This form is a Class Action Complaint. Plaintiffs seek damages and injunctive relief from defendants for liability under the Racketeer Influenced and Corrupt Organizations Act(RICO). Plaintiffs contend that the defendants' actions justify an award of substantial punitive damages against each.

Minnesota Complaint for Class Action For Wrongful Conduct - RICO - by Insurers

Description

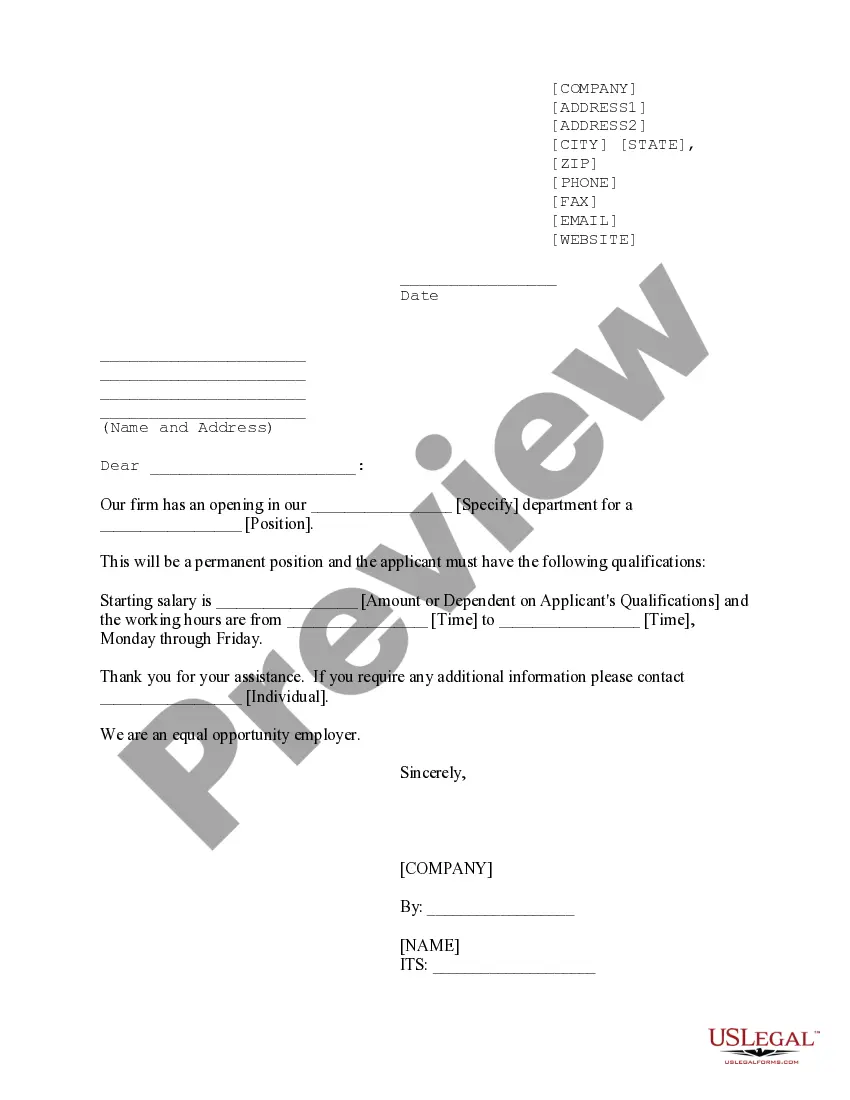

How to fill out Complaint For Class Action For Wrongful Conduct - RICO - By Insurers?

Selecting the optimal authorized document template can be challenging. Certainly, there are numerous formats accessible online, but how do you find the authorized version you require? Utilize the US Legal Forms website. The platform offers thousands of formats, such as the Minnesota Complaint for Class Action For Wrongful Conduct - RICO - by Insurers, which you can employ for both business and personal needs. All of the documents are reviewed by experts and comply with federal and state regulations.

If you are already registered, sign in to your account and click the Download button to obtain the Minnesota Complaint for Class Action For Wrongful Conduct - RICO - by Insurers. Use your account to browse through the authorized documents you have previously acquired. Proceed to the My documents section of your account and retrieve another copy of the document you need.

