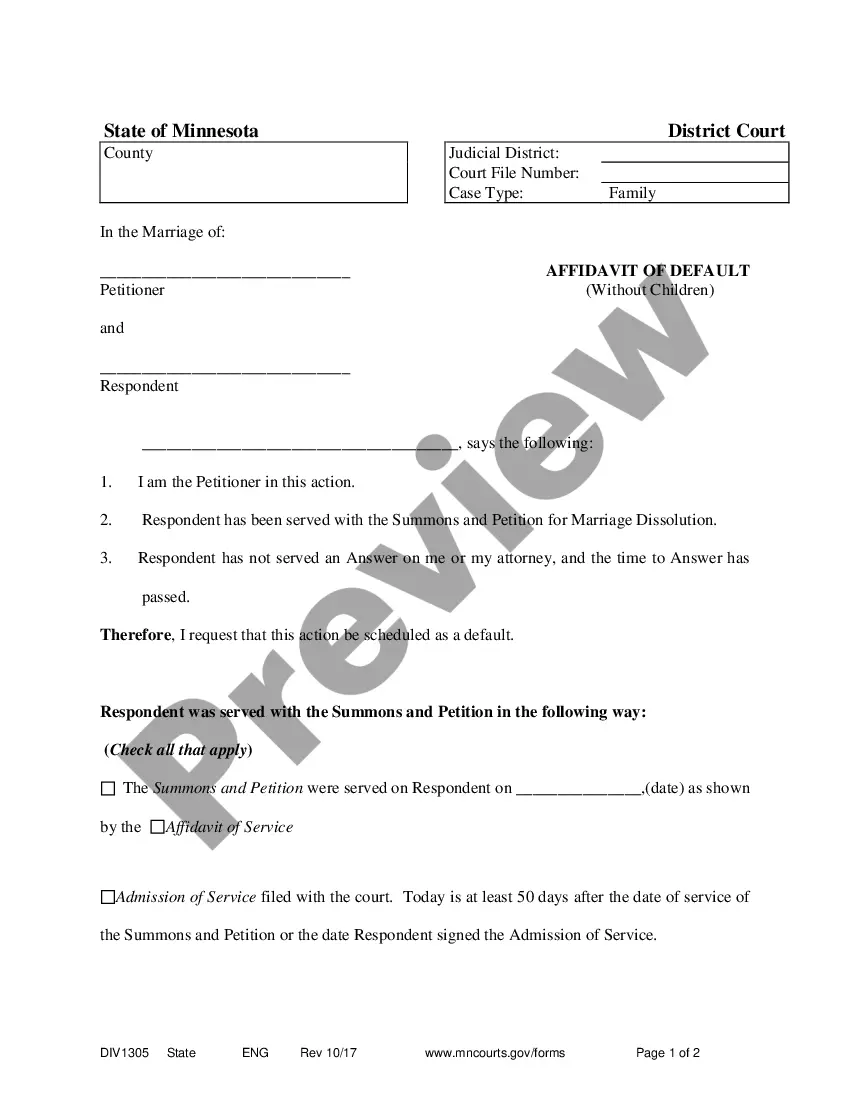

A Minnesota Affidavit of Default is a legal document used in Minnesota to prove that a debtor has failed to pay a debt. It is typically used when a creditor is attempting to collect a debt that is past due. There are two types of Minnesota Affidavit of Default: an Affidavit of Default for Secured Transactions and an Affidavit of Default for Unsecured Transactions. The Affidavit of Default for Secured Transactions is used when a debt is secured by a lien or other security interest, such as a mortgage or car loan. The Affidavit of Default for Unsecured Transactions is used when a debt is not secured by a lien or other security interest, such as a credit card debt or medical bill. The Affidavit of Default must be notarized and must include the names of the debtor and creditor, the amount of the debt, and a statement of facts that demonstrate the debtor has failed to pay the debt.

Minnesota Affidavit of Default

Description

How to fill out Minnesota Affidavit Of Default?

US Legal Forms is the most straightforward and cost-effective way to find suitable legal templates. It’s the most extensive online library of business and personal legal paperwork drafted and checked by lawyers. Here, you can find printable and fillable templates that comply with national and local laws - just like your Minnesota Affidavit of Default.

Getting your template requires only a few simple steps. Users that already have an account with a valid subscription only need to log in to the website and download the form on their device. Later, they can find it in their profile in the My Forms tab.

And here’s how you can obtain a properly drafted Minnesota Affidavit of Default if you are using US Legal Forms for the first time:

- Read the form description or preview the document to guarantee you’ve found the one corresponding to your requirements, or find another one utilizing the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and choose the subscription plan you like most.

- Create an account with our service, sign in, and pay for your subscription using PayPal or you credit card.

- Select the preferred file format for your Minnesota Affidavit of Default and save it on your device with the appropriate button.

After you save a template, you can reaccess it whenever you want - just find it in your profile, re-download it for printing and manual completion or upload it to an online editor to fill it out and sign more effectively.

Take advantage of US Legal Forms, your reputable assistant in obtaining the required official paperwork. Give it a try!

Form popularity

FAQ

Equitable distribution of marital wealth Minnesota is an equitable distribution state. This does not necessarily mean a 50-50 settlement of everything. But the law presumes that all assets and debts acquired during the marriage will be divided equitably, including: Your house and other real estate.

No, it does not legally matter who files for divorce first in Minnesota. When one party files the petition, the other party must respond to the court within 30 days or the divorce will be considered uncontested, which means the unresponsive party is giving up their rights to have a say in the divorce proceedings.

A default divorce is when the respondent doesn't respond to the petition for divorce within thirty days of the summons. They not only don't sign any paperwork, but they also don't appear in court as requested. This is perfectly legal, but it isn't in their best interest.

If your divorce does not require a contested hearing or you do not need a hearing, your divorce is considered a Default and you must submit a Default Scheduling Request.

In Minnesota, a divorce (legally called a ?dissolution of marriage?) can take anywhere from several weeks to a few months to even years to finalize. To determine a realistic timeline, you'll need to take into account how much you and your spouse agree on the terms of your divorce.

In Minnesota, once a divorce petition has been served, you have a certain amount of time to address the issue before it defaults. Once a divorce has defaulted, the spouse who filed for divorce will get everything they asked for because they other party did not contest any of it.

A motion for default judgment is a request asking the court to provide a default judgment when the defendant has not responded to a complaint within the court-allotted time-frame. The following are examples of forms used for a default judgment motion in Minnesota court.

Rule 306 attempts to make clear the role of notice required to be given to parties who are in default but who have "appeared" in some way in marriage dissolution proceedings.