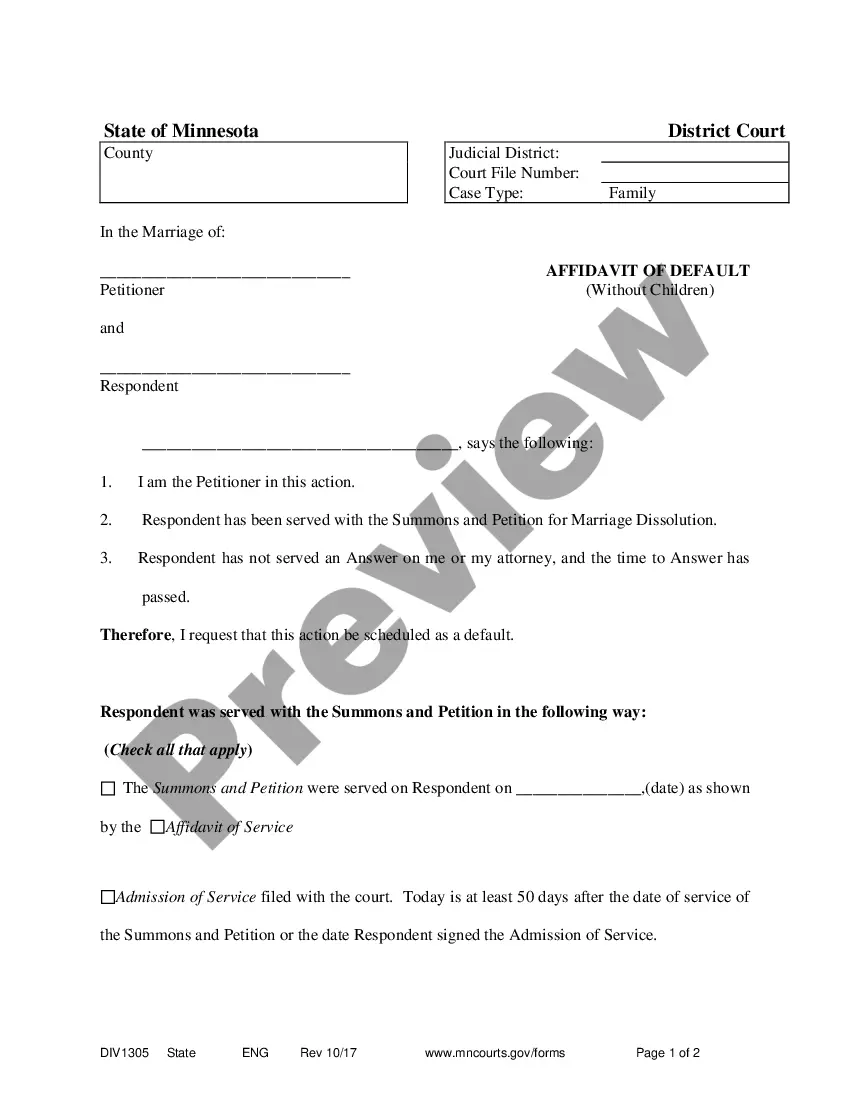

The Minnesota Affidavit of Default is an official document that serves as evidence that a borrower has defaulted on a loan. The affidavit is filed with the county court and provides a signed statement from the lender that the borrower has failed to make payments as stated in the loan agreement. Depending on the type of loan, different types of Minnesota Affidavit of Default exist. The most common type is the Minnesota Affidavit of Default of Mortgage. This affidavit is used to document the default of a mortgage loan. It includes information such as the loan amount, the loan terms, the dates of default, the amount due, and a description of the mortgaged property. The Minnesota Affidavit of Default of Promissory Note is used to document the default of a promissory note loan. It includes information such as the loan amount, the loan terms, the dates of default, the amount due, and a description of the collateral used to secure the loan. The Minnesota Affidavit of Default of Security Agreement is used to document the default of a loan that is secured by collateral. It includes information such as the loan amount, the loan terms, the dates of default, the amount due, and a description of the collateral used to secure the loan. The Minnesota Affidavit of Default of Guarantee is used to document the default of a loan that is guaranteed by a third party. It includes information such as the loan amount, the loan terms, the dates of default, the amount due, and a description of the guarantor and the collateral used to secure the loan. Overall, the Minnesota Affidavit of Default is a document used to provide evidence of loan default and to initiate foreclosure proceedings. It is important to use the correct type of affidavit to ensure that the court has all the necessary information to make a decision.

