Minnesota County Assessors Market Evaluation is a process used by assessors to determine the fair market value of a property. This evaluation is based on market trends, recent sales, and other criteria to determine the value of the property. The assessor will look at the size of the property, its location, and its condition to come up with a valuation. There are two types of Minnesota County Assessors Market Evaluation: Sales Comparison Approach and Cost Approach. The Sales Comparison Approach involves comparing the subject property to similar properties that have recently sold and determining a value based on those sales. The Cost Approach takes into account the cost of replacing the improvements on the property and determining a value based on that.

Minnesota County Assessors Market Evaluation

Description

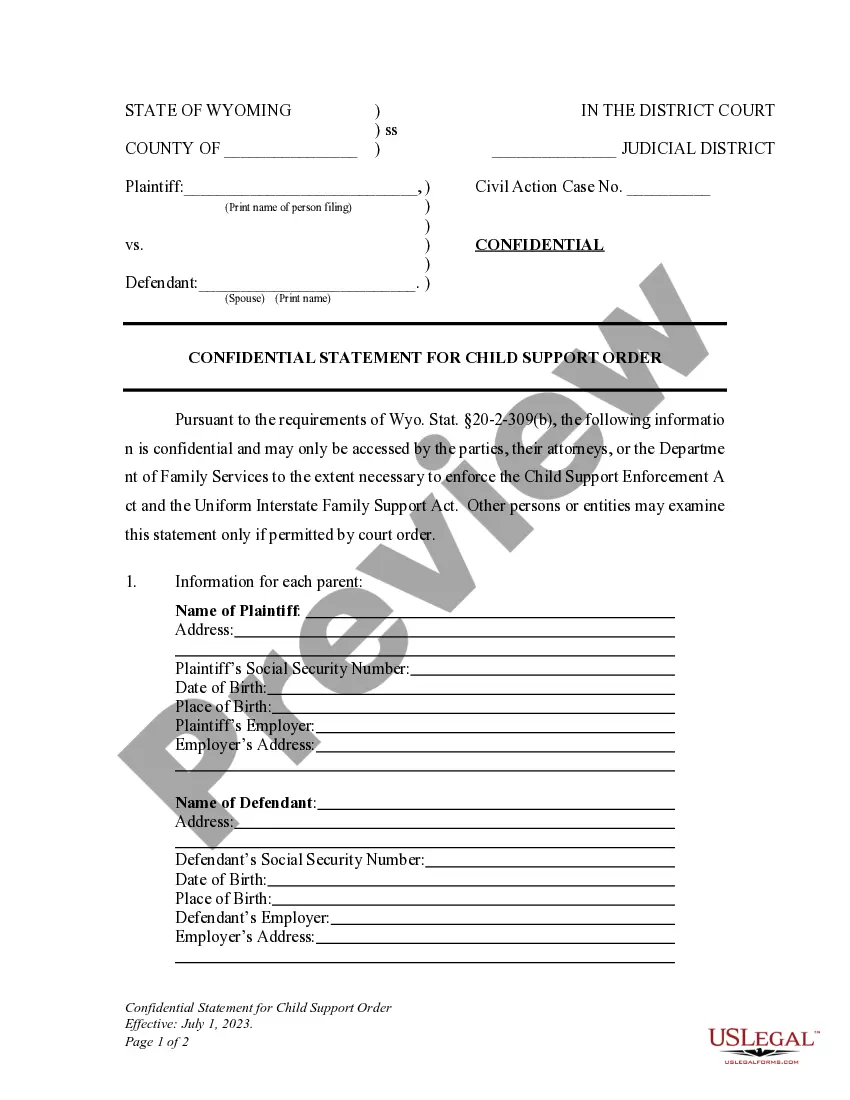

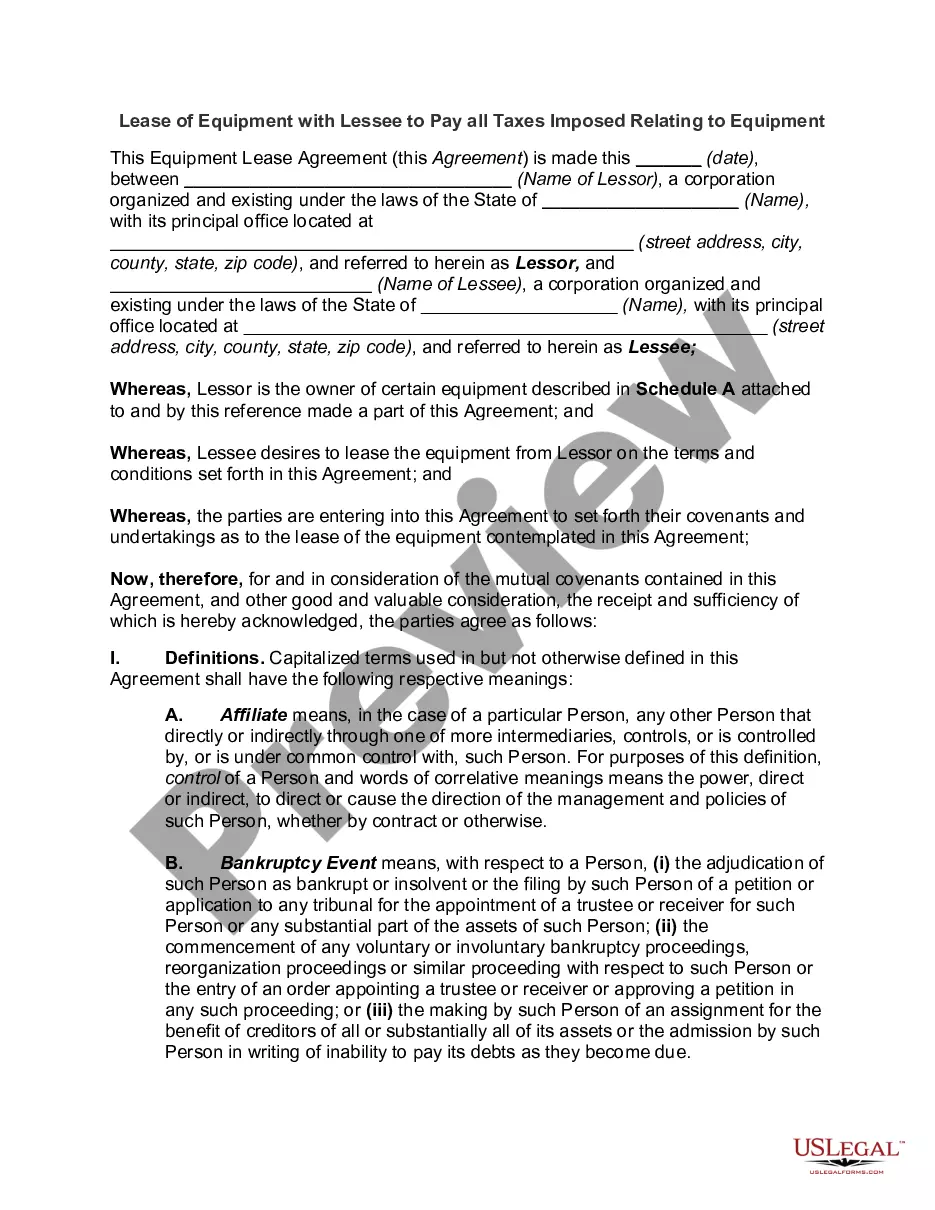

How to fill out Minnesota County Assessors Market Evaluation?

Preparing legal paperwork can be a real stress unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you find, as all of them comply with federal and state laws and are examined by our specialists. So if you need to complete Minnesota County Assessors Market Evaluation, our service is the best place to download it.

Obtaining your Minnesota County Assessors Market Evaluation from our service is as easy as ABC. Previously registered users with a valid subscription need only log in and click the Download button once they find the correct template. Later, if they need to, users can get the same blank from the My Forms tab of their profile. However, even if you are unfamiliar with our service, signing up with a valid subscription will take only a few minutes. Here’s a quick guideline for you:

- Document compliance check. You should attentively examine the content of the form you want and make sure whether it satisfies your needs and meets your state law regulations. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). If you find any inconsistencies, browse the library through the Search tab above until you find a suitable blank, and click Buy Now when you see the one you want.