If you are a new user of US Legal Forms, here are straightforward instructions that you should follow: First, make sure you have selected the correct document for your location/state. You can view the form using the Review button and check the form description to ensure it is the correct one for you. If the document does not meet your requirements, utilize the Search area to find the appropriate form. Once you are confident that the form is suitable, select the Purchase now button to obtain the document. Choose the pricing plan you wish and enter the required information. Create your account and pay for the order using your PayPal account or credit card. Select the file format and download the authorized document template to your device. Complete, modify, print, and sign the received Minnesota Complaint for Class Action For Wrongful Conduct - RICO - by Insurers.

Take advantage of this resource to streamline your legal document needs and ensure compliance with applicable laws.

- US Legal Forms is the largest repository of authorized documents where you can find numerous document templates.

- Utilize the service to download professionally-crafted documents that comply with state regulations.

- Access a wide range of templates for various legal needs.

- Ensure your documents are up-to-date and legally compliant.

- Easily manage your document downloads and access history.

- Receive expert-reviewed templates to ensure quality and accuracy.

Form popularity

FAQ

To initiate a class action lawsuit, you should first compile evidence that illustrates the wrongful conduct you are challenging, such as the Minnesota Complaint for Class Action For Wrongful Conduct - RICO - by Insurers. Next, seek legal counsel experienced in class actions to guide you through the complex filing process. They will help you draft and submit the necessary documents to the court, ensuring that your case is presented effectively.

In Minnesota, to prove a breach of contract, you must demonstrate that a valid contract existed, the other party failed to fulfill their obligations, and you suffered damages as a result. This principle also applies in cases involving the Minnesota Complaint for Class Action For Wrongful Conduct - RICO - by Insurers. Understanding these elements is essential, as they form the foundation of your legal arguments when addressing insurance disputes.

When proceeding with a lawsuit, especially one involving a Minnesota Complaint for Class Action For Wrongful Conduct - RICO - by Insurers, you need three key elements: a valid legal claim, a class of affected individuals, and a common issue that affects all members of the class. Establishing these elements is crucial for your case to move forward. An experienced attorney can assist you in identifying and proving these components.

To initiate a class action lawsuit against an insurance company, you must first gather evidence to support your claim. This includes documenting instances of wrongful conduct related to the Minnesota Complaint for Class Action For Wrongful Conduct - RICO - by Insurers. Then, consult with an attorney who specializes in class action cases to understand the process and requirements. They can help you file the necessary paperwork and represent your interests effectively.

Using strong, assertive language can make your complaint more impactful. Words like 'unacceptable,' 'negligent,' and 'failure' convey seriousness. Additionally, phrases such as 'I demand' or 'I expect' can express your intent clearly. When drafting your complaint, especially in the context of a Minnesota Complaint for Class Action For Wrongful Conduct - RICO - by Insurers, precise language can enhance your message.

To write a complaint letter to an insurance company, begin by stating your purpose and including your contact information. Clearly outline your complaint, citing specific instances of wrongful conduct. Attach copies of any relevant documents to support your case. For a comprehensive approach, consider the structure of a Minnesota Complaint for Class Action For Wrongful Conduct - RICO - by Insurers.

When writing a complaint letter against an insurance company, start with a clear and direct statement of your issue. Include relevant details like your policy number, claim number, and a description of the problem. Providing evidence to support your complaint is crucial. Referencing the Minnesota Complaint for Class Action For Wrongful Conduct - RICO - by Insurers can help you articulate your concerns more effectively.

The four classifications of unfair claims settlement practices typically include misrepresentation of policy provisions, failing to acknowledge or act promptly on claims, offering inadequate settlements, and denying claims without proper investigation. Understanding these categories can help you identify if your insurer is engaging in wrongful conduct. If you believe you have a case, consider referencing the Minnesota Complaint for Class Action For Wrongful Conduct - RICO - by Insurers.

To write a powerful complaint letter, be clear and concise. Start with your contact information and the date, followed by a direct statement of your issue. Make sure to include specific details and any supporting evidence, which adds weight to your argument. Reference the Minnesota Complaint for Class Action For Wrongful Conduct - RICO - by Insurers to frame your complaint effectively.

Filing a complaint in Minnesota involves gathering all necessary documents related to your case, such as your insurance policy and any correspondence with the insurer. You can file your complaint with the Minnesota Department of Commerce or the appropriate court, depending on the nature of your case. Ensure that you include a clear statement of your claim, referencing the Minnesota Complaint for Class Action For Wrongful Conduct - RICO - by Insurers for context.