Minnesota Affidavit of Default

Description

How to fill out Minnesota Affidavit Of Default?

How much time and resources do you frequently allocate to drafting official documents.

There’s a better method to obtain such forms than employing legal professionals or squandering hours searching online for an appropriate template. US Legal Forms is the leading online repository that offers expertly crafted and verified state-specific legal documents for any purpose, such as the Minnesota Affidavit of Default.

Another advantage of our service is that you can retrieve previously acquired documents that you securely store in your profile in the My documents tab. Access them anytime and redo your paperwork as often as necessary.

Conserve time and effort preparing official documents with US Legal Forms, one of the most reliable online services. Sign up for us today!

- Examine the form content to ensure it fulfills your state criteria. To do this, review the form description or utilize the Preview option.

- If your legal template does not meet your requirements, find an alternative using the search bar at the top of the page.

- If you already possess an account with us, Log In and download the Minnesota Affidavit of Default. If not, continue with the next steps.

- Click Buy now once you identify the correct blank. Select the subscription plan that best fits your needs to access the full range of our library.

- Create an account and complete your subscription payment. You can transact with your credit card or via PayPal - our service is completely secure for that.

- Download your Minnesota Affidavit of Default onto your device and complete it on a printed hard copy or electronically.

Form popularity

FAQ

The 48 hour rule in Minnesota refers to the timeframe for certain legal actions following a default. Specifically, it requires that any notice or action related to a Minnesota Affidavit of Default be executed within 48 hours. This rule helps ensure timely communication and responsiveness in legal matters. To stay informed and compliant, you can utilize resources from US Legal Forms for the necessary documents and guidance.

Yes, a Minnesota Affidavit of Default must be notarized to ensure its validity. Notarization adds a layer of authenticity and serves to confirm the identity of the signer. By using a notary, you can ensure that the document meets legal standards and can be accepted in court. If you need assistance with notarization, consider using US Legal Forms, which can guide you through the process.

The main purpose of an affidavit is to provide a written, sworn statement that can be used as evidence in legal proceedings. It helps to establish facts and clarify any disputes between parties. In cases of default, a Minnesota Affidavit of Default can play a crucial role in outlining the circumstances and providing clarity.

An affidavit carries significant weight in legal contexts as it is a sworn statement. This means that providing false information can lead to serious consequences, including penalties for perjury. Therefore, understanding the implications of a Minnesota Affidavit of Default is essential, as it can impact your legal standing.

When you file an affidavit, you present a written statement that is sworn to be true, under penalty of perjury. This document serves as evidence in legal matters and can help resolve disputes. Filing a Minnesota Affidavit of Default establishes a clear record of default and can aid in legal proceedings.

In the event of default, a party may lose certain rights and face legal consequences. Specifically, creditors may initiate collection actions, which could include foreclosure or repossession. Understanding the implications of a default is crucial, and using a Minnesota Affidavit of Default may formalize the situation and clarify obligations.

Equitable distribution of marital wealth Minnesota is an equitable distribution state. This does not necessarily mean a 50-50 settlement of everything. But the law presumes that all assets and debts acquired during the marriage will be divided equitably, including: Your house and other real estate.

In Minnesota, once a divorce petition has been served, you have a certain amount of time to address the issue before it defaults. Once a divorce has defaulted, the spouse who filed for divorce will get everything they asked for because they other party did not contest any of it.

A default divorce is when the respondent doesn't respond to the petition for divorce within thirty days of the summons. They not only don't sign any paperwork, but they also don't appear in court as requested. This is perfectly legal, but it isn't in their best interest.

Rule 306 attempts to make clear the role of notice required to be given to parties who are in default but who have "appeared" in some way in marriage dissolution proceedings.