- Account creation and form purchase. Register for an account with US Legal Forms. After account verification, log in and choose your most suitable subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Minnesota County Assessors Market Evaluation and click Download to save it on your device. Print it to fill out your paperwork manually, or take advantage of a multi-featured online editor to prepare an electronic version faster and more effectively.

Haven’t you tried US Legal Forms yet? Subscribe to our service now to obtain any formal document quickly and easily whenever you need to, and keep your paperwork in order!

Form popularity

FAQ

Assessments and market value A property's assessment is based on its market value. Market value is how much a property would sell for under normal conditions. Assessments are determined by the assessor, a local official who estimates the value of all real property in a community.

The assessed value of a home is usually less than market value, with the assessed value coming to 70-80% of market value.

State the reason(s) for protesting. Common reasons for protests are that a property has been assessed more than once (called a double assessment), an assessed location has been recently closed, or the stated value is too high.

Homesteads. Homestead is a program to reduce property taxes for owners who also occupy their home and are a Minnesota resident. You can qualify for this tax reduction if you own and occupy your house as your main place of residence or are a relative of an owner living in the owner's house.

Assessed value is the dollar value assigned to a home or other piece of real estate for property tax purposes. It takes into account the value of comparable properties in the area, among other factors. In many cases, the assessed value is calculated as a percentage of the fair market value of the property.

Every parcel of real property has a just value, an assessed value, and a taxable value. The just value is the property's market value. The assessed value is the just value minus assessment limitations (see the Save Our Homes section below).

The final commercial-industrial state general levy property tax rate for taxes payable 2023 is 33.003%. The final seasonal residential recreational state general levy property tax rate for taxes payable 2023 is 12.321%.

ESTIMATED MARKET VALUE ? This value is what the assessor estimates your property would likely sell for on the open market.