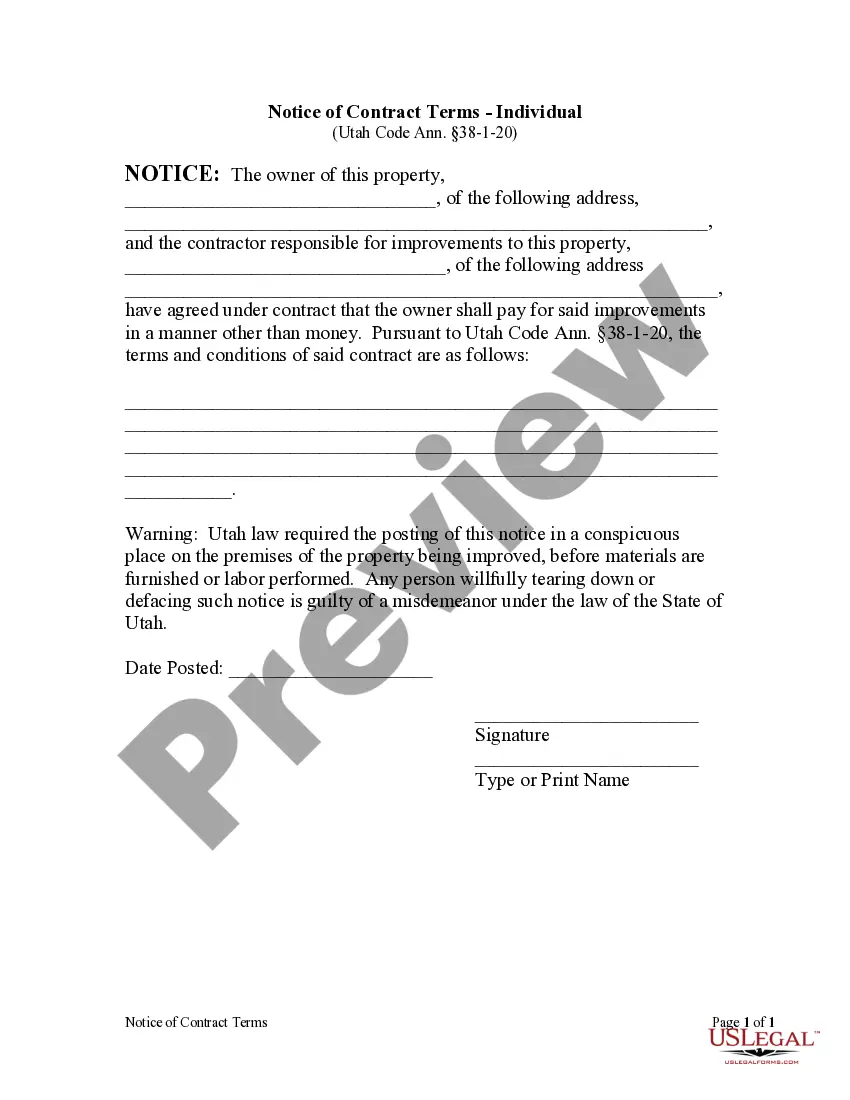

- Make sure the document you see on the page complies with your legal situation and state regulations by checking its text description or looking through the Preview mode.

- Enter the form name in the Search tab on the top of the page and select your state from the list to find an alternative template in case of any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Sign up for the service and opt for the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The blank will be available to download right after.

- Decide in what format you want to save your Minnesota Taxation of Costs and Disbursements and download it by clicking the appropriate button.

- Upload your template to an online editor to fill out and sign it rapidly or print it out to prepare your hard copy manually.

Another great thing about US Legal Forms is that you never lose the paperwork you acquired - you can pick any of your downloaded blanks in the My Forms tab of your profile any time you need it.