The Minnesota Notice of Order To A Mayor of Funds is a document served by a court or administrative body to notify a person or company of a financial obligation to another party. It is used in the context of a court order or administrative action requiring the mayor to remit funds to a designated recipient. This notice is legally binding and requires the mayor to comply with the specified terms. There are two types of Minnesota Notice of Order To A Mayor of Funds: the Garnishment Order and the Assignment Order. The Garnishment Order requires the mayor to withhold a specified amount of money from a debtor’s wages or other income and pay it to the designated recipient. The Assignment Order requires the mayor to pay the designated recipient directly from the mayor’s own funds. Both types of order specify the amount to be paid, the mayor’s name and address, the recipient’s name, and the date the funds must be remitted. The orders also specify the legal basis for the payment and the consequences for failing to comply.

Minnesota Notice of Order To A Payor of Funds

Description

How to fill out Minnesota Notice Of Order To A Payor Of Funds?

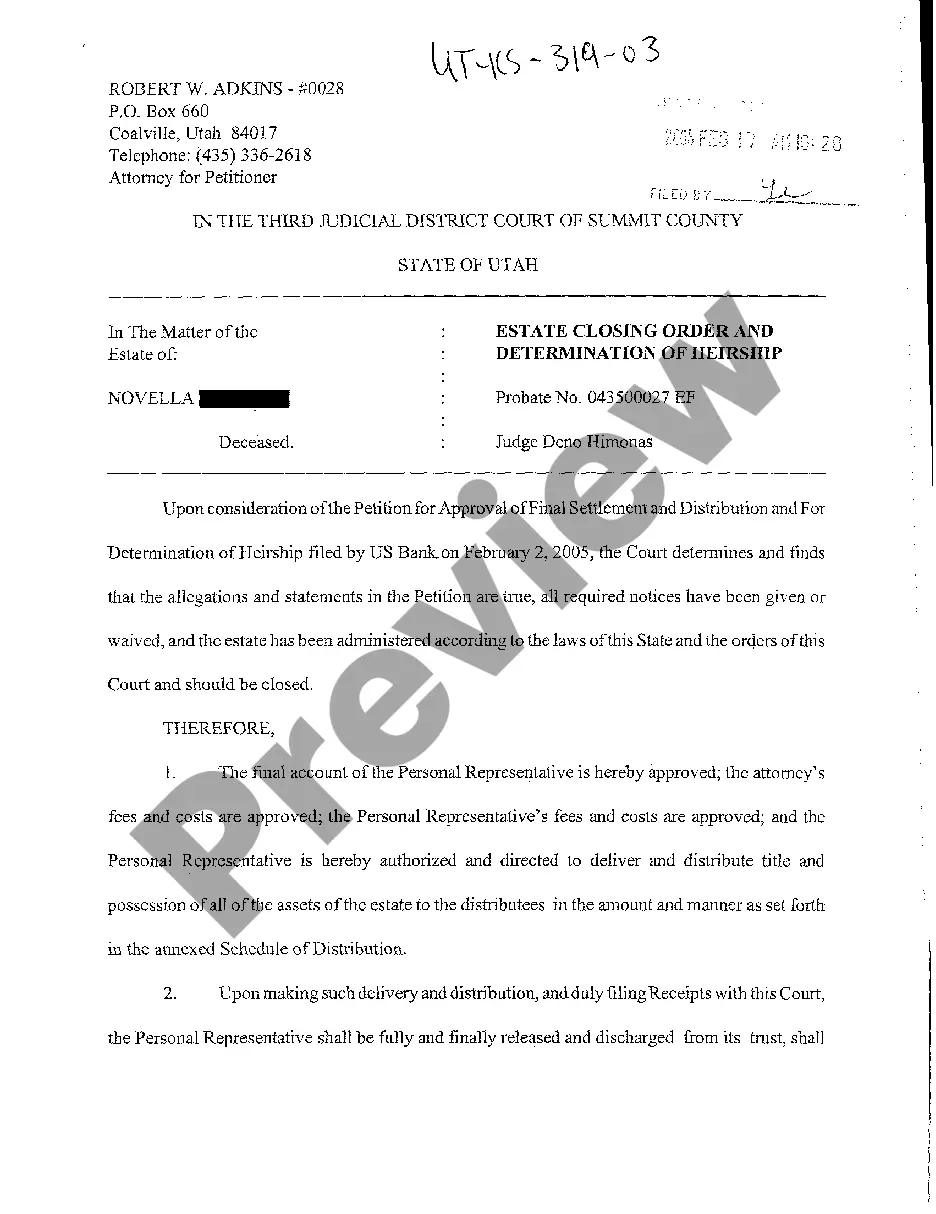

Preparing official paperwork can be a real burden if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you obtain, as all of them comply with federal and state regulations and are verified by our specialists. So if you need to fill out Minnesota Notice of Order To A Payor of Funds, our service is the perfect place to download it.

Obtaining your Minnesota Notice of Order To A Payor of Funds from our service is as easy as ABC. Previously registered users with a valid subscription need only log in and click the Download button after they find the correct template. Afterwards, if they need to, users can use the same blank from the My Forms tab of their profile. However, even if you are new to our service, signing up with a valid subscription will take only a few moments. Here’s a quick instruction for you:

- Document compliance verification. You should carefully examine the content of the form you want and check whether it suits your needs and fulfills your state law regulations. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library using the Search tab above until you find an appropriate blank, and click Buy Now when you see the one you want.

- Account registration and form purchase. Sign up for an account with US Legal Forms. After account verification, log in and select your most suitable subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your Minnesota Notice of Order To A Payor of Funds and click Download to save it on your device. Print it to fill out your paperwork manually, or use a multi-featured online editor to prepare an electronic version faster and more effectively.

Haven’t you tried US Legal Forms yet? Subscribe to our service today to get any formal document quickly and easily whenever you need to, and keep your paperwork in order!

Form popularity

FAQ

The court estimates that the cost of raising one child is $1,000 a month. The non-custodial parent's income is 66.6% of the parent's total combined income. Therefore, the non-custodial parent pays $666 per month in child support, or 66.6% of the total child support obligation.

The state has legal authority to request that child support payments be withheld from independent contractor income, although the withholding rate is different than the 50-65% rate used for employees.

Most new or modified child support orders require employers and payors-of-funds to automatically withhold basic support, medical support and child care support obligations from a parent's paycheck or other sources of income.

What is Contempt of Court? The court may find an obligor in contempt if they have the ability to pay but are not paying their child support obligation. The court may sentence an obligor to serve time in jail. Contempt is used only when other enforcement tools have failed and the county attorney approves it.

Second, the minimum basic support amounts were changed so that now, minimum amounts start at $50 for one child, with $10 increases for each additional child up to six children. In the case that a non-primary custodian has over six children, the judge will exercise discretion in setting a minimum basic support amount.

Hall's case have been re-written, there is still a presumptive ?cap? or ?limit? on how much income can be considered for a parent's child support obligation. Presently, that limit is Fifteen Thousand Dollars ($15,000) combined monthly income from both parents. See Minn.

The percentage of benefits withheld is determined by the child support enforcement agency. The amounts vary up to a maximum of 65 percent of the weekly benefit amount.